Z Spread

🔞 ALL INFORMATION CLICK HERE 👈🏻👈🏻👈🏻

Z Spread

High Quality tutorials for finance, risk, data science

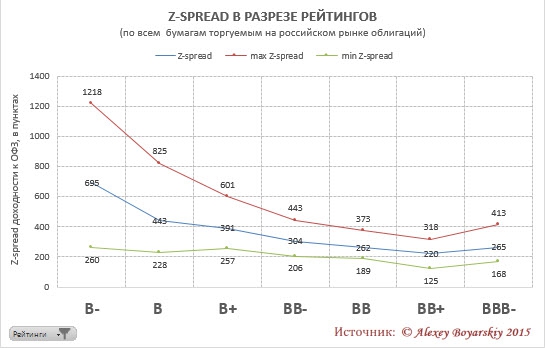

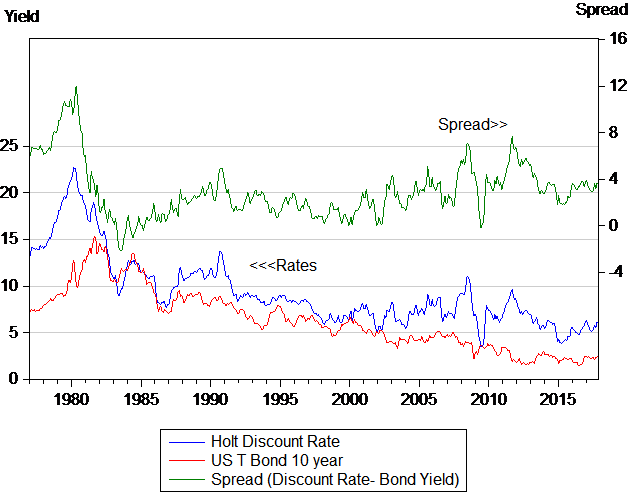

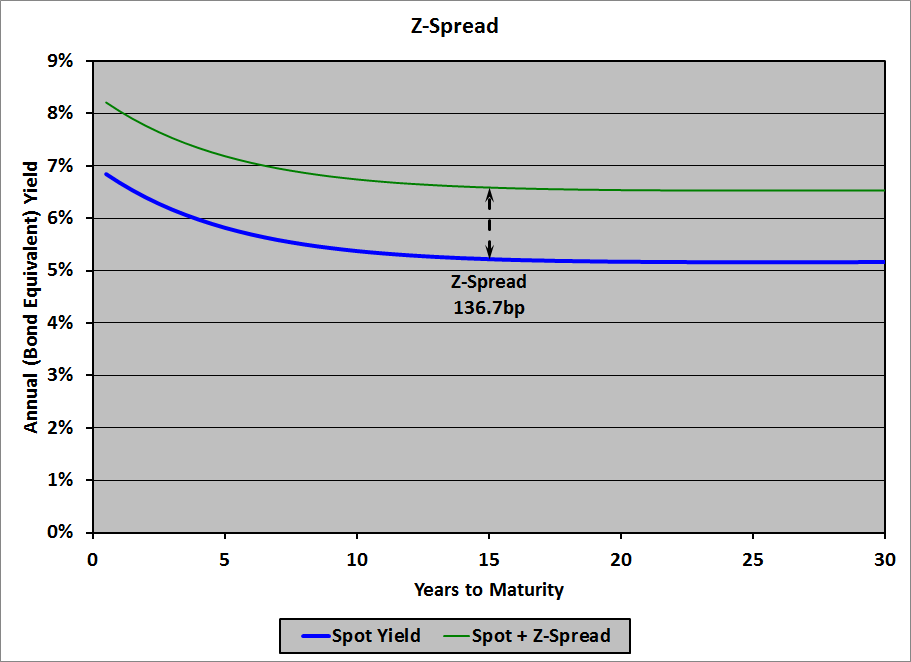

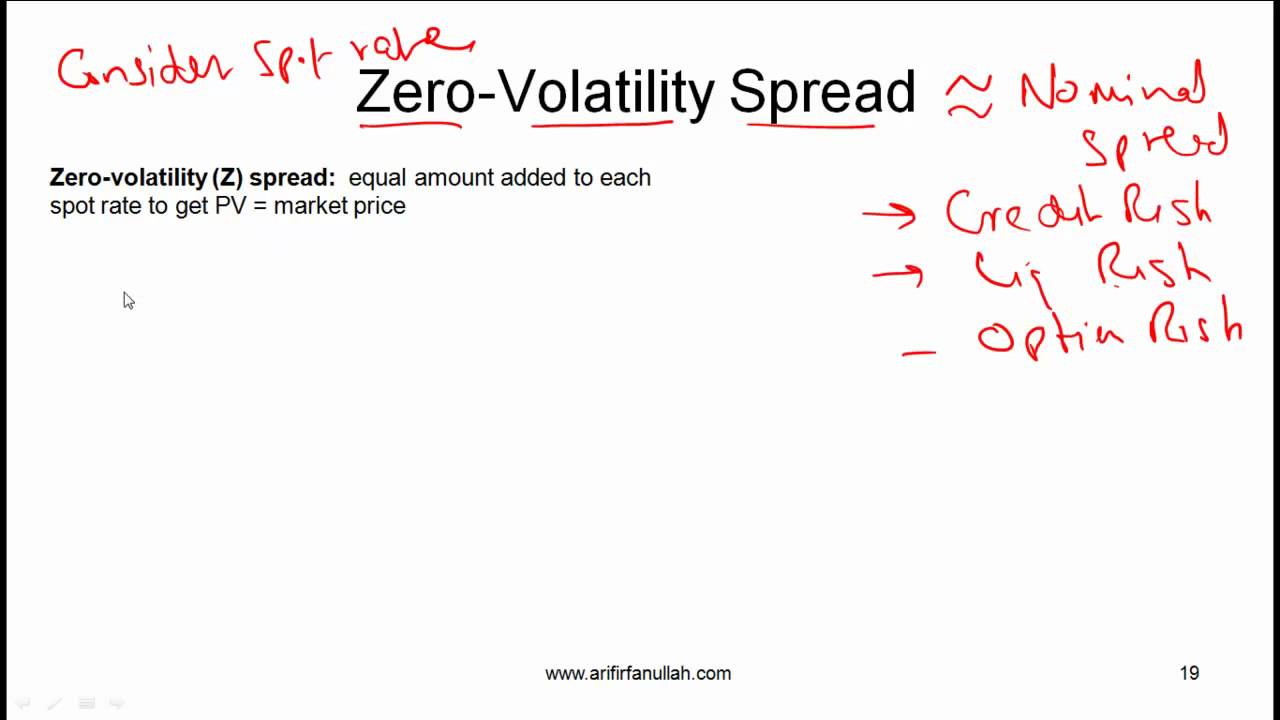

The problem with nominal spread is that it measures the spread at just one point on the yield curve. The z-spread solves this problem by considering the spot yield curve instead of the standard yield curve.

The z-spread, also known as the zero-volatility spread or the static spread, measures the spread that the investor will receive over the entire Treasury spot rate curve .

For the purpose of calculation, we start with an assumption for the z-spread. One takes the Treasury spot rates for each maturity, adds the z-spread to it, and uses this new rate as a discount rate for each maturity to price the bond. The correct z-spread is the one that makes the present value of cash flows equal to the price of the bond.

P = C 1 /(1+r 1 + z) + C 2 /(1+r 2 + z) 2 + C 3 /(1+r 3 + z) 3 … T(1+r n + z) n

Note that the benchmark for calculating z-spread is the spot rate curve. Unlike nominal spread, the z-spread is spread over the entire Treasury spot rate curve.

The z-spread represents the additional risk the investor is taking in the form of credit risk, liquidity risk, and option risk.

In most cases, such as for the vanilla coupon paying bonds, the z-spread will only slightly diverge from the nominal spread. The difference mainly comes from the shape of the term structure and the bond characteristics. For example, the difference will be high for amortizing bonds for which the principal is repaid over time, bonds with high coupon, and when the yield curve is steep.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

This site uses Akismet to reduce spam. Learn how your comment data is processed .

Unlock full access to Finance Train and see the entire library of member-only content and resources.

CFA Institute does not endorse, promote or warrant the accuracy or quality of Finance Train. CFA® and Chartered Financial Analyst® are registered trademarks owned by CFA Institute.

Copyright © 2021 Finance Train. All rights reserved.

Zero-Volatility Spread ( Z - spread )

Z - Spread : Definition and Calculation - Finance Train

Bond Z - Spread for Beginners

Yield Spread : G- Spread , Z - Spread & OAS | Formula & Example

What is the difference between Option Adjusted Spread (OAS) and Z - spread ?

Reviewed by: Ryan Cockerham, CISI Capital Markets and Corporate Finance

Copyright 2021 Leaf Group Ltd. / Leaf Group Media, All Rights Reserved.

While you don’t apply a Z-spread to your morning toast, it is a useful tool for pricing a bond. A bond’s yield is the annual interest it pays divided by its purchase price. When you plot yields against different maturity periods, you get a yield curve. When you compare two yield curves, you get a yield spread.

A zero-volatility spread can be defined as the amount of yield an investor can expect to receive from a non-treasury bond compared to a treasury bond.

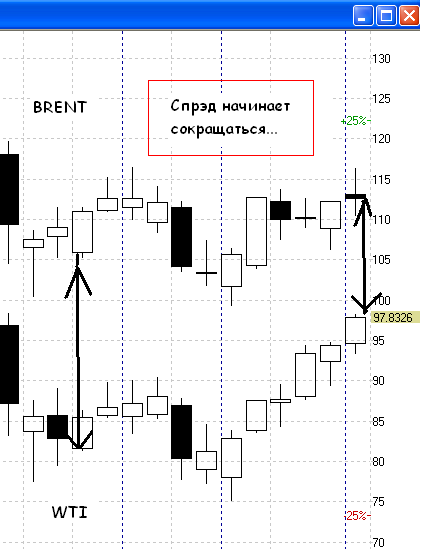

The most basic yield curve plots the yields of Treasury bills, notes and bonds against their times until maturity. These yields are known as the Treasury spot rates. Treasury debt is considered risk-free, so all other bonds of a similar maturity yield more than does Treasury debt. For example, suppose the Treasury yield curve shows that a five-year Treasury note is yielding 4.5 percent if held to maturity. A five-year note from XYZ Corporation that yields 5.5 percent creates a spread of 1 percent, or 100 basis points, above the five-year Treasury spot rate.

The zero-volatility spread, or Z-spread, is the amount of yield you’ll receive from a non-Treasury bond above the yield for the same-maturity Treasury bond. Finding the Z-spread requires computing the present value of the cash flows – interest payments and repayment of principal – from a non-Treasury bond. The discount factor of a present value calculation determines the amount of interest you would earn if you received a future cash flow today, and held it until the actual cash flow date. The price of the bond is equal to the sum of the present values of its cash flows.

The Z-spread for a particular bond is static – the spread above the Treasury yield is the same for any period. For example, a Z-spread of 100 basis points means that each cash flow is discounted at a rate equal to the Treasury spot rate that applies to the cash-flow's period plus 100 basis points. In other words, the present value of the non-Treasury bond uses a different discount factor for each cash flow. The correct solution provides a constant, or static, spread above all the different Treasury yields from today until maturity. In practice, a computer program calculates this quickly.

Finding the correct Z-spread value takes trial and error. You plug in a spread and apply it to each different Treasury spot rate corresponding to each cash flow. For example, the Treasury curve might show the spot rates for one-year, three-year and five-year Treasury debt to be 3.15, 4.25 and 4.50 percent respectively. Adding a 50 basis point spread gives you yields of 3.65, 4.75 and 5.00 percent. You apply the 3.65 percent discount to the XYZ interest payment that is one year out.

Similarly, apply a 4.75 percent discount to the interest payment three years out and a 5.00 percent discount to the cash flows – interest and principal repayment – that will occur at maturity, five years out. In reality, you apply the appropriate discount rate to each semi-annual cash flow, not just to the three in this example. The result is a present value greater than the XYZ note’s current price. Only by repeating the process do you eventually find that a 100 basis point spread gives you the correct present value.

Porno Bbw Secretary Sex

Allison Parker Double Penetration

Panty Pee Thisvid

Elvira Nubiles Soapy Tits

Sperm Facial