a Twitter thread from @jasonfurman

@TwitterVid_bot1.

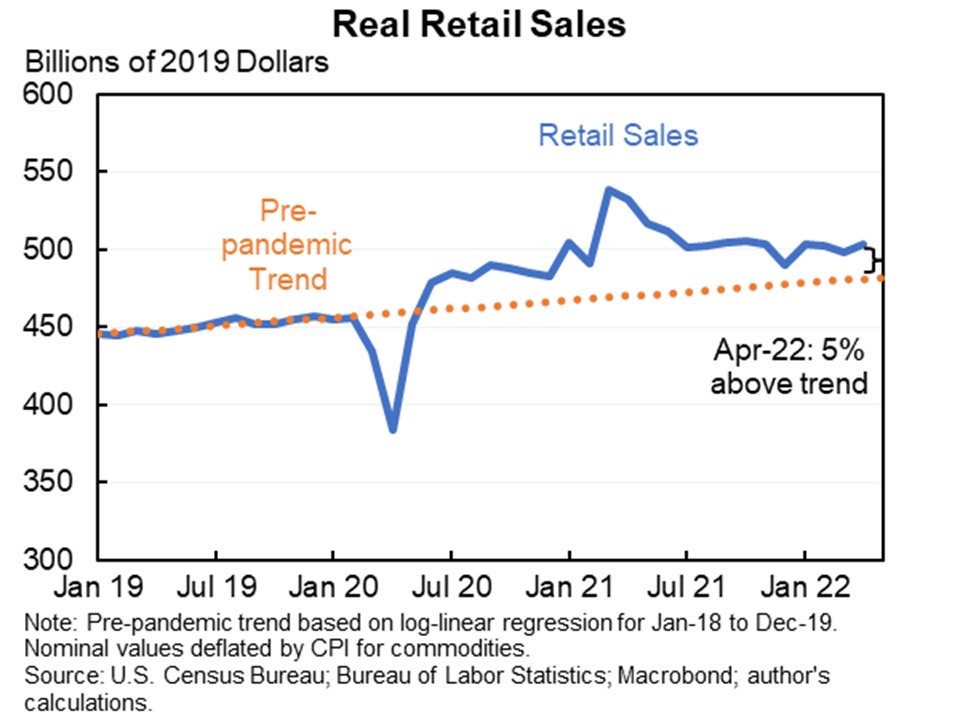

Another very strong retail sales report. Good news for GDP & recession prospects. Bad news for a normalization of the economy w/ slowing inflation.

Nominal sales +0.9% in April after a big revision for March.

A short 🧵

2.

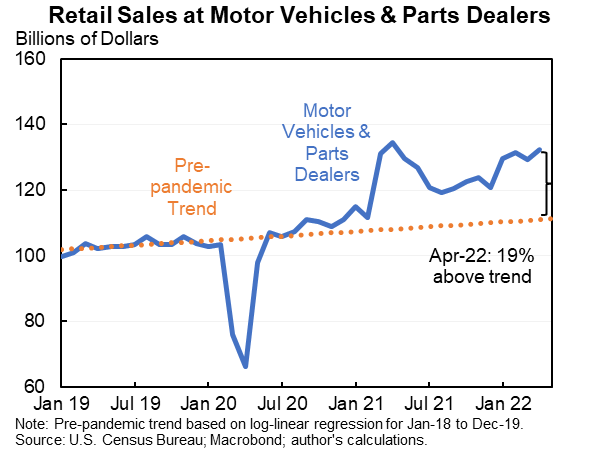

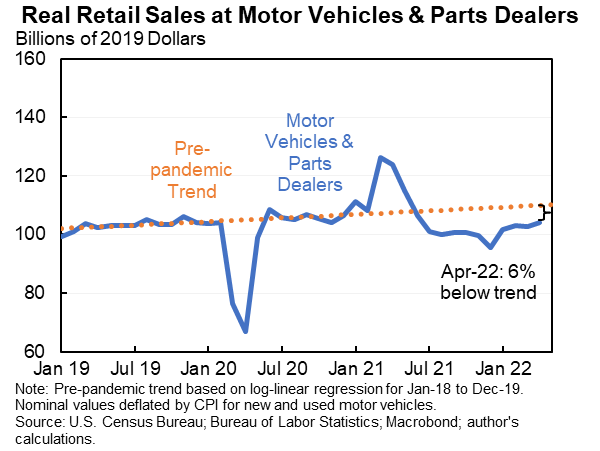

People have been steadily spending more dollars month after month at motor vehicles and parts dealers (+2.2% in April). But with prices up so much the amount of stuff they are buying has been down, although rising every so gently.

3.

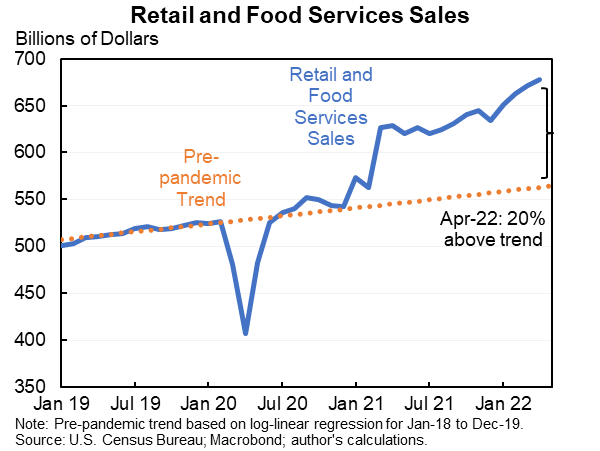

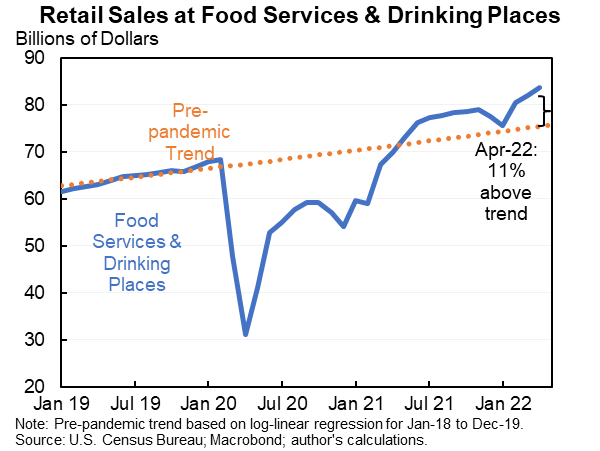

Most of today's release is goods but it also has spending at foods services and drinking places. With the exception of December 2021 these have steadily increased (+2.0% in April), you barely see the COVID waves in these data (some of it is takeout). Now way above trend.

4.

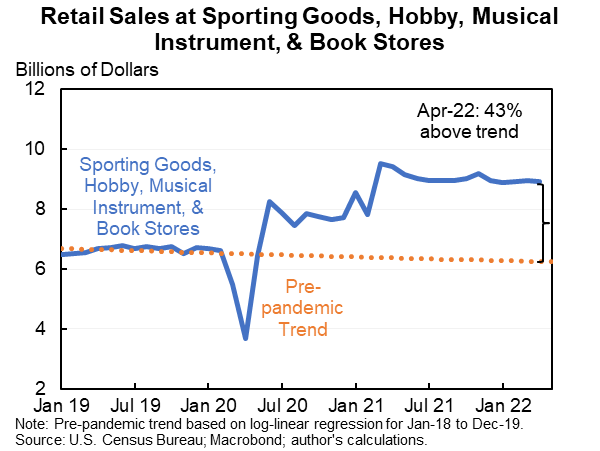

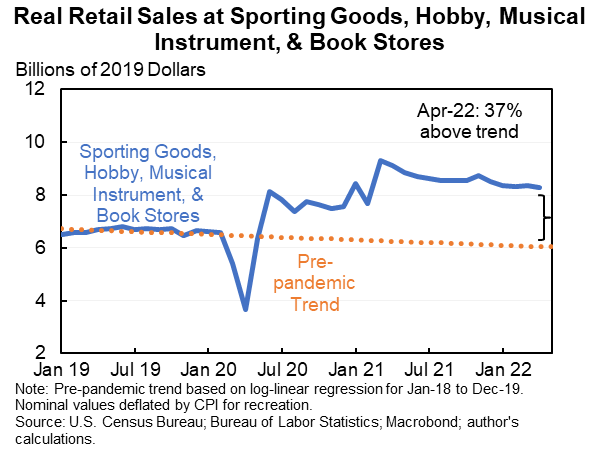

People cut their spending slightly at sporting goods, hobby, musical instrument and book stores (-0.5%) but that spending remains very, very high. (It's ~0.5% of GDP but I still love looking at it every month.)

5.

Will lead to upward revisions of Q1 GDP growth (1st estimate was -1.4% ar) & for Q2 GDP too.

Retail sales are so inertial it is hard for me to see the U.S. slipping into a recession.

But it is also hard for me to see the economy cooling down and inflation moderating either.

Read this thread on Twitter

Made by @TwitterVid_bot