Crypto alphas and betas

VizhnitskyThis is the first in a series of short notes on applicability of the well-known Modern Portfolio Theory to describe risk profiles of cryptoassets. We test “market risk” vs “diversifiable risk” concept for crypto market. Using CCI30 index as a benchmark, we obtain alpha and beta values for a list of 50 coins based on historical data since November 2017. While diversifiable risk can technically be identified (and show a number of coins suitable for diversification), good individual performance of a coin is coupled with investor's exposure to market risk. This means that risk diversification in crypto is hard to achieve.

More specifically, we are dealing with Security Characteristic Line (SCL), a simple linear model which desribes the relationship between returns of an asset and returns of a market benchmark, which is most often a stock market index, such as S&P500 for equity stock market, CCI30 or recent CMC200 for crypto market. The SCL model introduces two coefficients, alpha, describing the asset's relative performance against the market, and beta, describing the asset's sensitivity to overall market movements, or, in other interpretation, the level of systematic (i.e. market) risk associated with the asset when it is added to the portfolio. More background here:

https://en.wikipedia.org/wiki/Beta_(finance)

https://en.wikipedia.org/wiki/Alpha_(finance)

Both alpha and beta have numerous risk management implications, which we'll not mention here. It's much more important to test whether the concept can be meaningfully applied on crypto markets, which is often thought of as a single “industry” where all returns correlate and such thing as an “own” value of a coin rarely exists.

To keep long story short, for 50 chosed coins/tokens we perform a series of SCL linear regressions of the form

Ycoin = alpha + beta*Yindex [+ residual],

which is supposed to decompose the coin risk to “market” and “own” (in other words, systematic and non-systematic), the latter represened by residuals (i.e. forecast errors) from the regression and being possible to reduce through portfolio diversification. We would like to get uncorrelated residual series for individual coins; correlated residuals not only mean that the estimated alpha and beta are technically inappropriate, but as well that portfolio diversification does not help much to hedge against individual coin risks. On equity market, stocks belonging to single industry do have correlated residuals; this does not preclude from model application on the market as a whole, but suggests that a portfolio composed by a single industry is a bad investment decision.

We take CCI30 as our market index. For the sake of curiosity we take CMC historical market capitalization as another benchmark. As CMC200 index does not have historical values, we do not use it. Our coins include the CMC top 30 coins/tokens (CCI30 constituents) and 20 coins chosen arbitrarily, mostly listed on Binance and having CMC historical price data since at least November 2017. We use USD (the underlying unit of all indices and price data default) and BTC (for which we transform both index yield and stock yield: Ycoin/btc = [(1+Ycoin/usd)/(1+btc/usd)] – 1) as the underlying yield units. We further calculate the pairwise correlation of residuals for every pair of coins and estimate the correlation significance. Given 519 observations, we use 0.0001 alpha value, which results in treating correlation above 0.17 as significant (the 5% alpha would treat correlations above 0.087 as significant).

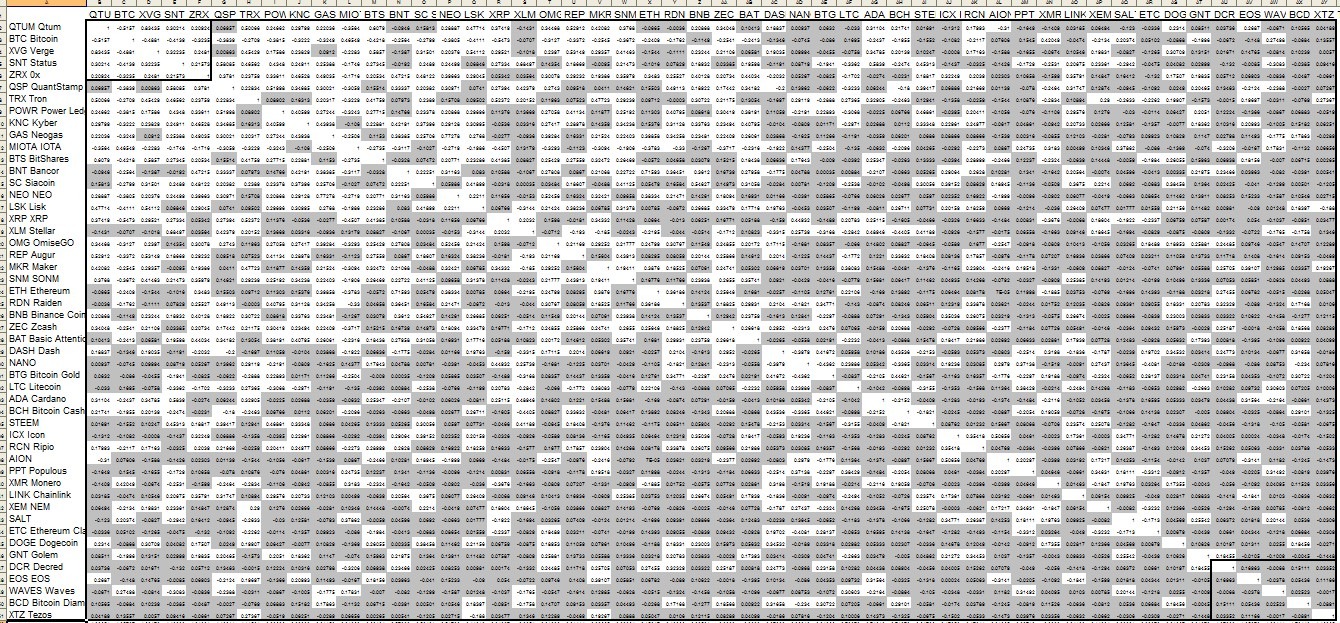

The tables 1 and 2 below show estimated alphas and betas in USD and BTC. Tables 3 and 4 show the residuals correlation matrices for USD and BTC regressions, insignificant correlations shaded in grey. CCI30 is the market index. Table 5 shows the correlation matrix for USD regression using CMC capitalization. As most residuals are correlated, it should be clear that total market cap is not appropriate for the market index. Although this is disputable, I consider the CCI30 model performance satisfying, especially in BTC units, and it clearly shows the “market” and “own” risk/return fractions for crypto assets.

The results imply that risk reduction through portfolio diversification is hard to achieve in crypto. Most coins that have regularly outperformed the market (Tron, Nano, Verge, Cardano, with the exception of BNB) have beta over 2 and thus expose investors to market risk greatly. Bitcoin Diamond, Tezos, EOS, Doge, Golem Network and Ethereum Classic have shown up as good diversifiers of non-systematic risk both in USD and BTC.

PS. The second part, dedicated to testing of crypto indices, is here: https://telegra.ph/Which-crypto-index-is-better-05-24