Which altcoins are more profitable to invest in and why?

Are you a hodler who has more varieties of tokens in his portfolio than fish in the Indian Ocean?

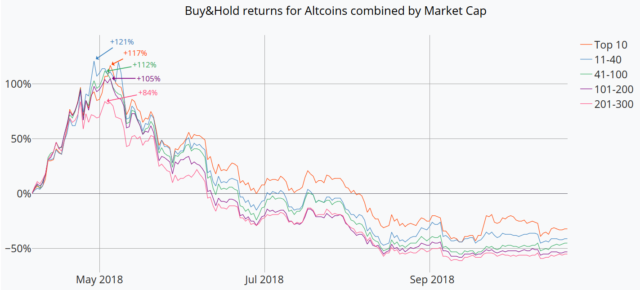

The smaller the capitalization of cryptocurrency, the more volatile its price is. It is logical that during the downtrend observed since the beginning of 2018, low capitalization assets fell in price more than large capitalized assets.

So which altcoins are more profitable to invest in and why?

Let’s group altcoins by capitalization and compare the price change of each group.

Thus, the first group included ETH, XRP, LTC and other cryptocurrencies from the top ten of the CoinMarketCap list (capitalization values as of December 31, 2017 were used). The second group includes 11 to 40 places in the list. In the third group, the remaining cryptocurrencies from the first hundred. Further cryptocurrencies from the 2nd and 3rd hundred list.

The top ten altcoin portfolio fell by 82% from the January maximum, while assets from the third hundred fell by 92%. It means $ 1000 distributed in January 2018 in large cryptocurrencies cost $ 180, while the same $ 1000 in small altcoins costs only $ 80.

Quite an expected result, but here's what to notice.

Many cryptocurrency owners like to buy small altcoins from the second and third hundreds in the hope of greater growth. After all, if they fall harder when the trend is down, then logically they should grow stronger with rising prices.

And this, as it turns out, is not always the case! Let's give an example. The most noticeable increase in prices during 2018 occurred in April. Here is a segment of the same graph from now:

From the graph it is clear that large altcoins not only reduce the risks of a fall, but also turn out to be more profitable than small altcoins with rising prices.

This can be explained. Considering how many new projects appeared due to hype over the past two years, it is clear that many of them received an unreasonably high rating. Now that the market is clearing and getting back to normal, weak projects are under the most pressure.

It is worth noting that this situation does not apply to Bitcoin. It is usually less mobile both during growth and during a fall. So, in April 2018, it showed an increase of only 49%.

Conclusion for holders: you need to be extremely cautious when investing in small altcoins. It should also be remembered that they are more subject to market manipulation. And if you do not have direct contact with the main holders of your chosen asset or any other additional information, keeping small altcoins in the hope of 3 or 5-fold growth in most cases is not profitable. Such portfolios are gradually complemented by new small assets and their result is getting closer to sets 4 and 5 of the graphs presented above.

A useful and advantageous rule for hodler is to keep in the first 50 altcoins.