Some Known Incorrect Statements About Wage Garnishment Maryland - Brennan Defense

Things about Wage Garnishment Laws by State 2021 - World Population

How courts and companies translate and apply the law can also alter. And some guidelines can even differ within a state. These are simply a few of the reasons to consider consulting an attorney if you're facing a wage garnishment. Limits for Child Assistance, Trainee Loans, and Unpaid Taxes If you owe kid assistance, federal student loans, or taxes, the government or financial institution can garnish your earnings without getting a court judgment for that purpose.

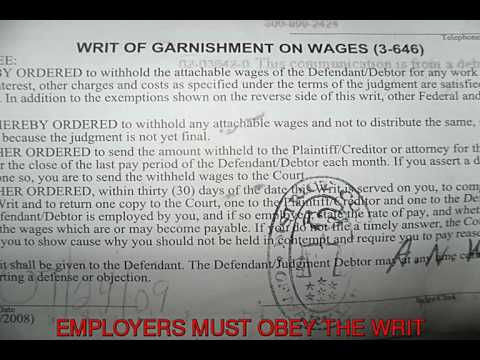

Technicalities Do Not Quash Garnishment in Debt Collection Case

Technicalities Do Not Quash Garnishment in Debt Collection CaseGarnishment Limits for Unpaid Child Support Because 1988, all court orders for kid assistance consist of an automated earnings withholding order. The other parent can likewise get a wage garnishment order from the court if you get behind in child assistance payments. This Website of wage garnishment. As much as 50% of your non reusable profits may be garnished to pay child support if you're presently supporting a spouse or a child who isn't the topic of the order.

Rumored Buzz on Maryland GovLarry Hogan prohibits garnishments of federal

An additional 5% may be taken if you're more than 12 weeks in financial obligations. (15 U.S.C. 1673). Garnishment Limitation for Federal Student Loans in Default If you remain in default on a federal student loan, the U.S. Department of Education or any entity gathering for this firm can garnish up to 15% of your pay.

What Is a Garnishment Release?

What Is a Garnishment Release?1095a(a)( 1 )). This sort of garnishment is called an "administrative garnishment." However you can keep a quantity that's equivalent to 30 times the existing federal minimum wage per week. (Federal law protects the level of earnings equal to 30 times the minimum wage weekly from garnishment.) (15 U.S.C. 1673). Garnishment Limits for Unpaid Taxes The federal government can garnish your earnings (called a "levy") if you owe back taxes, even without a court judgment.