Indicators on Common Risk Factors in Cryptocurrency - LIU - 2022 - Wiley You Should Know

Forbes India - Can Cryptocurrency Revolutionise Financial Services?

Forbes India - Can Cryptocurrency Revolutionise Financial Services? Crypto Finance AG - Crunchbase Company Profile & Funding

Crypto Finance AG - Crunchbase Company Profile & FundingHow Cryptocurrency - CNBC can Save You Time, Stress, and Money.

If the tokens are linked to the value of the company or job, they can be called security tokens (as in securities like stocks, not safety). Other tokens have a specific use case or function. Examples include Storj tokens, which permit people to share files across a decentralized network, or Namecoin, which supplies decentralized Domain Call System (DNS) service for Web addresses.

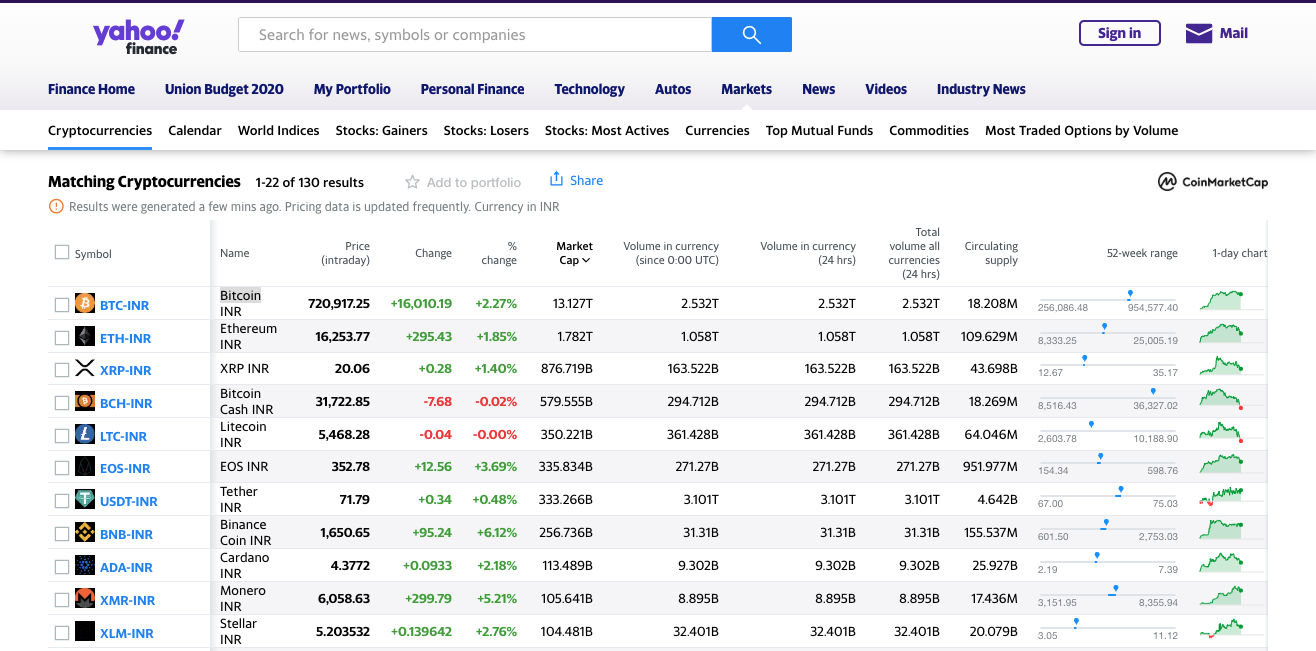

Today, while lots of users of crypto comprehend and appreciate these differences, traders and lay investors might not see the distinction due to the fact that all categories of token tend to trade on crypto exchanges in the same way. 1. Research It Here (ETH) The first Bitcoin alternative on our list, Ethereum (ETH), is a decentralized software platform that enables smart agreements and decentralized applications (d, Apps) to be developed and run without any downtime, fraud, control, or disturbance from a 3rd party.

This aspect makes the implications for those in some countries more compelling due to the fact that those without state infrastructure and state identifications can get access to checking account, loans, insurance, or a range of other monetary items. The applications on Ethereum are worked on ether, its platform-specific cryptographic token. Ether (ETH) resembles a lorry for moving around on the Ethereum platform and is sought primarily by designers wanting to develop and run applications inside Ethereum, or now, by financiers aiming to make purchases of other digital currencies using ether.

Two Worlds Colliding - Mainstream Finance and Cryptocurrency - The FactsTrading at around $2,565 per ETH since March 14, 2022, ether's market cap is less than half of bitcoin's. In 2014, Ethereum released a presale for ether, which got a frustrating response; this helped to usher in the age of the ICO. According to Ethereum, it can be utilized to "codify, decentralize, protect and trade almost anything." Following the attack on the decentralized self-governing company (DAO) in 2016, Ethereum was divided into Ethereum (ETH) and Ethereum Classic (ETC).

Hackers steal $80 million worth of crypto from DeFi platform Qubit Finance - Technology News,The Indian Express

Hackers steal $80 million worth of crypto from DeFi platform Qubit Finance - Technology News,The Indian ExpressThis move is planned to permit Ethereum's network to run itself with far less energy and improved transaction speed, as well as to produce a more deflationary economic environment. Po, S permits network individuals to "stake" their ether to the network. This procedure assists to secure the network and process the transactions that occur.