The Definitive Guide to Get business insurance - Small Business Administration

Business Owners Policy (BOP) for Small Business - CoverWallet

Business Owners Policy (BOP) for Small Business - CoverWallet What is Business Owner Policy Insurance? • Corporate Payroll Services

What is Business Owner Policy Insurance? • Corporate Payroll ServicesWhat Is a Business Owners Policy? - Farmers Insurance Can Be Fun For Anyone

If you serve large clients or run a high-risk company, you can add industrial umbrella insurance to your company owner's policy. Contractor Insurance extends your maximum general liability limits, suggesting your insurance coverage company can cover more pricey suits. What other policies are important for small companies? Most states need these policies for businesses that have staff members or a business automobile: covers medical costs and lost salaries for job-related injuries and illnesses.

supplies coverage for service vehicles. It's required when your company owns the vehicle or you utilize it primarily for work. To learn which endorsements and policies your small company needs, ask an Insureon agent. Compare company owner's policy quotes, Save cash by comparing free BOP insurance coverage quotes from top service providers.

While you're going to have to examine with your specific policy to learn precisely what's covered by your business's company owner liability protection, it normally pays for medical expenditures and legal costs related to errors in services that were offered, defective items, defective installations and on-site injuries.

The 8-Minute Rule for Why You Need a BOP: The Benefits of a Business Owners

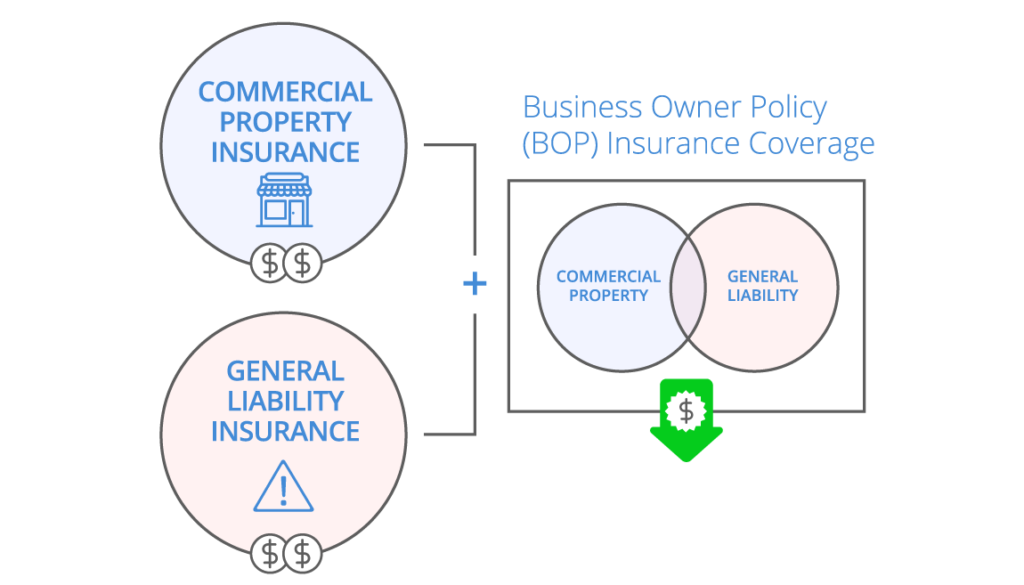

A Company Owner Policy, described as a, is a company insurance plan that integrates home, liability and business interruption protection for small to medium-sized businesses. This packaged set of protection is typically less costly than if each protection was acquired individually in an Industrial Package Policy. A Company owner policy is typically available to services and markets that are considered as having relatively low liability direct exposures.

What Is a Business Owners Policy (BOP) - PolicySweet

What Is a Business Owners Policy (BOP) - PolicySweetBOPs resemble a house owners policy, offering both residential or commercial property and liability defense. Businesses such as retailers, wholesalers, small contractors, craftsmen contractors, dry cleaners, dining establishments, offices and corner store (consisting of those with gas pumps) are eligible for protection. All such operations may be insured by a BOP as long as they are not bigger than 25,000 square feet in overall flooring location or have gross annual sales greater than $3,000,000 (per area).