Best Spread Betting Broker Uk

🛑 ALL INFORMATION CLICK HERE 👈🏻👈🏻👈🏻

Best Spread Betting Broker Uk

Home » UK Brokers » Best Spread Betting Platforms UK

79.3% of retail CFD accounts lose money

74% of retail CFD accounts lose money

79% of retail CFD accounts lose money

75.54% of retail CFD accounts lose money

Commission rebates for active traders

Spread Betting: Standard Account, No Commission Spreads

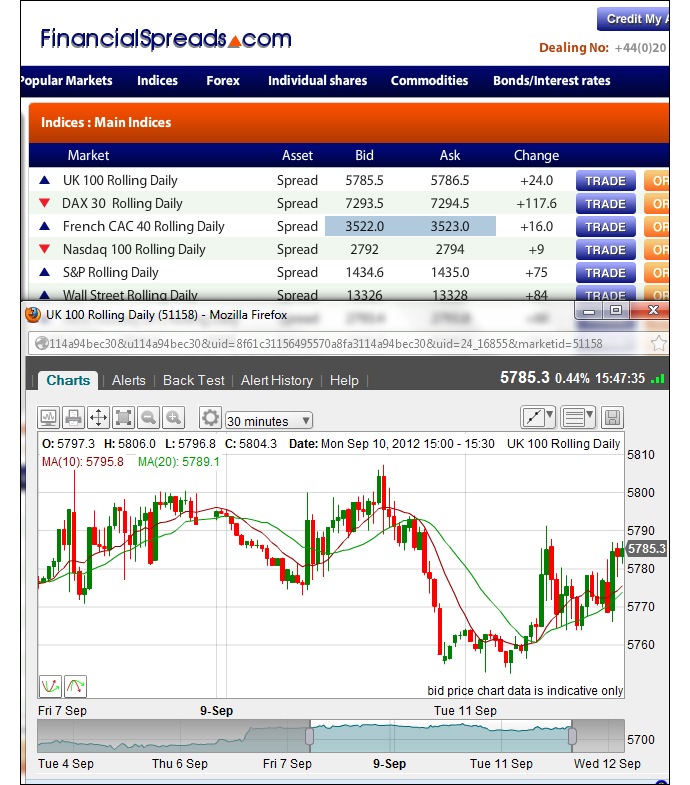

Spread Betting in the United Kingdom requires a good platform (MT4/MT5) and the top UK spread betting broker. The 2021 UK best spreads betting platform was based on features, fees and range of financial markets offered.

The top UK spread betting platforms in 2021 are the following.

Spread betting and CFD trading are similar in the sense that investors are trading leveraged products and speculating on the direction a financial market will move.

The main difference is that when spread betting, a trader is not buying and selling a derivative contract. Rather, traders bet on price movements, deciding on the amount to bet per point of price movement. Spread betters decide the ‘stake’ per price movement they wish to trade, with profits being made when the market moves in favour of the bet.

When compared to CFD trading, spread betting is more tax efficient. UK tax laws mean any gains made from CFD trading are subject to Capital Gains Tax (CGT). As spread betting involves no contracts, profits avoid both stamp duty and Capital Gains Tax, which means it can be considered a tax-free trading strategy.

Pepperstone is a no dealing desk (NDD) broker that offers spread betting on a range of asset classes with competitive pricing. As well as spread betting with currency pairs, Pepperstone clients gain access to thousands of index, commodity, treasury and stock markets. While cryptocurrencies were available in the past, recent changes to FCA regulation have restricted the ability for retail traders to access crypto markets such as Bitcoin or Bitcoin cash.

Pepperstone gained its reputation as one of the best brokers for ultra-tight forex spreads due to its NDD execution and top-tier liquidity providers. Although they don’t offer specific investment advice, the brokers offer educational resources suited to both beginner and experienced traders.

When spread betting forex, traders do not pay any flat-rate commission and therefore bet on spreads available to those using Pepperstone Standard account.

With the Standard account, Pepperstone offers minimum spreads as low as 1.0 pips on major currency pairs such as the EUR/GBP, AUD/JPY, AUD/USD, CHF/JPY, CHF/SGD and EUR/USD. The table below shows the average spreads for major currency available to spread bet with Pepperstone. Compared to brokers such as CMC Markets and FxPro, Pepperstone offers tighter average spreads on a wider range of fx pairs than its competitors.

Data taken from broker website. Accurate as at 04/02/2021

When spread betting with Pepperstone, customers can choose between MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms. Both platforms offer a good range of financial instruments as well as various technical analysis tools to develop spread betting trading strategies. Trading tools and features available on both MT4 and MT5 include:

MT4 and MT5 are available as desktop platforms, web trader platforms or mobile and tablet forex trading apps that are compatible with iOS and Android devices.

Before spread betting with real money, traders can sign up for Pepperstone’s demo account that is available with both MetaTrader 4 and MetaTrader 5. To start trading with real money, a Pepperstone spread betting account can easily be opened online with no initial minimum deposit , although the broker recommends depositing at least £200. To deposit and withdraw funds from a trading account, customers can make bank transfers and use a credit card (Mastercard and Visa).

As a spread betting and CFD broker, Pepperstone is overseen by the Financial Conduct Authority in the United Kingdom. The FCA ensures brokers follow UK regulation and that retail investor accounts are receiving a fair brokerage service. While Pepperstone’s Australian subsidiary is regulated by the Australian Securities and Investments Commission (ASIC), spread betting is not permitted in Australia and even outside the UK.

The overall rating is based on review by our experts

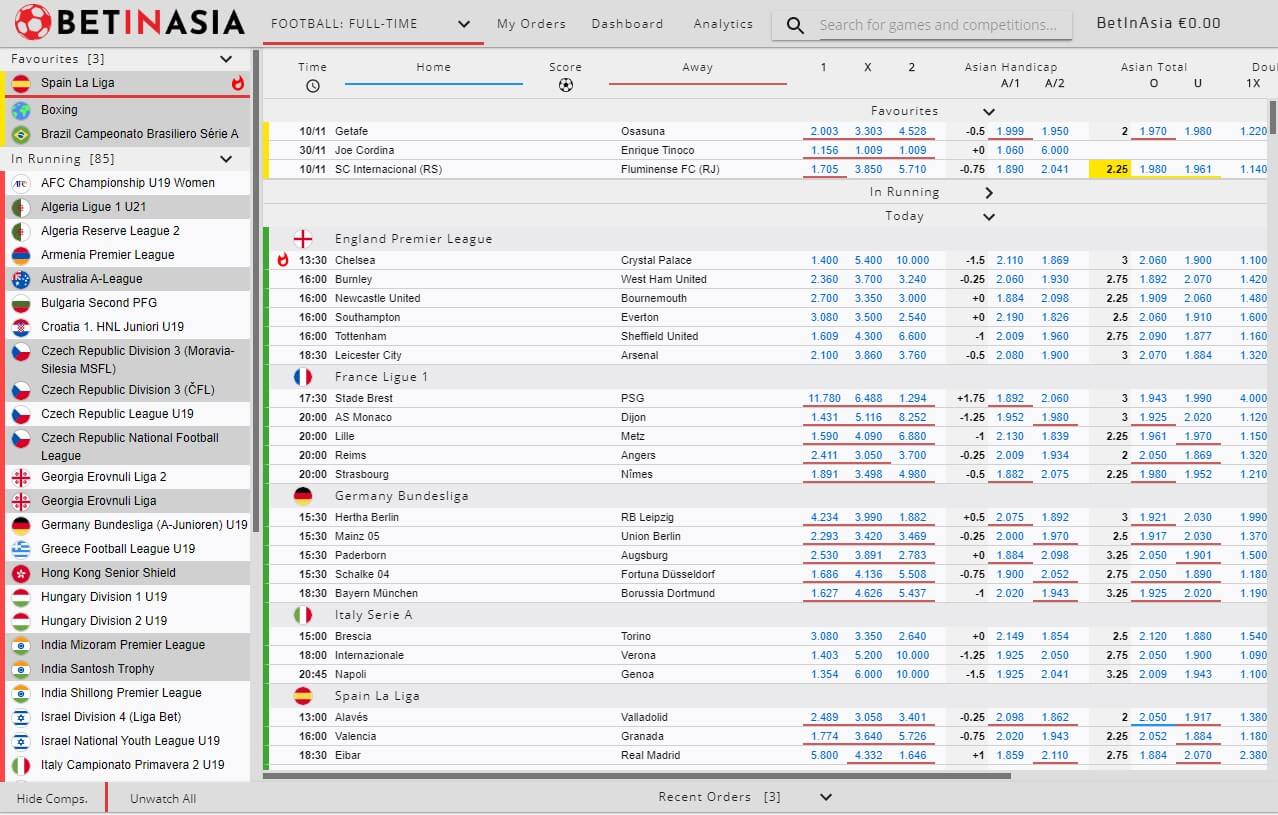

City Index is one of the best UK forex brokers with spread betting on a range of asset classes with 4,000 different financial products to bet on. These global markets can be accessed through the broker’s web trader platform or via the trading apps they offer designed for mobiles and tablet devices.

When spread betting with City Index, customers can bet on a range of financial instruments that are competitively priced. As with all spread betting in the UK, profits are tax-free and exempt from stamp duty and Capital Gains Tax (CGT).

As shown above, the UK broker offers tight spreads, starting as low as 0.5 pips for major currency pairs. For instance, spreads for the Euro/United States Dollar (EUR/USD) fx pair can be as low as 0.5 pips, with average spreads of 0.8 pips. City Index’s full forex product range consists of 65 different currency pairs, along with a solid selection of indices, shares, commodities, metals, bonds and interest rates.

Although no commission fees are incurred when spread betting with City Index, traders do face overnight financing fees, inactivity fees for dormant accounts, and premiums for Guaranteed Stop Loss Orders (GSLOs).

To manage the high risk of spread betting, stop-loss orders and limit orders are available to lock in profits and minimise losses.

As well as free order types, spread betters can pay a premium to place GSLOs. GSLOs ensure positions are closed at the exact price selected by the trader, whereas stop loss and limit orders do not provide guarantees that the pre-selected prices will be matched.

City Index’s proprietary online trading platform is powered by HTML 5 technology and accessible from any browser. Although the web trader platform may lack MT4’s Expert Advisor and automated trading features, a comprehensive suite of inbuilt technical analysis tools are provided.

City Index’s Web Trader platform features include:

City Index offers two forex trading apps specifically designed for iOS and Android devices. Many of City Index’s web trader features are available on the mobile apps, including different order types such as GSLOs, one-click trading, Reuters news and custom indicators.

The fully functional and customisable apps provide most of the online platforms charting tools with 60 inbuilt technical indicators and multiple timeframes included. A major benefit to City Index’s trading apps is that traders can easily and instantly contact customer support via the apps live chat function.

When spread betting with IG Markets, customers gain access to a range of CFDs along with a choice of trading platforms. It should be noted that trading CFDs is not purchasing the underlying asset rather than focusing on the price movements of that asset.

The broker’s proprietary trading platform for beginners is offered as a desktop or web trader. The beginner trading platform also offers trading apps designed for tablets and mobiles. For those wanting to use a third party spread betting platform, ProRealTime and MetaTrader 4 are other options.

When spread betting with IG Markets, customers can gain access to global markets and various asset classes. Available asset classes to spread bet include:

IG Markets proprietary software for beginners is a user-friendly, customisable platform suitable for all levels of trading experience. The web trader platform can be accessed from any browser, while mobile trading apps are compatible with Android and iOS devices.

An advantage to using IG Markets online trading platform is that users can utilise different order types such as Guaranteed Stop Loss Orders (GSLOs) to manage the high risk of spread betting. Platform features available on both the web trader platform and trading apps include:

Many traders prefer MetaTrader 4 due to the platform’s Expert Advisor (EAs) functionality. EAs allow users to automate trading, reducing the time spent conducting analysis and placing orders. As well as MT4’s inbuilt technical indicators, IG Markets offers an add-on package that provides an additional 12 MT4 add-ons.

Overall, IG is the best spread betting broker for beginners based on the provider’s trading platform, customer service and range of markets. IG Group is the largest retail foreign exchange broker, and so the training facilities are also ideally tailored for novice traders.

CMC Markets is an FCA (Financial Conduct Authority, United Kingdom) regulated broker offering spread betting via its proprietary trading platform.

The Next Generation platform offers an intuitive, user-friendly trading environment that is available in a standard or advanced format.

A range of trading tools is provided via the platform to assist traders with developing spread betting strategies and managing the high risk of forex trading, such as:

As a CMC Markets customer, traders can spread bet on over 9,500 financial instruments from forex, indices, commodity, share and treasury asset classes.

Although no commission is charged on top of competitive spreads, traders incur fees for overnight financing, premium order types, and inactive trading accounts. Spread betting costs include:

As well as an award-winning platform and impressive market access, CMC Markets provides an excellent range of educational resources to assist both novice and experienced spread betters.

In addition to webinars, trading platform tutorials and spread betting guides, customers can contact CMC Markets via phone, email or live chat 24/5 with any questions they may have about the broker and spread betting.

ETX Capital is an FCA regulated broker offering spread betting services on their proprietary trading platform, TraderPro and MetaTrader 4 (MT4).

ETX Capital’s MT4 trading platform includes all the tools needed to effective spread betting trading strategies, including wide market access, technical analysis tools and automated trading features.

ETX Capital customers spread betting via MetaTrader 4 enjoy access to 7 different asset classes. When spread betting on currency pairs, competitive spreads can be as low as 0.8 pips on major currency pairs such as the Euro/United States Dollar (EUR/USD). ETX Capital’s full spread betting product range accessible on MT4 includes:

ETX Capital offers MT4 as a desktop trading platform for Windows and Mac computers. The trading platform can easily be downloaded from the broker’s website and includes detailed installation and set setup instructions.

An advantage to spread betting through MetaTrader 4 and ETX Capital is the ability to create or download Expert Advisors (EAs or trading robots) to automate trading. EAs save a traders time by automatically analysing markets and entering and exiting bets, eliminating the need for lengthy and complex technical analysis.

Additional MT4 features and trading tools include:

Although the broker’s MT4 mobile app is fully functional, it is not available on Android devices and restricted to iOS mobiles and tablets. To analyse financial markets and determine spread betting opportunities, iPhone and iPad users can utilise the trading apps 30 technical indicators and 24 analytical objects.

Spreadex is a UK broker that specialises in sports and financial spread betting. As well as spread betting on global markets such as forex and indices, Spreadex customers gain access to the unique feature of spread betting on sporting events.

Rather than the traditional method of fixed-odds betting, Spreadex customers can bet higher or lower than the brokers spread, with more correct a bet is, the more stakes a trader wins.

To place bets on sporting events, traders can use an online trading platform or trading apps designed for mobiles and tablets (Android and iOS).

Sporting events available to spread bet on include:

ThinkMarkets is an FCA regulated broker that offers spread betting via MetaTrader 4, MetaTrader 5 as well as their own proprietary software.

ThinkTrader, the broker’s proprietary web platform and mobile app provide traders with an intuitive spread betting environment for all levels of experience, with a range of charting and risk management tools.

When spread betting on the go using the ThinkTrader mobile app, customers can place bets on instruments derived from forex, share, index, metal, and commodity assets.

Purpose-built Android or iOS apps are available to download with the software considered one of the best proprietary mobile trading apps with 4.8 stars on Apple’s App Store.

While many mobile apps are restricted in regards to charting tools, ThinkTrader offers an extensive range of technical analysis tools including 10 chart types, 12 timeframes, 40 objects and 100 technical indicators. Additional built-in mobile app features include:

FxPro is an FCA regulated broker that offers a purpose-built proprietary spread betting platform – FxPro Edge.

FxPro Edge users are provided with a professional trading environment with commission-free spread betting available on forex, share, index, energy and metal products. As with all spread betting in the United Kingdom, profits are tax-free and exempt from stamp duty and capital gains tax.

As spread betting involves complex instruments and comes with a high risk of losing money, choosing a broker with strong risk management tools can be useful. FxPro Edge users can place market orders as well as pending orders such as limit, stop-loss and take profit orders.

Although trading tools such as Expert Advisors and customer indicators are not supported by FxPro Edge, the broker is looking to incorporate such features into the trading platform in the near future.

FxPro is overseen by financial authorities around the globe, such as CySEC (Cyprus) and the FSCA (South Africa) but only permit spread betting to clients in the United Kingdom. FxPro is regulated by the Financial Conduct Authority (FCA) with the broker licensed to provide trading CFDs and spread betting services to UK residents only.

To protect investors participating in spread betting and trading CFDs, the FCA requires UK brokers to provide negative balance protection and automated closeout margins to ensure traders’ losses are limited. Additionally, segregated client funds ensure trading account balances are protected in the case of a broker being insolvent.

When choosing a UK broker that offers spread betting services, traders should look for good market access to a range of asset classes, low spreads and fees as well as trading platforms with analysis and risk management tools. Pepperstone is an excellent choice as the broker offers MT4 and MT5, ultra-tight spreads as well as different types of financial instruments including forex. The broker is regulated in the UK by the Financial Conduct Authority (FCA). To explore Pepperstone’s markets and trading platforms, a demo account is available for 30 days.

All spread betting within the United Kingdom should be done through a broker regulated by the FCA. There are other regulators in the EU which meet ESMA requirements such as CySEC, but the FCA is the best suited since spread betting is and CFDs are complex instruments. Brokers that only have tier 2 or tier 3 regulation, such as the Financial Supervision Commission (FSC) in Mauritius should be avoided. Not all traders such as those from the United States can trade with the brokers above with the list designed solely for UK and Ireland residents only. Not all regulated FCA brokers were included (but considered) in this comparison, including FXCM.

Justin Grossbard has been investing for the past 20 years and writing for the past 10. He co-founded Compare Forex Brokers in 2014 after working with the foreign exchange trading industry for several years. He also founded a number of FinTech and digital startups including Innovate Online and SMS Comparison. Justin holds a Masters Degree and an Honours in Commerce from Monash University. He and his wife Paula live in Melbourne, Australia with his son and Siberian cat. In his spare time, he watches Australian Rules Football and invests on global markets.

The leading forex broker comparison site, Compare Forex Brokers Pty Ltd is an Authorised Representative of Guildfords Funds Management Pty Ltd Australian Financial Services Licence No. 471379 (A/R No. 001274082). Copyright 2021 and all rights reserved. Trading Forex and CFDs with leverage poses significant risk of loss to your capital.

We use cookies to ensure you get the best experience on our website. By continuing to browse you accept our use of cookies.

Top 10 Spread Betting Brokers - Compare UK Platforms | GMG

UK Best Spread Betting Platforms: The Complete List (2021)

Top 10 Best UK Spread Betting Forex Brokers 2020 [ UK Spread Betting ]

Best 8 Spread Betting Brokers & Platforms January 2021 | Learnbonds

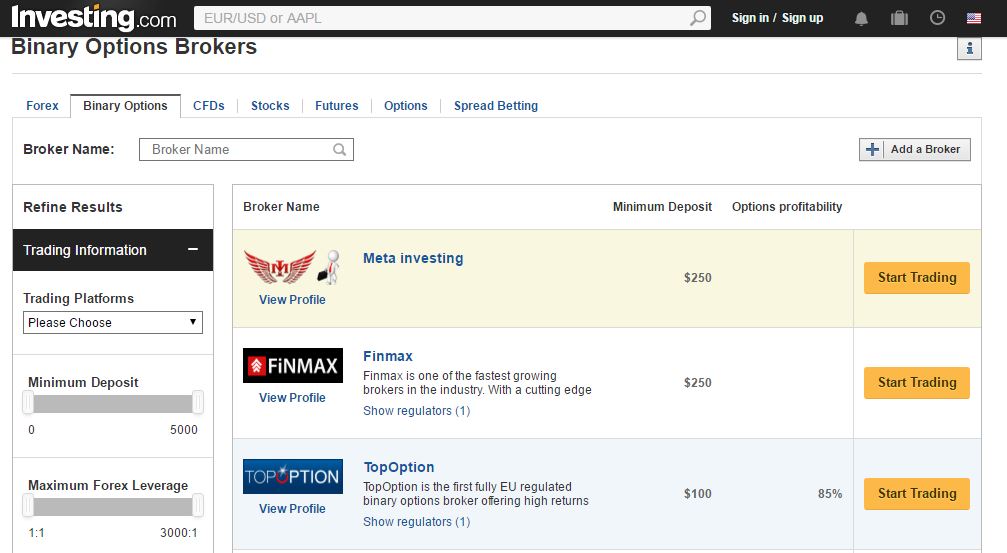

Spread Betting Brokers - Investing.com UK

We use cookies to ensure you get the best experience on our website.

Filippo Ucchino

Last Updated: January 2021

12 min read

76% of retail CFD accounts lose money

icon/platform Created with Sketch. Platforms: Proprietary Web Platform, MAC Platforms

Regulations: FSA, MAS, FINMA, FCA, CFTC, MIFID-ESMA, ASIC, FMA, FSCA, DFSA

Minimum Deposit:

79.6% of retail CFD accounts lose money

icon/platform Created with Sketch. Platforms: Mirror Trader, MT4 Dekstop, MT4 Web, Proprietary Desktop Platform, Proprietary Web Platform, MAC Platforms

Regulations: FCA, MIFID-ESMA

Minimum Deposit:

79% of retail investor accounts lose money

icon/platform Created with Sketch. Platforms: Mirror Trader, ZuluTrade, MT4 Web, MT5 Web, Proprietary Web Platform, MAC Platforms

Regulations: FSA, MIFID-ESMA, ASIC, IIROC, FSCA, Offshore, FSC (British)

Minimum Deposit: 100

74-89% of retail investor accounts lose money when trading CFDs

icon/platform Created with Sketch. Platforms: cTrader desktop, cTrader web, ZuluTrade, MT4 Dekstop, MT4 Web, MT5 Desktop, MT5 Web, MAC Platforms

Regulations: FCA, MIFID-ESMA, ASIC, DFSA, CYSEC, Offshore

Minimum Deposit:

73.5% of retail investor accounts lose money

icon/platform Created with Sketch. Platforms: Proprietary Desktop Platform, Proprietary Web Platform

Regulations: FSA, MAS, FCA, CFTC, MIFID-ESMA, ASIC, IIROC

Minimum Deposit:

75.54% of retail investor accounts lose money

icon/platform Created with Sketch. Platforms: cTrader desktop, cTrader web, MT4 Dekstop, MT4 Web, MT5 Desktop, MT5 Web, MAC Platforms

Regulations: FCA, MIFID-ESMA, FSCA, CYSEC, Offshore

Minimum Deposit:

75.7% of retail CFD accounts lose money

icon/platform Created with Sketch. Platforms: Mirror Trader, ZuluTrade, MT4 Dekstop, MT4 Web, MT5 Desktop, MT5 Web, Proprietary Desktop Platform, Proprietary Web Platform, MAC Platforms

Regulations: FCA, MIFID-ESMA, DFSA, Offshore

Minimum Deposit:

72% of retail CFD accounts lose money

icon/platform Created with Sketch. Platforms: Proprietary Desktop Platform, Proprietary Web Platform

Regulations: MAS, FCA, MIFID-ESMA, ASIC

Minimum Deposit:

76% of retail investor accounts lose money

icon/platform Created with Sketch. Platforms: MT4 Dekstop, MT4 Web, Proprietary Web Platform

Regulations: FCA, MIFID-ESMA

Minimum Deposit:

79% of retail investor accounts lose money

icon/platform Created with Sketch. Platforms: MT4 Dekstop, MT4 Web, MT5 Desktop, MT5 Web, Proprietary Web Platform

Regulations: MIFID-ESMA, ASIC, FMA, FSCA, CYSEC

Minimum Deposit:

Top 10 Best UK Forex Brokers For Spread Betting for 2021

More top 10 lists

ADVERTISER DISCLOSURE: InvestinGoal is completely free to use for all. Though we may receive a commission from brokers we feature, this does not impact the results of our reviews or rankings which are conducted with complete independence and objectivity, following our own impartial methodology. Help us continue to provide the best free broker reviews by opening your account with our links. Please read our Advertiser Disclosure to learn more.

Broker Search

Broker Search

Help Me Choose

Advanced Search

Broker Comparison

Broker Comparison

Compare List

2FC Financial Srl

Via Filippo Argelati, 10,

Milan, Italy

20143

VAT No. IT10004450960

Copyright © 2020 InvestinGoal.com – All rights reserved. /

Privacy Policy

/

Basic Terms of Use

/

Sitemap

Are you looking for the best UK forex brokers for spread betting because you want to avoid being taxed on your trades?

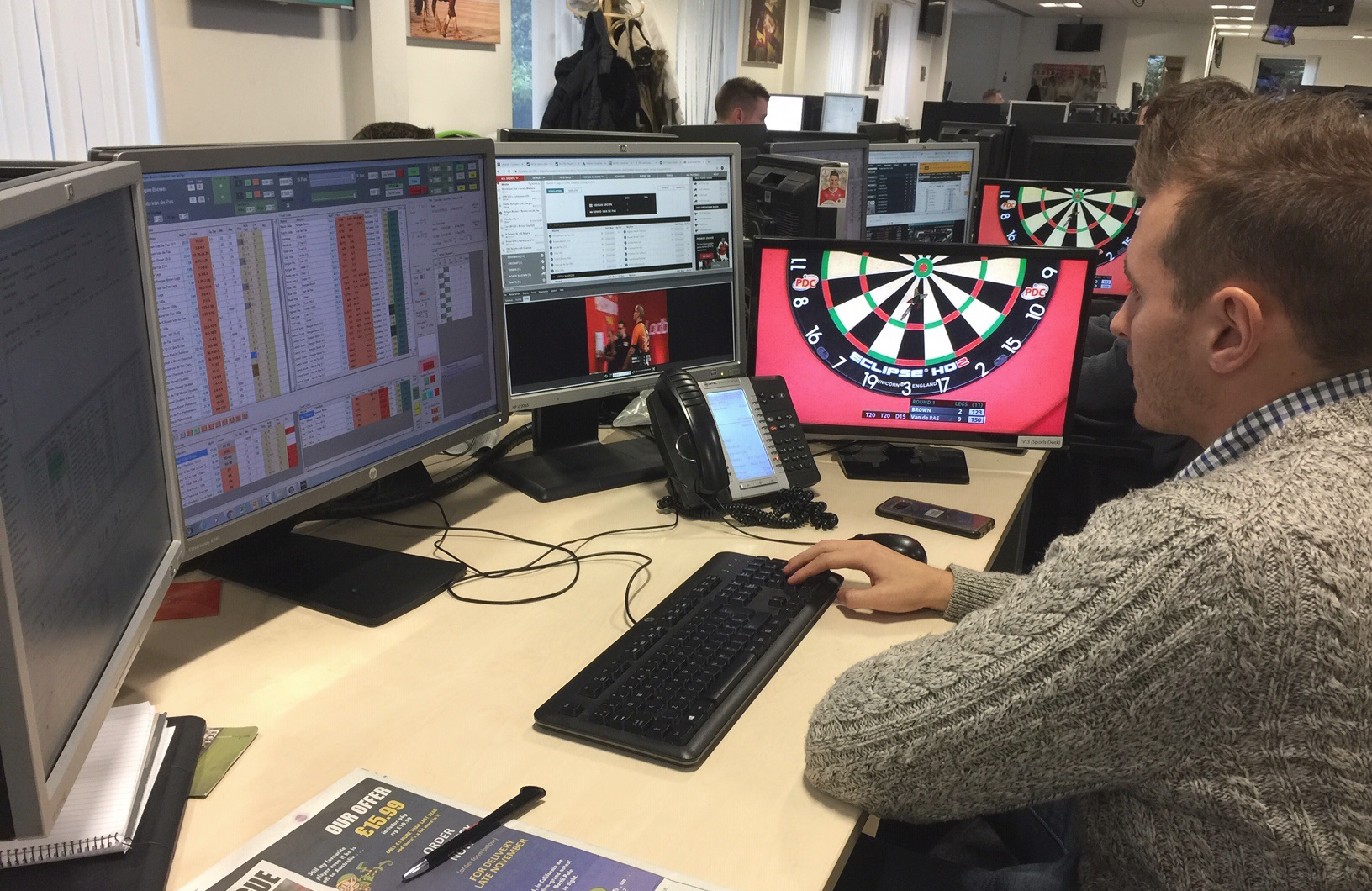

Spread betting has been around for a long time, but not all forex brokers have caught up with how popular it is. On top of that, while there are many that offer spread betting, there are plenty of brokers that lack the experience and technology traders really want.

Don’t just sign up to the first spread betting broker you come across. Sign up to a broker that will provide you with the trading conditions that suits your trading style.

As you can perhaps guess from the name, spread betting is most simply, betting on the spread of a market and how it is going to move . So, given that you are betting on the spread, your investment is not on the actual asset at all. Instead, the value of your money will rise and fall based on your predictions of the spread movement in that market. Very simply, you are betting on the spread rising or falling. If you bet on the spread rising and it does, then you will make a profit and vice versa.

Spread betting, due to the perception of many that it is closer to gambling than investing , is not legal in every country. It is however permitted in the UK , Ireland , Macau , Hong Kong , Taiwan , and some other countries . With that said, you should always verify with the local regulator as well as your broker first.

Countries where spread betting is currently illegal include the US, some European countries, China, Japan, and Australia. In some Islamic countries too where gambling is illegal, spread betting is also considered to be illegal regardless of whether you have an Islamic trading account.

For a truly great spread betting experience, you cannot go wrong with IG. Operating since 1974 , IG is perhaps the most experienced spread betting broker traders will come across. They are also a highly innovative broker, offering some of the best technology available today and a DMA trading environment . Traders can take advantage of IG’s web platform, which is built to handle spread betting and access to over 16,000 markets .

They are also a well-regulated CFD broker , boasting respected regulation from the FCA in the UK and offering trading in more than 10,000 shares markets. What you will find is that the IG Markets minimum deposit starts from $300 . This is not too small, but also still within range for most spread betting and forex traders. Spreads here start from 0.6 pips on forex trading and an even better value 0.1 pips on other assets including indices, shares, and cryptos.

ETX Capital is also a highly respected spread betting broker, operating for over 50 years. To get the most out of spread betting with ETX Capital, traders should use their ETX TraderPro platform which was awarded ‘ Best Spread Betting Platform 2018 ’ by the ADVFN International Financial Awards and offers a range of customisable features to implement strategies. ETX Capital also offers instant execution and access to over 5,000 markets .

This UK broker is also FCA regulated there so can be well trusted by traders. They boast a really strong educational section so this makes it the ideal place to learn about spread betting for beginners. As well as their own platform, you can trade through MT4 and get spreads on forex trading from 0.6pips , but as low as 0.01 on commodities, and 0.1 on bonds.

AvaTrade is another of the top forex brokers to also offer spread betting as an option through their dedicated platform. With spread betting being legal in the UK and Ireland, this means that many traders choose AvaTrade as their spread betting broker. They are a well respected Irish broker who are regulated there also.

Through AvaTrade as a spread betting trader or another form of trader, you will find that the minimum deposit is reasonable across the board at only $100 to open your account. This combined with very low spreads starting at 0 pips is another attractive point as well as the fact that you can spread bet on more than 200 assets including forex, commodities, indices, equities, bonds, and ETFs. You are also allowed to scalp and as a regular trader, the top trading platform MT4 is available for your use.

Pepperstone regularly features as a top broker on many of our listings, and again here as a top FCA regulated broker. Pepperstone is an Australian broker who operates and is regulated in many areas worldwide. This includes the UK where they are FCA regulated (#684312) . They too are a hugely successful, award-winning broker, and a very popular choice among all levels of trader. They provide spread betting and CFD trading across more than 150 instruments, including forex, index and commodities onMT4, MT5 and cTrader platforms.

You can get started trading with Pepperstone for a minimum deposit of £200 through either their standard, or Razor account types and once you are set up you will be glad to find a very good value spread that starts from the bottom, 0 pips . There is something for everyone with the broker also incorporating many great social trading features and a top class active trader program to help keep your trading costs as low as possible.

Oanda is another firmly established broker and has been operating since 1996 and has a strong presence in the UK. They are a great option for those who want to spread bet with the popular MT4 and have amassed plenty of awards for their service. While they do offer fewer instruments than other brokers, they do have some of the best analytical tools available. Irish traders are also accepted.

Perfect for newer traders is the fact that Oanda has no minimum deposit . This is one of the reasons that they are often noted as one of the best brokers for beginners to add to their already strong reputation as a top broker. You will find spreads here starting from an excellent value 1 pip on the majority of markets .

FxPro are yet another award-winning broker to feature in our selection of the very best spread betting brokers that you have to choose from. They are regulated by several top-tier regulatory bodies including the FCA in the UK where spread betting is legal and they have collected more than 60 forex trading related awards in total.

Here you can start your spread betting account with as little as $100 through their very intuitive beta platform FxPro Edge that allows for a great and interactive spread betting experience. On top of this, you can expect some of the tightest spreads in the business on all markets offered including forex, shares, indices, metals, and energis. This makes FxPro a top choice for traders around the world.

ActivTrades is one of few brokers that allow traders to spread bet on a variety of different platforms, including their ActivTrader, MT4, and MT5, which means traders can spread bet in a way they feel comfortable. They also claim to offer fully automated execution and allow traders to spread bet from a position as low as 10p up to £100 . Added to this that the ActivTrades is an FCA regulated broker and the attraction for spread betters increases.

The broker features a range of markets available to trade in with something that is bound to suit every trader . As well as forex trading, here you can find markets on options, ETF, indices, shares, commodities, and bonds CFDs with spread betting available on most to UK-based traders. The final positive here which sees many choose this broker is the fact there are no minimum deposits .

City Index are one of the most well-known spread betting brokers around, operating since 1983 . They currently have over 4 million customers and supposedly handle over 1 million trades per day, proof of their success. When you sign up to spread bet with City Index you automatically get a free spread betting guide .

As a new trader, City Index may also be perfect for you due to the fact that there is no minimum deposit in place. So you can get the most out of trading with the broker, they do recommend that you deposit at least $100 . Once you have an account you will be glad to find a wide array of assets , more than 8000 in total available to trade. These include many forex pairs, indices, shares, and cryptocurrency markets. The spreads here are also top value, starting at just 0.5 pips on forex with trading available through the trusted MT4 platform.

LCG or London Capital Group is another broker that’s great for those who are looking for experience, building an excellent reputation in 20 years. With LCG, traders can spread bet on over 7,000 global markets using their web-based LCG Trader platform or MT4. The LCG Trader platform is particularly unique, boasting one-click trading, 70 technical indicators, and plenty of customisation.

LCG are also regulated by the FCA which should give you a lot of confidence in the trustworthiness and transparency of the operation as a potential trader with them. It may also be ideal for new trader s in the sector since this broker does not need any minimum deposit . Once you have opened your account, you can engage in spread betting across a range of markets that include metals, indices, shares, bonds, commodities, and ETFs. With scalping allowed on the platform, this also is an attractive point for many of the more experienced traders to come to LCG.

Next on our listing of top spread betting brokers is a well-known and trusted name in the form of Markets.com. They have carved out an excellent reputation through their years in the industry and in particular for offering a great spread betting service.

Here you will find a tremendous selection of assets to choose from. This includes a total of more than 2,000 assets that you can spread bet on. Spread betting with Markets.com is available through their MarketsX account type and this is a popular choice for many spread betters looking for very fast execution that is offered by the broker alongside a top range of trading tools that can help you analyze the fundamental and technical points of an asset, as well as gain an insight into the current market sentiment. With Markets.com you will be able to open this spread betting account type with a £250 minimum deposit . This is great value given the experience and range of features available with the broker

Spread betting first of all, like any other form of trading, is not without risk to your funds . Only you as a trader who is interested in spread betting can really make the final decision if it is for you or not.

If you are spread betting then you can potentially make big returns within a short period of time, though the all or nothing nature of the trading style also means that you could potentially make losses . The margin between significant gains and losses in spread betting is slim. This is something that makes it very exciting though, and does attract many traders.

What makes spread betting illegal in some countries is its very high-risk nature . This and the comparisons that some people make between spread betting and gambling all play a role in its legality within some countries.

To illustrate why many consider spread betting to be very high risk, let’s take a look at the following example:

Stock with 10pip spread (bid/ask 100.40/100.50)

These same high risk losses though, can also lead to high risk profits in other cases.

If spread betting has been deemed to be too risky, or even illegal in your country of trading, then you will not be able to engage in spread betting. There is still plenty of other trading types and potential you can engage in though.

The recommendation would be to try some other derivative instruments trading. This means that futures , options , or CFDs trading could all be potentially good choices with the exception of the US where CFDs trading is also not permitted.

Check our listing of top forex brokers for more alternatives that may fit your trading needs.

When choosing the best spread betting broker for you, what you are doing is betting on the spread essentially. For that reason, you should try to choose a broker that has the most competitive spreads and the lowest commission in place.

To help you calculate your earnings or losses when spread betting, let’s take a look at an example with the major forex currency pair EUR/USD.

Let’s presume that EUR/USD pricing is 1.0940/1.0941

With spread betting, when you bet $10 that the spread will rise, you’ll earn $10 for every pip (0.0001) increment above 1.0941. Let’s say you close the position to 1.0950 , you’ve earned 9 pips , equivalent to $90

But you should be careful because if the spread goes the other way around, you’ll lose a lot of money. In case of -9pips loss, you’ll lose $90 , and not just the $10 you bet in first place.

In other words, you earn/lose 100% of the investment for every pip rise/fall . 5 pips, for example, equal a +/- 500% on the investment

Generally speaking, spread betting is usually considered to be tax-free in the sense that you will not likely be charged any capital gains tax on earnings and profits you make. Similarly, there would be no rebate possibility in the case of losses .

With that said, it may depend on the country you are spread betting from, and it is always advisable to consult with a professional tax advisor on these matters.

Your email address will not be published. Required fields are marked *

Big Tits Sex Ride

Secretary Sky Is Stripping

Russian Sleep Sex

Ig Spread Betting Review

Start Line Game Outdoor