Bear Spread

🛑 ALL INFORMATION CLICK HERE 👈🏻👈🏻👈🏻

Bear Spread

Credit Risk Modeling Course 4.6 (319 ratings) 1 Course | 3+ Hours | Full Lifetime Access | Certificate of Completion

Credit Risk Modeling Course

1 Course

3+ Hours

Full Lifetime Access

Certificate of Completion

LEARN MORE >>

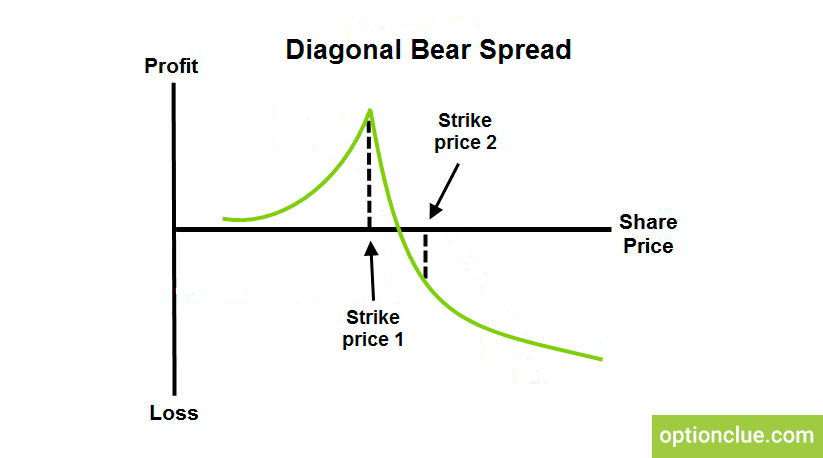

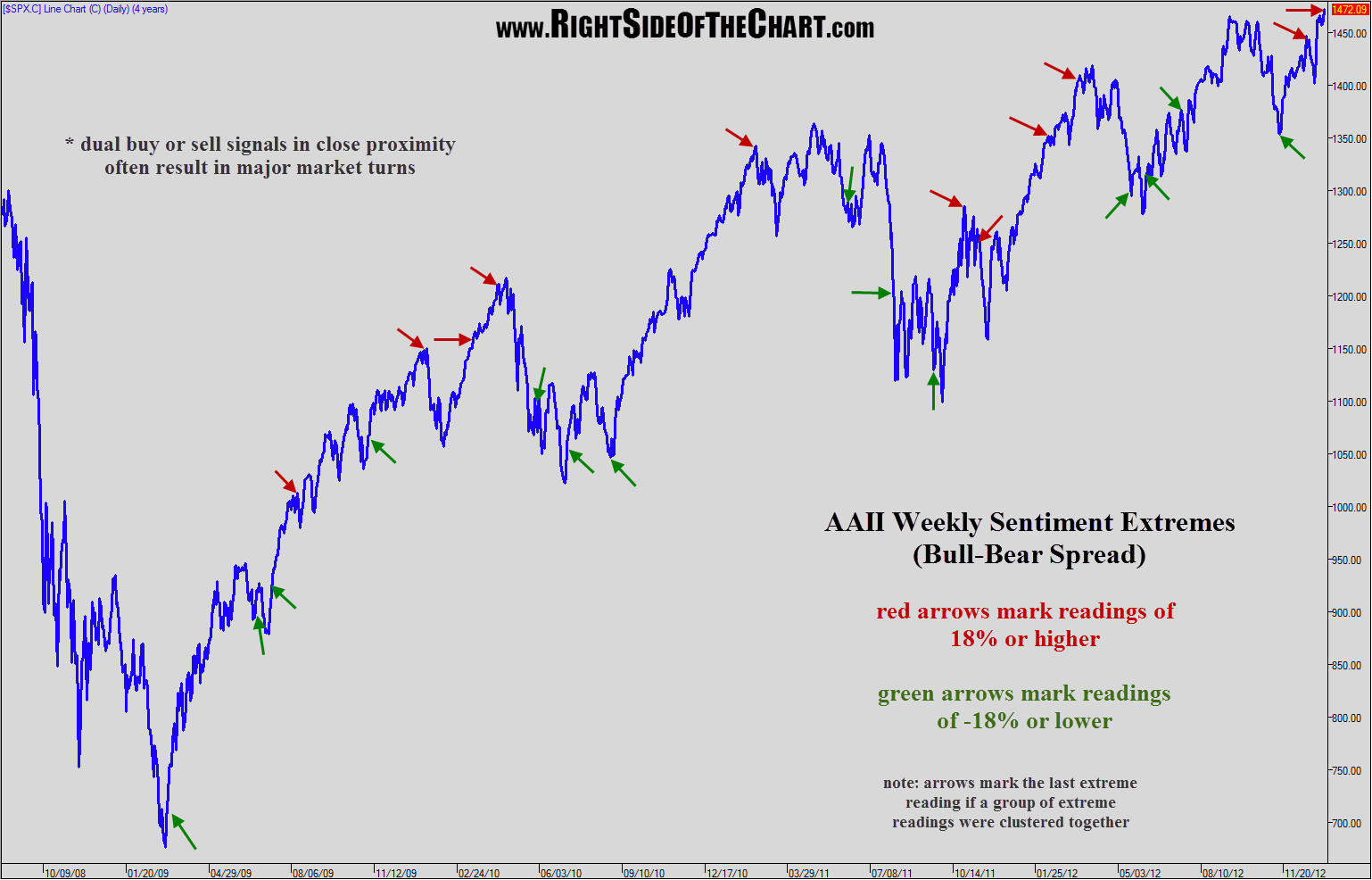

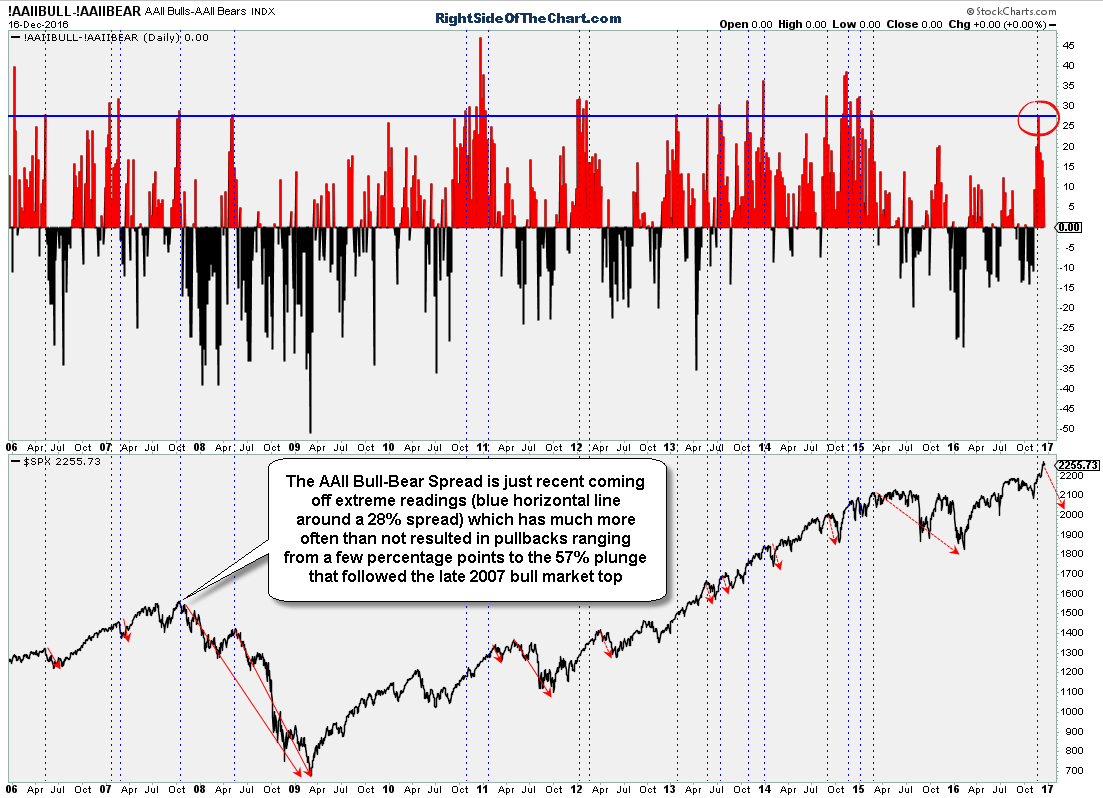

Bear Spread is a kind of price spread where you buy either call or put options at different Strike Prices having the same expiration and is used when an investor thinks that a stock price will go down, but it will not go down drastically.

There are several ways you can trade when you feel that a stock will go down.

The strategies mentioned in “a” and “b” are most effective when the stock price goes down drastically. There is no protection in the above two strategies. That is, if the stock price goes up, then there will be unlimited loss in strategy “a” and limited loss in strategy “b.” They help to minimize the initial cost of Strategy “b.” It helps to reach the breakeven point faster.

Say the stock price in the market is 100, and the put premium at different strike prices are mentioned below:

So now, if the stock price stays above 100 or 98, then it will be your loss of 2. What will happen if the stock price goes below 98.

Stage 1: Stock Price above 98. You will incur a loss of 2. Because both the put options will expire. 2 was your initial investment

Stage 2: Stock price from 98 to 96. As soon as the stock price crosses 98, the put you bought will be activated. So when the stock price reaches 96, then the gain from put will be 2. Your initial investment was -2, so you will reach Breakeven. This means there will be no profit or no loss at this stage.

Stage 3: Stock Price between 96 to 95. This is the stage where you will earn a profit. As you have already recovered the investment, so you will earn a profit of +1 here.

Stage 4: Stock Price below 95. At this stage, the put that you have sold will be activated. So you will not be able to earn any more profit from this stage. So your Net profit will remain at 1.

There are two types of bear spread strategies.

Bear Put Strategy has already explained above, so we will explain the Bear Call strategy here.

You may feel that why they have used call when the strategy is bear. So this strategy is to prove that you can use call options also when you feel that the market will go down.

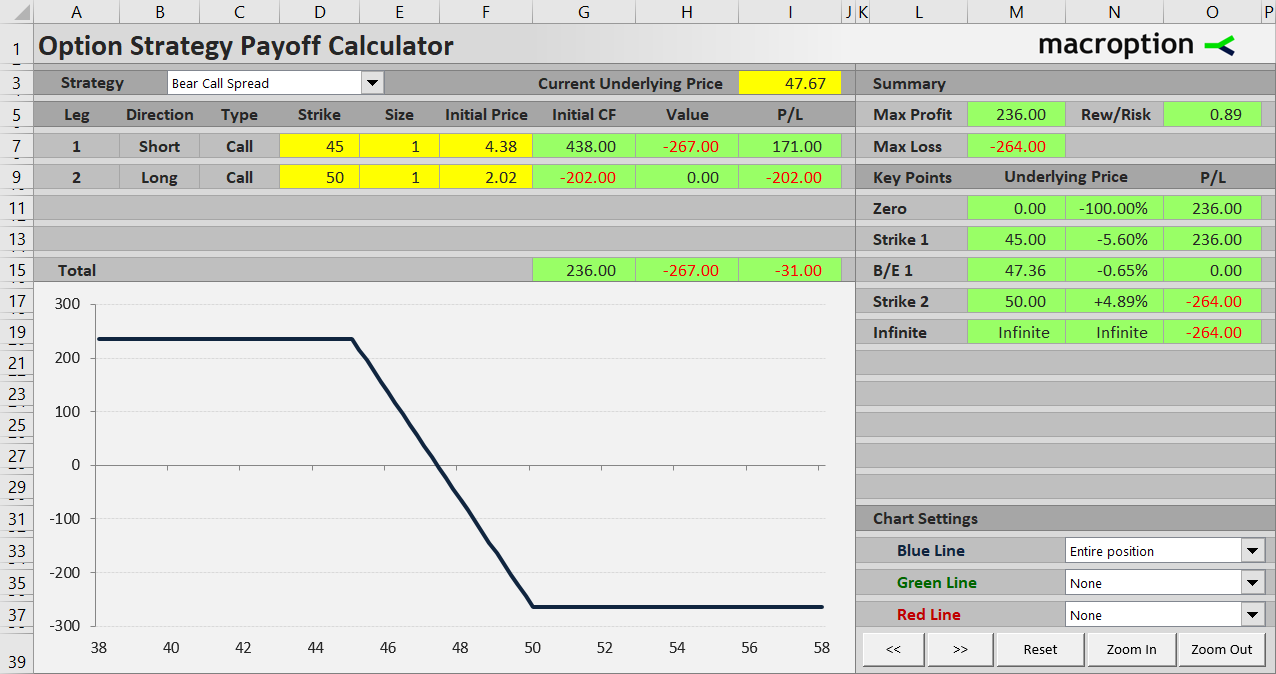

The most lucrative strategy to be used in case you feel that stock price will go down is call writing, also known as Selling Call option. Call Option writing has the potential of unlimited losses if the stock price goes up instead of going down. So to safeguard from the risk of unlimited losses, investors enter into bear call strategy. They buy out of the money call at the higher strike in case the stock price rises.

If an investor is bearish for the market, but he is not so bearish. He thinks that the stock price will go down but will not go down drastically. He should buy a put option and minimize the cost of premium paid. He should sell another out of the money put option. The premium earned from the out of the money will help to lower the initial cost and help to reach breakeven point fast.

Bear Spread Strategy is a kind of price spread where you buy similar options like Call and Put at different strikes but the same maturities. So these strategies are designed in such a way that both profit and losses can be limited. The share market has become extremely unpredictable. The market mostly runs on sentiments now. So one must protect himself in case he is taking any position. Bear spread strategies give protection.

This has been a guide to what is Bear Spread. Here we discuss two types (Bear Call and Bear Put), and an example of bear spread along with advantages and disadvantages. You may also have a look at the following articles –

Copyright © 2021. CFA Institute Does Not Endorse, Promote, Or Warrant The Accuracy Or Quality Of WallStreetMojo. CFA® And Chartered Financial Analyst® Are Registered Trademarks Owned By CFA Institute. Return to top

This website or its third-party tools use cookies, which are necessary to its functioning and required to achieve the purposes illustrated in the cookie policy. By closing this banner, scrolling this page, clicking a link or continuing to browse otherwise, you agree to our Privacy Policy

Special Offer - All in One Financial Analyst Bundle (250+ Courses, 40+ Projects) View More

Bear Spread Definition

Bear Spread (Meaning, Example)| Put / Call Bear Spread Strategy

Bear Put Spread - Fidelity

Bear Spreads Explained | The Options & Futures Guide

Bear Call Spread Payoff, Break-Even and R/R - Macroption

Customer Service

Profile

Open an Account

Refer a Friend

Log In

Customer Service

Profile

Open an Account

Refer a Friend

Log Out

Home »

Research »

Learning Center »

Investment Products »

Options »

Options Strategy Guide »

Locate an Investor Center by ZIP Code

Careers

News Releases

About Fidelity

International

Copyright 1998-2021 FMR LLC. All Rights Reserved.

Terms of Use

Privacy

Security

Site Map

Accessibility

Contact Us

Share Your Screen

Disclosures

This is for persons in the U.S. only.

To profit from a gradual price decline in the underlying stock.

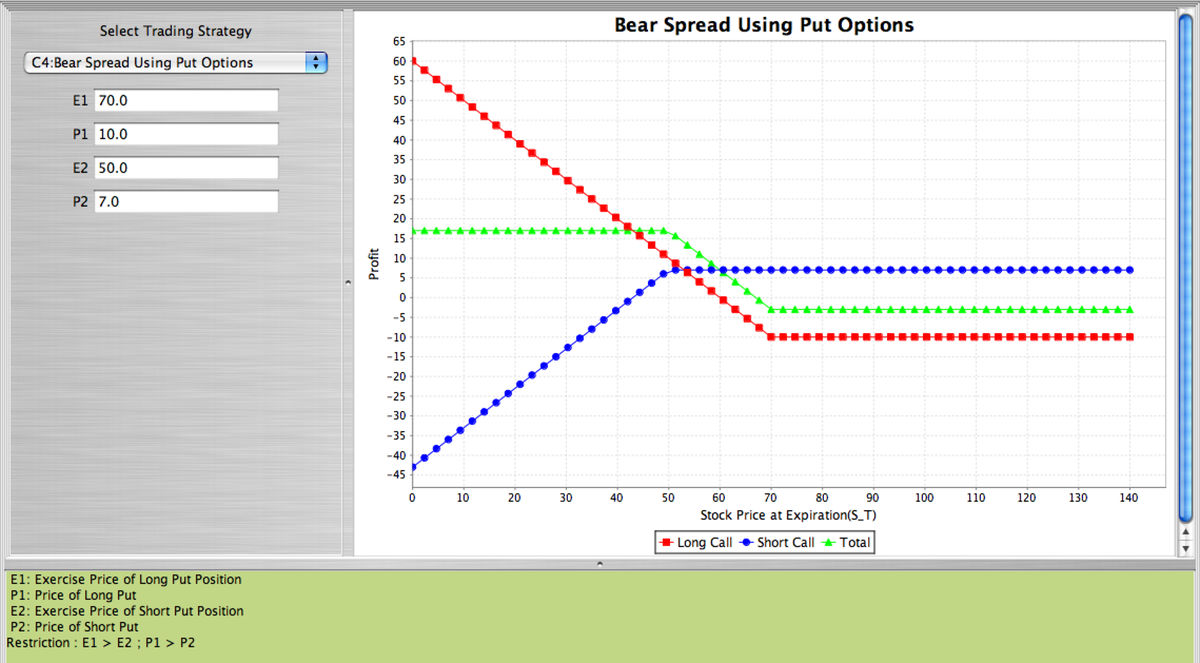

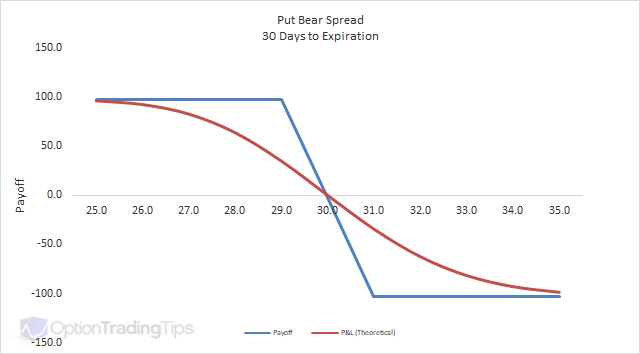

A bear put spread consists of one long put with a higher strike price and one short put with a lower strike price. Both puts have the same underlying stock and the same expiration date. A bear put spread is established for a net debit (or net cost) and profits as the underlying stock declines in price. Profit is limited if the stock price falls below the strike price of the short put lower strike), and potential loss is limited if the stock price rises above the strike price of the long put (higher strike).

Potential profit is limited to the difference between the strike prices minus the net cost of the spread including commissions. In the example above, the difference between the strike prices is 5.00 (100.00 – 95.00 = 5.00), and the net cost of the spread is 1.90 (3.20 – 1.30 = 1.90). The maximum profit, therefore, is 3.10 (5.00 – 1.90 = 3.10) per share less commissions. This maximum profit is realized if the stock price is at or below the strike price of the short put (lower strike) at expiration. Short puts are generally assigned at expiration when the stock price is below the strike price. However, there is a possibility of early assignment. See below.

The maximum risk is equal to the cost of the spread including commissions. A loss of this amount is realized if the position is held to expiration and both puts expire worthless. Both puts will expire worthless if the stock price at expiration is above the strike price of the long put (higher strike).

Strike price of long put (higher strike) minus net premium paid

In this example: 100.00 − 1.90 = 98.10

A bear put spread performs best when the price of the underlying stock falls below the strike price of the short put at expiration. Therefore, the ideal forecast is “modestly bearish.”

Bear put spreads have limited profit potential, but they cost less than buying only the higher strike put. Since most stock price changes are “small,” bear put spreads, in theory, have a greater chance of making a larger percentage profit than buying only the higher strike put. In practice, however, choosing a bear put spread instead of buying only the higher strike put is a subjective decision. Bear put spreads benefit from two factors, a falling stock price and time decay of the short option. A bear put spread is the strategy of choice when the forecast is for a gradual price decline to the strike price of the short put.

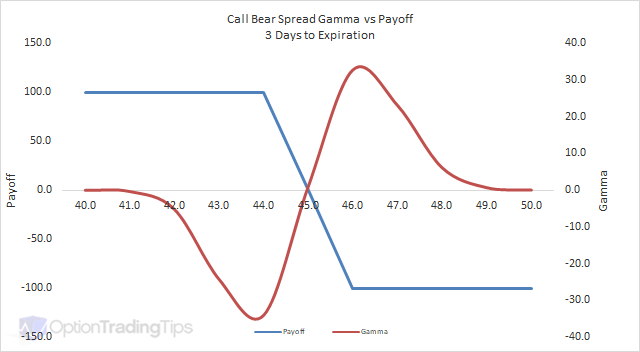

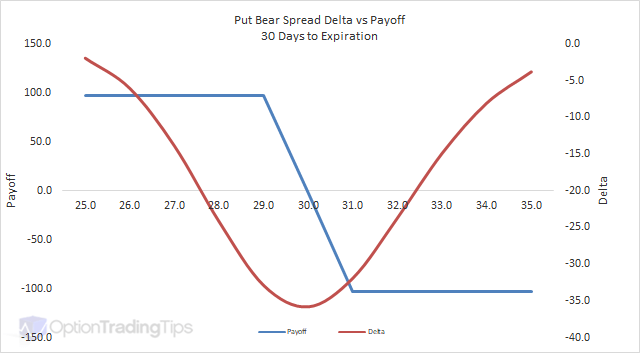

A bear put spread rises in price as the stock price falls and declines in price as the stock price rises. This means that the position has a “net negative delta.” Delta estimates how much an option price will change as the stock price changes, and the change in option price is generally less than dollar-for-dollar with the change in stock price. Also, because a bear put spread consists of one long put and one short put, the net delta changes very little as the stock price changes and time to expiration is unchanged. In the language of options, this is a “near-zero gamma.” Gamma estimates how much the delta of a position changes as the stock price changes.

Volatility is a measure of how much a stock price fluctuates in percentage terms, and volatility is a factor in option prices. As volatility rises, option prices tend to rise if other factors such as stock price and time to expiration remain constant. Since a bear put spread consists of one long put and one short put, the price of a bear put spread changes very little when volatility changes. In the language of options, this is a “near-zero vega.” Vega estimates how much an option price changes as the level of volatility changes and other factors are unchanged.

The time value portion of an option’s total price decreases as expiration approaches. This is known as time erosion, or time decay. Since a bear put spread consists of one long put and one short put, the sensitivity to time erosion depends on the relationship of the stock price to the strike prices of the spread. If the stock price is “close to” or above the strike price of the long put (higher strike price), then the price of the bear put spread decreases with passing of time (and loses money). This happens because the long put is closest to the money and decreases in value faster than the short put. However, if the stock price is “close to” or below the strike price of the short put (lower strike price), then the price of the bear put spread increases with passing time (and makes money). This happens because the short put is now closer to the money and decreases in value faster than the long put. If the stock price is half-way between the strike prices, then time erosion has little effect on the price of a bear put spread, because both the long put and the short put decay at approximately the same rate.

Stock options in the United States can be exercised on any business day, and the holder of a short stock option position has no control over when they will be required to fulfill the obligation. Therefore, the risk of early assignment is a real risk that must be considered when entering into positions involving short options.

While the long put in a bear put spread has no risk of early assignment, the short put does have such risk. Early assignment of stock options is generally related to dividends, and short puts that are assigned early are generally assigned on the ex-dividend date. In-the-money puts whose time value is less than the dividend have a high likelihood of being assigned. Therefore, if the stock price is below the strike price of the short put in a bear put spread (the lower strike price), an assessment must be made if early assignment is likely. If assignment is deemed likely and if a long stock position is not wanted, then appropriate action must be taken. Before assignment occurs, the risk of assignment can be eliminated in two ways. First, the entire spread can be closed by selling the long put to close and buying the short put to close. Alternatively, the short put can be purchased to close and the long put can be kept open.

If early assignment of a short put does occur, stock is purchased. If a long stock position is not wanted, the stock can be sold either by selling it in the marketplace or by exercising the long put. Note, however, that whichever method is chosen, the date of the stock sale will be one day later than the date of the stock purchase. This difference will result in additional fees, including interest charges and commissions. Assignment of a short put might also trigger a margin call if there is not sufficient account equity to support the stock position.

There are three possible outcomes at expiration. The stock price can be at or above the higher strike price, below the higher strike price but not below the lower strike price or below the lower strike price. If the stock price is at or above the higher strike price, then both puts in a bear put spread expire worthless and no stock position is created. If the stock price is below the higher strike price but not below the lower strike price, then the long put is exercised and a short stock position is created. If the stock price is below the lower strike price, then the long put is exercised and the short put is assigned. The result is that stock is sold at the higher strike price and purchased at the lower strike price and no stock position is created.

The “bear put spread” strategy has other names. It is also known as a “debit put spread” and as a “long put spread.” The term “bear” refers to the fact that the strategy profits with bearish, or falling, stock prices. The term “debit” refers to the fact that the strategy is created for a net cost, or net debit. Finally, the term “long” refers to the fact that this strategy is “purchased,” which is another way of saying that it is created for a net cost.

A bull put spread consists of one short put with a higher strike price and one long put with a lower strike price.

A bear call spread consists of one short call with a lower strike price and one long call with a higher strike price.

Article copyright 2013 by Chicago Board Options Exchange, Inc (CBOE). Reprinted with permission from CBOE. The statements and opinions expressed in this article are those of the author. Fidelity Investments cannot guarantee the accuracy or completeness of any statements or data.

Options trading entails significant risk and is not appropriate for all investors. Certain complex options strategies carry additional risk. Before trading options, please read Characteristics and Risks of Standardized Options Opens in a new window . Supporting documentation for any claims, if applicable, will be furnished upon request.

Charts, screenshots, company stock symbols and examples contained in this module are for illustrative purposes only.

Secretary Fuck Anal

Xnxx Com School Girl Video

Latex Double Penetration

Sensual Body

Slutwife Cum