Creating Down Goodwill

Again in November 2012, when it released its fourth quarter results, computer huge Hewlett-Packard introduced that It might be having an $eight.8 billion demand to put in writing down a botched acquisition of U.K.-based mostly Autonomy Corporation PLC. The write-off, which was called a non-income charge for that impairment in the Autonomy purchase, bundled goodwill and intangible asset fees.

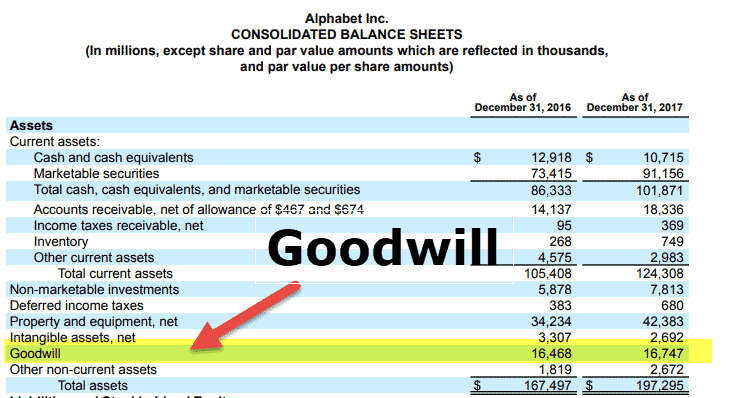

What exactly is Goodwill?

Goodwill often occurs when a single company purchases An additional; it is outlined as the amount paid out for the company about e-book benefit. Goodwill is undoubtedly an intangible asset, as opposed to tangible property like structures, Pc and Business tools, and similar physical products, such as stock and similar types of Doing the job money. To paraphrase, goodwill represents an acquisition volume around and over exactly what the procured company's Internet belongings are considered to become valued at about the equilibrium sheet. (For additional, see "Is Goodwill Viewed as a Form of Money Asset?")

When Goodwill Goes Undesirable

In the situation of HP's acquisition of Autonomy, specified the charge announced in November, it is obvious that a lot of of the first $eleven billion purchase value was about and above the guide worth, or Internet asset worth of Autonomy, a quick-escalating software program firm. As outlined by a Bloomberg analyze, Autonomy outlined whole property of $3.5 billion appropriate right before it absolutely was obtained. At some time of acquisition, HP at first accounted $6.6 billion towards goodwill and $four.six billion to other intangibles. These quantities were being afterwards improved to $six.nine billion and $4.3 billion, respectively.

HP's blunder, As well as inquiries about the quantities it originally chose to compose down goodwill by and subsequently booked, demonstrates that the idea of goodwill is uncertain and open up to interpretation. To find out goodwill amounts, organizations generally rely by themselves accountants, but they can also convert to valuation consultants that can help estimate.

The truth is, other tangible property, including the depreciated price of land and products can be topic to estimates as well as other interpretations, but these other values can at least is usually connected with either a Actual physical fantastic or asset. In contrast, goodwill is more difficult to put a company benefit on. A 2009 short article inside the Economist described it as "an is goodwill an asset intangible asset that signifies the extra price ascribed to an organization by advantage of its brand name and reputation."

From HP's point of view, There is certainly little problem that it had higher hopes for Autonomy, which was dependent off its claimed revenue levels as well as expectation that its quick growth would continue on nicely into the long run.

How Goodwill Is Written Down

At the time an acquisition is created, and provided it had been a seem obtain, goodwill continues to be within the attaining company's equilibrium sheet indefinitely. Before 2002, goodwill was amortized about 40 a long time, much the best way a chunk of equipment may very well be depreciated around a time period, determined by estimates of its useful daily life. But since then, principles have gotten additional stringent: Goodwill can be amortized on the straight-line basis about a interval not to exceed 10 years. If at any time, the value declines, as occurred in immediate fashion with goodwill linked to Autonomy, then an impairment cost is needed.

HP, and various firms that end up creating down important quantities of goodwill, are speedy to indicate that a goodwill impairment cost is non-dollars, and so would not affect money flows. It represents, nevertheless, a massive previous blunder that drained the corporate coffers. In regard to HP, which funded the Autonomy obtain by means of income reserves, it ended up destroying billions in shareholder value, because the organization is well worth only a fraction of its before approximated worth.

The Bottom Line

Goodwill impairment costs don't damage present-day 12 months funds flows, However they show errors made up to now by administration teams. In HP's case, the choice to get Autonomy without having sufficient homework and tire-kicking represented just one of many situations where a significant lapse in judgment was created.

For other businesses, goodwill impairment charges are frequently considerably less considerable, but they however demand analysts to investigate precisely what went Incorrect and if the error is likely for being repeated in the future, to the detriment of present sha