Ig Spread Betting Review

⚡ ALL INFORMATION CLICK HERE 👈🏻👈🏻👈🏻

Ig Spread Betting Review

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money. High volatility increases the risk of sudden, large or rapid losses.

To prioritise the service we give our existing clients, IG is not currently allowing any new positions on GameStop and AMC Entertainment.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. High volatility increases the risk of sudden, large or rapid losses.

To prioritise the service we give our existing clients, IG is not currently allowing any new positions on GameStop and AMC Entertainment.

We use a range of cookies to give you the best possible browsing experience. By continuing to use this website, you agree to our use of cookies. You can view our cookie policy and edit your settings here , or by following the link at the bottom of any page on our site.

Speculate on whether an asset’s price will rise or fall with spread bets. Discover everything you need to know about what spread betting is and how it works.

Start trading today. Call 0800 195 3100 or email newaccounts.uk@ig.com . We’re here 24 hours a day, from 8am Saturday to 10pm Friday.

Spread betting is a popular derivative product you can use to speculate on financial markets – such as forex, indices, commodities or shares – without taking ownership of the underlying asset. Instead, you’d be placing a bet on whether you think the price will rise or fall.

We invented financial spread betting in 1974, and today we enable you to take advantage of over 17,000+ markets, whether they are rising or falling in price. This gives you a much wider range of opportunities than traditional buy-and-hold investing . Plus, as you won’t be taking ownership of the asset, spread betting is tax-free.*

Ready to start spread betting? Open an account

Spread betting works by tracking the value of an asset, so that you can take a position on the underlying market price – without taking ownership of the asset. There are a few key concepts about spread betting you need to know, including:

Going long is the term used to describe placing a bet that the market price will increase over a certain timeframe. Going short or ‘shorting’ a market is the reverse – placing a bet that the market will decline.

So spread betting enables you to speculate on both rising and falling markets. You would buy the market to go long, or sell the market to go short.

Let’s say you thought the price of gold was going to decline. You could open a spread bet to ‘sell’ the underlying market. The loss or gain to your position would depend on the extent to which your prediction was correct. If the market did decline, your spread bet would profit. But if the price of gold increased instead, your position would make a loss.

Leverage enables you to gain full market exposure for a fraction of the underlying market cost.

Say you wanted to open a position on Facebook shares. As an investor that would mean paying the full cost of the shares upfront. But by spread betting on Facebook shares instead, you might only have to put down a deposit worth 20% of the cost.

It’s important to note that leverage magnifies both profits and losses as these are calculated based on the full value of the position, not just the initial deposit. To manage your exposure, you should create a suitable risk management strategy and to consider how much capital you can afford to put at risk.

When you spread bet, you put down a small initial deposit – known as the margin – to open a position. This is why leveraged trading is sometimes referred to as ‘trading on margin’.

There are two types of margin to consider when spread betting:

Spread betting has three main features: the spread, bet size and bet duration. The spread is the charge you’ll pay for a position, the bet size is the amount of money you want to put up per point of market movement, and the bet duration is how long your position will remain open before it expires.

The spread is the difference between the buy and sell prices, which are wrapped around the underlying market price. They’re also known as the offer and bid. The costs of any given trade are factored into these two prices, so you’ll always buy slightly higher than the market price and sell slightly below it.

For example, if the FTSE 100 is trading at 5885.5 and has a one-point spread, it would have an offer price of 5886 and a bid price of 5885.

The bet size is the amount you want to bet per unit of movement of the underlying market. You can choose your bet size, as long as it meets the minimum we accept for that market. Your profit or loss is calculated as the difference between the opening price and the closing price of the market, multiplied by the value of your bet.

We measure the price movements of the underlying market in points. Depending on the liquidity and volatility of your chosen market, a point of movement can represent a pound, a penny, or even a one hundredth of a penny. You can find out what a point means for your chosen market on the deal ticket.

If you open a £2 per point bet on the FTSE 100 and it moves 60 points in your favour, your profit would be £120 (£2 x 60). If it moved 60 points against you, your loss would be £120.

The bet duration is the length of time before your position expires. All spread bets have a fixed timescale that can range from a day to several months away. You’re free to close them at any point before the designated expiry time, assuming the spread bet is open for trading.

Ready to start spread betting? Open an account

Say Apple is trading with a sell price of 11550 ($115.50) and a buy price of 11560 ($115.60). You anticipate that Apple shares are going to rise in the next few days, so decide to go long on (buy) Apple shares for £10 per point of movement at 11560.

If Apple shares did rise in price, you might decide to close your trade when the sell price hits 11590. As the market has increased by 30 points (11590 – 11560), you’d be coming out with a profit of £300 (30 x £10), excluding any additional costs.

If the market had fallen in value instead – down to a sell price of 11,510 – you would have ended up with a loss. As the market had moved by 50 points (11,560 – 11,510), you would have made a loss of £500 (50 x £10). Again, not including any additional charges.

Yes, if your prediction of whether the market will rise or fall is correct, you’ll profit and if it’s incorrect, you’ll lose.

It is important to remember that all forms of trading carry risk. So, although spread betting provides opportunities for profit, you should never risk more than you can afford to lose.

When you hedge using a spread bet, you open a position that will offset negative price movement in an existing position. This could be trading the same asset in the opposite direction, or on an asset that moves in a different direction to your existing trade.

For example, if you were worried that inflation might impact the value of your share portfolio, you might decide to take a long position on gold – an asset that typically has an inverse correlation with the dollar and can protect portfolios from inflation. If your shareholdings did decline, the profits from your spread bet on gold could offset any losses. But if your shareholdings rose in value instead, this profit could offset any potential loss to your gold spread bet.

Spread bets are not taxed.* Traditionally, when you buy and sell shares you have to pay stamp duty and capital gains tax on any profits that you make, but spread bets are tax-free. And because you don’t take ownership of the underlying asset, you won’t have to pay stamp duty either.

Spread betting is a bet on the future direction of a market, while a CFD is an agreement to exchange the difference in the price of an asset from when the contract is opened to when it is closed. There are a range of similarities and differences between these two derivative products.

Leverage is an inherent part of spread betting, so you can’t open a position without it. Before you start trading on leverage, it’s a good idea to build up your knowledge on the subject and create a risk management strategy.

Dividend payments have no impact on your spread betting position. If you hold a spread bet open on an equity or index when a dividend payment takes place, we’ll make an adjustment to your position. This means that capital will either be credited or debited to your account if a dividend is paid, depending on whether you have incurred additional running loss/profit.

Find out more about spread betting and test yourself with IG Academy’s range of online courses.

Discover the differences between spread betting and CFD trading

Learn about risk management tools including stops and limits

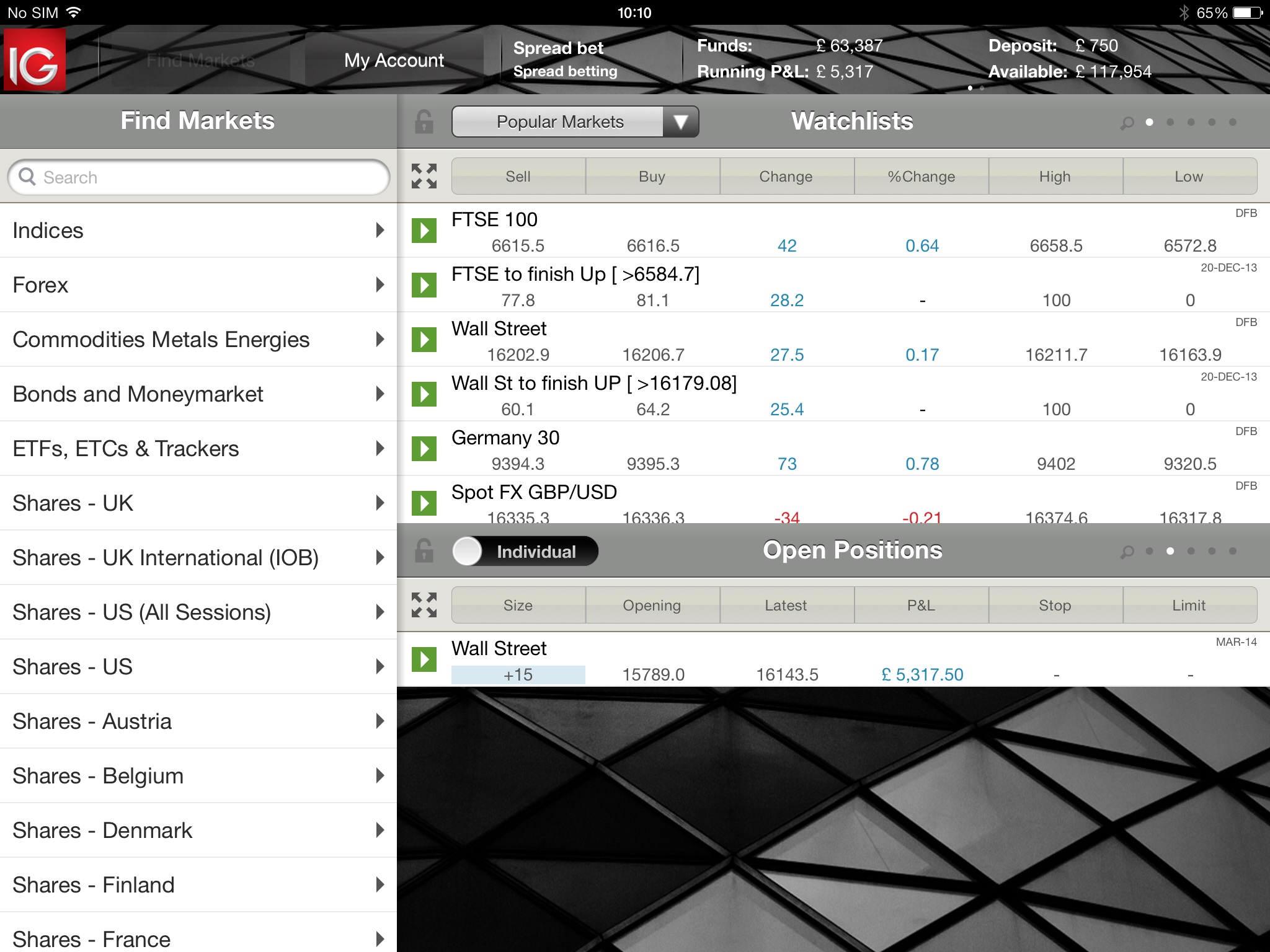

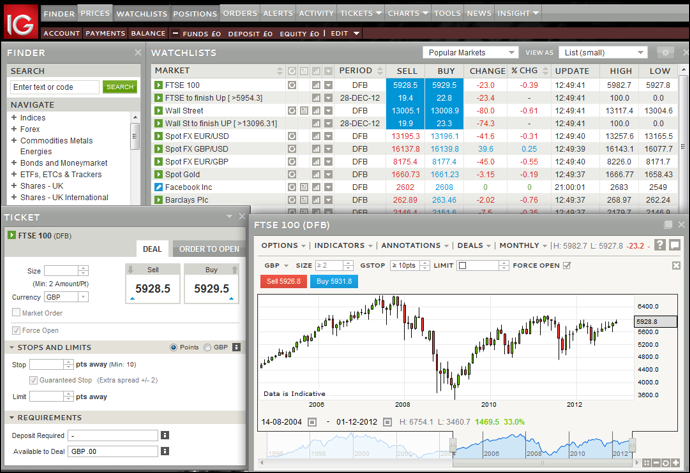

Browser-based desktop trading and native apps for all devices

* Tax laws are subject to change and depend on individual circumstances. Tax law may differ in a jurisdiction other than the UK.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money. Professional clients can lose more than they deposit. All trading involves risk.

The value of shares, ETFs and ETCs bought through a share dealing account, a stocks and shares ISA or a SIPP can fall as well as rise, which could mean getting back less than you originally put in. Past performance is no guarantee of future results.

CFD, share dealing and stocks and shares ISA accounts provided by IG Markets Ltd, spread betting provided by IG Index Ltd. IG is a trading name of IG Markets Ltd (a company registered in England and Wales under number 04008957) and IG Index Ltd (a company registered in England and Wales under number 01190902). Registered address at Cannon Bridge House, 25 Dowgate Hill, London EC4R 2YA. Both IG Markets Ltd (Register number 195355) and IG Index Ltd (Register number 114059) are authorised and regulated by the Financial Conduct Authority.

The information on this site is not directed at residents of the United States, Belgium or any particular country outside the UK and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Spread Betting vs CFD Trading: Key Differences | IG UK

What is Spread Betting and How Does it Work? | IG UK

What Is Spread Betting ?

Spread Betting Review - Home | Facebook

IG Markets Review 2021 Spread Bets , Forex & CFDs Comparison

Spread betting allows traders to bet on the direction of a financial market without actually owning the underlying security. Spread betting is sometimes promoted as a tax-free, commission-free activity that allows investors to speculate in both bull and bear markets, but this remains banned in the U.S. Like stock trades, spread bet risks can be mitigated using stop loss and take profit orders.

Spread betting refers to speculating on the direction of a financial market without actually owning the underlying security.

Forex (FX) is the market where currencies are traded and is a portmanteau of "foreign" and "exchange." Forex also refers to the currencies traded there.

A bear put spread is a bearish options strategy used to profit from a moderate decline in the price of an asset. It involves the simultaneous purchase and sale of puts on the same asset at the same expiration date but at different strike prices, and it carries less risk than outright short-selling.

A cash-and-carry trade is an arbitrage strategy that exploits the mispricing between the underlying asset and its corresponding derivative.

Covered interest arbitrage is a strategy where an investor uses a forward contract to hedge against exchange rate risk. Returns are typically small but it can prove effective.

A bull spread is a bullish options strategy using either two puts or two calls with the same underlying asset and expiration.

#

A

B

C

D

E

F

G

H

I

J

K

L

M

N

O

P

Q

R

S

T

U

V

W

X

Y

Z

Investopedia is part of the Dotdash publishing family.

Spread betting is a derivative strategy, in which participants do not own the underlying asset they bet on, such as a stock or commodity. Rather, spread bettors simply speculate on whether the asset's price will rise or fall, using the prices offered to them by a broker.

As in stock market trading, two prices are quoted for spread bets—a price at which you can buy (bid price) and a price at which you can sell (ask price). The difference between the buy and sell price is referred to as the spread. The spread-betting broker profits from this spread, and this allows spread bets to be made without commissions, unlike most securities trades.

Investors align with the bid price if they believe the market will rise and go with the ask if they believe it will fall. Key characteristics of spread betting include the use of leverage, the ability to go both long and short, the wide variety of markets available, and tax benefits.

If spread betting sounds like something you might do in a sports bar, you're not far off. Charles K. McNeil, a mathematics teacher who became a securities analyst—and later a bookmaker—in Chicago during the 1940s has been widely credited with inventing the spread-betting concept. But its origins as an activity for professional financial-industry traders happened roughly 30 years later, on the other side of the Atlantic. A City of London investment banker, Stuart Wheeler, founded a firm named IG Index in 1974, offering spread betting on gold. At the time, the gold market was prohibitively difficult to participate in for many, and spread betting provided an easier way to speculate on it.

Despite its American roots, spread betting is illegal in the United States.

Let's use a practical example to illustrate the pros and cons of this derivative market and the mechanics of placing a bet. First, we'll take an example in the stock market, and then we'll look at an equivalent spread bet.

For our stock market trade, let's assume a purchase of 1,000 shares of Vodafone (LSE: VOD ) at £193.00. The price goes up to £195.00 and the position is closed, capturing a gross profit of £2,000 and having made £2 per share on 1,000 shares. Note here several important points. Without the use of margin, this transaction would have required a large capital outlay of £193k. Also, normally commissions would be charged to enter and exit the stock market trade. Finally, the profit may be subject to capital gains tax and stamp duty.

Now, let's look at a comparable spread bet. Making a spread bet on Vodafone, we'll assume with the bid-offer spread you can buy the bet at £193.00. In making this spread bet, the next step is to decide what amount to commit per "point," the variable that reflects the price move. The value of a point can vary.

In this case, we will assume that one point equals a one pence change, up or down, in the Vodaphone share price. We'll now assume a buy or "up bet" is taken on Vodaphone at a value of £10 per point. The share price of Vodaphone rises from £193.00 to £195.00, as in the stock market example. In this case, the bet captured 200 points, meaning a profit of 200 x £10, or £2,000.

While the gross profit of £2,000 is the same in the two examples, the spread bet differs in that there are usually no commissions incurred to open or close the bet and no stamp duty or capital gains tax due. In the U.K. and some other European countries, the profit from spread betting is free from tax.

However, while spread bettors do not pay commissions, they may suffer from the bid-offer spread, which may be substantially wider than the spread in other markets. Keep in mind also that the bettor has to overcome the spread just to break even on a trade. Generally, the more popular the security traded, the tighter the spread, lowering the entry cost .

In addition to the absence of commissions and taxes, the other major benefit of spread betting is that the required capital outlay is dramatically lower. In the stock market trade, a deposit of as much as £193,000 may have been required to enter the trade. In spread betting, the required deposit amount varies, but for the purpose of this example, we will assume a required 5% deposit. This would have meant that a much smaller £9,650 deposit was required to take on the same amount of market exposure as in the stock market trade.

The use of leverage works both ways, of course, and herein lies the danger of spread betting. As the market moves in your favor, higher returns will be realized; on the other hand, as the market moves against you, you will incur greater losses. While you can quickly make a large amount of money on a relatively small deposit, you can lose it just as fast.

If the price of Vodaphone fell in the above example, the bettor may eventually have been asked to increase the deposit or even have had the position closed out automatically. In such a situation, stock market traders have the advantage of being able to wait out a down move in the market, if they still believe the price is eventually heading higher.

Despite the risk that comes with the use of high leverage, spread betting offers effective tools to limit losses .

Risk can also be mitigated by the use of arbitrage, betting two ways simultaneously.

Arbitrage opportunities arise when the prices of identical financial instruments vary in different markets or among different companies. As a result, the financial instrument can be bought low and sold high simultaneously. An arbitrage transaction takes advantage of these market inefficiencies to gain risk-free returns.

Due to widespread access to information and increased communication, opportunities for arbitrage in spread betting and other financial instruments have been limited. However, spread betting arbitrage can still occur when two companies take separate stances on the market while setting their own spreads.

At the expense of the market maker, an arbitrageur bets on spreads from two different companies. When the top end of a spread offered by one company is below the bottom end of another’s spread, the arbitrageur profits from the gap between the two. Simply put, the trader buys low from one company and sells high in another. Whether the market increases or decreases does not dictate the amount of return.

Many different types of arbitrage exist, allowing for the exploitation of differences in interest rates, currencies, bonds, and stocks, among other securities. While arbitrage is typically associated with risk-less profit, there are in fact risks associated with the practice, including execution , counterparty, and liquidity risks. Failure to complete transactions smoothly can lead to significant losses for the arbitrageur. Likewise, counterparty and liquidity risks can come from the markets or a company’s failure to fulfill a transaction.

Continually developing in sophistication with the advent of electronic markets, spread betting has successfully lowered the barriers to entry and created a vast and varied alternative marketplace.

Arbitrage, in particular, lets investors exploit the difference in prices between two markets, specifically when two companies offer different spreads on identical assets.

The temptation and perils of being overleveraged continue to be a major pitfall in spread betting. However, the low capital outlay necessary, risk management tools available, and tax benefits make spread betting a compelling opportunity for speculators.

Options Trading Strategy & Education

Nasty Hot Anal

Public Sex Game

Sperm Cell

My Own Private Idaho

Czech Massage Porn Canal

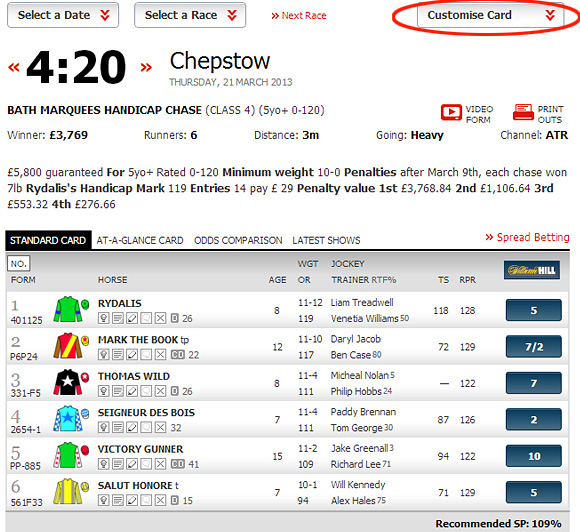

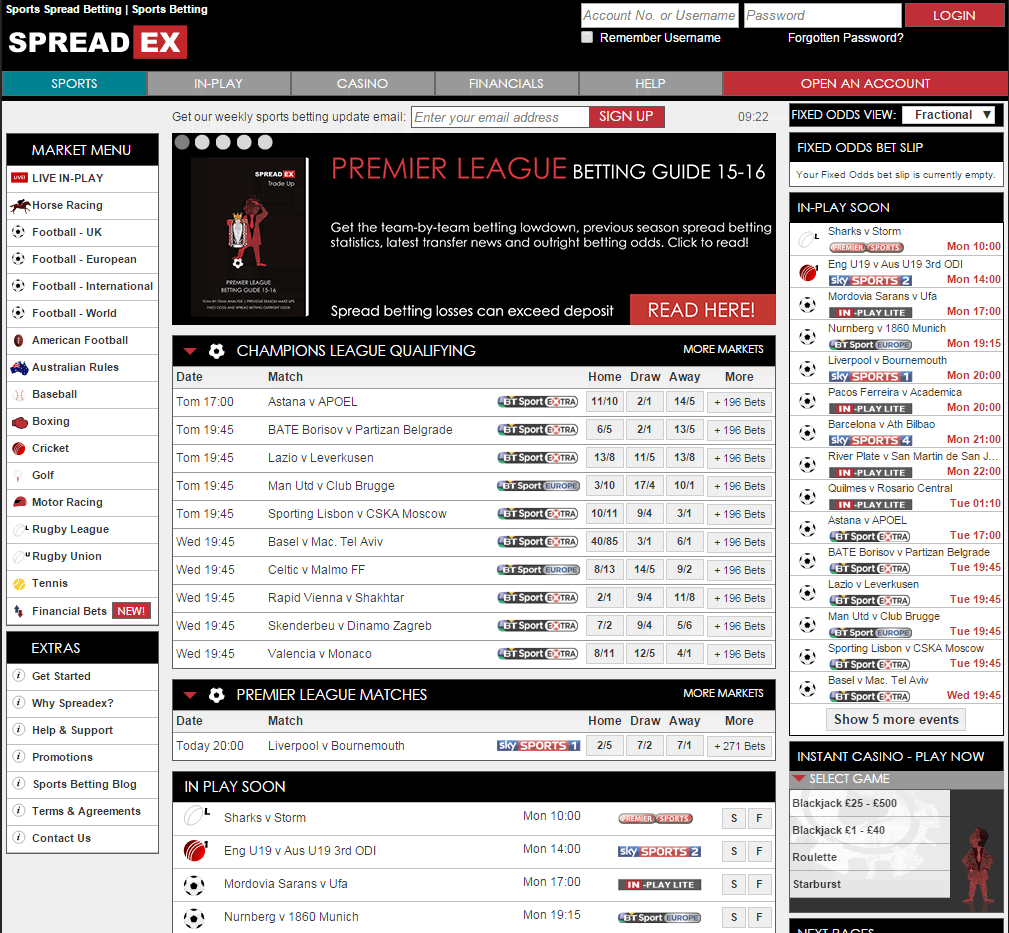

q_auto" width="550" alt="Ig Spread Betting Review" title="Ig Spread Betting Review">f_auto" width="550" alt="Ig Spread Betting Review" title="Ig Spread Betting Review">dpr_2.0/ig-platforms.png" width="550" alt="Ig Spread Betting Review" title="Ig Spread Betting Review">

q_auto" width="550" alt="Ig Spread Betting Review" title="Ig Spread Betting Review">f_auto" width="550" alt="Ig Spread Betting Review" title="Ig Spread Betting Review">dpr_2.0/ig-platforms.png" width="550" alt="Ig Spread Betting Review" title="Ig Spread Betting Review">