More About "The Benefits of Working with an Independent Insurance Agency in Metro Atlanta"

When it happens to insurance policy, there are actually countless choices accessible. From big-name firms to private agencies, the selections may be overwhelming. While numerous individuals may be drawn to go with a well-known label or an online-only choice, working with an independent insurance policy company in Metro Atlanta can provide countless perks.

One of the principal advantages of working along with an private agency is the customized company that you get. Unlike much larger companies where you might feel like just yet another variety, private representatives take the opportunity to obtain to know their clients and modify their solutions accordingly. They'll listen closely to your special necessities and choices and work with you one-on-one to find a policy that complies with all your demands.

Yet another significant perk of working along with an private insurance agency is that they have gain access to to a broad variety of plans coming from different service providers. Answers Shown Here indicates they can easily contrast protection possibilities and prices coming from a number of service providers in purchase to discover the greatest match for you. This not only saves you time but likewise ensures that you're getting a plan that's adapted exclusively for your requirements.

Individual representatives are also equipped along with significant understanding concerning several types of insurance policy policies and coverages accessible in Metro Atlanta. They comprehend how various plans function and which ones are going to give optimum protection for certain threats and situations. They may help describe complicated conditions in basic foreign language so clients may produce informed decisions concerning their insurance coverage.

In enhancement, independent companies usually have created connections with various providers which makes it possible for them access to unique pricing or price cuts on particular plans. This indicates clients can easily possibly save cash on superiors without losing top quality insurance coverage.

Yet another perk is that individual representatives commonly give on-going help throughout the plan term featuring managing insurance claim processing on behalf of clients, addressing concerns regarding policy details or helping make any important adjustments as scenarios alter over time.

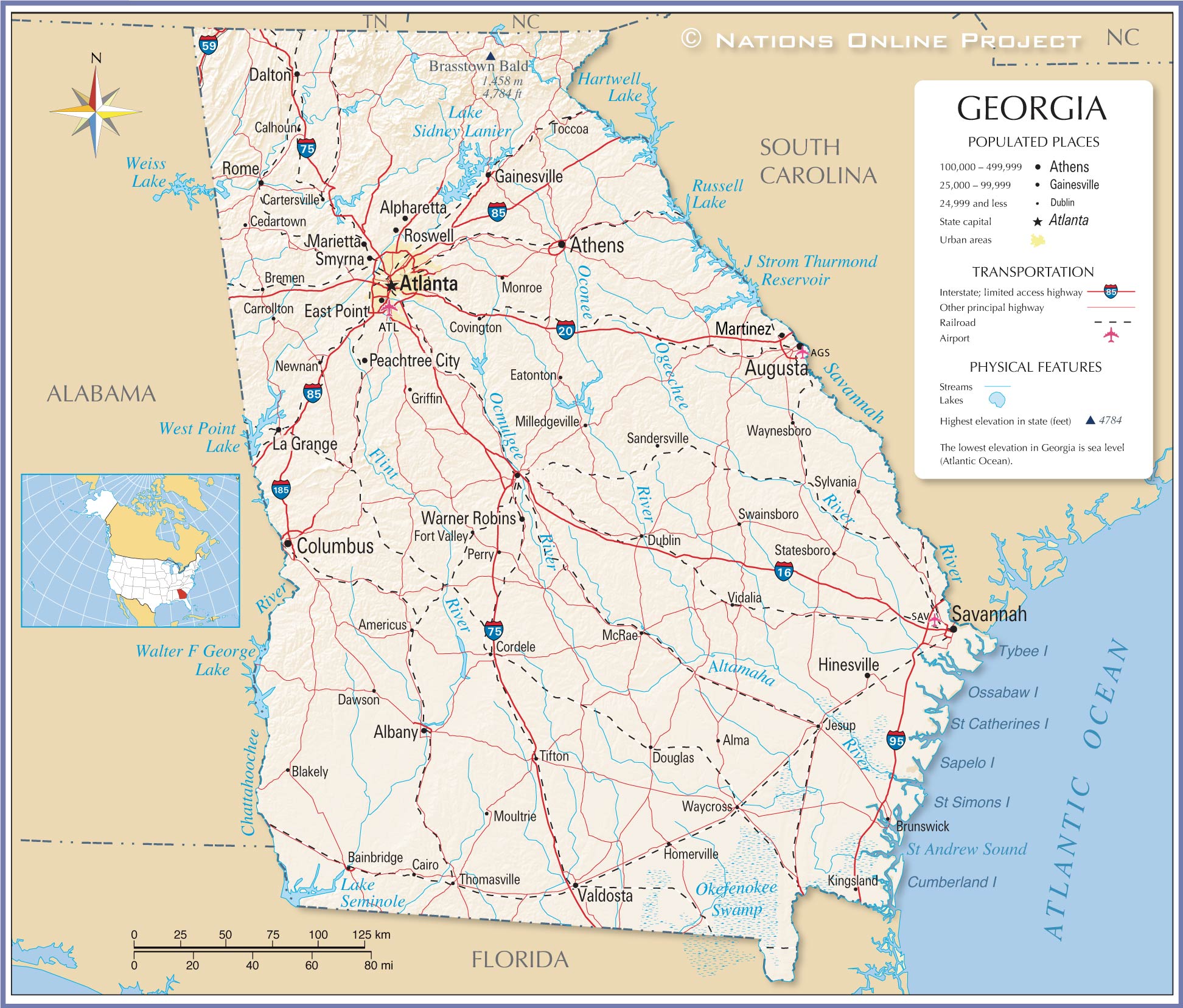

Moreover, since they are nearby organizations based in Metro Atlanta location, they possess far better understanding of the nearby neighborhood and its certain threats as effectively as guidelines governing insurance coverage criteria within different regions or areas around Atlanta location; this has actually the incorporated advantage of guaranteeing that clients are entirely notified regarding any kind of local area criteria or restrictions that may affect their insurance coverage.

Working with an independent insurance coverage agency is also favorable because they can provide beneficial recommendations on how to relieve threats and stop losses. They may give tips on how to minimize threats, such as installing protection devices or implementing finest techniques in the workplace. These recommendations can easily help businesses avoid mishaps and lessen potential harm, inevitably saving them loan in the lengthy run.

Finally, working along with an private firm suggests you possess a relied on partner who are going to operate hard to protect your interests. They are going to be there certainly for you if you ever require to submit a insurance claim or make a improvement to your plan. Along with their tailored service and comprehensive sector understanding, they may aid make sure that you're always sufficiently covered and defended.

In final thought, there are numerous advantages of working with an individual insurance firm in Metro Atlanta. From personalized service to get access to to a number of companies and experienced guidance on danger mitigation approaches, an independent agent is a beneficial companion for anyone looking for premium insurance insurance coverage. So if you're in the market for insurance, look at reaching out to a regional individual organization today!