Cfds And Spread Betting Explained

⚡ 👉🏻👉🏻👉🏻 INFORMATION AVAILABLE CLICK HERE 👈🏻👈🏻👈🏻

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 70% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

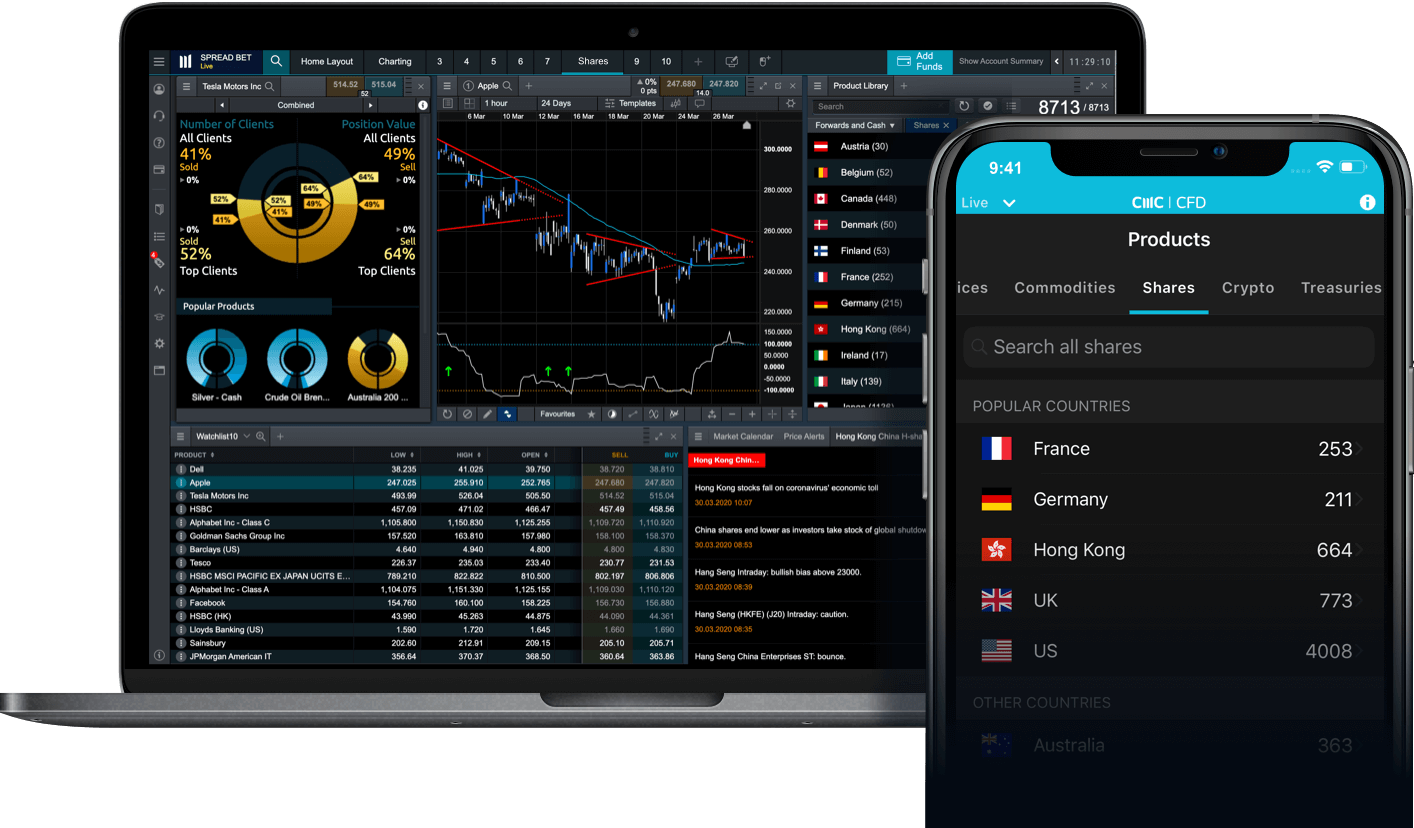

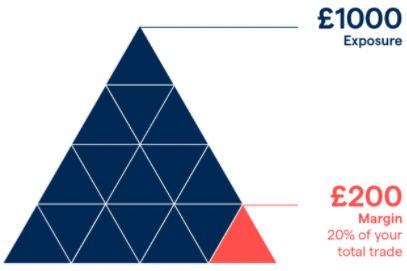

Spread betting and CFDs are traded on margin.

This means that with a small initial deposit you can control a much larger position.

Call 020 7638 6996 or email newaccounts@guardianstockbrokers.com to discuss opening a trading account.

Features of Spread betting and CFDs

Open an Spread betting or CFD Trading account now

Spread betting allows you to speculate tax free on thousands of global instruments including forex, indices, shares, commodities and bonds..

With spread betting you decide which direction a market will move. Then you place a bet based on the amount you want to make or lose per point movement. If the market moves in your chosen direction you will make a profit and if it moves in the opposite direction you will make a loss.

The profit is calculated by multiplying the amount of points moved by the amount that you bet per point movement.

CFDs allow you speculate on a huge range of markets including forex, indices, shares, commodities and bonds.

With CFDs you buy or sell a specific amount of units or contracts.

If your chosen market moves in your favor you will make a profit. If it moves in the opposite direction you will make a loss

Tax laws are subject to change and depend on individual circumstances.

Choose Guardian Stockbrokers to be your partner in trading

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 70% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money. Professional clients can lose more than they deposit.

The value of shares, ETFs and ETCs bought through a share dealing account, a stocks and shares ISA or a SIPP can fall as well as rise, which could mean getting back less than you originally put in. Past performance is no guarantee of future results.

The information on this site is not directed at residents of the United States, Belgium or any particular country outside the UK and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Guardian Stockbrokers Limited is authorised and regulated by the Financial Conduct Authority (No. 492519).

Registered office: 14 City Road, London EC1Y 2AA. Registered in England and Wales. Company No. 06756375.

We use cookies and similar technologies to enable services and functionality on our site and to understand your interaction with our service. By clicking on accept, you agree to our use of such technologies for marketing and analytics.See Privacy Policy

Let’s keep it simple…

Throughout your MATI Trader experience, we’ll stick to the two most popular and profitable ways to trade using…

CFDs and Spread Trading…

In the previous article we tackled what derivatives are and why they’re a revolution to traders.

In this issue, we’ll discuss the differences between both CFDs and Spread Trading…

Spread Trading (betting) and CFDs are financial instruments that allow us to do one thing.

To place a bet on whether a market will go up or down in price – without owning the underlying asset.

If we are correct, we stand a chance to make magnified profits and vice versa if wrong.

Both CFDs and Spread Trading, allow us to buy or sell a huge variety of markets including:

• Stocks

• Currencies

• Commodities

• Crypto-currencies and

• Indices.

When you have chosen a market to trade, there are two types of CFD or Spread Trading positions you can take.

You can buy (go long) a market at a lower price as you expect the price to go up where you’ll sell your position at a higher price for a profit.

You can sell (go short) a market at a higher price as you expect the price to go down where you’ll buy your position at a lower price for a profit.

DEFINITION:

A CFD is an unlisted over-the-counter financial derivative contract between two parties to exchange the price difference between the opening and closing price of the underlying asset.

Let’s break that down into an easy-to-understand definition.

EASIER DEFINITION:

A CFD (Contract For Difference) is an:

• Unlisted (You don’t trade through an exchange)

• Over The Counter (Via a private dealer or market maker)

• Financial derivative contract (Value from the underlying market)

• Between two parties (The buyer and seller) to

• Exchange the

• Price difference (Of the opening and closing price) of the

• Underlying asset (Instrument the CFD price is based on)

EASIEST DEFINITION

Essentially, you’ll enter into a CONTRACT at one price, close it at another price FOR a profit or a loss depending on the price DIFFERENCE (between your entry and exit).

Moving onto Spread Trading.

EXPLAINED: Spread Trading

for Dummies

The costs you WILL pay with Spread Trading and CFDs

Both Spread Trading and CFDs are geared-based derivative financial instruments.

As their values derive from an underlying asset, when you trade using Spread Trading or CFDs, you never actually own any of the assets.

You’re just making a simple bet on whether you expect a market price to rise or fall in the future.

If you decide to go with the broker or market maker who offers CFDs or Spread Trading, there are certain costs you’ll need to pay.

Costs with Spread Trading

With Spread Trading, you’ll only have one cost to pay – which are all included in – the spread.

The spread is the price difference between the bid (buying price) and the offer (selling price).

EXAMPLE: Let’s say you enter a trade and the bid and offer prices is 5,550c – 5,610c.

The spread, in this case, is 60c (5,610c – 5,550c).

This means your trade has to move 60c to cross the spread in order for you to be in the money-making territory. Also, if the trade goes against you, the spread will also add to your losses.

Why the spread you ask?

The spread is where the brokers (market makers’) make their money.

Costs with CFDs

Brokerage

With CFDs, it can be different.

Depending on who you choose to trade CFDs with, you may need to cover both the spread as well as the brokerage fees – when you trade.

These brokerage fees can range from 0.2% – 0.60% for when you enter (leg in) and exit (leg out) a trade.

NOTE: If the minimum brokerage per trade is R100, you’ll have to pay R100 to enter your trade.

Daily Interest Finance Charge

The other (negligible) cost, you’ll need to cover is the daily financing charges.

If you buy (go long) a trade, you’ll have to pay this negligible charge (0.02% per day) to hold a trade overnight.

However, if you sell (go short) a CFD trade, you’ll then receive this negligible amount (0.009%) to hold a short trade overnight.

The costs you WON’T pay as a Spread Trader

With spread trading (betting), you don’t own anything physical.

When you take a spread bet, you’re simply making a financial bet on where you expect the price to move and nothing else.

This means, there will be no costs to pay as you would with shares including:

NO Daily Interest Finance charges

NO Stamp Duty costs

NO Capital Gains Tax

NO Securities Transfer Tax

NO Strate

NO VAT

NO Brokerage (all wrapped in the spread).

The costs you WON’T pay as a CFD trader

With CFDs, you’ll notice that there are similar costs with Spread Trading that you won’t have to pay including:

NO Stamp Duty costs

NO Securities Transfer Tax

NO Settlement and clearing fees

NO VAT

NO Strate

The great thing about Spread Betting or CFD trading is that, you can trade markets trade 24/5.

I’m talking about currencies, commodities and indices.

And with Crypto-currencies you can trade them 24 hours a day seven days a week.

I have left out a very important difference between CFDs and Spread Trading… Gearing and how it works in real life…

Either you can wait till next week, as I will explain exactly how much money you can make or lose through the art of gearing or you can click here where I explain how it works through a FREE video…

Trade well,

Timon Rossolimos

Founder, MATI Trader

PS: If you found this article helpful let me know by e-mailing timon@timonandmati.com or click here to let us know in our MATI Trader chat room.

Designed by Elegant Themes | Powered by WordPress

Kick Ass Candy

These Sluts Are Hot

Collagen Power Lifting Cream Tube

Separated Wife Dating Someone

Mi Band 4 Overwatch

Spread Betting vs CFD Trading: Key Differences | IG UK

Spread Betting vs CFDs | Learn the Key Differences ...

Spread Trading And CFDs For Dummies - MATI Trader

CFDs & Spread Betting with CFDs.com | CFDs & Spread Betting

CFD Trading vs Spread Betting - Differences Explained

Difference Between CFDs vs Spread Betting

CFDs and Spread Betting Compared | Contracts-For ...

CFD Trading vs Spread Betting | What's the Difference?

Getting Market Leverage: CFD versus Spread Betting

Cfds And Spread Betting Explained