Market structure

BEARISH & BULLISH STRUCTURE

Market structure, the foundation of price analysis, the most important aspect of trading.

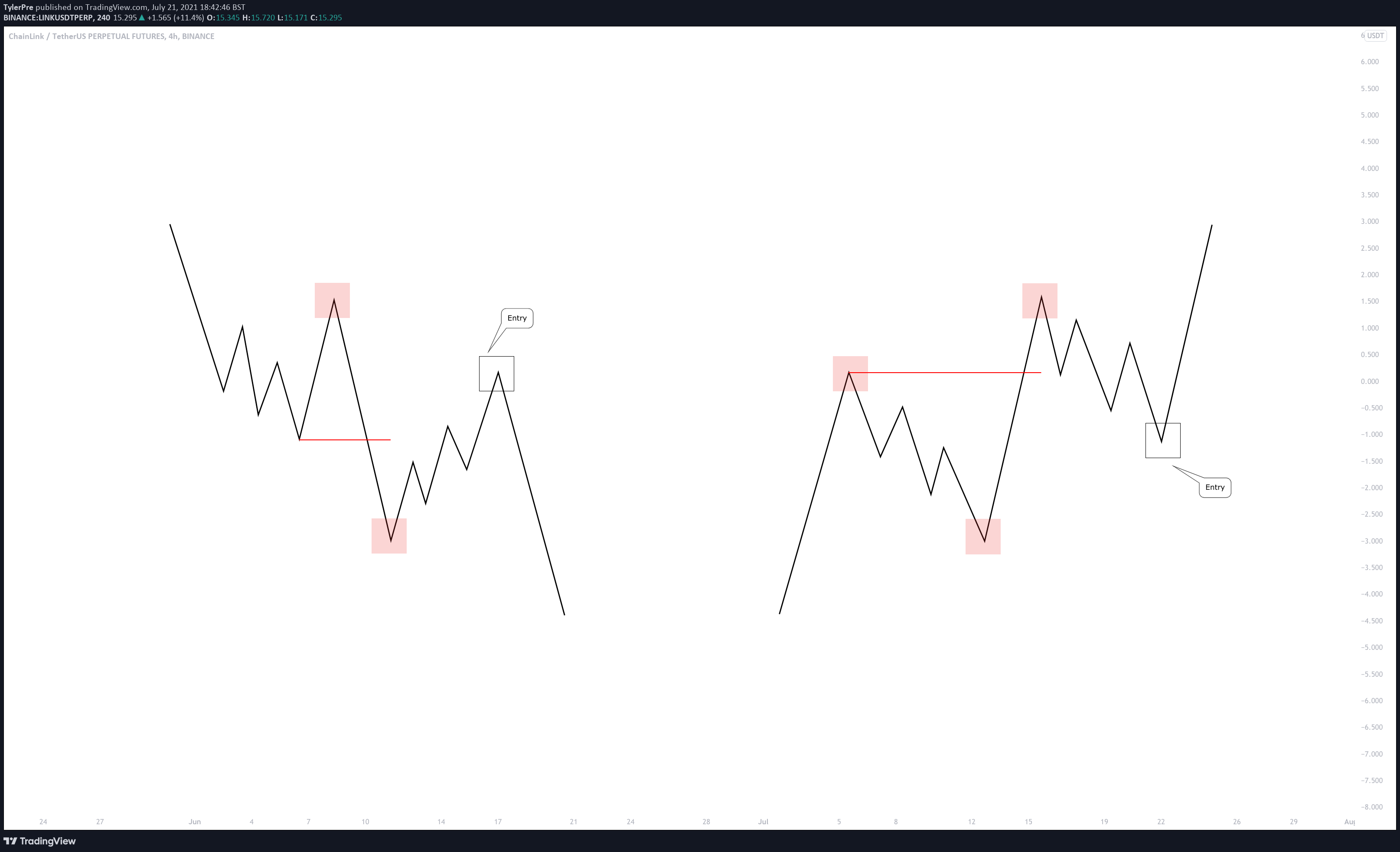

Swing structure legs, forming bullish and bearish directional environments

Example #1

Example #2

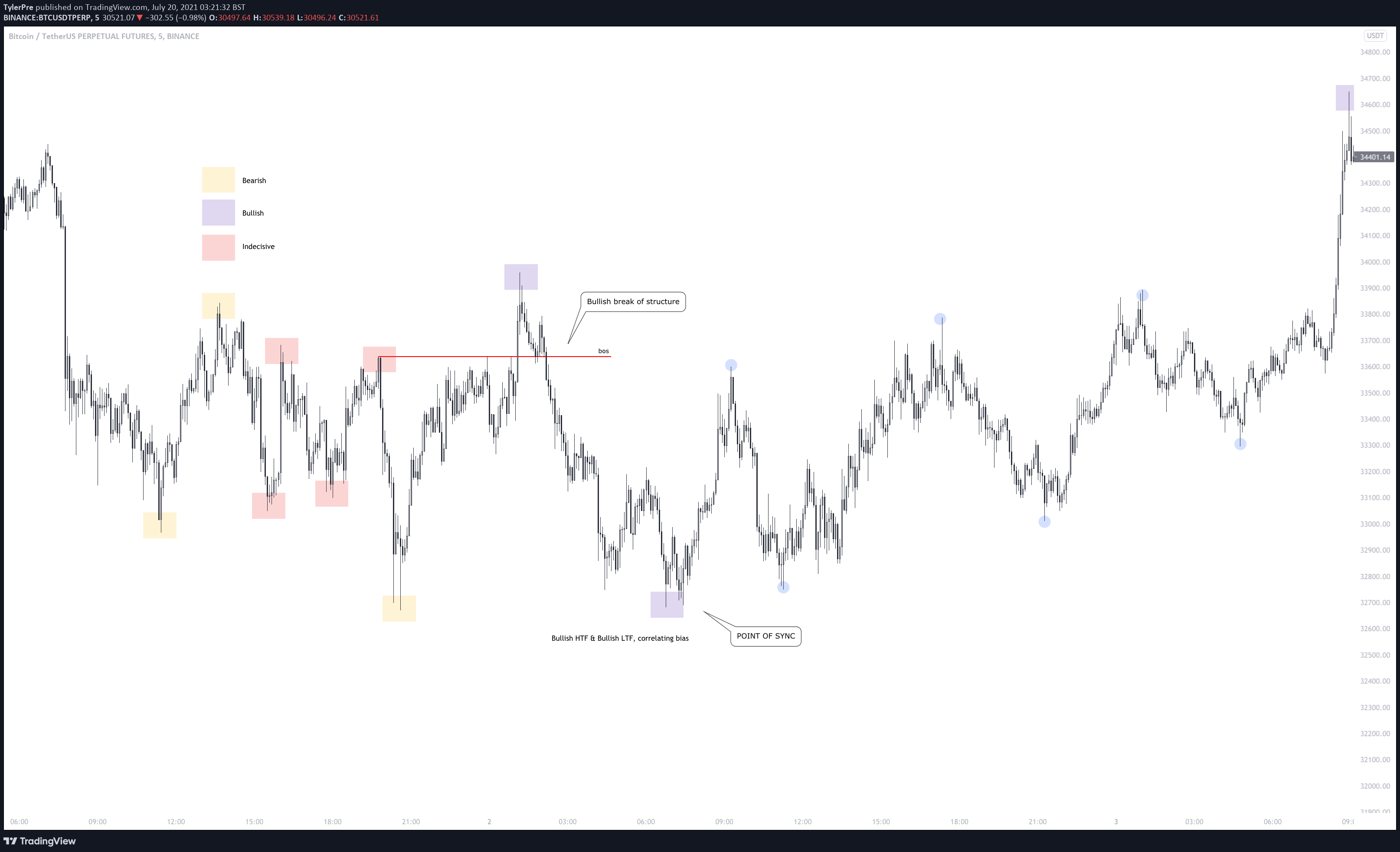

1) BOS

The most commonly used technique of market structure; absoloute paramount to trading

Abbreviations

- BOS - Break of structure

- Micro BOS - LTF break of structure

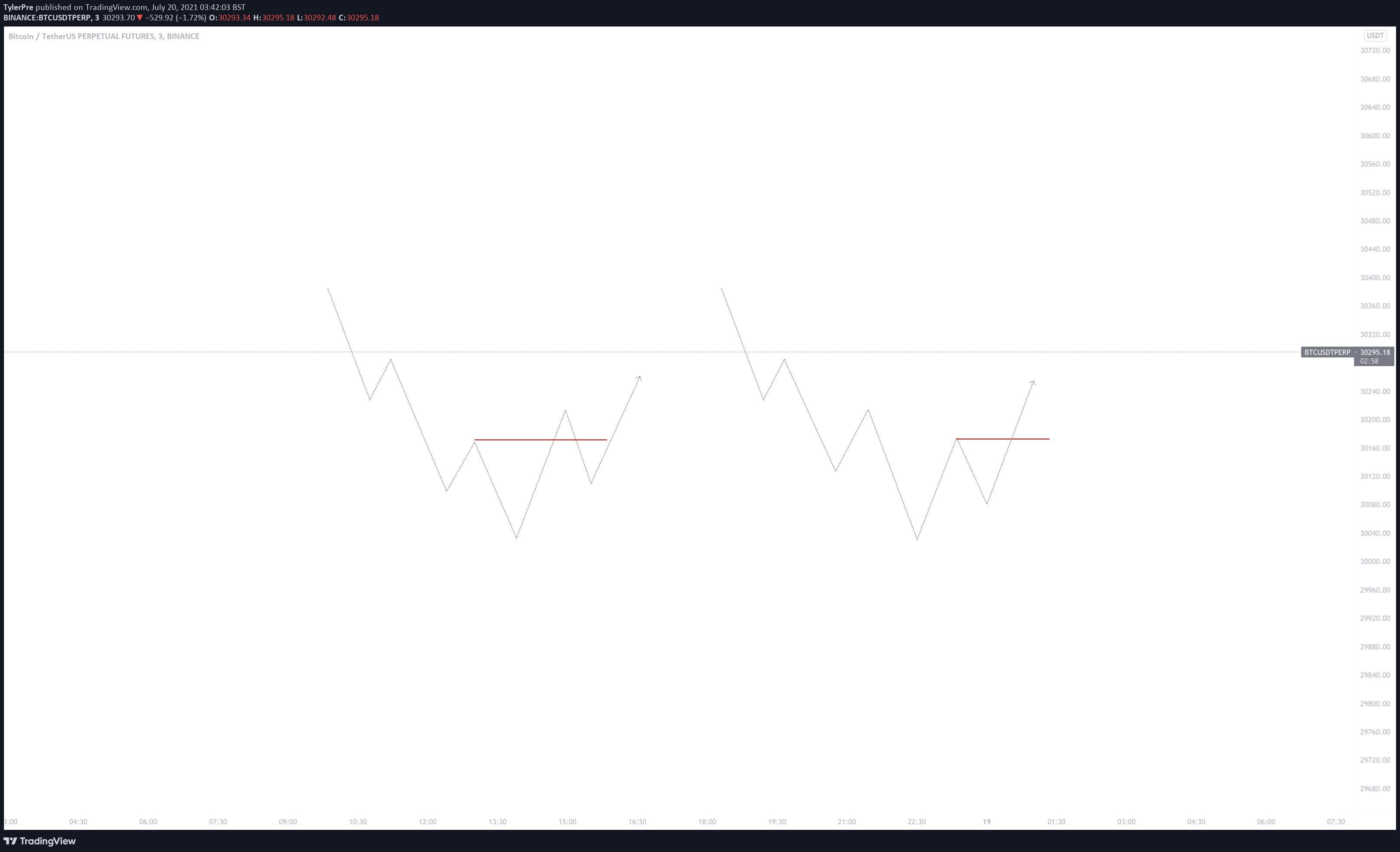

Break of structure is the process of swing highs and lows shifting forming a new 'structural formation'

we also use this to find the point of sync in which the higher time frame bias coincides with the lower time frame bias to allow for a clean and efficient trade.

Bos structures

The two structure types you should be watching for

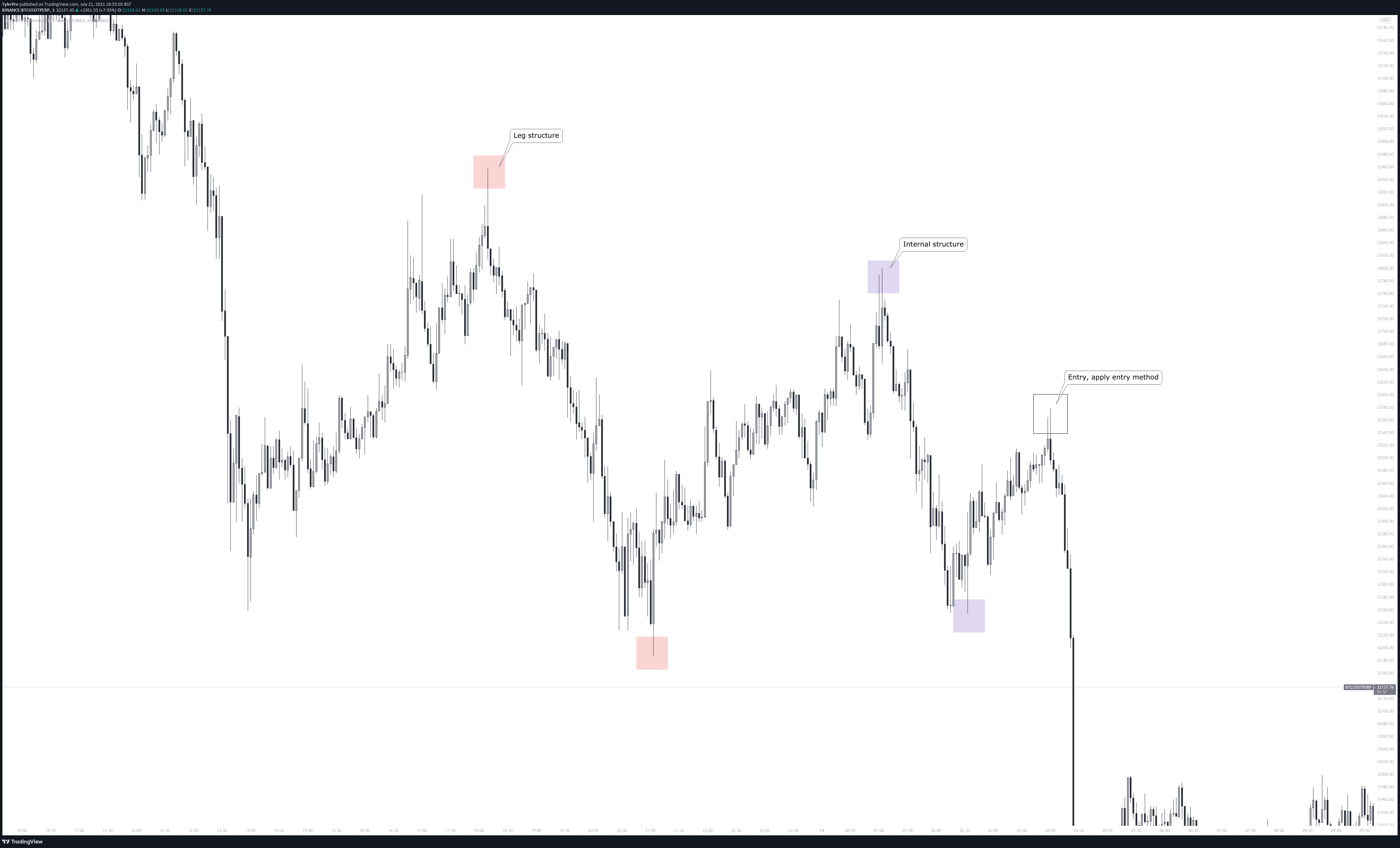

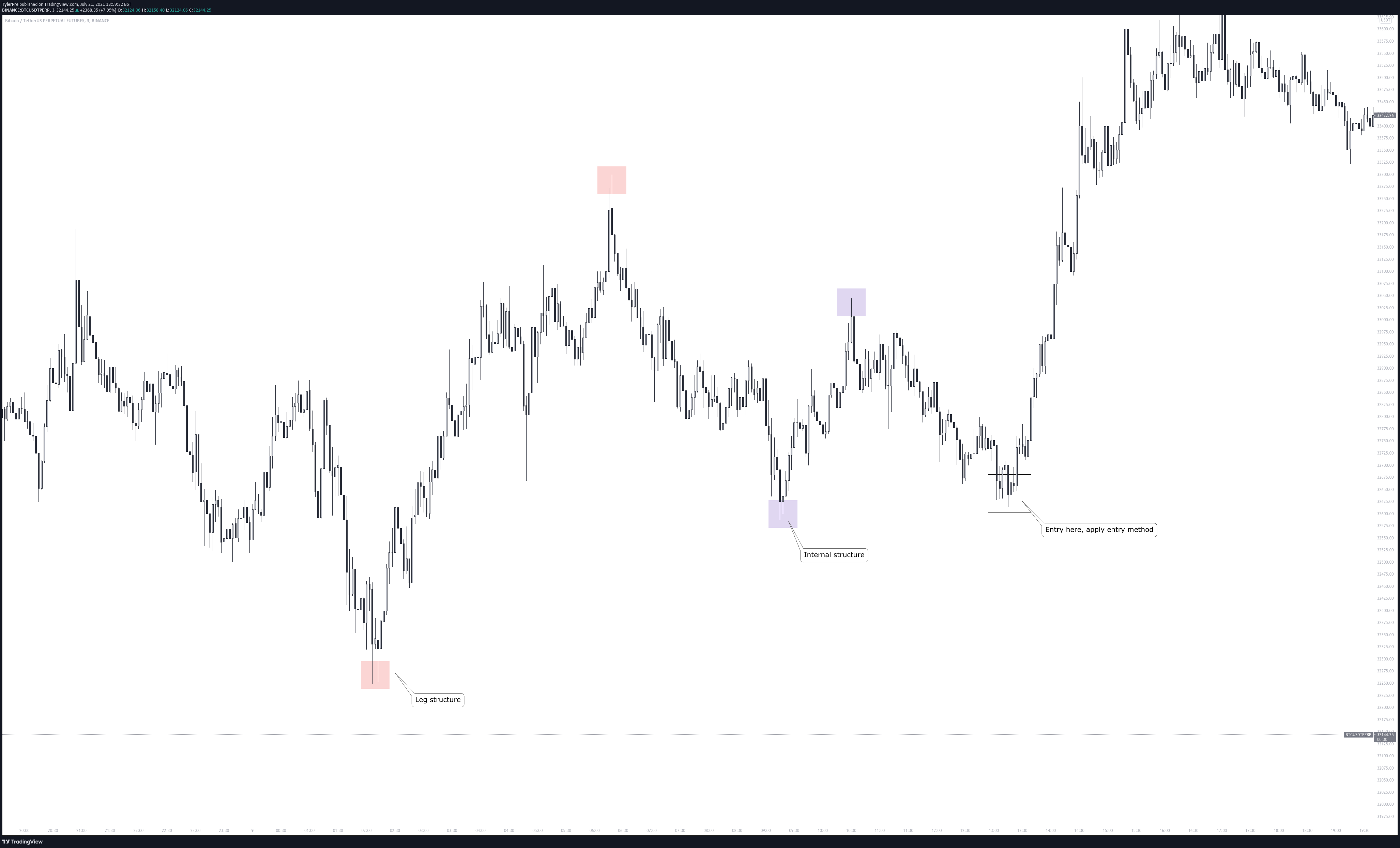

Example #1

HTF Bearish break in structure indicating a new lower high (complex pullback)

Upon inspecting the lower time frame we need to find the point of sync to start looking for an entry.

Here we find a bullish LTF break of structure to fit our already bullish HTF bias, calling this the point of sync (bullish LTF and HTF bias in sync)

Upon finding the point of sync entry opportunities are obtainable.

Entries following BOS

Using previously discussed techniques such as

- Sc mitigation

- Price inefficiency

- Order blocks

- Breaker blocks

Following the point of sync / break of structure are the optimal strategies to execute an efficient trade.