Composing Down Goodwill

Again in November 2012, when it unveiled its fourth quarter final results, Pc large Hewlett-Packard introduced that It could be getting an $8.8 billion charge to write down down a botched acquisition of U.K.-based mostly Autonomy Corporation PLC. The publish-off, which was referred to as a non-dollars cost to the impairment on the Autonomy invest in, involved goodwill and intangible asset rates.

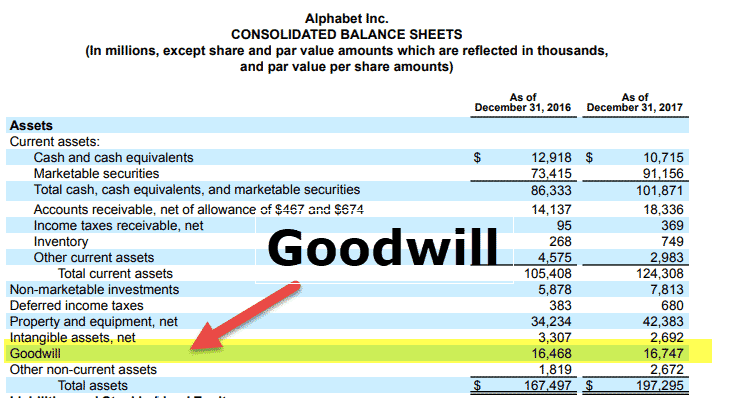

What's Goodwill?

Goodwill often occurs when a person corporation buys An additional; it is described as the amount paid out for the organization over reserve worth. Goodwill is definitely an intangible asset, versus tangible assets which include buildings, Laptop or computer and Office environment gear, and linked physical goods, which include stock and associated forms of Functioning funds. In other words, goodwill represents an acquisition sum in excess of and higher than just what the procured firm's Web belongings are deemed to get valued at to the harmony sheet. (For more, see "Is Goodwill Regarded as a Form of Cash Asset?")

https://telegra.ph/Writing-Down-Goodwill-01-17

When Goodwill Goes Lousy

In the situation of HP's acquisition of Autonomy, provided the charge introduced in November, it is clear that the majority of the first $11 billion buy price was around and earlier mentioned the e-book benefit, or Internet asset price of Autonomy, a quick-increasing program corporation. In line with a Bloomberg study, Autonomy shown total assets of $3.5 billion suitable prior to it had been acquired. At enough time of acquisition, HP initially accounted $6.six billion towards goodwill and $four.6 billion to other intangibles. These quantities were later altered to $6.nine billion and $four.3 billion, respectively.

HP's miscalculation, In combination with concerns above the amounts it at first decided to create down goodwill by and subsequently booked, demonstrates which the thought of goodwill is unsure and open to interpretation. To ascertain goodwill quantities, firms generally count on their own accountants, but they are going to also flip to valuation consultants to assist estimate.

In reality, other tangible property, such as the depreciated value of land and equipment is usually matter to estimates along with other interpretations, but these other values can a minimum of is usually linked with both a Actual physical excellent or asset. In distinction, goodwill is more challenging to place a agency benefit on. A 2009 post during the Economist explained it as "an intangible asset that signifies the additional value ascribed to an organization by virtue of its model and standing."

From HP's perspective, There is certainly very little question that it experienced high hopes for Autonomy, which was primarily based off its documented income concentrations and the expectation that its fast development would carry on very well into the long run.

How Goodwill Is Prepared Down

After an acquisition is manufactured, and offered it was a audio obtain, goodwill continues to be to the getting company's equilibrium sheet indefinitely. Just before 2002, goodwill was amortized more than 40 many years, A great deal how a chunk of equipment is likely to be depreciated in excess of a interval, according to estimates of its useful daily life. But because then, regulations have gotten more stringent: Goodwill might be amortized over a straight-line foundation about a interval never to exceed a decade. If Anytime, the value declines, as occurred in quick vogue with goodwill related to Autonomy, then an impairment demand is necessary.

HP, and various corporations that turn out producing down major amounts of goodwill, are rapid to indicate that a goodwill impairment cost is non-income, and so will not have an effect on dollars flows. It represents, however, a big previous error that drained the company coffers. In regard to HP, which funded the Autonomy obtain through dollars reserves, is goodwill an asset it ended up destroying billions in shareholder price, given that the company is worthy of just a portion of its earlier approximated price.

The underside Line

Goodwill impairment costs Really don't damage present 12 months hard cash flows, but they exhibit faults made before by management teams. In HP's case, the decision to purchase Autonomy with no enough research and tire-kicking represented one particular of many circumstances the place a serious lapse in judgment was created.

For other organizations, goodwill impairment expenses are normally a lot less major, Nevertheless they nevertheless demand analysts to analyze precisely what went Improper and when the mistake is probably going to become recurring Later on, into the detriment of current shareholders.