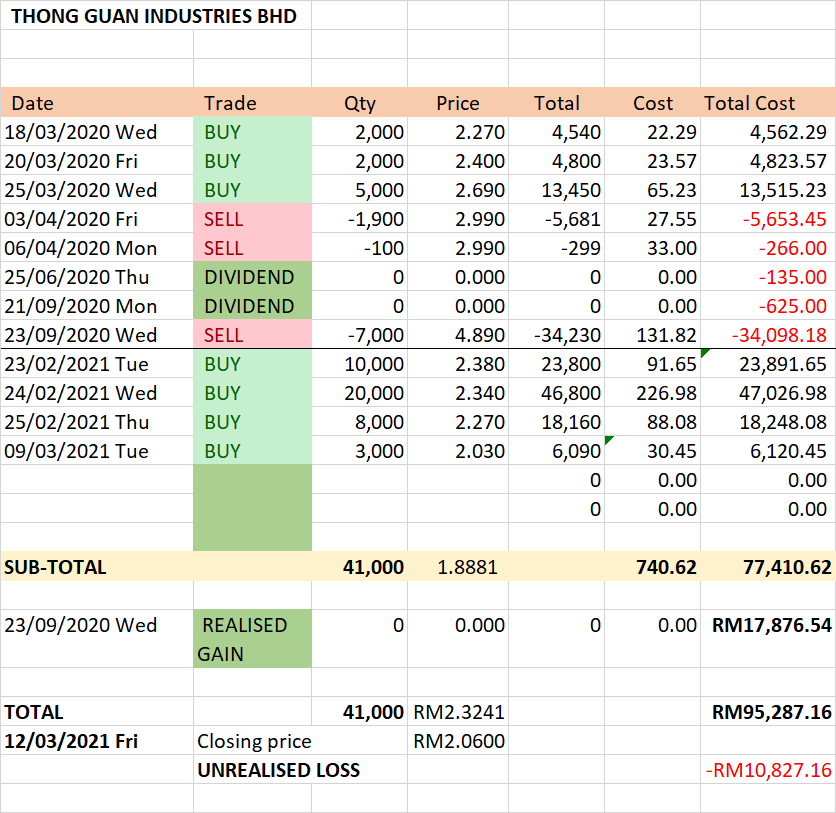

TGuan - My Trading History

YouKnowWho

First bought TGuan in March 2020 during MCO time.

Why Tguan ?

- Good Financial Performance.

- Industry sector, to diversify my portfolio.

- Not expensive, not overpriced.

Bought more when the price UP very fast within a week.

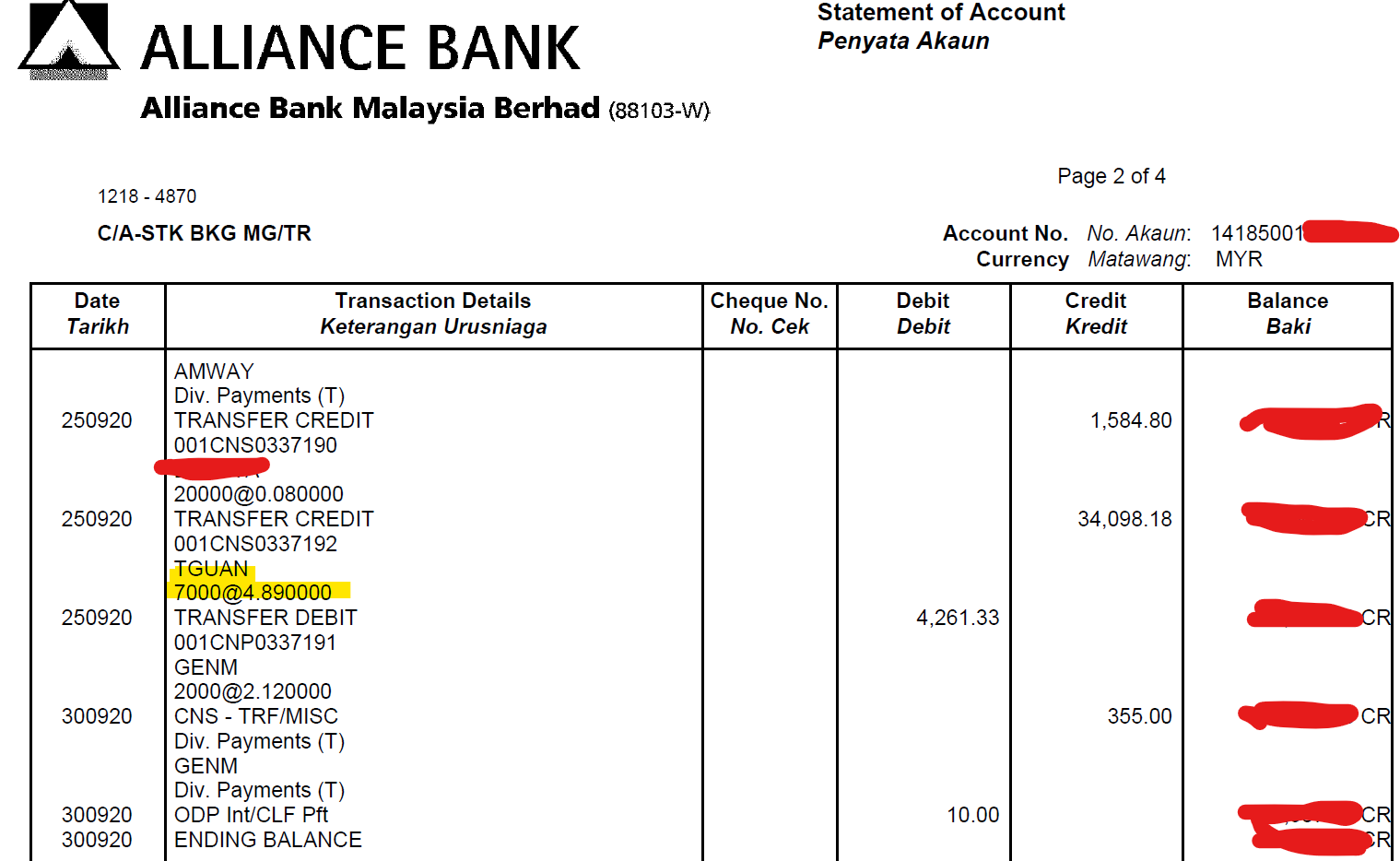

Sold too early, price was above RM5.00 for almost 3 weeks before ex-date for Bonus Issue, but can't be too greedy la.

Hand itchy

After seeing lower price, bought back at much higher volume.

Got confident in the company mah...

But caught the falling knife, bleeding 5 figures but still okay, got confident mah.

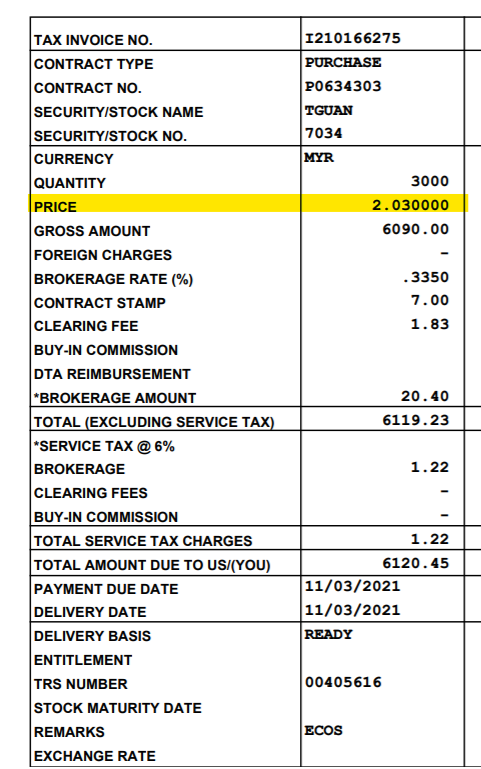

Buy more with limited cash/margin.

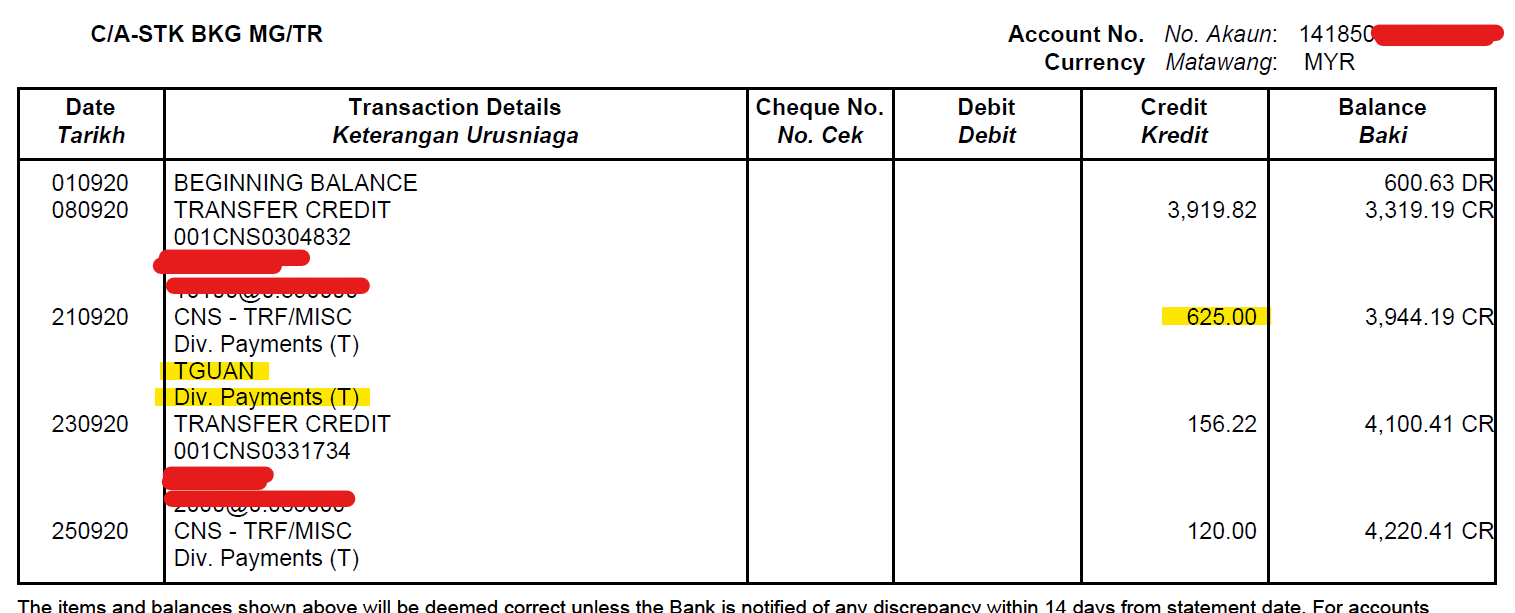

Dividend is not good, less than 3%

But something better than nothing.

Worth buying NOW ?

- At current price RM2.06 and L4Q EPS of 19.62 sen, TGUAN's PE is merely 10.50

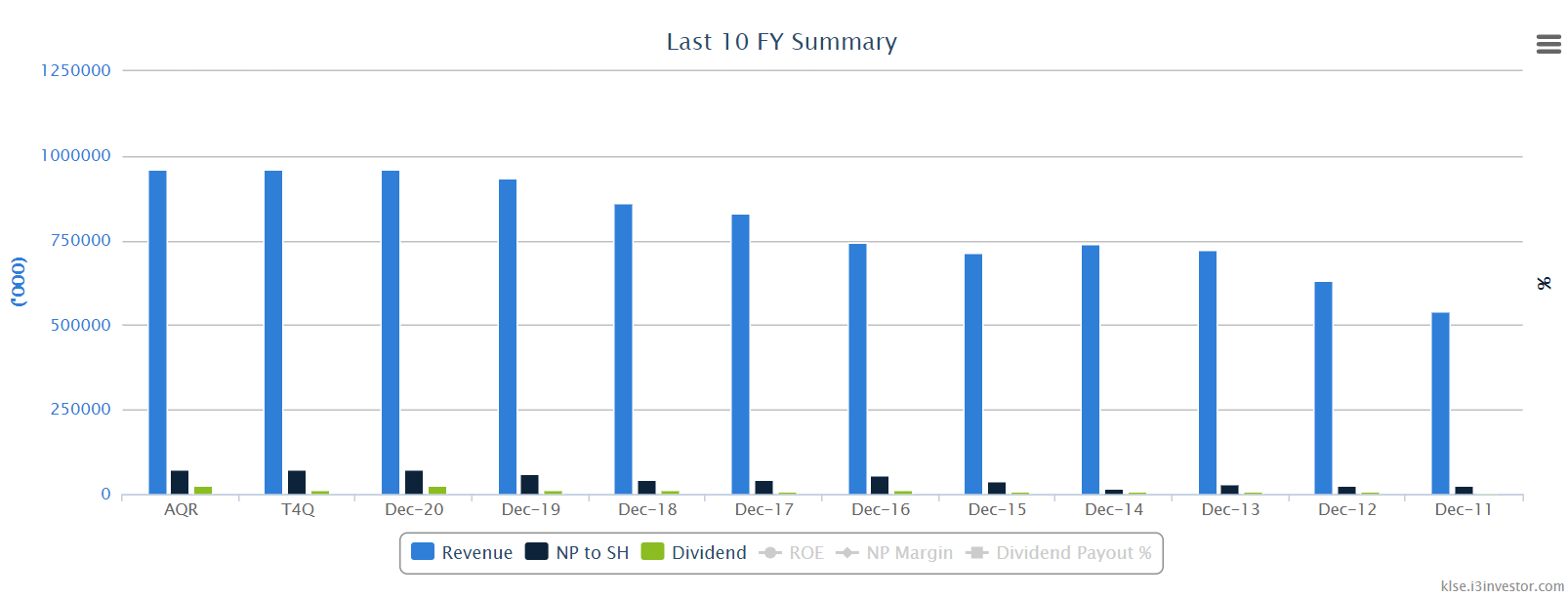

- Impeccable performance last 10 years,

https://klse.i3investor.com/servlets/stk/fin/7034.jsp?type=last10fy

I don't see reason not to buy.

but accidentally bought too many shares.

Will I sell ?

Sure.

RM100 Realised Gain is better than RM150 Unrealised Gain.

Will start selling at RM2.40 x 3 shares

Then RM2.50 x 5,000 shares

Then RM2.80 x 10,000 shares

Then RM3.20 x 20,000 shares.

My other story

Top Glove

https://telegra.ph/TOPGLOV-7113-03-14-2