What Is a W-2 Form and How to Fill Out It?

Alice Zdraj

Formal employment comes with a lot of bureaucracy, which is as perplexing as it needs to be. The employer and employee must process multiple tax forms for each annual tax return to reflect their income. Let's take a closer look at Form W-2 and what to do with it to file your tax return correctly.

What Is IRS W-2 Form?

Form W-2, also called Wage and Tax Statement, issues a payroll and tax return to track and collect data about your income and taxes. Each year, the employer must send a document to each staff member to match their income information with their records. In addition, it shows the amount of taxes deducted from the previous year's income to submit this information to the Social Security Administration.

While the purpose and procedures of the W-2 are clear, the entire process of sending and receiving is complex. The document is received by the employer for sending to the employee. After that, the employee sends it to the employer, who submits it to the SSA. Finally, the form is returned to the IRS.

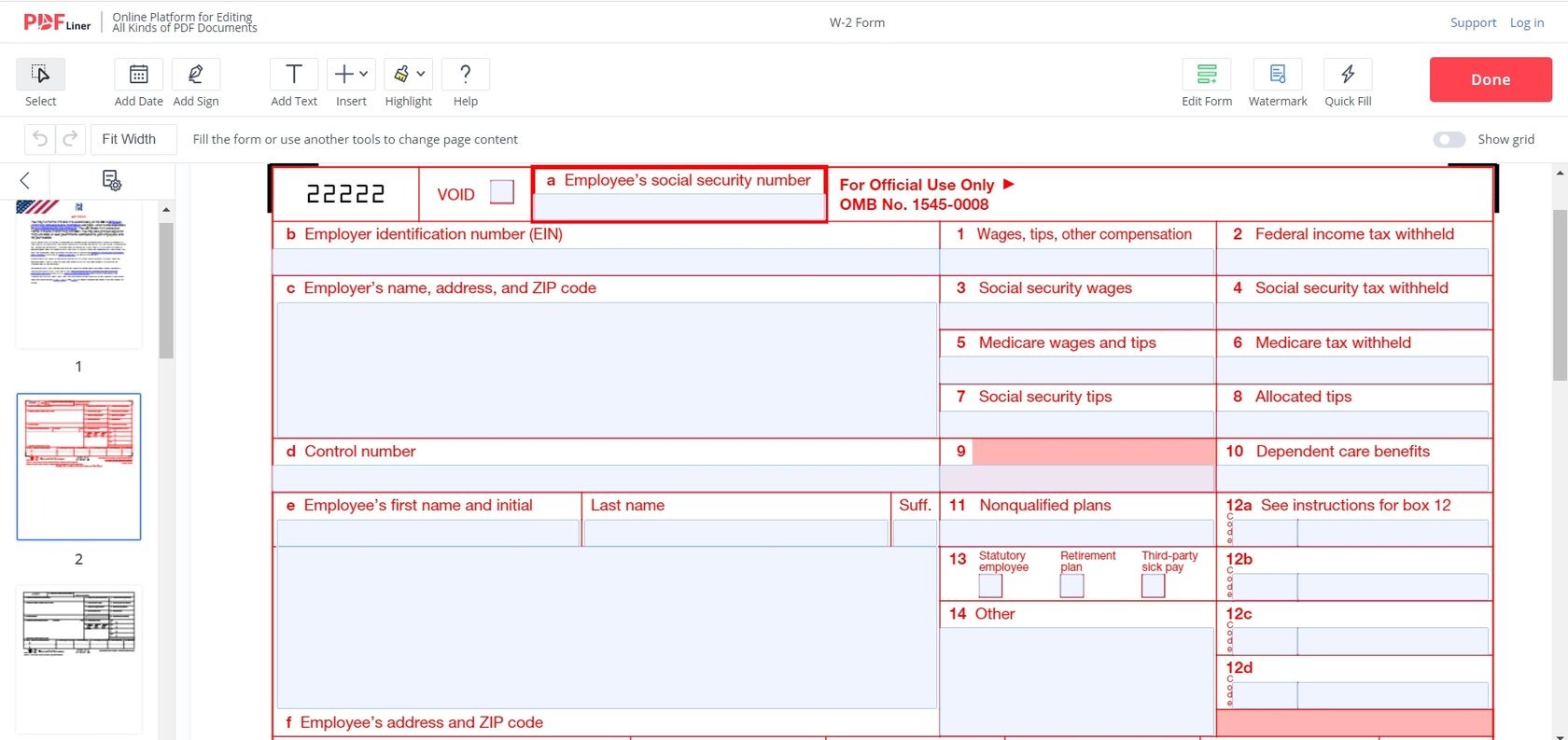

How to Fill Out Form W-2

Besides wondering how to get w2 online, it's also a question about how to file W-2, so let's dive into this process.

1. Fill in fields a-f with information about the employer's company. Enter SSN, EIN, name, and address. Also, add the company control number, the item where this Form W-2 is recorded in the employer's books.

2. Fields 1,3,5,7 require information about your income (wages, salaries, tips, etc.), and opposite fields 2,4,6,8 contain your tax information about income.

3. In boxes 9-14, list your health care, benefits, and reimbursements.

4. In boxes 15-20, you must enter income tax for your state and local income. It is important to file both documents accordingly, as your tax return depends on them.

Nothing complicated if you know how to do it right. I hope this article will help you complete the tax form correctly.

Based on article by pdfliner.com