iShares MSCI Emerging Markets ETF

Blackmoon Team101 Educational Series

Emerging Markets Opportunities

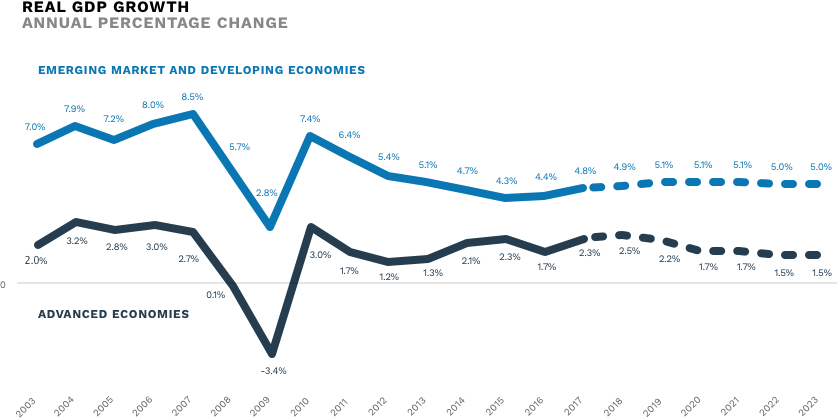

For the past 10 years the emerging markets and developing economies share in the Global GDP achieved the level of 58.69% and will further grow in long-term perspective according to IMF projections. One more interesting fact about the emerging markets and developing economies is that since 2000 year their real GDP growth has outperformed the growth of developed economies, and this tendency is going to be kept. So, what do these statistics mean for potential investors?

First of all, further growth of emerging markets will have more and more impact on global trade and economies. Considering the investment opportunities, emerging markets may look more attractive, especially for the portfolio diversification purposes due to its faster growth compared to its advanced counterparts. Moreover, for the past years the increasing contribution of emerging markets to the world economy has resulted in improved performance in their capital markets.

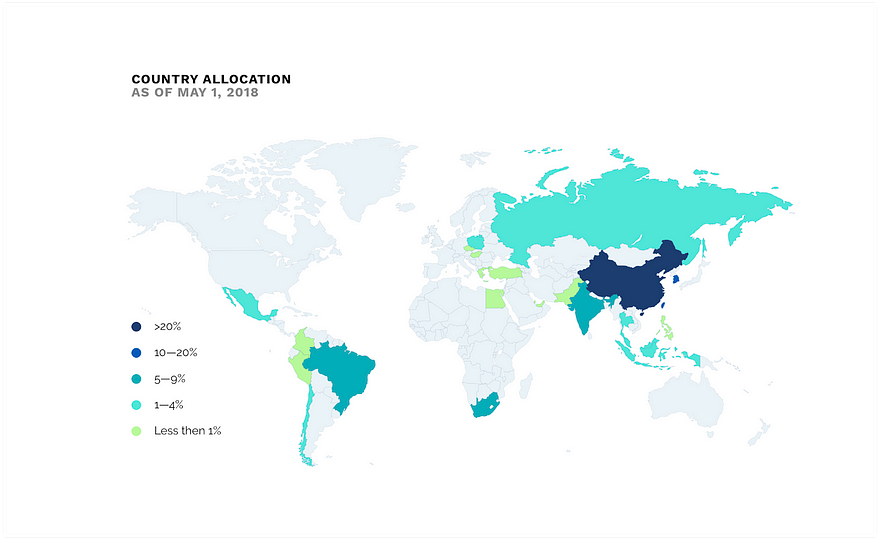

Who are those countries united under the definition “emerging markets”? All of them are well known and are represented by such countries as Brazil, India and one of the world’s largest economies — China. For example, China’s GDP is projected to increase up to 6.6% in 2018 vs 2.9% of the USA.

While the S&P 500 index is considered to be the best representation of the US stock market, the MSCI Emerging Markets index is supposed to be the benchmark for emerging markets. Let’s take a closer look to this index as it will help us to understand the latest tendencies of capital markets of these countries.

MSCI Emerging Markets index

MSCI Emerging Markets index was created by Morgan Stanley Capital International and is designed to measure the equity market performance in the global emerging markets. This index consists of more than 830 mid- and large-capitalization securities from 24 emerging market countries all over the world. The MSCI Emerging Market index is reviewed quarterly and rebalanced twice a year in order to reflect changes in the equity markets.

Today MSCI Emerging Markets index represents more than 10% of the world’s total market capitalization and covers approximately 85% of the free float-adjusted market capitalization in each of the 24 countries. So this index tends to successfully track the emerging markets’ stock performance.

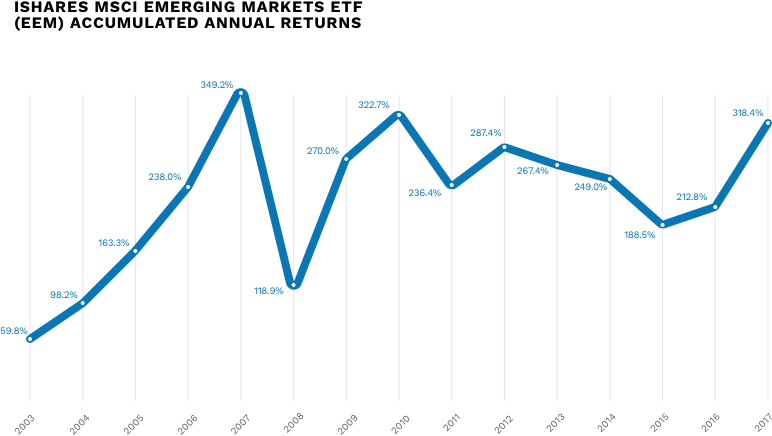

What can this index tell us regarding the latest performance of the emerging markets? The chart below shows that after several tough years emerging markets posted a strong recovery in 2017. Last year MSCI Emerging Markets index advanced by 37.3% while its colleague from the USA provided only 22%.

You may also find out from the chart that emerging markets are exposed to the higher volatility than developed economies. It is expected that emerging markets will outperform the profitability of developed countries in the bull market, but this may be true and in the opposite direction. In addition investors should be prepared for the risks commonly associated with emerging countries: foreign exchange rate, non-normal distribution, poor corporate governance, political risks etc.

Despite several risks the emerging markets are considered to be the attractive opportunity for investors as they have high growth potential and may be used for the portfolio diversification purposes and momentum investing.

So in what ways the investors use to get exposure to the emerging markets?

iShares MSCI Emerging Markets ETF

One of the easiest ways is to invest in the exchange traded fund (ETF) based on the index composed of emerging markets equities. The iShares MSCI Emerging Markets ETF tracks the performance of MSCI Emerging Market index with the aim to provide its investors with the price and yield corresponding to the underlying index.

This iShares Emerging Market ETF was originated in 2003 and is managed by BlackRock Fund Advisors. This ETF invests at least 90% of its assets in the securities included in the underlying index and the rest of assets may be invested in the futures, options and other types of securities, which BlackRock Fund Advisors believes will help to track the performance of MSCI Emerging Markets index.

Key benefits of iShares MSCI Emerging Markets ETF:

- Closely tracks the performance of the MSCI Emerging Markets index.

- Ability to invest in 800+ emerging market large- and mid-cap companies.

- Provides an opportunity to diversify the portfolio of investor.

- Can be used as a hedging instrument.

- Highly liquid.

The iShares MSCI Emerging Markets ETF cumulative return for the 1Q 2018 reached 2.46% while the global benchmark of the US economy, the SPDR S&P 500 ETF, provided its investors with -1.00%.

How do crypto investors get exposure to this ETF? Blackmoon provides a unique opportunity for a blockchain investors to access the performance of a liquid, conventional and diversified instrument such as an ETF, gaining exposure to the 800+ large- and mid-cap companies from the emerging markets without leaving the Blockchain ecosystem.

You may find more information regarding the iShares MSCI Emerging Markets ETF and Blackmoon here.

Prepared by Anastasia Rodina