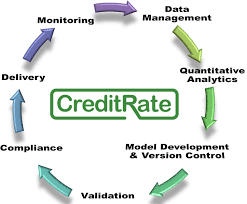

credit management system software

This calculation can likewise be improved by incorporating elective information focuses about borrowers, like representative information (from EPFO), lawful debate information (from courts data sets) and news opinion examination. ML-driven danger scorecards are additionally used to assess gatherings of associated advertisers or chiefs and more extensive industry boundaries like guideline or union. The work processes of credit management system guaranteeing, including the investigation of insurances and resources, can likewise be computerized. Loan specialists can likewise change to income based loaning, in view of ongoing business execution, business standpoint and prescient insight. This has shown to be better for certain moneylenders when diminishing their NPAs and credit defaults.

One of the most ignored parts of the credit the executives lifecycle is checking. With the coming of AI/ML innovation, information social affair and investigation can be performed at a lot more noteworthy speed – here and there in close to ongoing – contrasted with the customary interaction. Artificial intelligence calculations can be designed to screen the monetary and non-monetary boundaries of all borrowers in the portfolio. These frameworks raise early admonitions when the chance of hazard has disturbed because of substantial information sources.accounts receivable automation software

This offers monetary foundations chances to course right. For instance, hazard officials or investigators can trigger a solicitation to their assortments office to determine a hazardous circumstance with a borrower before it's past the point of no return. Likewise, they could proactively draw in with a borrower (to either close an advance or rebuild terms), sell the credits outside their danger hunger, and see how hazard in one business or industry could have bigger ramifications for their portfolios.

The most recent AI/ML instruments additionally enable moneylenders to mechanize different apparatuses in their assortments modules. This saves time, assets and empowers moneylenders to zero in additional on the records that need an accentuation on dispossession, obligation rebuilding, or an early discount whenever required.Robotize the creation and conveyance of solicitations in any possible configuration – electronic or printed – and oversee through one simple to-utilize interface. Corcentric EIPP is conveyed as an oversaw administration presenting to smooth out set-up, onboarding, and the board. Zero in on your business and let EIPP deal with the invoicing.

Computerizing debt claims measures past the record conveyance and installments of treatment of EIPP requires Corcentric ManagedAR. Corcentric ManagedAR joins individuals, interaction, innovation, and inventory network finance across your AR cycles to convey ensured DSO decrease, on-time installments, worked on working capital, and end of terrible obligation.