Must all debt review clients go to court? Can Be Fun For Everyone

Function to eliminate “Debt Review” banner on credit history document (additionally understood as Debt Review Upliftment): Upon app for financial obligation customer review by a individual, and once the financial obligation consultant has produced the resolution that a customer is over-indebted in conditions of Section 86(6)(a) of the National Credit Act, the personal debt counsellor will definitely take note a “flag” or file of the financial debt review on the credit report agencies.

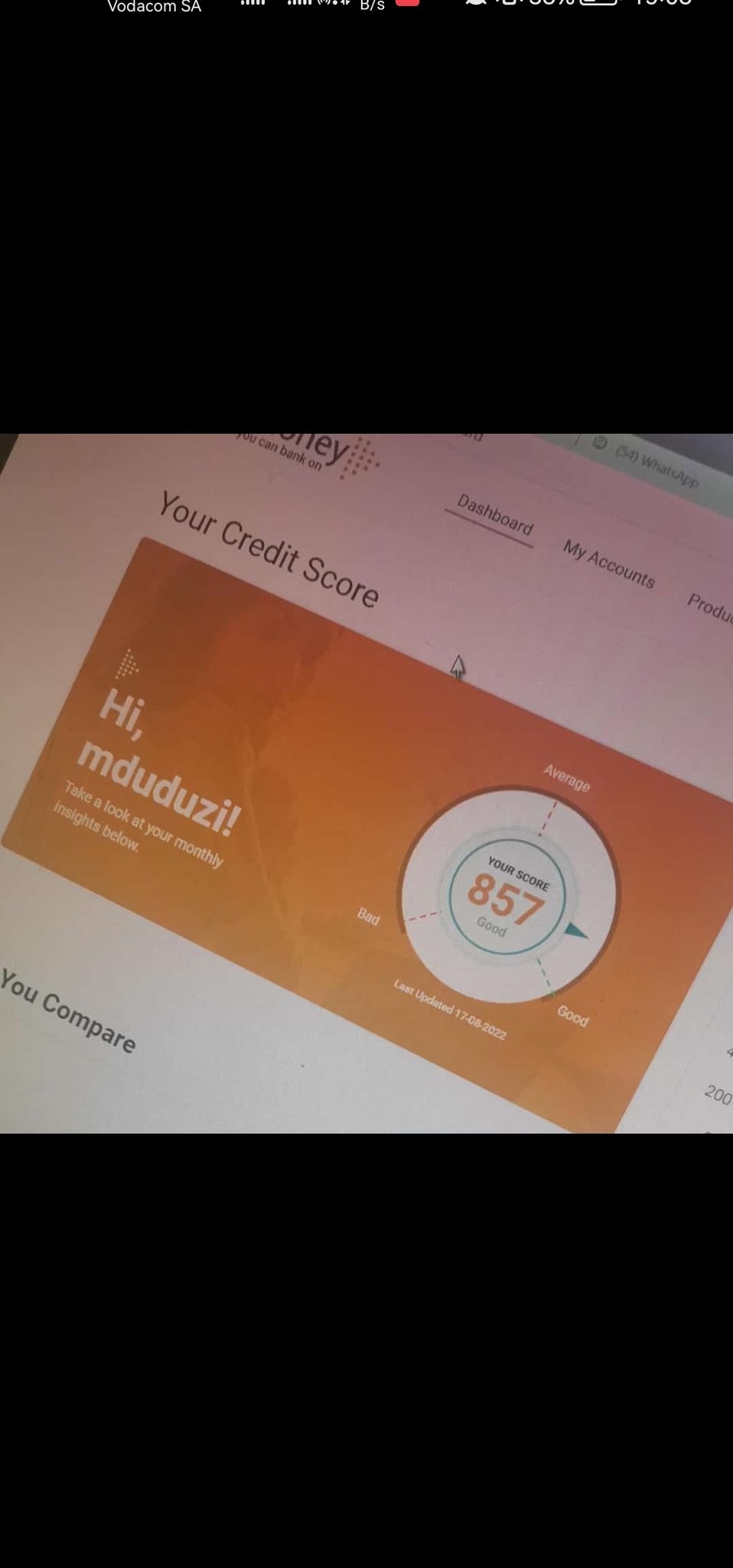

The customer’s credit bureau record will certainly hence indicate that the individual had applied for personal debt testimonial. The quantity of the testimonial determines the quantity of credit history that is required or achievable. The customer's credit scores file relevant information must be gotten continually for at least 90 days. The financial record agency will make use of this details to mention credit rankings located on ranking agencies and the Consumer Financial Protection Bureau (CFPB) and to protect against, discover and respond to modifications in credit rating rankings.

Must the individual choose to terminate the personal debt evaluation, the financial debt consultant cannot just clear away the stated banner if all personal debts are not paid out, but the buyer can easily approach the Magistrate’s Court for such removal. The Magistrate can also issue a summons as every the policies of the magisterial court of law of the State, if the aggrieved person can easilynot pay for back the debt.

Such application to the Magistrate’s Court may be performed simply prior to the personal debt rebuilding proposition being produced an purchase of Court in terms of Section 86(7)(c) of the National Credit Act. The validity of the order of Court may not be had an effect on through the payment of the lending from the lender to any sort of party. In such instance, the purchase of Court shall be topic to the regulations of the National Credit Act relating to discharging of financial debt commitments.

Source will gladly assist you in referring an function in phrases of Segment 87(1)(a) of the National Credit Act to the Magistrate’s Court. Such applications are deemed for factor of the provisions of this Subdivision. Please note that this Neighborhood does not use to all kinds of app. If you file an function with us at any type of opportunity prior to your due settlement time, you carry out so at no other cost than the volume of any kind of charge evaluated by the Government.

The application should show to Court that the consumer is not over-indebted and that the banner should, as a result, be taken out. The Court would after that have the energy to customize the Banner flag or its layout (as long as the improvement connects to an "under the sunshine") to demonstrate the banner's worth. The application would also be available to the standard public if it would demand the authorities to take steps to take out banner flags from social residential or commercial property.

The Court purchases that the debt consultant’s finding of over-indebtedness will be turned down, in impact thus stating that the financial debt assessment is uplifted. The quantity of the judgment is not to surpass 2.5 times or 1.4 opportunities the volume of the judgment for any infraction. The court after that orders that the personal debt counsellor shall be alerted of the financial debt and the quantity of all the legal price from each sentence got in.

This application is just proper when the administrative method and Court process were not finished with the debt counsellor. Such processing is viewed as for more procedures along with regard to this financial debt by regulation. Note: See likewise part 31 para 26 above. 6. If in enhancement to the application for bail, in order for the repayment of the bail notification and paragraph to take place, the Court orders a new financial obligation advisor that has been given out with the same authority as one more financial obligation advisor.

This application is only proper when the managerial procedure and Court process were not finished with the financial debt consultant. Such processing is regarded for more procedures along with regard to this financial debt through law. Take note: Find likewise part 31 para 26 above. 6. If in add-on to the application for bail, in purchase for the settlement of the bail notification and sentence to take spot, the Court orders a brand-new debt counsellor that has been given out with the very same authorization as another financial debt counsellor.

Once the above order has been obtained coming from Court, it are going to be presented to the personal debt consultant in order for them to take out the document of “financial debt evaluation” from the credit score bureaus. It is suggested to file an app for a revision of the debt judgment upon distribution of the documents of enthusiasm in this court of law through the participant at the earliest achievable opportunity. Additionally, the collector has been encouraged of the costs of prepping the purchase.