XTRD - Unifying Cryptocurrency Exchange

Thejohnmatch

Introduction

As progressive as it sounds, Blockchain really is a system to convey everybody to the most noteworthy level of responsibility. Not any more missed exchanges, human or machine blunders, or even a trade that was not finished with the assent of the gatherings included. Above whatever else, the most basic territory where Blockchain causes is to ensure the legitimacy of an exchange by recording it on a principle enroll as well as an associated dispersed arrangement of registers, which are all associated through a safe approval component.

The blockchain is a morally sound computerized record of monetary exchanges that can be customized to record not simply money related exchanges but rather for all intents and purposes everything of esteem. Blockchain innovation resembles the web in that it has a worked in power. By putting away squares of data that are indistinguishable over its system, the blockchain can't be controlled by any single substance and has no single purpose of disappointment. The web itself has turned out to be tough for just about 30 years. It's a reputation that looks good for blockchain innovation as it keeps on being produced.

OVERVIEW OF XTRD

XTRD is contained a group of veteran Wall Street business pros with a mission to bind together the digital money trades. This mission has showed in four item that ar all interconnected. These item ar a brought together FIX API relatively like ones officially utilized for prime volume trade, one motivation behind Access (SPA) for cryptographic money trades to broaden liquidity, a downloadable business stage to known as XTRD proficient, and a concentrated Dark Pool for transforming crypto into establishment. With a more secure and solid framework, substances identical to banks, flexible investments, and huge institutional dealers will essentially get to cryptographic money markets.

Brief History of XTRD

As of January 2018, there are more than 120 independent cryptographic money trades, encouraging exchanging in excess of 1000 individual markets. Every day exchanging volume for cryptographic forms of money is currently comparable to 20 billion USD, with an aggregate market top of over $700 billion. Most of the exchanging is concentrated among the main 20 trades, named in various monetary forms going from crypto ones including Bitcoin and Ethereum to sovereign ones, for example, USD, GBP, JPY, CNY, and KRW, among others. Expectations point to development toward a $1-2 trillion market capitalization in 2018, and a comparing 3% normal day by day exchanging volume of $50 at least billion. Resource directors are starting to see expanded interest for digital money presentation in their portfolios, more than 500 dynamic assets are being made to enter the market in 2018, and the administrative atmosphere is warming. Nonetheless, the market is early, and extensive spreads are regular between trades on the same crypto sets, taking into consideration abundant arbitrage openings that don't exist in more productive markets. The wastefulness is a result of cryptographic money exchanging markets being profoundly cracked regarding execution, account setup, computerized get to, liquidity, execution speed, valuing, and security. XTRD was made by back and exchanging experts to take care of those issues by both enhancing and uniting current exchanging rehearses.

Aim

XTRD intends to fabricate exchanging framework (Hardware and Software) in the crypto space and end up one of the main full-administrations shop in the digital currency markets for expansive merchants and assets.

Problem

The accompanying issues are related with digital currency exchanging:

An unpredictable web of trades

A mix of contrasting KYC strategies related with APIs, financing, and interfaces will result in a divided interwoven of liquidity for the cryptographic money. Significant worries for customary cryptographic money advertise members run from liquidity and hacking anticipation to unmitigated slippage and counterparty dangers.

High expenses

The trade commissions related with exchanging of cryptographic forms of money commonly are in 0.1%-0.25% territory for each exchange, which are 10 to 25 premise focuses. The powerful expenses of exchanges are substantially higher when taken into spreads and offers kept up by the trades.

There is by and large no focal controller or specialist for looking at inside trade arranges that efficiently isolates client movement from restrictive action, which can guarantee reasonable evaluating.

Abatement in liquidity

If not oversaw accurately and executed just on the trade, a solitary request to buy USD1,000,000 worth of digital currency can cost an extra USD50,000-USD100,000 per exchange to the financial specialists because of the absence of liquidity.

Solutions

Three separate items in consecutive stages will be propelled by XTRADE to take care of the issue of low per advertise liquidity, decentralized execution in digital currency space, and new interfaces.

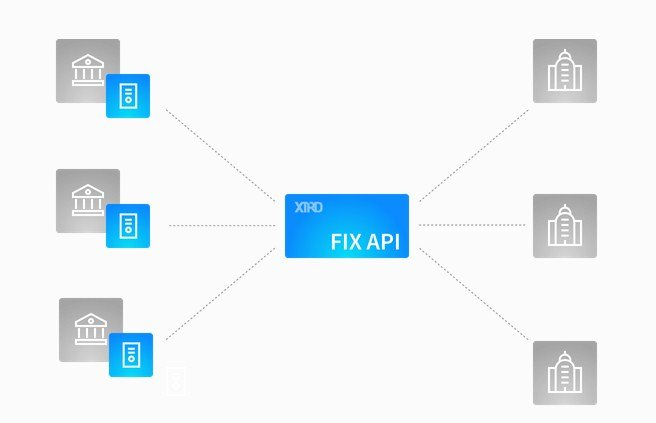

Stage 1. Usage of the Multi Exchange Fix API

Xtrade will dispatch an all inclusive low idleness Financial Information eXchange (FIX) based API that will be associated with all digital currency trades to make it simple for real calculation merchants, real establishments, and flexible investments to get to all cryptographic money advertises by coding to only one FIX application.

Stage 2. Propelling the XTRADE genius exchanging stage

A profoundly powerful, multi-trade remain solitary exchanging stage will be propelled by Xtrade in 2018 for dynamic digital currency dealers around the globe.

Stage 3. SPA (Single Point of Access) cross-trade/liquidity total

This stage will make a solitary brought together purpose of access amid organize 3 of improvement. It will total liquidity crosswise over trades for digital currency dealers. What's more, it will enable merchants to clear at the most ideal cost while methodicallly conveying the least conceivable exchange cost. It will likewise convey nuclear swap ability all inside only one customer side record.

FIX (Financial Information Exchange) Protocol serve as the common language for international financial transactions because all other systems are different, there was a great requirement to communicate all executions between brokers, exchanges, mutual funds , investment banks and direct market access participants using a universal format.

FIX is the standard means of communication for trading in global equity markets, and is also heavily used in currencies, bonds, and derivatives. Every large institutional and professional market participant uses FIX to trade and has been doing so for over 25 years. FIX works by defining preset “tags” as value placeholders

XTRD creates a single unified point of access (SPA) to aggregate liquidity across exchanges for traders. This aggregation allows traders to clear at the best possible prices while delivering the lowest possible transaction costs as well as atomic swap capability for all with just one client-side account.

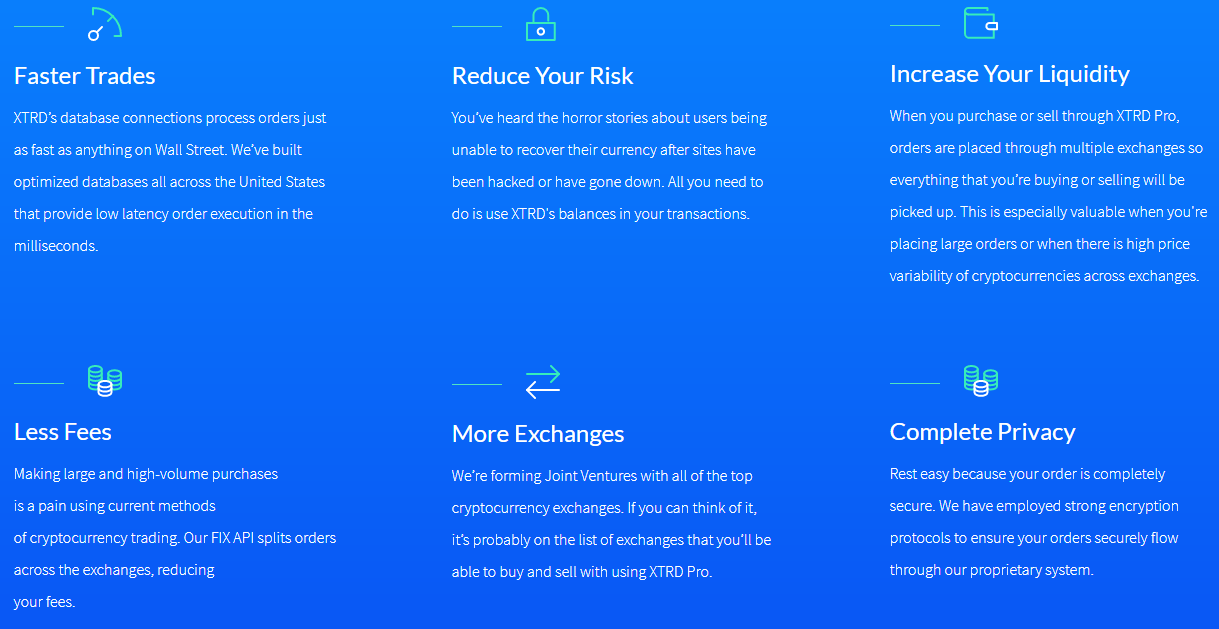

XTRD Pro is a downloadable solution to the fragmented markets. You’ll have access to all cryptocurrency exchanges and all your accounts from one application. XTRD Pro is a standalone trading platform that won’t suffer outages. Make more profitable choices with hotkeys, custom buy orders, and consolidated booking.

Benefits of XTRD

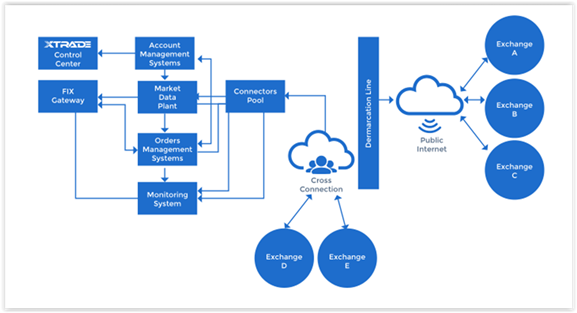

XTRD TOP LEVEL ARCHITECTURES

The XTRD has a structural architecture which displays the pattern on how the platform works. The general representation is shown below.

MARKET DATA PLANT

ORDER MANAGEMENT SYSTEM

ACCOUNTS MANAGEMENT

CONNECTOR POOL

TOKEN SALE AND ICO DETAILS

XTRD token is an ERC20 compliant utility token, which is developed on the Ethereum blockchain just like other popular ICO tokens such as BunnyToken, Cibus, Amon, Aktie Social, Alttex, THEFANDOME.

It will be used as a primary means of payment by users for obtaining services rendered by this platform. XTRD tokens will be sold by this platform to accredited investors through a SAFT (simple agreement for future tokens). The price of one token will be USD 0.10 during the ICO sale.

Token Details

Platform: Ethereum

Accepted: ETH

Start date: Feb 20, 2018

End date: Mar 31, 2018

Soft cap: 0 $

Hard cap: 45 000 000$

Minimal amount: 10 XTRD

Token: XTRD – 0.00814835$

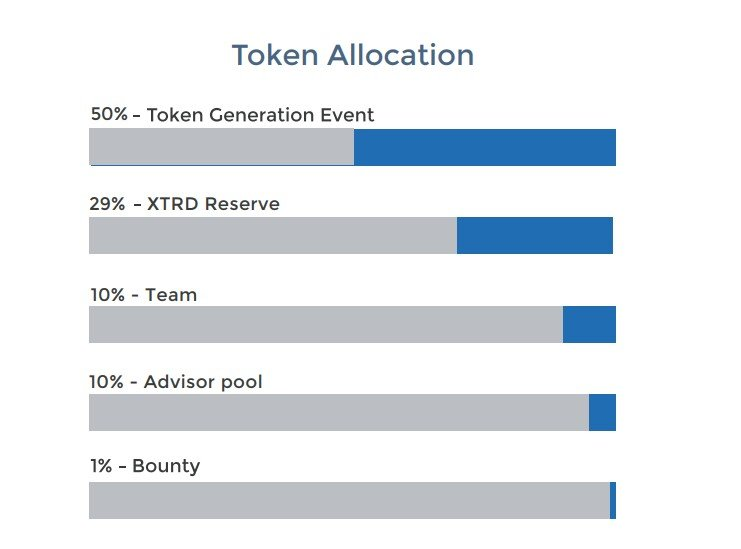

ALLOCATION OF TOKENS

50% of XTRD tokens will be issued for sale during the ICO event.

29% will be held in reserve.

10% XTRD tokens will be allocated as an advisor pool.

10% XTRD tokens will be allocated to a team.

1% tokens will be allocated for bounty rewards.

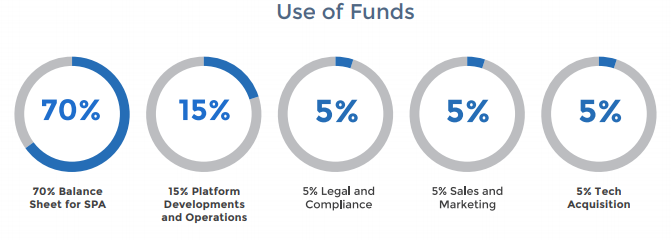

USE OF XTRD FUNDS

70% of the funds will be used for SPA development.

5% will be used for tech acquisition.

5% will be used for sales and marketing.

5% will be used for legal and compliance purposes.

15% of the funds will be used for platform developments and operations.

RoadMap

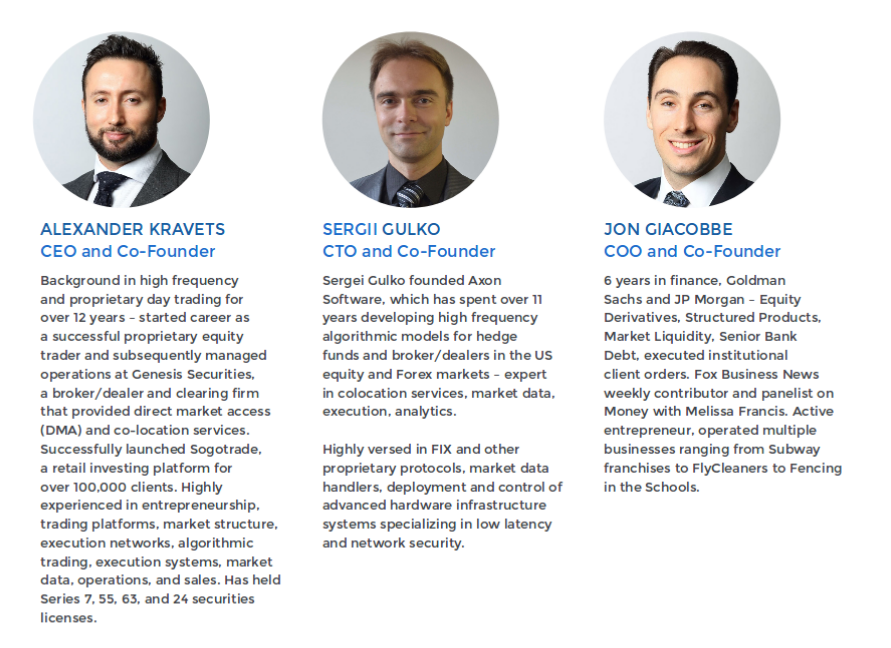

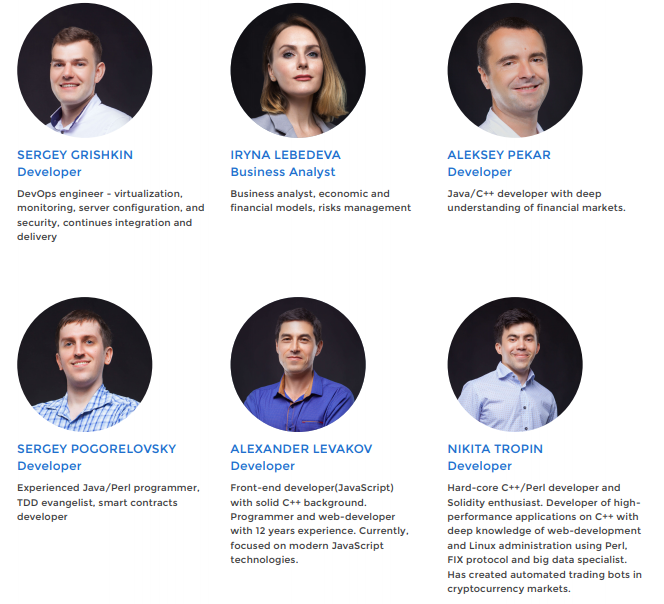

Team

For more information, please visit:

Website : https://xtrd.io/

WhitePaper: https://xtrd.io/xtrd_whitepaper.pdf

Twitter: https://twitter.com/xtradeio

Facebook: https://www.facebook.com/xtradeio/

LinkedIn: https://www.linkedin.com/company/18273025

Telegram Community: https://t.me/xtradecommunity

Telegram Announcements: https://t.me/xtradeannoucements

Bounty chat: https://t.me/Bounty_XTRADEIO

Medium: https://medium.com/@community.xtrd

Reddit: https://www.reddit.com/r/XtradeIO

Author TheJohnMatch

Mybitcointalkprofile:https://bitcointalk.org/index.php?action=profile;u=1673694