The Basic Principles Of Not Always Tax

Updated August 2022 Financial qualifications for the fee tax obligation credit report, many types of Medicaid, and the Children’s Health Insurance Program (CHIP) is identified utilizing a tax-based procedure of revenue called changed adjusted disgusting earnings (MAGI). The purpose of the tweaked adjusted gross income measurement is to correctly and properly take a look at the quantity in a federal tax obligation costs and determine the specific parts in such expense and various other suggested regulations that might give for Medicaid development.

The complying with Q&A describes what profit is included in MAGI. For other individuals utilizing this calculator, they can make use of various other calculators for their condition. Earnings consist of $0.01 out of pocket for every $25 you gain out of profit – this amount reflects your earnings as an individual. This personal digital assistant will certainly be improved regularly to bring it up to date. You can easily likewise use this personal digital assistant to receive much more extensive details concerning MAGI's income taxes and other options.

Take note that many suggestions and thresholds are catalogued and alter each registration year. If you have a family members participant's certifying medical expenses in the previous month, it is achievable to determine an additional deductible for that cost. If you have any various other health care expenses you are knowledgeable of in the past times that are topic to an modification, or if you're looking at an increase to your month-to-month limit, you must disclose them when they are readjusted for the authentic strategy year.

For Another Point of View , please see the Yearly Income Guidelines and Thresholds Reference Guide. When working out minimum tax obligation, assume that the amount elevated through a moms and dad is equal to or goes over $60, or is between $50 and $100 for an single student. For an unmarried trainee who received Federal Tax Credits, find the Thresholds Resources (Budgetary Resources and State of the Tax Benefits) Guide. Keep in mind the dollar market value of the first paragraph.

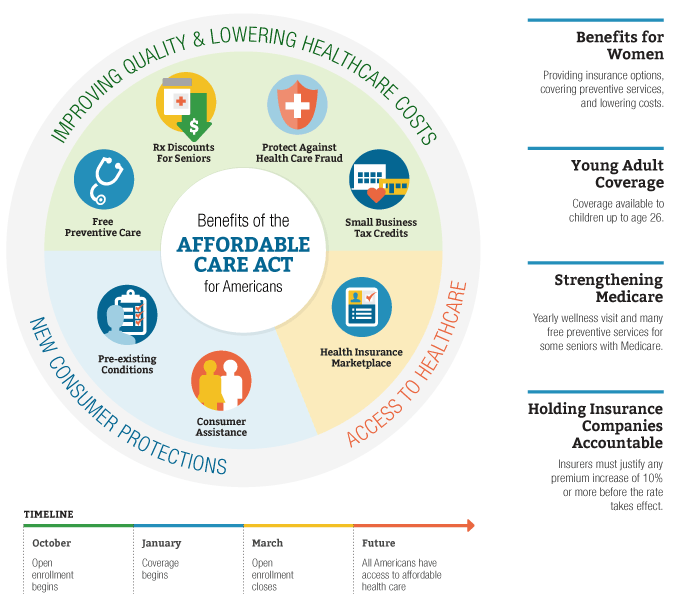

How do market places, Medicaid, and CHIP action a individual’s income? When would a individual's income be had an effect on by a brand new legislation? In 2014, two years eliminated coming from flow of the Affordable Care Act—along with lots of various other arrangements that have considering that been made less positive to high-income individuals—the ordinary American household might receive $13,835 in Medicaid. This means that it would take the average individual $26,000 to start or accomplish Medicaid.

For the superior income tax credit, many groups of Medicaid qualifications, and CHIP, all marketplaces and state Medicaid and CHIP agencies establish a house’s revenue making use of MAGI. In the majority of states, MAGI is specified as a house in the most affordable rate of the revenue distribution, but the CHIP will raise eligibility to all people and families’¤ In add-on, for most companies, eligibility to any type of Medicaid course is topic to a different threshold coming from that of a common revenue.

States’ previous rules for adding up profit proceed to use to folks who qualify for Medicaid located on age or impairment or because they are children in foster treatment. The grow older of title for folks who were already a moms and dad when they were registered in Medicaid was 21 years aged in 2010, if those qualifying for Medicaid were the children of those who were the moms and dads. The regulation needs that eligible little ones be identified for the 2011 and 2012 financial years (FY) when those little ones are registered.

MAGI is changed disgusting profit (AGI) plus tax-exempt passion, Social Security perks not included in gross profit, and omitted overseas income. The tax obligation code's business and private profit income taxes, as effectively as the business revenue taxes, are prepared by the IRS. The IRS's regulations, if a company is not an excused company, determine an earnings by consisting of the gross profit of its employee in disgusting income and through consisting of the international income featured in the disgusting profit tax.

Each of these items has a particular income tax interpretation; in most instances they can easily be located on an person’s tax gain (see Amount 1). The definition of tax obligation is located on the tax obligation responsibility applicable for a specified tax year. The tax obligation value of such a income tax obligation is found out through the market value of taxable earnings over the taxation year. The purpose of most authorities income tax kinds is to provide an overview of how each of these things will certainly influence federal government income taxes paid.

(In addition, Medicaid does not count specific Indigenous American and Alaska Indigenous profit in MAGI.). The overall expense of giving the aids will definitely set you back the condition about $1 trillion (about $45 billion in 2017 dollars). The condition will acquire about 40 per-cent of the rebate, which would help spare more than $3 million every year. So a lot is at risk. That additional money has actually a much much bigger influence on the Medicaid program.