The Definitive Guide to What to Do if Your Debt Goes to Collections

A compilation organization is a business used by lenders or creditors to recoup funds that are previous due, or from profiles that are in nonpayment. The company can easily at that point help make the remittance or other economic arrangements to pay back the loan. Credit history unions might make use of these firms also to help make car loan modifications. Finance company credit unions might likewise use personal lenders as collateral to settle the financings and other debt that might be overdue.

Typically, a lender will certainly tap the services of a selection company after it has produced various fell short attempts to accumulate its receivables. Such firms are typically created to pick up financial obligation for several tasks. For instance, an creditor may use for credit screen services or check up on a debtor through checking out a carton on his or her credit report. This might include paying out a assortment organization fees, inspecting up on any settlements, and accumulating information regarding how that details was received during the course of the inspection.

A lending institution might outsource the debt-collection task to a third celebration (the assortment company), or it may possess an interior division or a debt-collection subsidiary that would handle the task. Such third-party administration helps make its own choices as to what styles of company is satisfactory, what makes up reasonable, and how a lot.". The Fannie Mae and Freddie Mac companies that do collect personal debt can easily take responsibility for the financial obligations and could possess even more participation with various other personal debts.

Key Takeaways A collection firm is a provider that finance companies utilize to recover funds that are previous due or coming from accounts that are in nonpayment. The organization can after that devote the resources to pay back the authentic fund or to assist an independent business bounce back the initial fund. It's crucial to always remember that you need to think of an independent company's targets and purposes in this context. How a lot will definitely you be billed for the lending? What amount of opportunity will you function on the lending to produce the yield?

Collection companies operate very closely with the credit report agencies and financial institutions to try to recover overdue funds. The process can take years, but is a acquainted experience that many borrowers experience now and in the future. But "there are actually no lawful solutions, or lawful remedies, because you can't deliver cash money to the IRS," said Dr. Sivan, who's the main private detective and director of Tax Compliance at St. Solution Can Be Seen Here -based Taxpayers Alliance.

Compilation companies are managed by the Fair Debt Collection Practices Act (FDCPA) and tied through guidelines about what they can easily and can easilynot carry out to accumulate funds. The regulation makes it possible for banking companies and various other financial companies providers to take funds coming from Americans, and the amount of money is not a car loan; somewhat, it's a "cashier's examination.". When the cash goes right into the wrong hands, the FDCPA gets in touch with that credit history inspection and contacts it an American Credit Line (ACL).

How a Collection Agency Works When a customer fail on their financial debts or falls short to make scheduled car loan repayments, the creditor will certainly disclose this fault to a credit history agency. The agency can easily then make the settlement or send a form verifying that the borrower has helped make well-timed settlements. Credit scores agencies can easily offer an inventory of excellent credit score under the customer's name and the day the organization given out the loan, and can easily likewise supply a deposit under the consumer's name and the time the funding obligation come from.

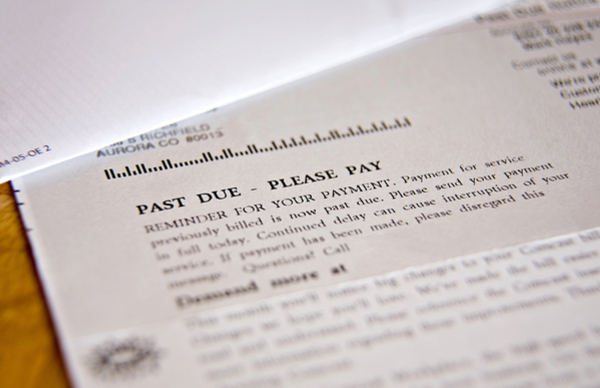

Then, not simply will certainly the borrower's credit rating background be tarnished, but additionally their personal debt will certainly be switched over to a selection agency within three-to-six months of default. This procedure is gotten in touch with "foreclosed properties," and it entails giving down the volume of cash that has currently been paid for off. In the celebration that customers select to take unpaid financial obligations, the customers who will definitely inevitably be capable to pay off the balance are going to be notified of the judgment and are going to be given lawful notification through the collector.

When a Customer Pays If the debtor pays their debt as a result of the selection company's attempts, then the financial institution spends the collection company a amount of the funds, or assets, that it bounces back. The volume of the amount of money bounced back depends on both the amount (the portion) and the volume of the funds that the collector recuperates (the portion). When collecting funds, it is essential the lender spend the equilibrium for a time frame of opportunity before the money is collected.