What about Bitcoin? Sell Everything or 'HODL'?

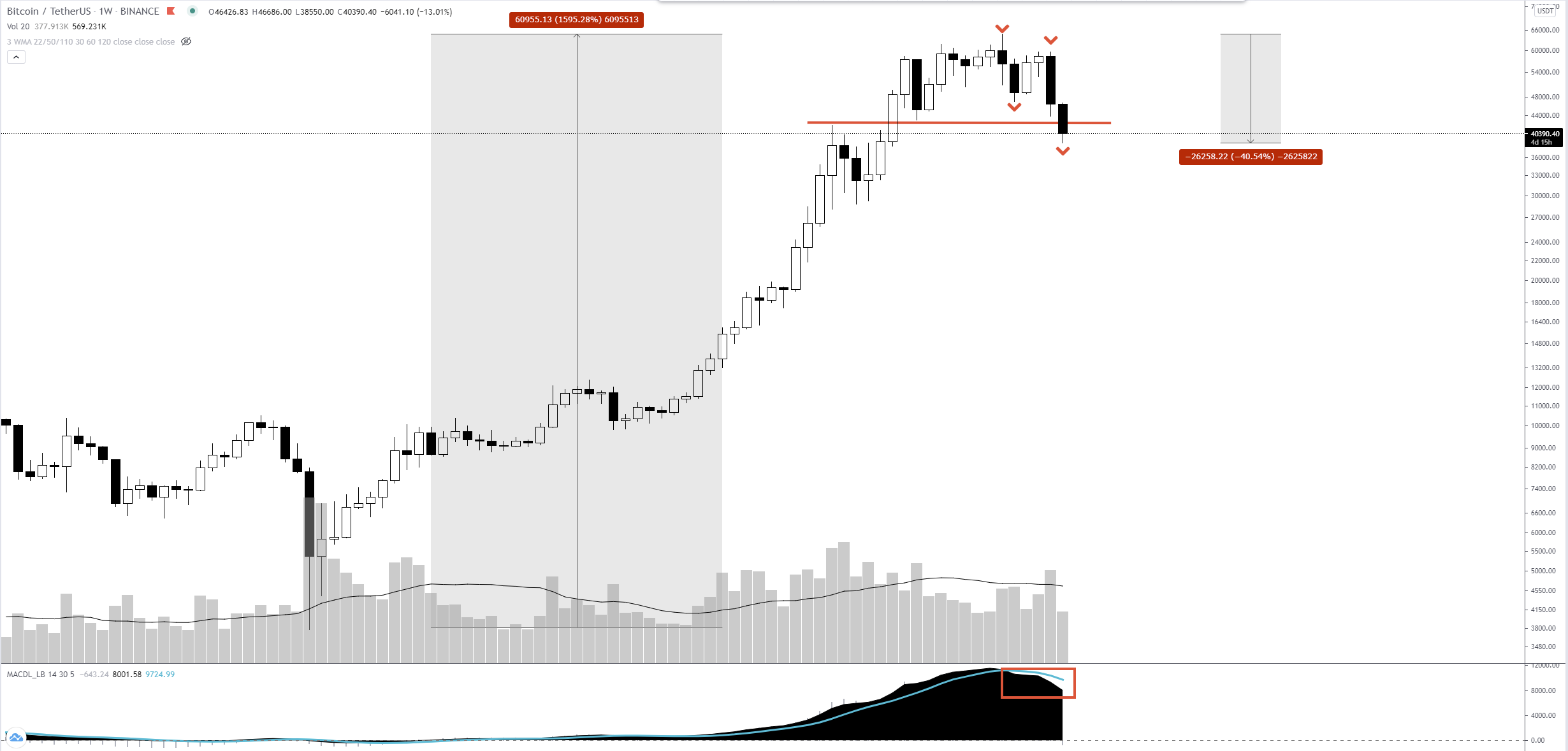

CcThis is a weekly timeframe chart of Bitcoin

As you can see after the growth of 1600% this drop seems quite ridiculous and insignificant, but when you look at the balance of the deposit it does not seem so, right?

Let's see what we can note for ourselves on the chart by week.

- We have formed descending lows and highs (marked with red ticks) - this is not very good as such a trend could easily turn into a full bearish cycle.

- We can see a tear in the signal line on the MACD indicator (the tear is marked with a red square) - this is also not good as it is a negative signal for those who expect further growth.

- You can also pay attention to last week's candlestick, which closed on higher volumes almost "to the very floor" - and as it is easy to guess - this is also not the best thing that could happen to Bitcoin.

To sum up, the weekly picture, if this week will not close above the 43K-45K level (marked with a red line on the chart), there is no desire to hold BTC.

Let's go below Bitcoin on the daily timeframe.

- We have a moving-plate cross or "death cross", which is a very strong signal that the market can change its direction.

- We have already made two fundamental lows on the chart (marked with red ticks), which already tells us that bears prevail on the daily timeframe and their next target is the area of 30k, where we have a third fundamental low, which the bulls should try to protect.

- The fall is going on higher volumes, where each market participant will interpret this differently, but if in fact, we are updating the lows and highs and the market has enough supply to do it - mark that as not the most positive signal for further growth.

The last picture we will analyze is the four-hour timeframe.

After the "rising wedge" pattern, which is considered bearish, we do see a significant drop.

Of course, we have here also updated lows and highs, which is a downtrend.

But there are small clues that can be seen as positive, which means we can predict some growth from this area.

- The first is the movement structure, which has evolved from our all-time high into a three-wave structure, which tells us that this is more likely to be a corrective cycle than the beginning of a bear market globally.

- The second is that we are already quite close to our third milestone, which we noted earlier, which is low around 30k. That means that there will be both historical demand and short trades fixing, which could also positively impact the market as a whole in favor of a counter uptrend.

- Bitcoin is already heavy enough to afford a free fall, which means that the so-called "market inefficiency" in simple words, the market cannot endlessly fly down without pullbacks, and the more aggressive the fall, the more likely we will get a quick "rebound".

One of these scenarios is shown on the chart. It is a positive scenario, where we can still count on further growth.

But if Bitcoin is not released above 48k. This is the red level on the chart. We will have to recognize the strength of the supply and we are more likely to get an even deeper correction.

Now a bit of just thinking about it...

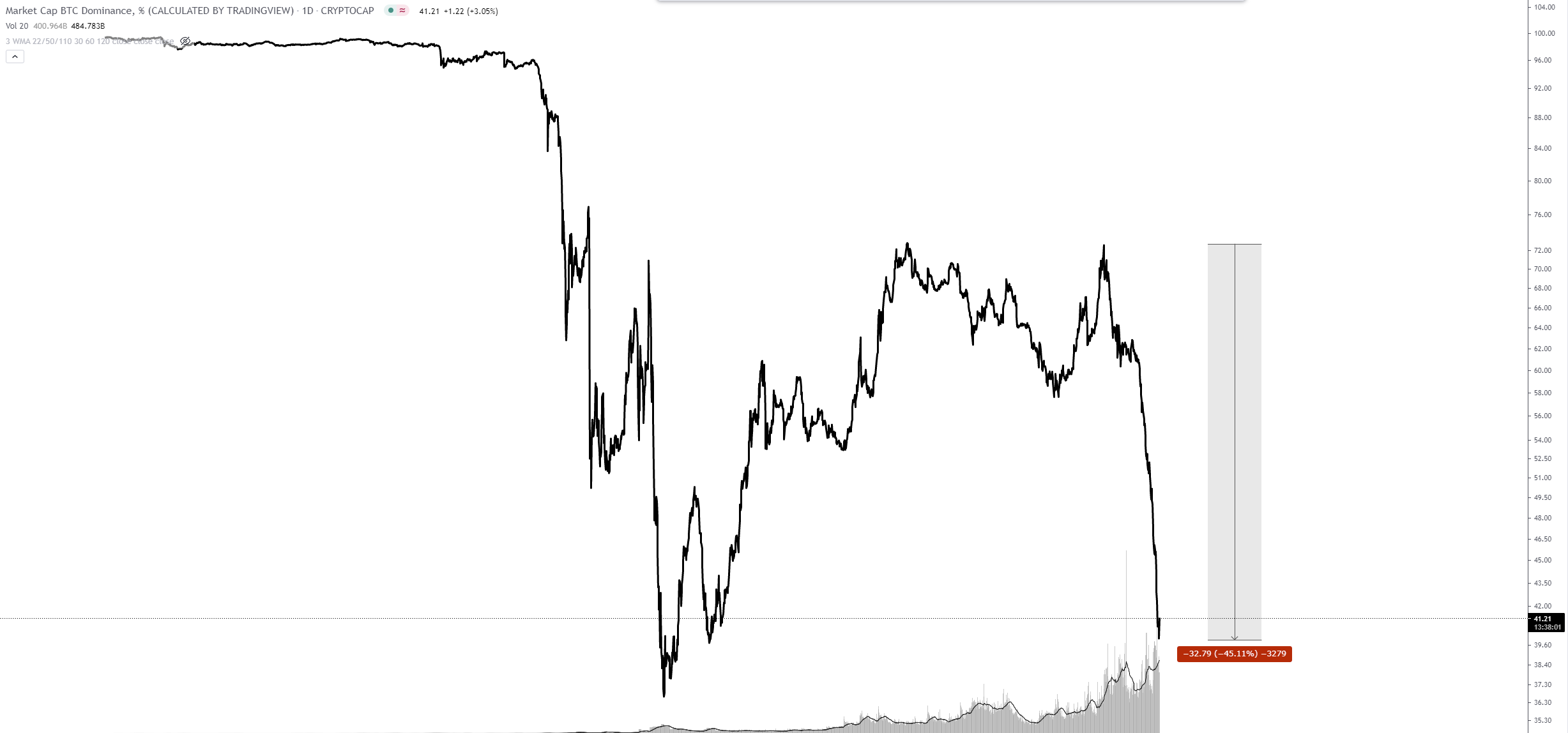

This is what bitcoin dominance looks like right now

This picture tells us that it's time for Altcoin to spill over into Bitcoin, which in turn should have a positive effect on its value.

But many Altcoins look good relative to Bitcoin and still remain in an uptrend, unlike Bitcoin.

This is probably the reason for the current volatility, it is extremely ineffective to tie it to something on the chart now, coins can just "randomly" shoot up by tens of percent in few hours and instantly level out the whole growth. And that's us omitting the panic sell-offs as well...

Going short when Bitcoin is flying 40% without a pullback is also a bad idea (think of market inefficiencies)

Again, once Bitcoin starts a small upward movement, altcoins that look better can immediately recover quickly.

Conclusions:

- If you believe in further market growth, there are not many reasons to buy "on sale. But if you do buy, strong projects where your notional stop loss is the value of the project is zero.

- If you think this is a global reversal, opening short positions now is not the best place, nor is it a good place to fix positions. This can be done at the nearest recovery.

- So this is the best time to just watch what development the market will get and when it is determined - to join the majority.

And we remind you that you get recommendations in the usual format, but keep in mind our advice for the time of current volatility (risk management and position calculation, where your stop-loss is the value of the project zero)