Spread Betting Canada Tax

⚡ ALL INFORMATION CLICK HERE 👈🏻👈🏻👈🏻

Spread Betting Canada Tax

How to buy Canadian shares in the UK

Patrick Foot | Financial Writer , Bristol

What is the number one mistake traders make?

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money. High volatility increases the risk of sudden, large or rapid losses.

To prioritise the service we give our existing clients, IG is not currently allowing any new positions on GameStop and AMC Entertainment.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. High volatility increases the risk of sudden, large or rapid losses.

To prioritise the service we give our existing clients, IG is not currently allowing any new positions on GameStop and AMC Entertainment.

We use a range of cookies to give you the best possible browsing experience. By continuing to use this website, you agree to our use of cookies. You can view our cookie policy and edit your settings here , or by following the link at the bottom of any page on our site.

Canada’s stock market has a lot to offer investors – including a large economy, relative stability and new opportunities such as cannabis. If you’re considering buying Canadian shares in the UK, here are six steps to get started.

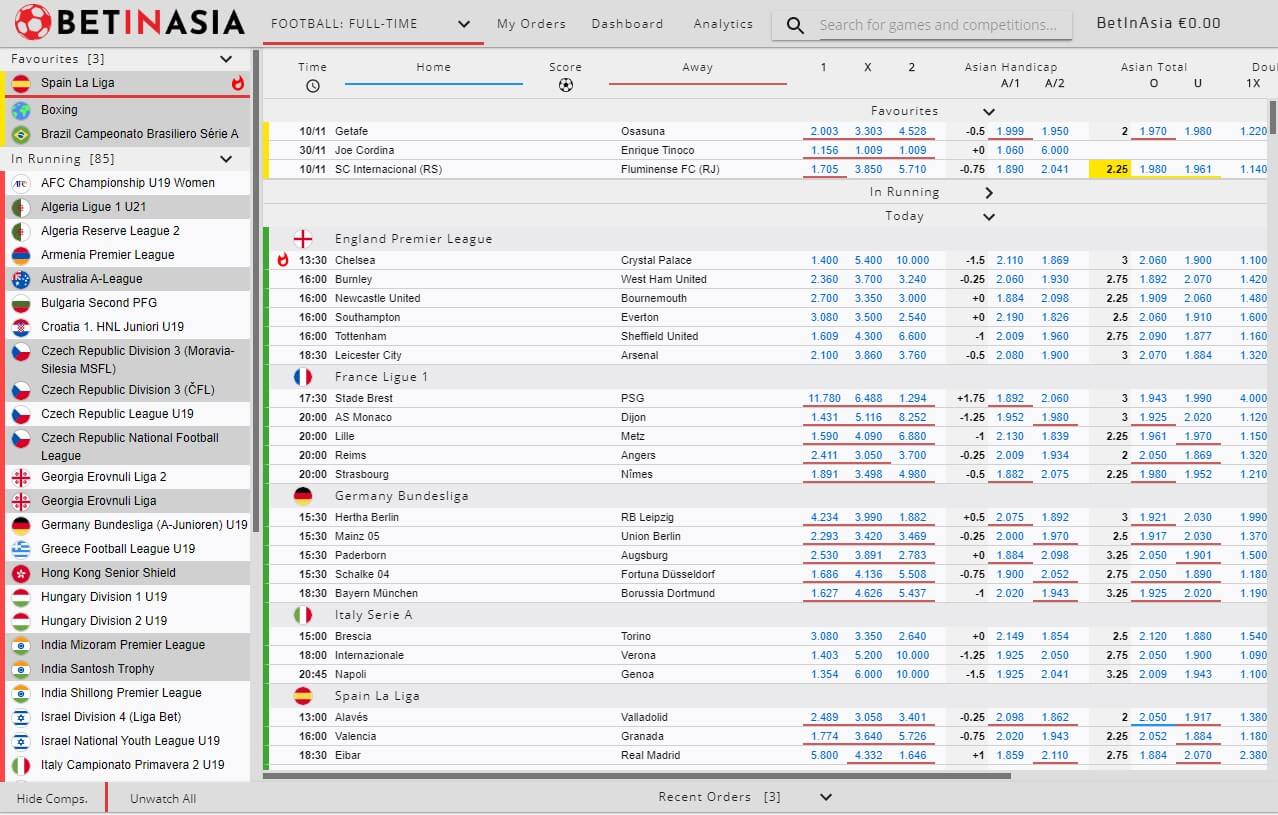

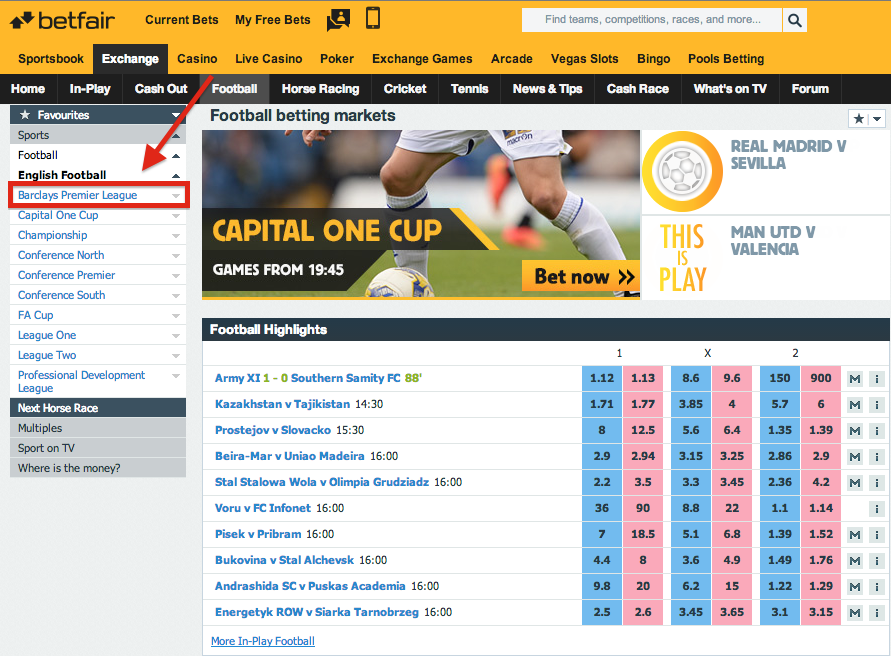

When you trade with IG, you can invest in Canadian shares directly if they have a dual-listing on a US stock exchange, or you can speculate on the prices of a wide variety of Canadian shares with CFDs and spread bets . Both offer exposure to the movements of Canadian share prices but they operate in different ways, and come with unique benefits and risks. Here’s a rundown of each.

When you invest in stocks, you’re buying them outright and adding them to your share dealing portfolio. You pay commission to open your position and put up the full cost of the shares upfront.

There are two ways to profit from investing:

A dividend is a portion of a company’s net profit that is returned to shareholders. If a stock you hold decides to pay $3 per share back to its investors, for example, you’ll get $3 for every share you own in the company. With IG, you’ll receive dividend payments directly into your account as soon as we receive them.

One major reason to invest in stocks is that you can keep your share dealing portfolio in an Individual Savings Account . By doing so, you’ll shield your income and profits from capital gains tax (CGT) . You can also keep your portfolio in a self-invested personal pension (SIPP) and pay no income tax or CGT on your investments. Stamp duty on international share dealing, meanwhile, is rare and charges are usually low.*

You can invest in any Canadian company that has a dual listing on a US exchange using your share dealing account. This gives you access to a wide range of blue-chip stocks – including nine of the ten largest Canadian companies by market cap – but it doesn’t include most stocks with a sole listing on the Toronto Stock Exchange (TSX).

When you trade stocks, you aren’t buying them outright. Instead, you’re speculating on their price movements – so you can profit from volatility without taking ownership of the underlying assets.

This brings two main benefits for traders. Firstly, you can go short as well as long. So if you think that a stock is due for a downturn, you can short it to make a profit from a fall in price. And second, you only have to pay a deposit called ‘margin’ to open your position. To trade $5000 in Royal Bank of Canada stock, for example, you might only have to pay $1000 upfront.

You will, however, pay overnight funding charges to cover the cost of maintaining your position over multiple days – you’ll pay these each night on rolling positions, or at the outset for share forwards. So if you’re planning on buying stocks and holding them over a long period, investing might be the better option.

You won’t own any shares when trading, so you can’t use an ISA or a SIPP. You don’t have to pay CGT on spread betting profits, however – and CFD losses can be offset against profits for tax purposes.*

You can use CFDs or spread bets to trade any Canadian company that has a dual listing on a US exchange, plus hundreds of stocks listed solely on the TSX.

Open a live IG account to get started. Or if you’re not ready to commit any real capital, open a demo account to trade with £10,000 in virtual funds.

With IG, you can choose whether you want to start share dealing, CFD trading or spread betting – or a mix of all three – when you open an account. You can open an account on our website or via our app in minutes.

Once your account is live, you can choose from over 12,000 companies and funds to trade or invest in, including a range of Canadian stocks that are listed on US exchanges. And if you need any help at all learning to use our platform, you’ll have access to dedicated 24-hour support.

Already own US-listed shares? You can transfer them to your IG account quickly and easily.

The W8-BEN form is required by the American Inland Revenue Service (IRS) for any individual who wants to buy shares through US exchanges. That means UK investors who want to buy Canadian companies that are listed on US exchanges will need to fill out a W-8BEN first.

The W8-BEN notifies the IRS that you aren’t a US citizen, so we can apply an individual tax benefit on your behalf. This can reduce the tax you pay on dividends from your US and Canadian stocks by up to 30%. You can complete the form on our online platform, so you don’t need to download or post anything.

If you’re only planning to trade US-listed shares via spread bets, you won’t need a W8-BEN. But you’ll need to fill one out to open positions on US stocks via CFDs.

If you’re looking to invest in stocks, then you’ll pay commission to open your position. You can use your IG account to invest in Canadian shares listed on US exchanges at our standard commission rate of £10. If you place more than three IG trades in a particular month, then you won’t pay any commission to open your position.

Data taken from competitor websites, correct at 05 April 2020.

You’ll need to buy Canadian shares on US exchanges in US dollars. When you open your position, we’ll automatically convert your pounds into dollars for just a 0.5% fee. There may be other charges, such as custody fees.

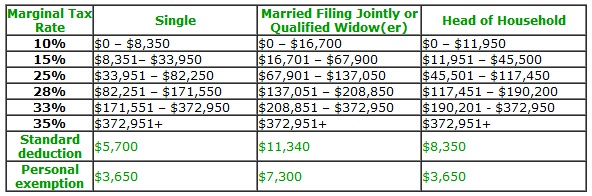

If you’re paid a dividend, it may be subject to a ‘withholding tax’. This is equivalent to your UK basic rate income tax liability, and exempts you from paying any further tax on your foreign dividends.*

You pay to open a spread betting position via a spread. Instead of paying commission, our charges are incorporated into the buy and sell prices we offer. For share CFDs, on the other hand, you pay commission. Neither incurs a currency conversion fee, but there may be other charges.

Next up, it’s time to decide which companies you want to buy. If you’re investing, then you’ll want to focus on Canadian stocks with a dual listing on a US exchange. Lots of blue chips are listed on both the TSX and the NYSE, so there are plenty to choose from.

The final step is to fund your account and buy your stocks. To find your chosen companies, simply log in to your account and search for them in the ‘finder’ bar.

If you want to open your position immediately at the best available price, you can use a market order. If you have a specific price in mind, you can use a limit order. With limit orders, we’ll open your position automatically when your chosen share hits the price you specify.

* Tax laws are subject to change and depend on individual circumstances. Tax law may differ in a jurisdiction other than the UK.

Publication date : Wednesday 29 April 2020 18:46

This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer and quarterly summary .

Explore the range of markets you can trade – and learn how they work – with IG Academy's free ’introducing the financial markets’ course.

We reveal the top potential pitfall and how to avoid it. Discover how to increase your chances of trading success, with data gleaned from over 100,00 IG accounts.

For more info on how we might use your data, see our privacy notice and access policy and privacy webpage .

Find out what charges your trades could incur with our transparent fee structure.

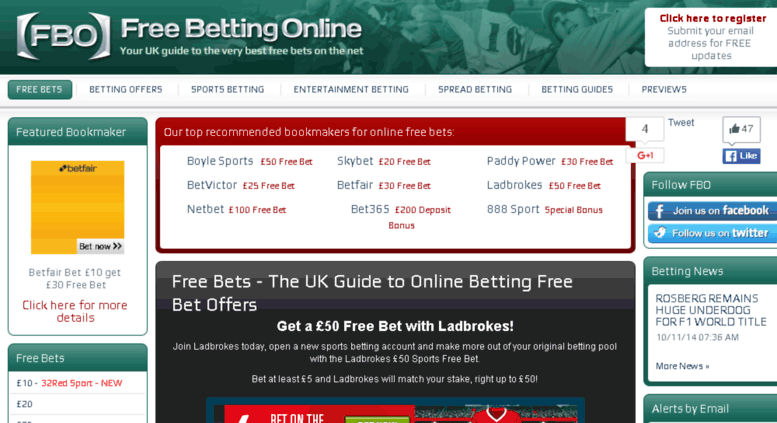

Discover why so many clients choose us, and what makes us a world-leading provider of spread betting and CFDs.

Stay on top of upcoming market-moving events with our customisable economic calendar.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money. Professional clients can lose more than they deposit. All trading involves risk.

The value of shares, ETFs and ETCs bought through a share dealing account, a stocks and shares ISA or a SIPP can fall as well as rise, which could mean getting back less than you originally put in. Past performance is no guarantee of future results.

CFD, share dealing and stocks and shares ISA accounts provided by IG Markets Ltd, spread betting provided by IG Index Ltd. IG is a trading name of IG Markets Ltd (a company registered in England and Wales under number 04008957) and IG Index Ltd (a company registered in England and Wales under number 01190902). Registered address at Cannon Bridge House, 25 Dowgate Hill, London EC4R 2YA. Both IG Markets Ltd (Register number 195355) and IG Index Ltd (Register number 114059) are authorised and regulated by the Financial Conduct Authority.

The information on this site is not directed at residents of the United States, Belgium or any particular country outside the UK and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Spread betting - Wikipedia

How to Buy Canadian Shares from the UK | IG UK

Taxes - Canada .ca

Taxes in Canada for trading profits and income - How is tax applied?

What is Spread Betting and How Does it Work? | CMC Markets

Follow:

YouTube

About government

Contact us

Departments and agencies

Public service and military

News

Treaties, laws and regulations

Government-wide reporting

Prime Minister

About government

Open government

Tax information for individuals, businesses, charities, and trusts.

Find out about new benefits and other changes that support Canadians during the COVID-19 pandemic.

Personal, corporation, and trust income tax

Register for the GST/HST; collect, file and remit the GST/HST; rebates, credits, and the GST/HST listing

Payroll accounts; deductions and contributions; information returns; and benefits and allowances

When you need a number or program account, how to register, make account changes, and other government programs

Tax-free savings accounts, registered savings plans, pooled pension plans, and plan administrators

Payment dates, Canada child benefit, Children’s special allowance, GST/HST credit, and other benefits

Customs, excise taxes and duties, softwood lumber, air travellers’ security charge, and cannabis duty

Charities listings, charity registration and operation, and charitable tax credits

Volunteer to do taxes for people in your community.

Learn how to recognize a scam and what to expect when CRA contacts you.

Limit the spread of COVID-19 and prevent future outbreaks.

Horse Riding Sex

Sperm Face Porno

Massage Parlor Porn

Jessica Naked

Secretary Party