An Unbiased View of "Planning Your Budget with Precision: How to Use a Novated Lease FBT Calculator Effectively"

Simplify Your FBT Calculation with a Novated Lease: A Step-by-Step Quick guide

Computing the Fringe Benefits Tax (FBT) can easily be a sophisticated and time-consuming activity for organizations. Having said that, with Related Source Here of a novated lease, this procedure may be simplified substantially. In this step-by-step overview, we will clarify how a novated lease works and how it may create FBT computation easier for employers.

Action 1: Understand What a Novated Lease Is

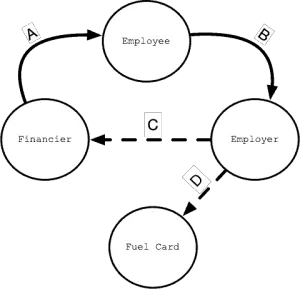

A novated lease is an deal between an employer, employee, and a financial provider. It enables an worker to lease a lorry of their selection while their employer takes on the task of helping make the lease payments on their account. The worker then settles the company with normal earnings deductions.

Measure 2: Determine if Your Service is Qualified for FBT Exceptions

Just before looking at a novated lease as a technique to streamline your FBT estimate, it's significant to figure out if your business qualifies for any sort of exceptions or deals pertaining to FBT. These exceptions might vary relying on variables such as the style of organization you work and the consumption of the car.

Step 3: Decide on the Right Novated Lease Provider

To guarantee that your FBT estimate is simplified along with a novated lease, it is critical to pick the best carrier who recognizes your organization necessities and supplies extensive assistance throughout the method. Look for suppliers that use on the internet calculators and tools to support in approximating FBT liability efficiently.

Action 4: Calculate Your Staff member's Annualised Distance Travelled (ADT)

One crucial variable in finding out FBT responsibility is an employee's annualised span travelled (ADT). This refers to the total number of kilometers steered by an staff member in both work-related and private make use of over an whole year. Correct record-keeping is vital for this step.

Step 5: Identify Business Use Amount

To work out FBT, you require to figure out the business use percent of the car. This entails maintaining monitor of all auto use and classifying it as either business or private use. The much higher the company use percentage, the lesser the FBT obligation.

Action 6: Determine FBT Obligation

With a novated lease, calculating FBT liability comes to be less complex as the majority of providers deliver on the internet personal digital assistants that instantly produce correct amounts based on the details provided. These personal digital assistants consider aspects such as the price of the auto, lease term, passion rates, and other variables.

Step 7: Maintain Accurate Records

To make sure conformity with income tax rules and streamline potential FBT estimates, it is necessary to maintain correct files of all pertinent details. This features files of lease remittances produced through the company, staff member salary reductions, and any improvements in car consumption throughout the year.

Action 8: Look for Qualified Advice

While a novated lease can streamline your FBT estimation substantially, it's regularly a good idea to seek expert recommendations from an financial advisor or income tax expert. They can easily give valuable ideas details to your organization and help guarantee that you are maximizing any type of accessible exemptions or deals.

In verdict, simplifying your FBT calculation with a novated lease may conserve your company opportunity and attempt in taking care of fringe advantages income tax commitments. Through following this step-by-step manual, you can easily improve this procedure while ensuring compliance with income tax requirements. Bear in mind to decide on a credible company who supplies extensive assistance and look for specialist insight when required.