Writing Down Goodwill

Back again in November 2012, when it launched its fourth quarter results, computer giant Hewlett-Packard announced that It might be using an $8.8 billion demand to write down a botched acquisition of U.K.-primarily based Autonomy Corporation PLC. The create-off, which was described as a non-income charge for the impairment from the Autonomy obtain, incorporated goodwill and intangible asset fees.

https://telegra.ph/Creating-Down-Goodwill-01-17

Exactly what is Goodwill?

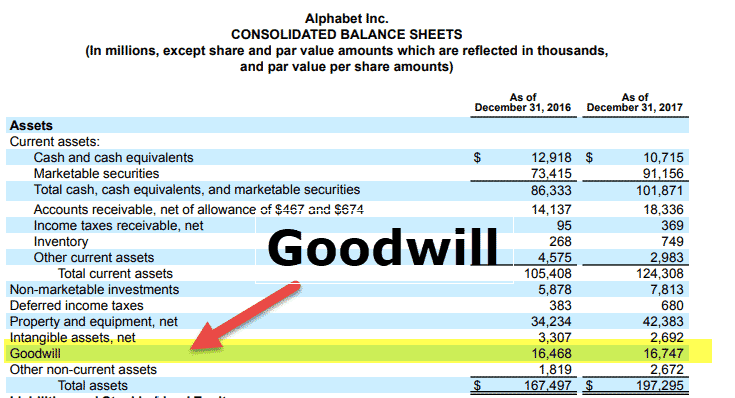

Goodwill frequently occurs when one particular firm buys another; it is actually outlined as the quantity paid out for the company around e book value. Goodwill is definitely an intangible asset, versus tangible assets which include properties, Laptop and Workplace devices, and associated Bodily products, such as inventory and linked forms of Functioning funds. In other words, goodwill signifies an acquisition quantity in excess of and earlier mentioned just what the procured firm's Web belongings are deemed to get valued at to the harmony sheet. (For more, see "Is Goodwill Deemed a Type of Capital Asset?")

When Goodwill Goes Bad

In the situation of HP's acquisition of Autonomy, presented the charge declared in November, it is obvious that many of the original $eleven billion invest in selling price was in excess of and over the book price, or net asset worth of Autonomy, a quick-developing software program enterprise. As outlined by a Bloomberg study, Autonomy stated total property of $3.5 billion ideal just before it had been obtained. At some time of acquisition, HP initially accounted $6.6 billion towards goodwill and $four.six billion to other intangibles. These quantities had been later transformed to $6.9 billion and $four.three billion, respectively.

HP's oversight, Along with queries over the quantities it in the beginning made a decision to generate down goodwill by and subsequently booked, demonstrates which the strategy of goodwill is unsure and open to interpretation. To ascertain goodwill amounts, organizations normally rely by themselves accountants, but they may also convert to valuation consultants that can help estimate.

Actually, other tangible belongings, including the depreciated price of land and products is additionally subject to estimates and other interpretations, but these other values can not less than might be joined with either a Bodily good or asset. In contrast, goodwill is tougher to position a company worth on. A 2009 posting while in the Economist explained it as "an intangible asset that signifies the additional benefit ascribed to a company by virtue of its brand and status."

From HP's standpoint, There exists minimal question that it had higher hopes for Autonomy, which was based mostly off its described financial gain concentrations and also the expectation that its speedy development would proceed properly into the future.

How Goodwill Is Created Down

As soon as an acquisition is produced, and supplied it absolutely was a sound purchase, goodwill continues to be about the obtaining firm's harmony sheet indefinitely. Before 2002, goodwill was amortized over 40 years, Substantially the best way a chunk of equipment could possibly be depreciated above a interval, according to estimates of its useful daily life. But because then, regulations have gotten more stringent: Goodwill might be amortized over a straight-line foundation about a interval never to exceed a decade. If Anytime, the value declines, as occurred in rapid fashion with goodwill linked to Autonomy, then an impairment charge is required.

HP, along with other firms that wind up writing down substantial quantities of goodwill, are brief is goodwill an asset to point out that a goodwill impairment charge is non-cash, and so would not affect hard cash flows. It represents, nevertheless, a huge previous blunder that drained the company coffers. In regard to HP, which funded the Autonomy obtain via hard cash reserves, it ended up destroying billions in shareholder price, given that the company is worthy of just a portion of its earlier approximated price.

The underside Line

Goodwill impairment costs Really don't damage present yr hard cash flows, but they show faults made prior to now by management teams. In HP's case, the decision to purchase Autonomy without having adequate due diligence and tire-kicking represented a single of many situations in which a serious lapse in judgment was made.

For other businesses, goodwill impairment costs are typically significantly less important, However they nonetheless require analysts to analyze precisely what went Improper and when the mistake is probably going for being recurring in the future, to the detriment of current shareholders.