Uk Spread Betting Tax Rules

👉🏻👉🏻👉🏻 ALL INFORMATION CLICK HERE 👈🏻👈🏻👈🏻

РекламаНаучитесь составлять эффективные прогнозы и управлять линиями. Скидка до -30%! · Москва · пн-пт 10:00-18:00

Много практики · Учитесь где удобно

РекламаМы создали нейросеть, которая делает точный анализ всех спортивных событий

Essentially, spread betting is regarded by UK tax law as a gambling activity, and therefore the profits from spread betting are tax free – i.e., there is no capital gains tax to pay on the earnings generated.

www.independentinvestor.com/spread-betting/ho…

Is the money you make from spread betting taxed?

Is the money you make from spread betting taxed?

And because profits from betting are not taxed in the UK, any money you make from spread betting is yours to keep in full. We must emphasise that spread betting is only tax-free under current UK tax law, which may change, and that ultimately your tax treatment will depend on your individual circumstances.

www.intertrader.com/en/spread-betting/spr…

How much tax do you pay on betting in UK?

How much tax do you pay on betting in UK?

Winnings between £50,001 and £150,000 are taxed at 40%. However, if you make money by betting on somebody else playing e-sports, your winnings are tax-free. As mentioned, virtually all forms of gambling income are tax-free in the UK.

www.gamblingjudge.com/betting-uk/bettin…

Do you have to pay stamp duty on spread betting?

Do you have to pay stamp duty on spread betting?

Particularly for leveraged transactions, this can be a significant tax liability to pay on each and every transaction over the threshold value. Without going too far into the intricacies of Stamp Duty and how it is calculated, this liability can be instantly removed from the equation when dealing with spread betting.

www.independentinvestor.com/spread-betti…

Can you open a spread betting account in Spain?

Can you open a spread betting account in Spain?

A: There's no problem in opening an account from Spain but the tax rules are pretty murky for those outside the UK. The first point is that spreadbetting doesn't exist in Spain and therefore you have to assume that it will be taxed like something that does. The question is 'what'?

www.financial-spread-betting.com/Expatriat…

https://www.gov.uk/hmrc-internal-manuals/business-income-manual/bim22015

The taxpayer placing a spread bet is not normally carrying on a trade (see BIM22020 for exceptions). They are not taxable on the profits, nor do they receive relief for their losses. The bookmaker...

https://investoo.com/tax-implications-of-spread-betting-in-the-uk

The Implications of Tax-Free Spread Betting. As already stated, if you are an UK citizen then your profits will not be subjected to capital gain or income tax levies. In addition, your spread betting activities will not attract stamp duty. You will find that not being eligible to capital gains taxation …

https://www.independentinvestor.com/spread-betting/how-spread-betting-is-taxed

Tax on Trading Activities

Tax on Spread Betting Activities

Questions & Answers

Conclusion

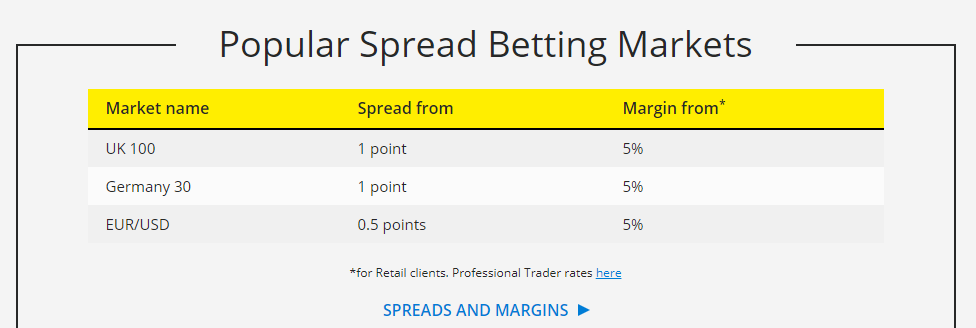

One of the key advantages of spread bettingis that it is taxed accordingly to considerably more favourable rules than other forms of trading. Essentially, spread betting is regarded by UK tax law as a gambling activity, and therefore the profits from spread betting are tax free – i.e., there is no capital gains tax to pay on the earnings generated. Because spread betting is based on asset prices, r…

https://www.onlinebetting.org.uk/betting-guides/gambling-and-betting-tax-in-the-uk.html

Spread betting, index betting and binary options are not regulated by the UK Gambling Commission but instead fall under the umbrella of the Financial Conduct Authority (FCA). Despite this you do not …

https://www.intertrader.com/en/spread-betting/spread-betting-tax-benefits

Spread betting tax benefits. Make a profit from financial markets without paying any tax; Profits from spread betting are not subject to UK Capital Gains Tax or stamp duty; Tax treatment depends on your individual circumstances and may change in the future; We must emphasise that spread betting is only tax-free under current UK tax …

https://www.gamblingjudge.com/betting-uk/betting-tax-uk

To date, betting tax is abolished for all UK players. This means that you do not need to pay tax on anything you win. The UK Government does care if you win £1 or £100 million. It doesn’t matter if you win at football betting sites in the UK (including 5 pound betting …

https://www.daytrading.com/taxes/uk

UK trading taxes are a minefield. Whether you are day trading CFDs, bitcoin, stocks, futures, or forex, there is a distinct lack of clarity, as to how taxes on losses and profits should be applied. However, with day trading promising an enticing lifestyle and significant profit potential, you shouldn’t let the UK’s obscure tax rules …

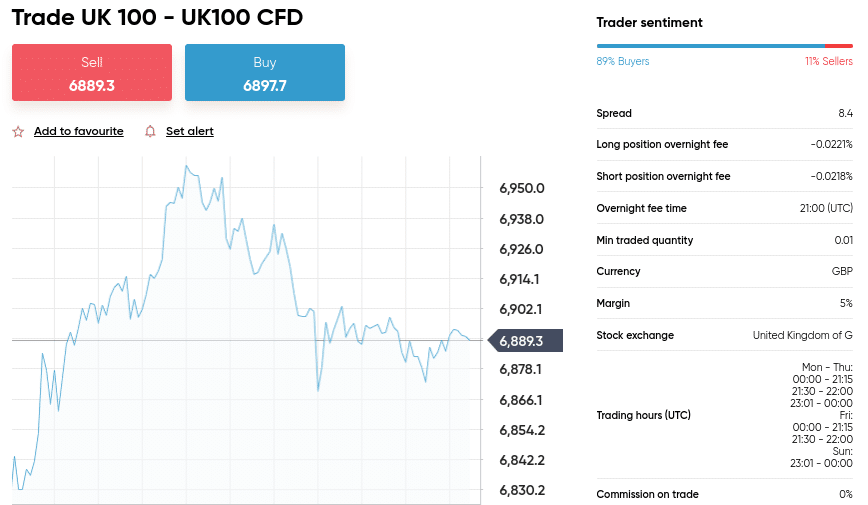

https://www.cityindex.co.uk/spread-betting/spread-betting-vs-standard-trading

With regular shares dealing, you have to pay tax on any profits you make. But, in the UK, spread betting is currently exempt from Capital Gains Tax and Stamp Duty.* We’ve summarised these key differences between spread betting …

www.tradingspreadbetting.com/trade/trading-and-taxes

Are you sure your spread bets are tax free? The general assumption is that financial spread betting is tax free here in the UK (at least under the current tax laws). However, this isn’t always 100% the …

РекламаНаучитесь составлять эффективные прогнозы и управлять линиями. Скидка до -30%! · Москва · пн-пт 10:00-18:00

Много практики · Учитесь где удобно

РекламаМы создали нейросеть, которая делает точный анализ всех спортивных событий

Нало́г — обязательный, индивидуально безвозмездный платёж, взимаемый с …

Не удается получить доступ к вашему текущему расположению. Для получения лучших результатов предоставьте Bing доступ к данным о расположении или введите расположение.

Не удается получить доступ к расположению вашего устройства. Для получения лучших результатов введите расположение.

We use some essential cookies to make this website work.

We’d like to set additional cookies to understand how you use GOV.UK, remember your settings and improve government services.

We also use cookies set by other sites to help us deliver content from their services.

Accept additional cookies

Reject additional cookies

View cookies

beta This part of GOV.UK is being rebuilt – find out what beta means

From:

HM Revenue & Customs

Published

22 November 2013

Updated:

6 April 2021, see all updates

BIM22015 - Meaning of trade: exceptions and alternatives: betting and gambling - introduction

The basic position is that betting and gambling, as such, do not constitute trading. Rowlatt J said in Graham v Green [1925] 9TC309:

‘A bet is merely an irrational agreement that one person should pay another person on the happening of an event.’

This decision has stood the test of time. In an Australian case, Evans v FCT [1989] 20ATR922, 89ATC4540 Hill J said:

‘There has been no decision of a court in Australia nor, so far as I am aware, in the United Kingdom where it has been held that a mere punter was carrying on a business.’

However, an organised activity to make profits out of the gambling public will normally amount to trading.

Although over time new forms of games of chance have evolved, these principles remain the same. The taxpayer placing a spread bet is not normally carrying on a trade (see BIM22020 for exceptions). They are not taxable on the profits, nor do they receive relief for their losses. The bookmaker organising the spread bet is taxable on their profits.

The section on betting and gambling contains the following further guidance:

Is this page useful?

Yes this page is useful

No this page is not useful

Don’t include personal or financial information like your National Insurance number or credit card details.

To help us improve GOV.UK, we’d like to know more about your visit today. We’ll send you a link to a feedback form. It will take only 2 minutes to fill in. Don’t worry we won’t send you spam or share your email address with anyone.

Borderlands 2 Cosplay

Dxd With Some Weird Ass Mc

Girls And Boys Fuck

Candid Ass Legs

Bi Lesbian Dating Site

BIM22015 - Business Income Manual - HMRC internal ... - GOV.UK

Spread Betting and Tax in the UK - Investoo.com

How Spread Betting Is Taxed - Independent Investor

Tax on Betting and Gambling in the UK – Do you pay tax on ...

Spread Betting Tax Benefits - Intertrader

Betting Tax in the UK - What do you have to pay, and when ...

Tax on Trading Income in the UK - Day trading taxes explained

Spread Betting Vs Shares Dealing | Spread Betting Tax ...

Trading and Spread Betting Taxes | Trading Spread Betting

Uk Spread Betting Tax Rules