Wire Transfers - Dupaco Community Credit Union Can Be Fun For Everyone

Getting The Wire Transfer Scams - Office of the Attorney General To Work

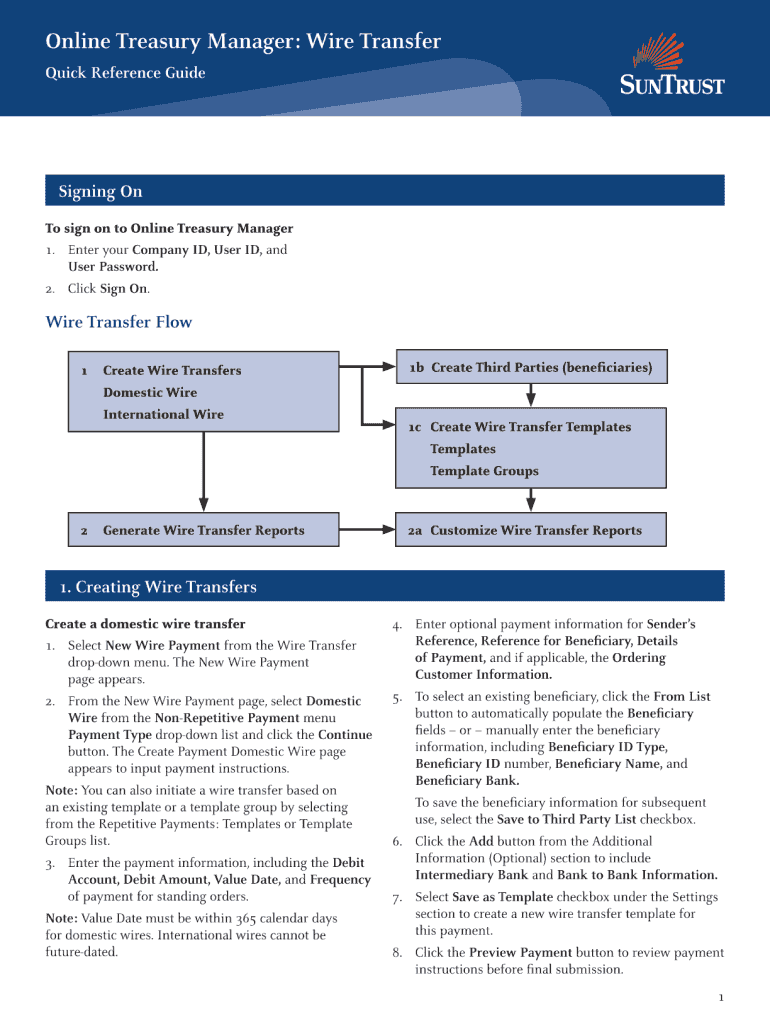

What Is a Wire Transfer? The term wire transfer refers to an electronic transfer of funds by means of a network that is administered by banks and move service companies around the globe. Wire transfers involve a sending and receiving organization and need details from the party initiating the transfer, such as the receiver's name and account number.

Types of wire transfers consist of those facilitated between domestic banks and global ones. Secret Takeaways A wire transfer helps with money transfers digitally throughout a network of banks or transfer companies all over the world. Senders pay for the transaction at the remitting bank and supply the recipient's name, savings account number, and the quantity moved.

International Wire User Guide — Fidelity Bank

International Wire User Guide — Fidelity BankThe Ultimate Guide To Wire Transfers - First Hawaiian Bank

International wire payments are kept an eye on by the Office of Foreign Assets Control to make sure the cash isn't being wired to terrorist groups or for money laundering functions. All transfers go through a domestic automatic cleaning house before they are settled. Understanding Wire Transfers Wire transfers, which are also called wire payments, permit money to be moved rapidly and safely without the requirement to exchange money.

A transfer is usually started from one bank or monetary institution to another. Rather than digital banking , the taking part institutions share information about the recipient, the bank getting account number, and the amount transferred. The sender pays for the deal upfront at their bank. This celebration should offer their bank with the following information: The recipient's name, address, contact number, in addition to any other personal info required to help with the transaction The recipient's banking info, including their account number and branch number The receiving bank's info, that includes the organization's name, address, and bank identifier (routing number or SWIFT code) The factor for the transfer Once the info is documented, the wire transfer can begin.

How International Wire Transfers Work via SWIFT : r/coolguides

How International Wire Transfers Work via SWIFT : r/coolguidesWire Transfers - BECU Fundamentals Explained

The recipient's bank receives the details from the initiating bank and transfers its own reserve funds into the correct account. The two banking organizations then settle the payment on the back end after the money has been deposited. Wire transfers are crucial tools for anyone who needs to send out money rapidly and securelyespecially when they aren't in the same location.