When Does My Chapter 7 Bankruptcy Case End? - Nolo Things To Know Before You Buy

Bankruptcy student loans undue hardship letter - Detroit Lawyers

Bankruptcy student loans undue hardship letter - Detroit LawyersThe Best Guide To What Is a Bankruptcy Discharge? Things You Should Know

A. If you submit personal bankruptcy, It becomes public record, and will be in the "public record" area of your credit report. A. If you filed personal bankruptcy in 2004 or prior, your records are restricted, and may not be readily available to purchase electronically. Call (800) 988-2448 to examine the accessibility prior to ordering your records, if this applies to you.

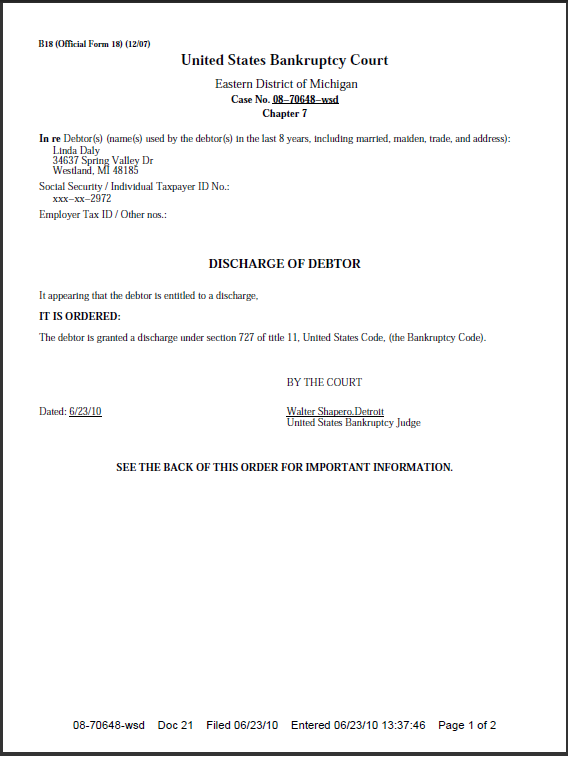

What do my bankruptcy discharge papers look like?

What do my bankruptcy discharge papers look like?However, we can assist you in the purchasing process. U.S. Records cost's to help in the retrieval process of getting insolvency documents from NARA, depends upon the time involved and cost included for U.S. Records, plus NARA's charges.

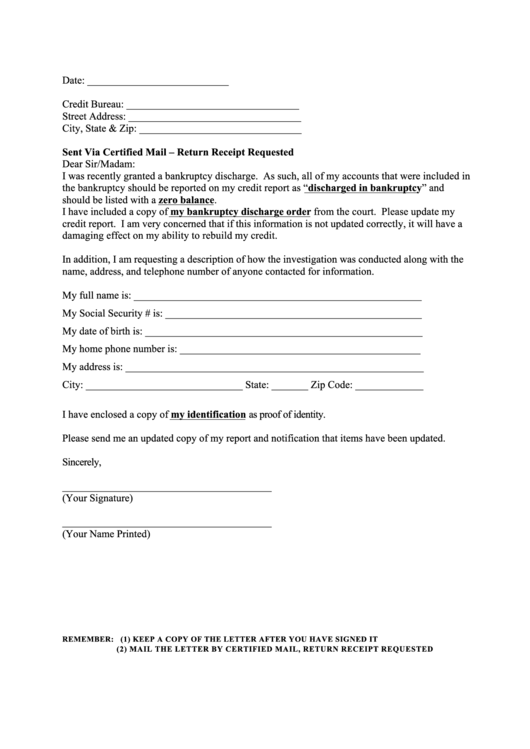

Lots of people want to get a copy of their bankruptcy discharge documents and other bankruptcy documents, and there are lots of reasons. Perhaps you require your complete bankruptcy file for your records, or you're wanting to obtain a brand-new task and need a copy of your discharge papers. Frequently a debtor will require access to their personal bankruptcy records to remedy their credit report after their case is discharged.

Request Copies of Court Records - indy.gov - The FactsIt is necessary to keep a copy of your bankruptcy case. Speak to copyofbankruptcydischargepapers.com for legal suggestions post-discharge. Getting legal guidance from an experienced insolvency lawyer is constantly essential. In addition, they can examine your case file if concerns arise after discharge. A personal bankruptcy legal representative can assist you get personal bankruptcy records for you records and future usage.

Having a copy of your bankruptcy records can be really valuable in case you get sued on a financial obligation that should be discharged or need to challenge a released financial obligation with the credit reporting firms. Table of contents An insolvency discharge order frees the debtor from individual liability for various types of debt.

A financial institution can not collect upon a debt when the insolvency court discharges it in either a chapter 7 personal bankruptcy or a chapter 13 personal bankruptcy. For this reason it is necessary to keep a copy of your insolvency discharge. If you lost or misplaced your copy you should attempt to get a copy of your personal bankruptcy records.