ZBT that didn't turn out is not a good reason to avoid a long trade. Oct 2015 study.

@anonymous · 3h

Private 0

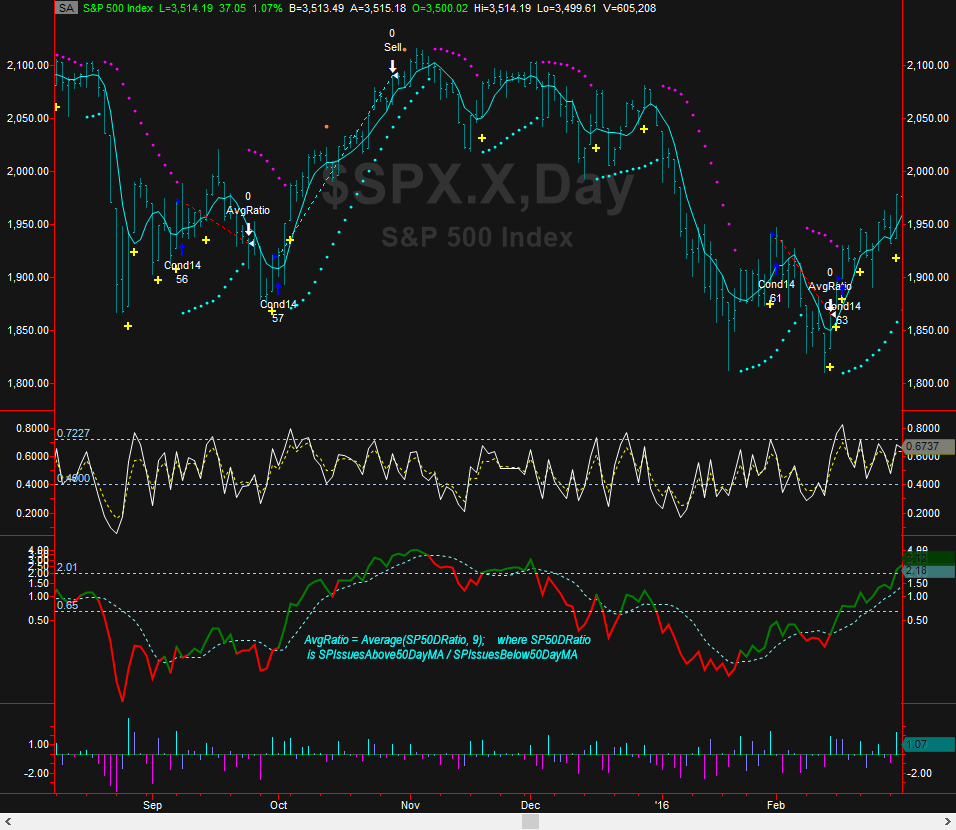

The following chart showed what happened to ZBT after its formation on 10/5/15. As Cam correctly pointed out ZBT failures do occur and from this strategy analysis triggered by 'mini-ZBT' thrusts, about 25% of these early mZBTs turned out not to be profitable swing trades. However, that is not really a good reason for not taking the trades. As the example on 10/5/15 showed, there were many chances to enter and exit the trade before the trend goes south. The ZBT rally for 10/5/15 actually lasted nearly a month, until it topped on 11/4/15. By that time, this strategy had already taken profit at around 8% gain and if a trader would just exit using the daily Parabolic SAR, that would have gained more than 9%. The following strategy is more complicated but it studied over 10 years of data and kept the drawdowns to a minimum by using better entries. The annualized Sharpe ratio is 1.97.