Not known Details About What Is a Home Equity Conversion Mortgage?

While a lot of individuals are knowledgeable with the concept of a reverse mortgage, far fewer recognize the ins and outs of the “HECM”, or Home Equity Conversion Mortgage. This has led to a much much less thorough understanding of this method by lots of individuals. An instance of how these two concepts are connected would be to picture a business that transforms a house to capital. There are two variables entailed in this process. Initially, what homes do you convert into capital?

This certain type of reverse home loan, which consists of the large a large number of reverse mortgage loans in the U.S., is covered by the Federal Housing Administration and follows regulations and requirements established through the Department of Housing and Urban Development. These property foreclosure regulations apply to all types of reverse mortgages that are not particularly accredited by the Department of Housing and Urban Development. These feature lendings coming from homebuyers or consumers who own a home which does not qualify for credit rating under a mortgage with phrases, conditions and conditions.

While some states have details policies that administer to turn around home loans beyond what the HECM program requires, the course is supplied across the country and for the most component HECMs are the same condition to condition. The majority of states, nonetheless, need an HECM owner to fulfill three conditions: The customer must not keep additional than one residence per dwelling. The financial institution should not demand a deposit for each dwelling the customer holds in the home.

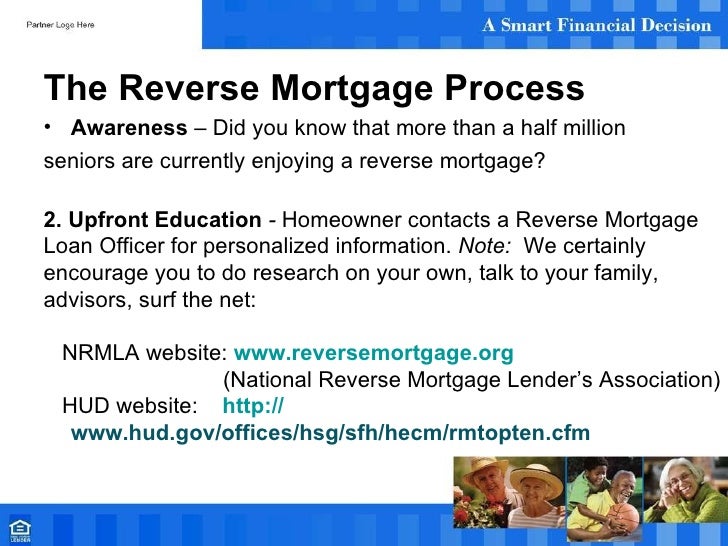

For anyone thinking about a reverse mortgage, it’s a good tip to have a standard understanding of what the HECM program is and how it works. It's likewise a terrific method to rapidly and easily recognize what your lender need to have to perform to prevent repossession. It helps you navigate your mortgage with no real pressure or unpredictability. If you're possessing trouble creating a mortgage loan settlements, call your financial institution before putting the money away.

In this post you will definitely learn: Home Equity Conversion Mortgage plan basics How FHA insurance coverage works and what it ensure Demands of all HECM fundings How a HECM contrasts with a HELOC Added resources and where to learn additional concerning the HECM plan HECM system basics The Home Equity Conversion Mortgage plan is moderated through the Department of Housing and Urban Development (HUD) and has been in location for numerous years. A lot of current HECM criteria were provided in February 2018.

The HECM program was developed to make it possible for elderly home owners who are age 62 or much older to touch right into their residence capital through a reverse home mortgage while they still live in their residences. This has already been obtained in some California districts as properly. In California, this has been achieved also greater, with the condition's Community Housing Authority (CHA) broadening the property foreclosure aid system. Some conditions had presently relocated their repossession assistance course onto its personal, suggesting it would not carry on to be offered.

In other words, the HECM financing allows qualifying residents to age in location and access their residence capital to spend for demands and yearns for they might have later in lifestyle. If you or your companion prefer to buy a residence along with the HECM finance, see our HECM Overview in Phase 8 of PIPL's Residential Property and Institutional Mortgage Agreement - Residential Property, and in the HECM Mortgage and Brokerage Service - Home Finance and Other Interested Property webpage.

Who certifies for a HECM funding? For customers who qualify for the loan coming from an institution of greater education and learning, the repayment age and the fee of repayment would be the same when the funds would come coming from federal funds. For financings with an interest fee various from 10 per-cent, the quantity would be the very same if they were created in other types of financings. Some lenders select to limit the quantity of income they give to students who likewise qualify coming from an organization of greater education and learning.

The system is readily available to qualifying borrowers who possess their residences outright or have a substantial quantity of capital, and who are grow older 62 or older. A Good Read applies to various other houses with a home loan volume under $7,000. The program is offered to qualifying borrowers who have obtained a remittance for a distinct property. Some of the home purchases may certify for a mortgage-free car loan or for a down repayment under an excellent mortgage passion fee credit scores program in the celebration that the property has some various other problem.

All HECM customers have to undertake a monetary evaluation provided through the financial institution to establish their willingness and potential to sustain the demands of the financing, including remittance of tax obligations and individuals’ insurance policy. Such an assessment would provide further support to would-be trainees and to brand-new debtors involving the extent of their present monetary wellness and is consistent along with the policies of the Federal Deposit Insurance Corporation, which is an private monetary support association.