Call Spread

🔞 ALL INFORMATION CLICK HERE 👈🏻👈🏻👈🏻

Call Spread

Customer Service

Profile

Open an Account

Refer a Friend

Log In

Customer Service

Profile

Open an Account

Refer a Friend

Log Out

Home »

Research »

Learning Center »

Investment Products »

Options »

Options Strategy Guide »

Locate an Investor Center by ZIP Code

Careers

News Releases

About Fidelity

International

Copyright 1998-2021 FMR LLC. All Rights Reserved.

Terms of Use

Privacy

Security

Site Map

Accessibility

Contact Us

Share Your Screen

Disclosures

This is for persons in the U.S. only.

To profit from a gradual price rise in the underlying stock.

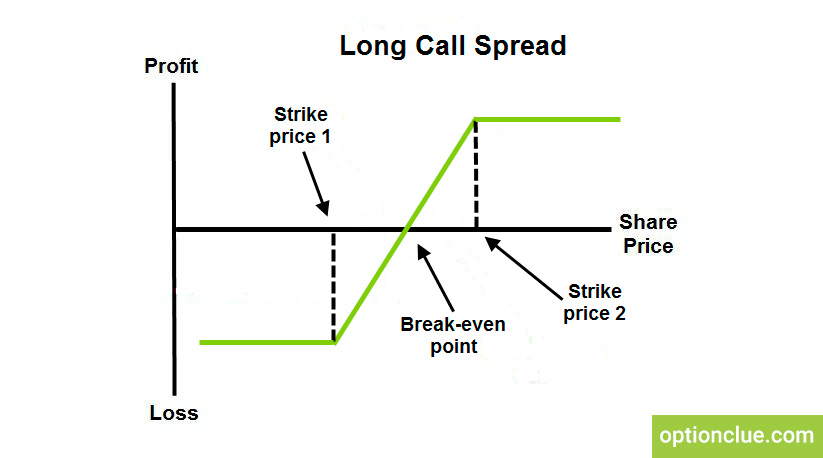

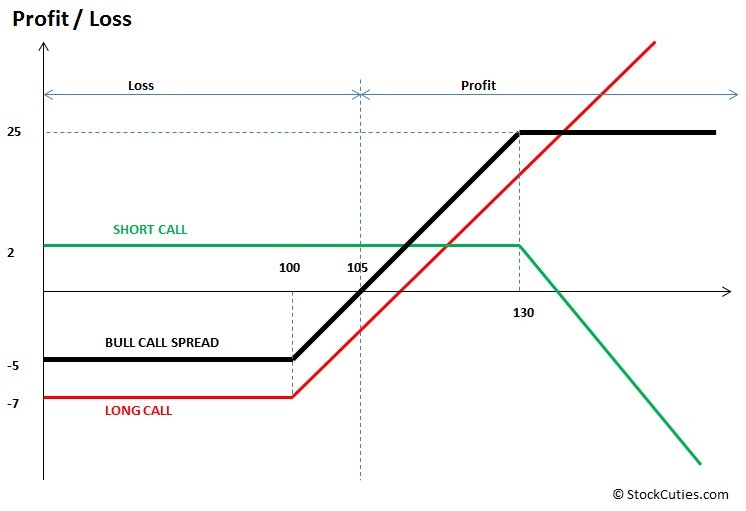

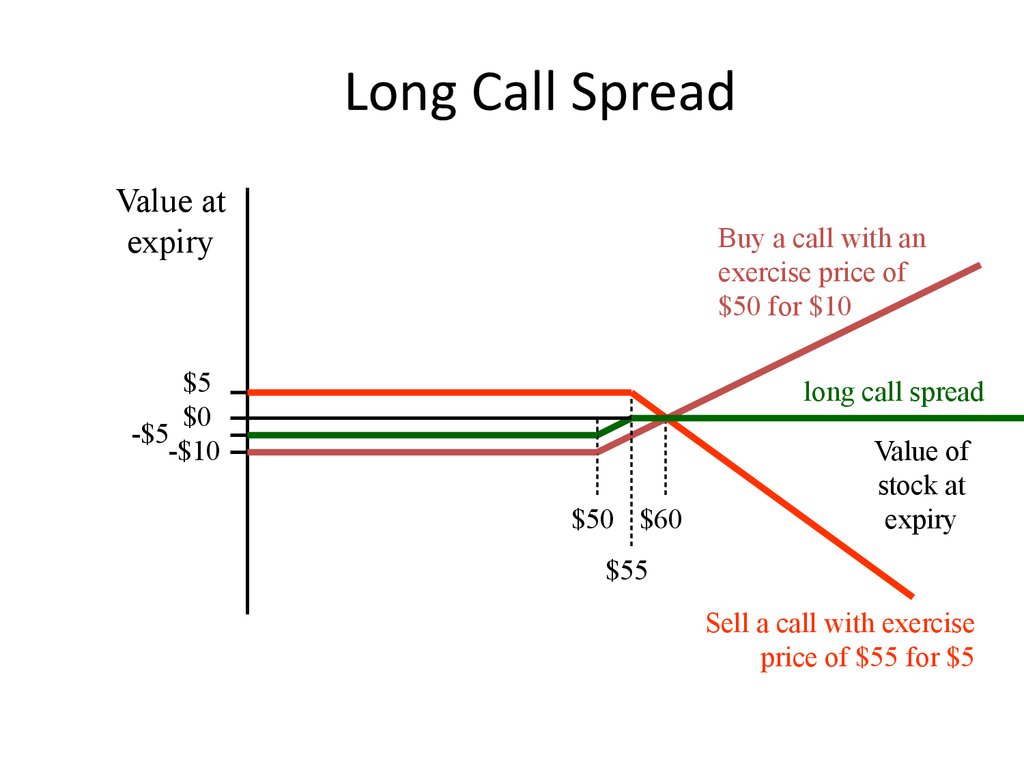

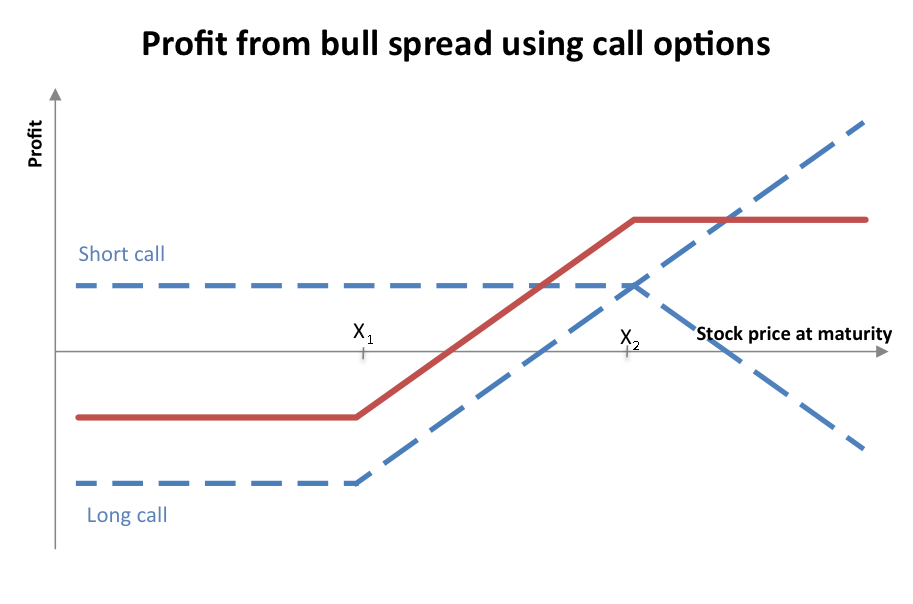

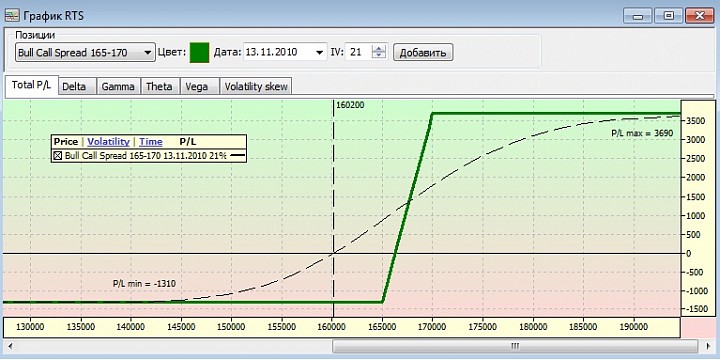

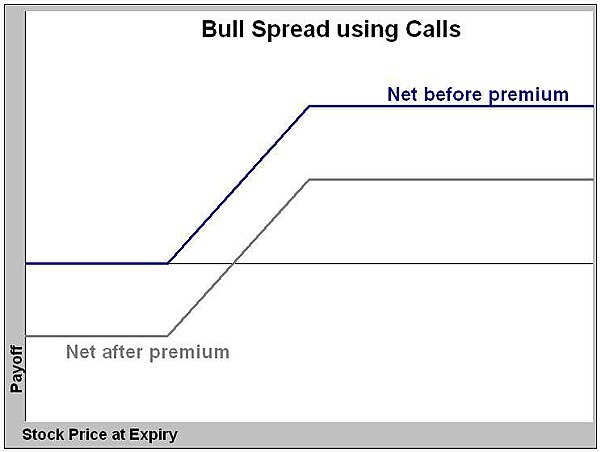

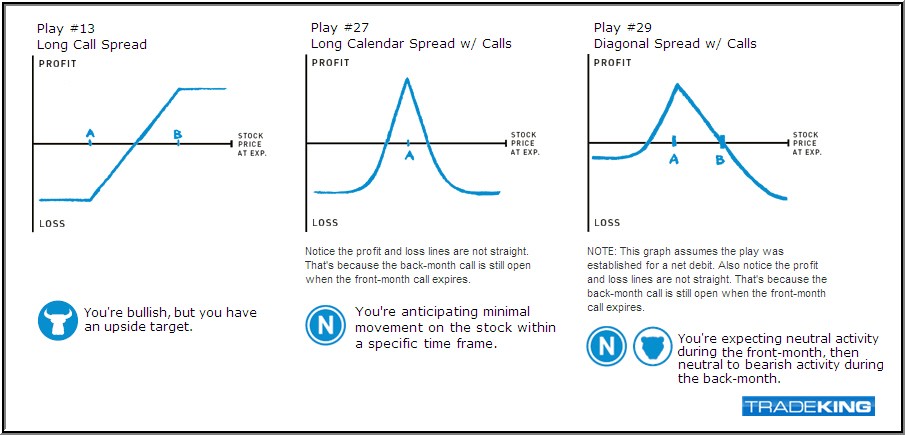

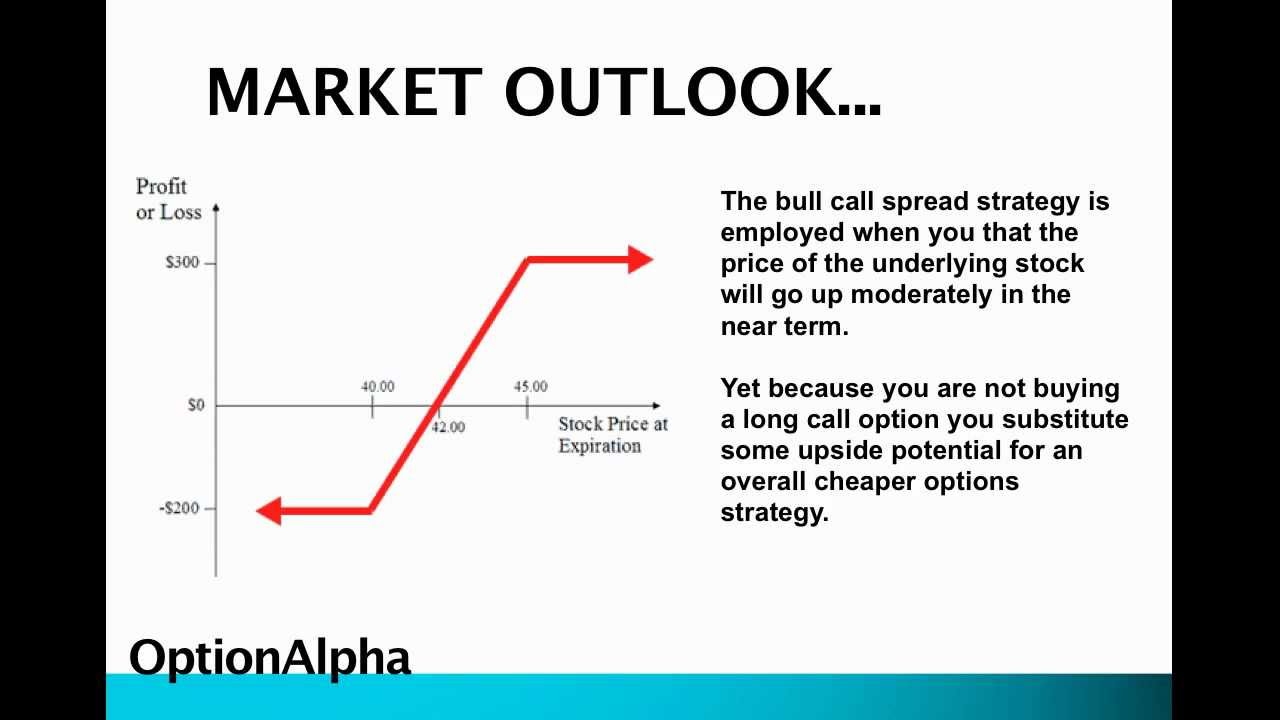

A bull call spread consists of one long call with a lower strike price and one short call with a higher strike price. Both calls have the same underlying stock and the same expiration date. A bull call spread is established for a net debit (or net cost) and profits as the underlying stock rises in price. Profit is limited if the stock price rises above the strike price of the short call, and potential loss is limited if the stock price falls below the strike price of the long call (lower strike).

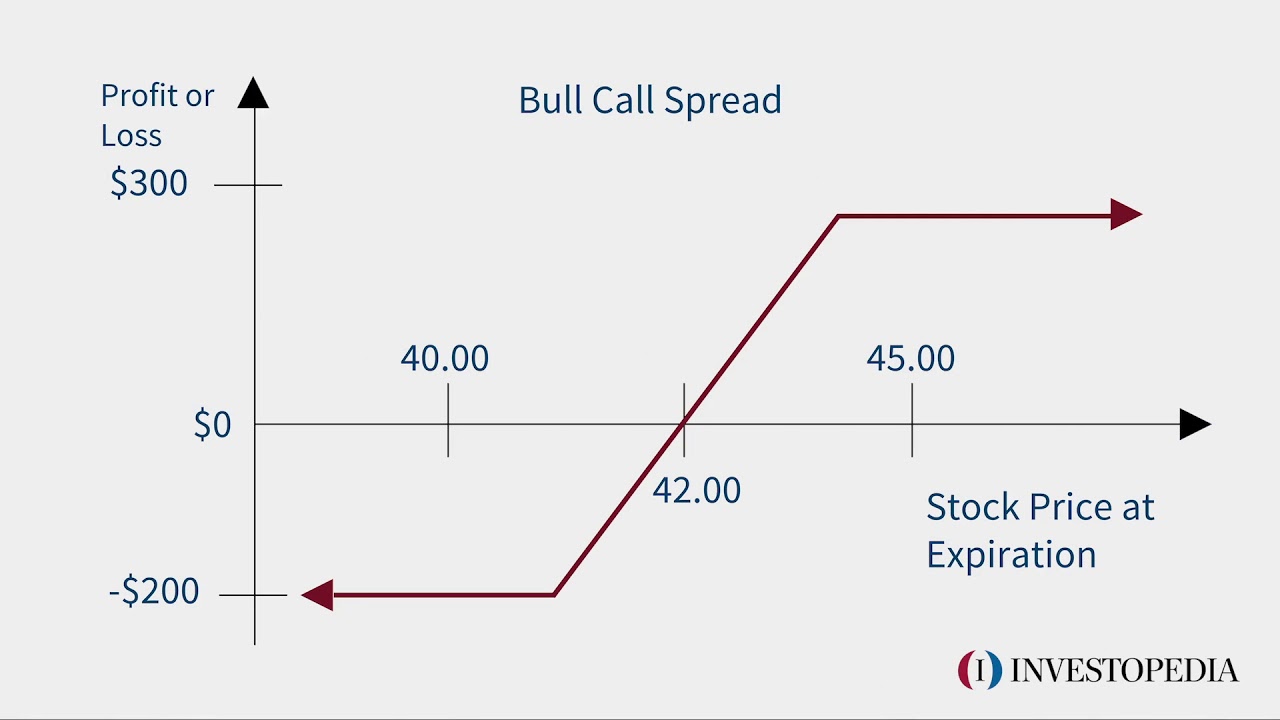

Potential profit is limited to the difference between the strike prices minus the net cost of the spread including commissions. In the example above, the difference between the strike prices is 5.00 (105.00 – 100.00 = 5.00), and the net cost of the spread is 1.80 (3.30 – 1.50 = 1.80). The maximum profit, therefore, is 3.20 (5.00 – 1.80 = 3.20) per share less commissions. This maximum profit is realized if the stock price is at or above the strike price of the short call at expiration. Short calls are generally assigned at expiration when the stock price is above the strike price. However, there is a possibility of early assignment. See below.

The maximum risk is equal to the cost of the spread including commissions. A loss of this amount is realized if the position is held to expiration and both calls expire worthless. Both calls will expire worthless if the stock price at expiration is below the strike price of the long call (lower strike).

Strike price of long call (lower strike) plus net premium paid

In this example: 100.00 + 1.80 = 101.80

A bull call spread performs best when the price of the underlying stock rises above the strike price of the short call at expiration. Therefore, the ideal forecast is “modestly bullish.”

Bull call spreads have limited profit potential, but they cost less than buying only the lower strike call. Since most stock price changes are “small,” bull call spreads, in theory, have a greater chance of making a larger percentage profit than buying only the lower strike call. In practice, however, choosing a bull call spread instead of buying only the lower strike call is a subjective decision. Bull call spreads benefit from two factors, a rising stock price and time decay of the short option. A bull call spread is the strategy of choice when the forecast is for a gradual price rise to the strike price of the short call.

A bull call spread rises in price as the stock price rises and declines as the stock price falls. This means that the position has a “net positive delta.” Delta estimates how much an option price will change as the stock price changes, and the change in option price is generally less than dollar-for-dollar with the change in stock price. Also, because a bull call spread consists of one long call and one short call, the net delta changes very little as the stock price changes and time to expiration is unchanged. In the language of options, this is a “near-zero gamma.” Gamma estimates how much the delta of a position changes as the stock price changes.

Volatility is a measure of how much a stock price fluctuates in percentage terms, and volatility is a factor in option prices. As volatility rises, option prices tend to rise if other factors such as stock price and time to expiration remain constant. Since a bull call spread consists of one long call and one short call, the price of a bull call spread changes very little when volatility changes. In the language of options, this is a “near-zero vega.” Vega estimates how much an option price changes as the level of volatility changes and other factors are unchanged.

The time value portion of an option’s total price decreases as expiration approaches. This is known as time erosion, or time decay. Since a bull call spread consists of one long call and one short call, the sensitivity to time erosion depends on the relationship of the stock price to the strike prices of the spread. If the stock price is “close to” or below the strike price of the long call (lower strike price), then the price of the bull call spread decreases with passing of time (and loses money). This happens because the long call is closest to the money and decreases in value faster than the short call. However, if the stock price is “close to” or above the strike price of the short call (higher strike price), then the price of the bull call spread increases with passing time (and makes money). This happens because the short call is now closer to the money and decreases in value faster than the long call. If the stock price is half-way between the strike prices, then time erosion has little effect on the price of a bull call spread, because both the long call and the short call decay at approximately the same rate.

Stock options in the United States can be exercised on any business day, and the holder of a short stock option position has no control over when they will be required to fulfill the obligation. Therefore, the risk of early assignment is a real risk that must be considered when entering into positions involving short options.

While the long call in a bull call spread has no risk of early assignment, the short call does have such risk. Early assignment of stock options is generally related to dividends, and short calls that are assigned early are generally assigned on the day before the ex-dividend date. In-the-money calls whose time value is less than the dividend have a high likelihood of being assigned. Therefore, if the stock price is above the strike price of the short call in a bull call spread (the higher strike price), an assessment must be made if early assignment is likely. If assignment is deemed likely and if a short stock position is not wanted, then appropriate action must be taken. Before assignment occurs, the risk of assignment can be eliminated in two ways. First, the entire spread can be closed by selling the long call to close and buying the short call to close. Alternatively, the short call can be purchased to close and the long call can be kept open.

If early assignment of a short call does occur, stock is sold. If no stock is owned to deliver, then a short stock position is created. If a short stock position is not wanted, it can be closed by either buying stock in the marketplace or by exercising the long call. Note, however, that whichever method is chosen, the date of the stock purchase will be one day later than the date of the stock sale. This difference will result in additional fees, including interest charges and commissions. Assignment of a short call might also trigger a margin call if there is not sufficient account equity to support the short stock position.

There are three possible outcomes at expiration. The stock price can be at or below the lower strike price, above the lower strike price but not above the higher strike price or above the higher strike price. If the stock price is at or below the lower strike price, then both calls in a bull call spread expire worthless and no stock position is created. If the stock price is above the lower strike price but not above the higher strike price, then the long call is exercised and a long stock position is created. If the stock price is above the higher strike price, then the long call is exercised and the short call is assigned. The result is that stock is purchased at the lower strike price and sold at the higher strike price and no stock position is created.

The “bull call spread” strategy has other names. It is also known as a “long call spread” and as a “debit call spread.” The term “bull” refers to the fact that the strategy profits with bullish, or rising, stock prices. The term “long” refers to the fact that this strategy is “long the market,” which is another way of saying that it profits from rising prices. Finally, the term “debit” refers to the fact that the strategy is created for a net cost, or net debit.

A bull put spread consists of one short put with a higher strike price and one long put with a lower strike price.

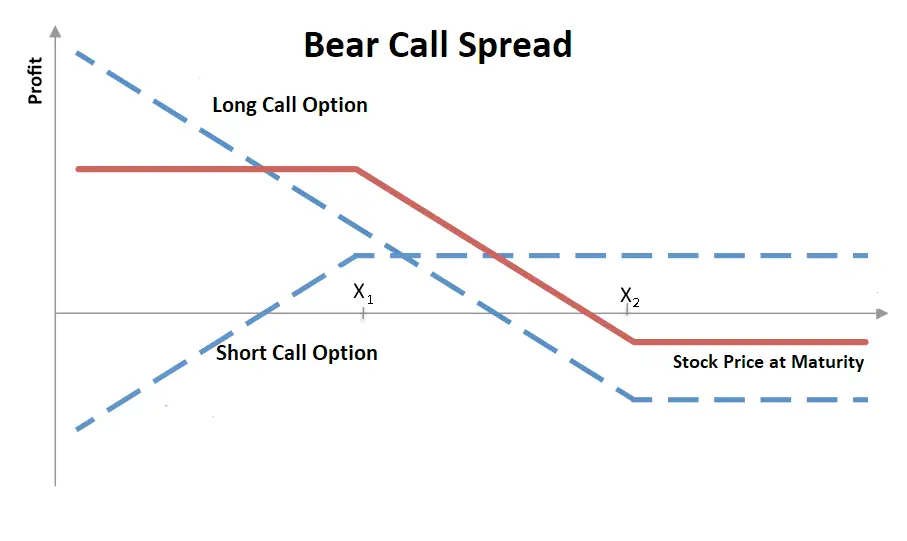

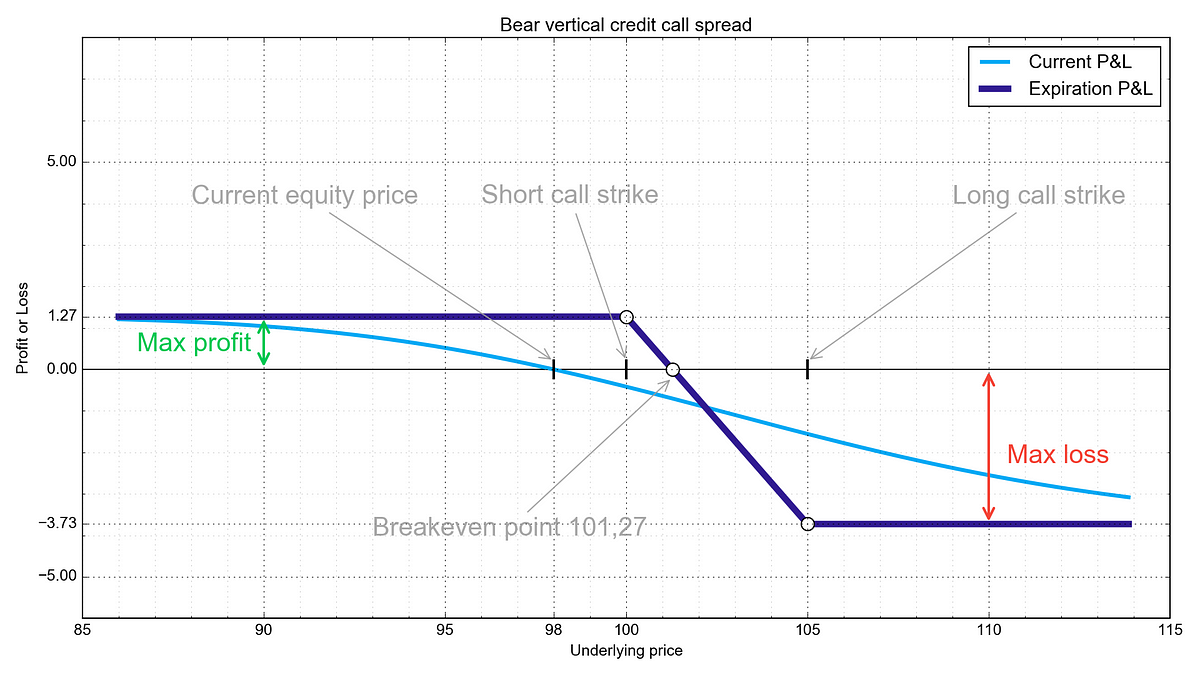

A bear call spread consists of one short call with a lower strike price and one long call with a higher strike price.

Article copyright 2013 by Chicago Board Options Exchange, Inc (CBOE). Reprinted with permission from CBOE. The statements and opinions expressed in this article are those of the author. Fidelity Investments cannot guarantee the accuracy or completeness of any statements or data.

Options trading entails significant risk and is not appropriate for all investors. Certain complex options strategies carry additional risk. Before trading options, please read Characteristics and Risks of Standardized Options Opens in a new window . Supporting documentation for any claims, if applicable, will be furnished upon request.

Charts, screenshots, company stock symbols and examples contained in this module are for illustrative purposes only.

Call Spreads Explained | The Options & Futures Guide

What Is A Bull Call Spread ? - Fidelity

Bull spread - Wikipedia

call spread - это... Что такое call spread ?

Bull Call Spread - Overview, How It Works, Example

From Wikipedia, the free encyclopedia

In options trading, a bull spread is a bullish , vertical spread options strategy that is designed to profit from a moderate rise in the price of the underlying security.

Because of put-call parity , a bull spread can be constructed using either put options or call options . If constructed using calls, it is a bull call spread (alternatively call debit spread). If constructed using puts, it is a bull put spread (alternatively put credit spread).

A bull call spread is constructed by buying a call option with a lower strike price (K), and selling another call option with a higher strike price.

Often the call with the lower exercise price will be at-the-money

while the call with the higher exercise price is out-of-the-money . Both calls must have the same underlying security and expiration month. If the bull call spread is done so that both the sold and bought calls expire on the same day, it is a vertical debit call spread.

Break even point= Lower strike price+ Net premium paid

This strategy is also called a call debit spread because it causes the trader to incur a debit (spend money) up front to enter the position.

The trader will realize maximum profit on the trade if the underlying closes above the short strike on expiration.

A bull put spread is constructed by selling higher striking in-the-money put options and buying the same number of lower striking out-of-the-money put options on the same underlying security with the same expiration date. The options trader employing this strategy hopes that the price of the underlying security goes up far enough that the written put options expire worthless.

If the bull put spread is done so that both the sold and bought put expire on the same day, it is a vertical credit put spread.

Break even point = upper strike price - net premium received

This strategy is also called a put credit spread because the trader will receive a credit (be paid the premium) for entering the position.

The trader will realize maximum profit if the underlying closes above the short strike on expiration.

The bull put spread is explained as selling ITM put and buying OTM put, while in the example both puts are ITM.

Secretary Babe

Licking Oral Porn

Bbw Sensual Sammie Porno

Young Ass Sex

Low Sperm Count

:max_bytes(150000):strip_icc()/dotdash_Final_Bear_Call_Spread_Apr_2020-01-876ed1191c524f8dbbea367e3d1bb3b9.jpg)

/dotdash_Final_Call_Option_Definition_Apr_2020-01-a13f080e7f224c09983babf4f720cd4f.jpg)

/understandingstraddles2-c0215924b5ba43189e1a136abc5484bf.png)