What is bitcoin very popular cryptocurrency - learn here

What is Bitcoin?

Bitcoin is a decentralized digital currency created during the month of January. It is based on ideas laid in a paper by the obscure anonymity of Satoshi Nakamoto.12 The identity of the individual or those who invented the technology remains an unanswered question. Bitcoin provides the promise of lesser transaction fees than traditional payment options on the internet as well as, unlike other currencies issued by governments, Bitcoin is operated through a decentralized authority.

Bitcoin is considered to be a kind of cryptocurrency due to the fact that it relies on cryptography to make it safe. There are no physical bitcoins, just balances held on a publicly accessible ledger with which all users have transparent access to (although each record is encrypted). Every one of Bitcoin transactions are vetted by a large amount computing power, which is known as "mining." Bitcoin is not backed or guaranteed by banks or government as well as does not make an individual bitcoin considered a commodity. Despite not being legal and regulated in the majority that the planet, Bitcoin has become extremely popular and has led to the launch of a variety of other cryptocurrencies, collectively referred to as altcoins. Bitcoin is commonly abbreviated as BTC when trading.

Key TAKEAWAYS

This was the first cryptocurrency to be launched in 2009. make money civ 6 is the world's most valuable cryptocurrency by market capitalization.

The difference between Bitcoin and fiat currency is that Bitcoin is created with the intention of being distributed, traded and stored with the use of a decentralized ledger system, otherwise known as a "blockchain.

The history of Bitcoin as a store of value has been turbulent; it has seen several cycles of boom and bust during its rather short life span.

* As the first virtual currency to be able to attain widespread acceptance and success, Bitcoin has inspired a array of other cryptocurrencies following after it.

What exactly is Bitcoin

Understanding Bitcoin

The Bitcoin system is a group of computers (also known as "nodes" also known as "miners") which all use Bitcoin's code to store its digital currency. A blockchain can be considered to be a collection of blocks. In each block , you will find an assortment of transactions. Since all the computer systems that run the blockchain share the exact same list of blocks along with transactions, and have the ability to view these new blocks in the sense that they are filled with fresh Bitcoin transactions, nobody could ever cheat the system.

Everyone, regardless of whether they are an Bitcoin "node" or not--can see these transactions occurring in real time. To perpetrate a shady act one is required to use 51% of the computing power that makes up Bitcoin. Bitcoin has about 13,768 full nodes up to mid-November 2021 and this number is growing which makes an attack quite unlikely.3

However, if it were to happen, Bitcoin miners--the people who are part of the Bitcoin network with their computers likely break off and join a new blockchain, rendering those efforts that the malicious actor employed to create the attack a waste.

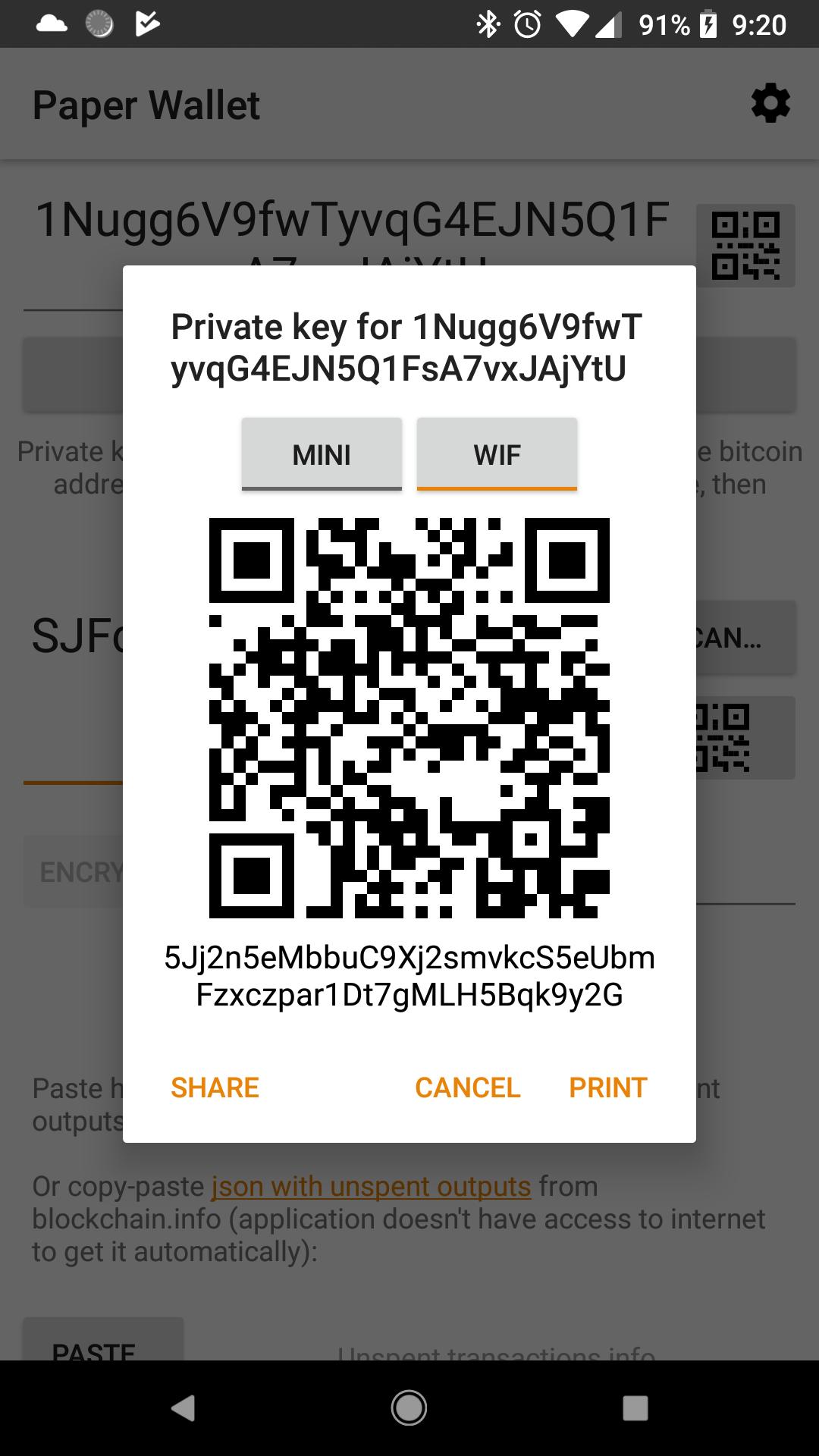

In the case of balances, Bitcoin tokens are stored using public and private "keys," which are long strings of letters and numbers connected by the mathematical encryption algorithm that generates the keys. A public key (comparable to the bank account number) functions as the address that is made available to the world and from which other parties can transfer Bitcoin.

The secret key (comparable for an ATM PIN) is designed to be a guarded secret and only used for authorization of Bitcoin transmissions. Bitcoin keys do not need to be confused the Bitcoin wallet which is a tangible technology that allows bitcoin trading Bitcoin and lets users monitor ownership of their coins. The term "wallet" is somewhat confusing since Bitcoin's nature of being decentralized signifies that it is not stored "in" any wallet, but rather distributed on a blockchain.

Peer-to-Peer Technology

Bitcoin is among the first digital currencies that make use of peer-to_peer (P2P) technology to facilitate rapid payments. The businesses and individuals who hold the governing computing power and who participate in the Bitcoin network--Bitcoin "miners"--are responsible for making transactions available on the blockchain. They are motivated by reward (the release of a new Bitcoin) and charges for transactions made in Bitcoin.

The miners could be seen as the decentralized authority that ensures the credibility for the Bitcoin network. New bitcoins are released to miners on a regular but progressively decreasing rate. There are just 21 million bitcoins which can be mined in total. As of November 2021, there are over 18.875 million Bitcoin still in existence, with under 2.125 millions Bitcoin available to mine.4

In this manner, Bitcoin and other digital currencies operate differently from fiat currencies. in central banking systems, the currency is released at a speed matching the growth of the economy. This is designed to guarantee price stability. A decentralized system, similar to Bitcoin has the ability to determine the rate of release ahead of time and in accordance with an algorithm.

Bitcoin Mining

Bitcoin mining involves the method that determines how Bitcoin circulates. Usually, mining involves solving the most complex and difficult computational puzzles to create an additional block, which is then added to the existing blockchain.

Bitcoin mining adds and verifies record of transactions across the internet. Miners receive Bitcoin which is reduced by a halving every 210,000 blocks. Block rewards were 50 new bitcoins during 2009. On May 11 on the 11th of May, 2020, the three rounding occurred, bringing payout for each discovery of a block reduced to 6.25 bitcoins.5

An array of hardware may be utilized to create Bitcoin. However, some offer higher returns than other types of hardware. Certain computer chips called Application-specific integrated circuits (ASICs) and more advanced processing units, such as Graphic Processing Units (GPUs) may earn higher benefits. These powerful mining processors can be classified as "mining mining rigs."

One bitcoin is divisible up to eight decimal decimal points (100 millionths of a bitcoin) The the smallest unit is often referred to as Satoshi. Satoshi.6 If it is necessary, and if the participating miners accept the change, Bitcoin may be eventually divisible to more decimal places.

An Early Timeline for Bitcoin

Aug. 18, 2008

The Domain Name Bitcoin.org is registered.7 In the present, at a minimum the site is WhoisGuard Protected, meaning the identity of the person who registered the domain is not public information.

Oct. 31, 2008

A person or group with the name Satoshi Nakamoto makes an announcement for the Cryptography Mailing List at metzdowd.com: "I've been working on an innovative electronic cash system which is 100% peer-to -peer, with no third-party trusted." The now-famous whitepaper published on Bitcoin.org, entitled "Bitcoin: A Peer To Peer Electronic Cash System," could become the Magna Carta for how Bitcoin operates today.1

Jan. 3, 2009

First Bitcoin block has been mined: Block 0. It's also known as"the "genesis block" and has the following text: "The Times 03/Jan/2009 Chancellor at the brink of another bailout for banks," possibly to prove that blocks were mined on or in the following year, and could also serve as an important political commentary.8

Jan. 8, 2009

The initial Version of the Bitcoin software is released through users of Cryptography Mailing List.

Jan. 9, 2009

Block 1 is produced, and Bitcoin mining begins.

Who is Satoshi Nakamoto?

The mystery of who developed Bitcoin, or at least not in a definitive way. Satoshi Nakamoto is the name associated with the name of the person or group of people who first released the Bitcoin white paper in 2008 and created the first version of the Bitcoin software that was released in 2009.1 In the time since it was released, many people have either claimed to be or have been reported to be authentically the people behind this pseudonym. However, at the time of writing, November 20, 2021, the the identity (or identity) for Satoshi Nakamoto remains obscured.

While it's tempting to believe the media's assertion that Satoshi Nakamoto's is a sole, quixotic genius who created Bitcoin out of thin air. But such innovations aren't typically created in a vacuum. All major scientific discoveries, regardless of the degree of originality they are, were based upon conducted research.

There are a few precursors to Bitcoin: Adam Back's Hashcash developed at the time of 1997, then Wei Dai's B-money, Nick Szabo's bitgold, as well as Hal Finney's Reusable Proof of Works. In the Bitcoin white paper in itself references Hashcash and b-money as well with other papers that span many research areas. Not surprisingly, a lot of those responsible for the other projects have been suspected of having had a hand in creating Bitcoin.

There are a few possible reasons why Bitcoin's founder would want to hide their identity. One reason is privacy: Since Bitcoin continues to gain popularity and becoming an international phenomenon, the creator, Satoshi Nakamoto will likely attract a lot of publicity from the media and from government officials. Another reason could be the potential for Bitcoin be able to cause an enormous disruption to the current money and banking systems. If Bitcoin was to gain widespread acceptance, it would surpass the nation's sovereign fiat currencies. This threat to existing currency might prompt governments to take legal measures against Bitcoin's founder.

Another reason is that it is safe. The year 2009 was the most active. 32,490 bitcoins were mined. at a rate for each block of fifty Bitcoin per block. That means the payout for 2009 was 1,624,500 Bitcoin.9 It could be concluded that it was only Satoshi and possibly a few other people were mining in 2009 . They also have a majority of that stash of Bitcoin.

Someone who owns that much Bitcoin could end up being a crime target, especially because Bitcoin isn't as popular as stocks and more like cash with the private keys needed to sign off on spending could be printed out and literally kept under a mattress.

Although it's possible that the creator of Bitcoin would have taken steps so that any extortion-related transfers are identifiable, keeping your identity private is a good strategy for Satoshi Nakamoto to limit exposure.

Special Concerns

Bitcoin as a way of payment

Bitcoin is accepted as a means of payment for services or products that are provided. Brick-and mortar stores are able to display a sign saying "Bitcoin Can Be Accepted here" Transactions can be handled with the requisite hardware terminal , or wallet addresses via QR codes or touchscreen applications. A business online can easily accept Bitcoin by including this payment option in its other online payment options like credit cards, PayPal or other similar payment methods.

El Salvador became the first country to officially recognize Bitcoin as a legal currency in June 2021.10

Chances to work in Bitcoin

The self-employed can earn money for jobs that is related to Bitcoin. There are a variety of ways to accomplish this including creating an internet-based platform and adding you Bitcoin bitcoin wallet to their website in order to make it a way to pay. There are numerous sites and job boards dedicated to digital currencies.

* Jobs4Bitcoins are part of Reddit.com.

* BitGigs claims to be "a Bitcoin job board."

* Bitwage allows you to select a percentage of the salary you earn at work to be converted to Bitcoin and sent through the Bitcoin address.

You can invest in Bitcoin

Zero seconds in 4 minutes, 24 secondsVolume 75%

4:24

How to Buy Bitcoin

Many Bitcoin users believe that digital currency is the future. Many individuals who endorse Bitcoin believe it will provide the fastest, most cost-effective payment system for transactions across the globe. Although it's not owned by any government or central bank, Bitcoin can be exchanged to traditional currencies. In fact, its exchange rate against the dollar attracts prospective investors and traders who are interested in trading in currencies. One key factor behind the rapid growth of digital currencies like Bitcoin is that they can serve as an alternative to government-issued fiat currency and conventional items like gold.

In March 2014 in the month of March, the IRS declared that all virtual currencies which includes Bitcoin are treated as property and not currency. Gains or losses from Bitcoin kept as capital would be taxed as capital gains or losses. Bitcoin stored as inventory will be subject to ordinary gains or losses. The sale of Bitcoin you mined or purchased from an outside source, or any use you make of Bitcoin to pay for either goods or services, are instances of transactions that are taxed.11

Like all other assets, the concept of buying low and selling for high applies to Bitcoin. Most popular means of collecting the currency is purchasing through a Bitcoin exchange, but there are many other ways to earn money and own Bitcoin.

The risks associated with Bitcoin Investing

It is believed that investors from the speculative market have been attracted to Bitcoin because of its dramatic price rise over the last few years. Bitcoin was priced at $7,167.52 at the time of December. 31, 2019, and a year later, had appreciated more than 300% to $28,984.98. The value continued to increase during the first half of 2021and reached the record-breaking high of 68,000 dollars in 2021.12

Thus, many people purchase Bitcoin for its potential investment value as opposed to its capability to serve as a medium of exchange. The lack of certain value and its virtual nature implies that its purchase and usage are subject to a number risks. Numerous investor alerts are published by Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA) as well as the Consumer Financial Protection Bureau (CFPB) and other authorities.

The concept of a virtual currency is still relatively new when compared with traditional investments, Bitcoin doesn't have much of a history or any evidence of credibility to back it. With its rise in popularity Bitcoin will become more experimental each day. However, even after just a decade all digital currencies are under development. "It is basically the most risky and highest-return investment possible," says Barry Silbert as CEO of Digital Currency Group, which constructs and invests into Bitcoin as well as blockchain companies.13

Risks from regulation

Investments in money under any of the various forms of Bitcoin does not suit those who are wary of risk. Bitcoin is a competition to government currency and may use it for illegal market transactions as well as money laundering, illicit acts, or tax fraud. In the end, governments might try to restrict, regulate, or even ban the use and distribution of Bitcoin (and some have already done this). Others are coming up with diverse rules.

In 2015, for instance this year, New York State Department of Financial Services finalized regulations that required companies that handle the sale, buy, transfer, or storage of Bitcoin to maintain the identity of their customers, hire the services of a compliance manager, and keep reserves of capital. Transactions worth $10,000 or at least $10,000 must be registered and reported.14

The lack of uniformity in regulations concerning Bitcoin (and others virtual currency) can raise questions about their reliability, longevity, and universality.

Security Risk

Most individuals who own and use Bitcoin do not obtain their cryptocurrency through mining operations. Instead, they buy and sell Bitcoin as well as other digital currencies through any or the numerous online markets which are referred to as Bitcoin exchanging or cryptocurrency exchanges.

Bitcoin exchanges are entirely digital . And, as with any other technology--are at risk from hackers or malware as well as operational issues. When a criminal gets access to a Bitcoin owner's hard drive in their computer and steals their private encryption key it is possible to transfer the stolen Bitcoin to a different account. (Users have the option of preventing this in the event that their Bitcoin is stored in a personal computer that's remote from internet connections, and else by opting for paper wallets and printing the Bitcoin private numbers and addresses, but not storing their Bitcoins on a laptop computer at all.)

Hackers could also attack Bitcoin exchanges, and gain access to thousands of accounts as well as digital wallets in which Bitcoin will be kept. The most well-known hacking incident was reported in 2014 in which Mt. Gox was a Bitcoin exchange in Japan, was forced to close down after millions of dollars of Bitcoin was stolen.

This is a particular issue given that the majority of Bitcoin transactions are irrevocable and irreversible. Like cash The transaction made using Bitcoin can only be reversed when the person who been the recipient of them repays the money. There is no third party or payment processor as when using credit or debit cards. Thus, no source of protection or recourse if there's any issue.

Risk of insurance

Certain types of investments are covered through an organization called the Securities Investor Protection Corporation (SIPC). Regular bank accounts are insured through the Federal Deposit Insurance Corporation (FDIC) to a specified amount , subject to the jurisdiction.

Most of the time, Bitcoin Exchanges as well as Bitcoin accounts aren't covered under any federal or state-sponsored program. In the year 2019, prime marketer and trading platform SFOX announced that they would be able to provide Bitcoin customers with FDIC insurance, but only for transactions that involve cash.15

Fraud risk

Although Bitcoin employs encryption using private keys in order to verify the identity of its owners and also to register transactions, fraudsters and scammers may attempt to sell false Bitcoin. For instance, in the month of July, the SEC has taken legal action against an owner of the Bitcoin-related Ponzi scheme.16 There have also been instances of Bitcoin price manipulation, a different typical type of fraud.

Markets

Just like any investment, Bitcoin values can fluctuate. In actuality, the currency has experienced wildly changes in value during its relatively short time. With a high volume of buying of and selling in exchanges it has a high sensitivity to newsworthy events. As per the CFPB it was reported that the price of Bitcoin dropped by 61% in just one day during 2013 as well as the one-day record-breaking price drop recorded in 2014 was as much as 80%.17

If fewer people begin to begin to accept Bitcoin as a currency, these digital currencies could go out of value and worthless. Indeed, there was speculation about the possibility that there was a "Bitcoin bubble" began to pop when the price declined from its all-time maximum during the cryptocurrency boom in the latter half of 2017 and into early 2018.

There's already plenty of competition, and even though Bitcoin has a significant advantage over other digital coins that have popped up due to its popularity and venture capital an innovation in the form of a better virtual currency will always pose in danger.

$68,990

Bitcoin's all time high price attained on Nov. 10, 2021.12

Discords in the Cryptocurrency Community

Since Bitcoin became popular, there's been numerous instances where conflicts between groups of developers and miners triggered massive disagreements within the cryptocurrency market. In some instances, groups of Bitcoin users and miners have altered how Bitcoin operates. Bitcoin network.

This is commonly referred to for its slang term "forking," and it typically leads to the creation the new type of Bitcoin with a name change. It could be an "hard fork," where the new Bitcoin shares the history of transactions of Bitcoin up until a decisive split period, at which time there is a new cryptocurrency created. The most prominent cryptocurrencies that have been developed as a result hard forks include Bitcoin Cash (created on August 17, 2017), Bitcoin Gold (created in October 2017) as well as Bitcoin SV (created at the end of November of 2018).

"Soft fork "soft fork" is a change to the protocol , but it is compatible with previous system rules. For instance, Bitcoin soft forks have enhanced features, for instance Segregated Witness (SegWit).

Why is Bitcoin Invaluable?

The price of Bitcoin has increased exponentially within just a 10 years, from less that $1 in 2011 and now more than $6,000 as of November 2021. Its worth is determined by various factors, including its relative quantity, market demand and the marginal expense of producing. Therefore, even though it is intangible, Bitcoin commands a high valuation. It had a total market capitalization of $1.11 trillion at the time in November 2021.12

Are Bitcoin actually a Scam?

Although Bitcoin is virtual and can't be altered, it's certainly real. Bitcoin has been in existence for more than a decade and the system has proven to be durable. The code running the system, in addition, is open source and is able to be downloaded and examined at any time for flaws or evidence that suggests a criminal motive. Of course, fraudsters could try to con people out the money they have in Bitcoin or hack sites like cryptocurrency exchanges however, these are flaws in the human behavior, or third-party software and not Bitcoin itself.

The number Bitcoins How Many Bitcoins Are Available?

The maximum amount of bitcoins that can be developed is 21million, and the last bitcoin will be mined between 2140 and 2140. As of November 2021, greater than 18.85 million (almost 90%) of the bitcoins have been mined.18 Further, scientists estimate that as high as 20% of these bitcoins were "lost" because of users forgetting their secure keys or passing away without leaving access instructions, and sending bitcoins through unusable addresses.19

Should I Capitalize the B on Bitcoin?

The standard is to use a capital B when discussing the Bitcoin network (or protocol) or system. Use a small B when discussing Bitcoins as a single unit of value (for example, I've sent 2 bitcoin).

Where can I buy Bitcoin?

There are a variety of online exchanges that permit you to purchase Bitcoin. Furthermore Bitcoin ATMs --internet-connected machines that let you purchase bitcoins using cash or credit card--have been in the news all over the world. If you've got someone with bitcoins, they may be willing to offer them to you in person, with no exchange required or exchange.