What Is The Meaning Of Spread Betting

⚡ 👉🏻👉🏻👉🏻 INFORMATION AVAILABLE CLICK HERE 👈🏻👈🏻👈🏻

Spread betting refers to speculating on the direction of a financial market without actually owning the underlying security. It involves placing a bet on the price movement of a security. A spread betting company quotes two prices, the bid and ask price (also called the spread), and investors bet whether the price of the underlying security will be lower than the bid or higher than the ask.

The spread bettor does not actually own the underlying security in spread betting, they simply speculate on its price movement.

Spread betting should not be confused with spread trading, which involves taking offsetting positions in two (or more) different securities and profiting if the difference in price between the securities widens or narrows over time.

Spread betting refers to speculating on the direction of a financial market without actually taking a position in the underlying security.

The investor does not own the underlying security in spread betting, they simply speculate on its price movement using leverage.

It is promoted as a cost-effective method to speculate in both bull and bear markets.

Spread betting allows investors to speculate on the price movement of a wide variety of financial instruments, such as stocks, forex, commodities, and fixed-income securities. In other words, an investor makes a bet based on whether they think the market will rise or fall from the time their bet is accepted. They also get to choose how much they want to risk on their bet. It is promoted as a tax-free, commission-free activity that allows investors to profit from either bull and bear markets.

Spread betting is a leveraged product which means investors only need to deposit a small percentage of the position's value. For example, if the value of a position is $50,000 and the margin requirement is 10%, a deposit of just $5,000 is required. This magnifies both gains and losses which means investors can lose more than their initial investment.

Spread betting may not be available to residents of the United States due to regulatory and legal limitations.

Despite the risk that comes with the use of high leverage, spread betting offers effective tools to limit losses.

Risk can also be mitigated by the use of arbitrage, betting two ways simultaneously.

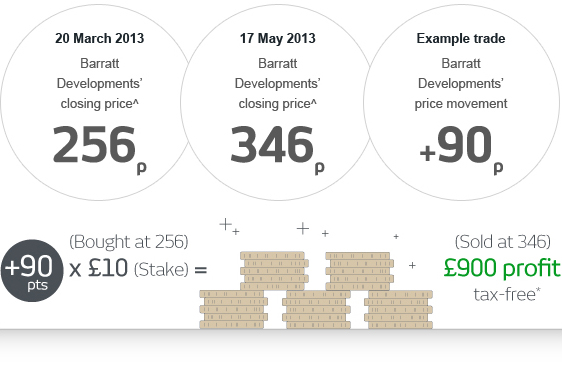

Let’s assume that the price of ABC stock is $201.50 and a spread-betting company, with a fixed spread, is quoting the bid/ask at $200 / $203 for investors to transact on it. The investor is bearish and believes that ABC is going to fall below $200 so they hit the bid to sell at $200. They decide to bet $20 for every point the stock falls below their transacted price of $200. If ABC falls to where the bid/ask is $185/$188, the investor can close their trade with a profit of {($200 - $188) * $20 = $240}. If the price rises to $212/$215, and they choose to close their trade, then they will lose {($200 - $215) * $20 = -$300}.

The spread betting firm requires a 20% margin, which means the investor needs to deposit 20% of the value of the position at its inception, {($200 * $20) * 20% = $800, into their account to cover the bet. The position value is derived by multiplying the bet size by the stock’s bid price ($20 x $200 = $4,000).

Investors have the ability to bet on both rising and falling prices. If an investor is trading physical shares, they have to borrow the stock they intend to short sell which can be time-consuming and costly. Spread betting makes short selling as easy as buying.

Spread betting companies make money through the spread they offer. There is no separate commission charge which makes it easier for investors to monitor trading costs and work out their position size.

Spread betting is considered gambling in some tax jurisdictions, and subsequently, any realized gains may be taxable as winnings and not capital gains or income. Investors who exercise spread betting should keep records and seek the advice of an accountant before completing their taxes.

Because taxation on winnings in some countries is far less than that on capital gains or trading income, spread betting can be quite tax-efficient, depending on one's location.

Investors who don’t understand leverage can take positions that are too large for their account, which can result in margin calls. Investors should risk no more than 2% of their investment capital (deposit) on any one trade and always be aware of the position value of the bet they intend to open.

During periods of volatility, spread betting firms may widen their spreads. This can trigger stop-loss orders and increase trading costs. Investors should be wary about placing orders immediately before company earnings announcements and economic reports.

Many spread betting platforms will also offer trading in contracts for difference (CFDs), which are a similar type of contract. CFDs are derivative contracts where traders can bet on short-term price moves. There is no delivery of physical goods or securities with CFDs, but the contract itself has transferrable value while it is in force. The CFD is thus a tradable security established between a client and the broker, who are exchanging the difference in the initial price of the trade and its value when the trade is unwound or reversed.

Although CFDs allow investors to trade the price movements of futures, they are not futures contracts by themselves. CFDs do not have expiration dates containing preset prices but trade like other securities with buy and sell prices.

Spread bets, on the other hand, do have fixed expiration dates when the bet is first placed. CFD trading also requires that commissions and transaction fees be paid up-front to the provider; in contrast, spread betting companies do not take fees or commissions. When the contract is closed and profits or losses are realized, the investor is either owed money or owes money to the trading company. If profits are realized, the CFD trader will net the profit of the closing position, minus the opening position and fees. Profits for spread bets will be the change in basis points multiplied by the dollar amount negotiated in the initial bet.

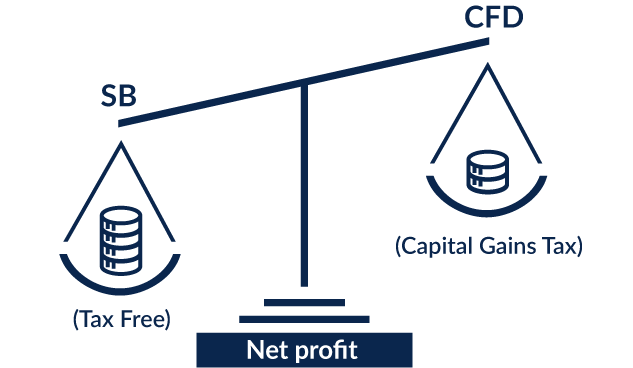

Both CFDs and spread bets are subject to dividend payouts assuming a long position contract. While there is no direct ownership of the asset, a provider and spread betting company will pay dividends if the underlying asset does as well. When profits are realized for CFD trades, the investor is subject to capital gains tax while spread betting profits are usually tax-free.

Spread betting is a way to bet on the change in the price of some security, index, or asset without actually owning the underlying instrument.

While spread betting can be used to speculate with leverage, it can also be used to hedge existing positions or make informed directional trades. As a result, many who participate prefer the term spread trading. From a regulatory and tax standpoint it may be considered a form of gambling in certain jurisdictions, since no actual position is taken in the underlying instrument.

The majority of U.S.-based brokers do not offer spread betting, as it may be illegal or subject to overt regulatory scrutiny in many U.S. states. As a result, spread betting is largely a non-U.S. activity.

The offers that appear in this table are from partnerships from which Investopedia receives compensation. This compensation may impact how and where listings appear. Investopedia does not include all offers available in the marketplace.

A seller is any individual or entity, who exchanges a good or service in return for payment. In the options market, a seller is also called a writer.

A leg is one component of a derivatives trading strategy in which a trader combines multiple options contracts or multiple futures contracts.

A position is the amount of a security, commodity, or currency that is owned, or sold short, by an individual, dealer, institution, or other entity.

A contract for differences (CFD) is a marginable financial derivative that can be used to speculate on very short-term price movements for a variety of underlying instruments.

A futures contract is a standardized agreement to buy or sell the underlying commodity or other asset at a specific price at a future date.

Futures are financial contracts obligating the buyer to purchase an asset or the seller to sell an asset at a predetermined future date and price.

Options Trading Strategy & Education

Advanced Trading Strategies & Instruments

Investopedia is part of the Dotdash publishing family.

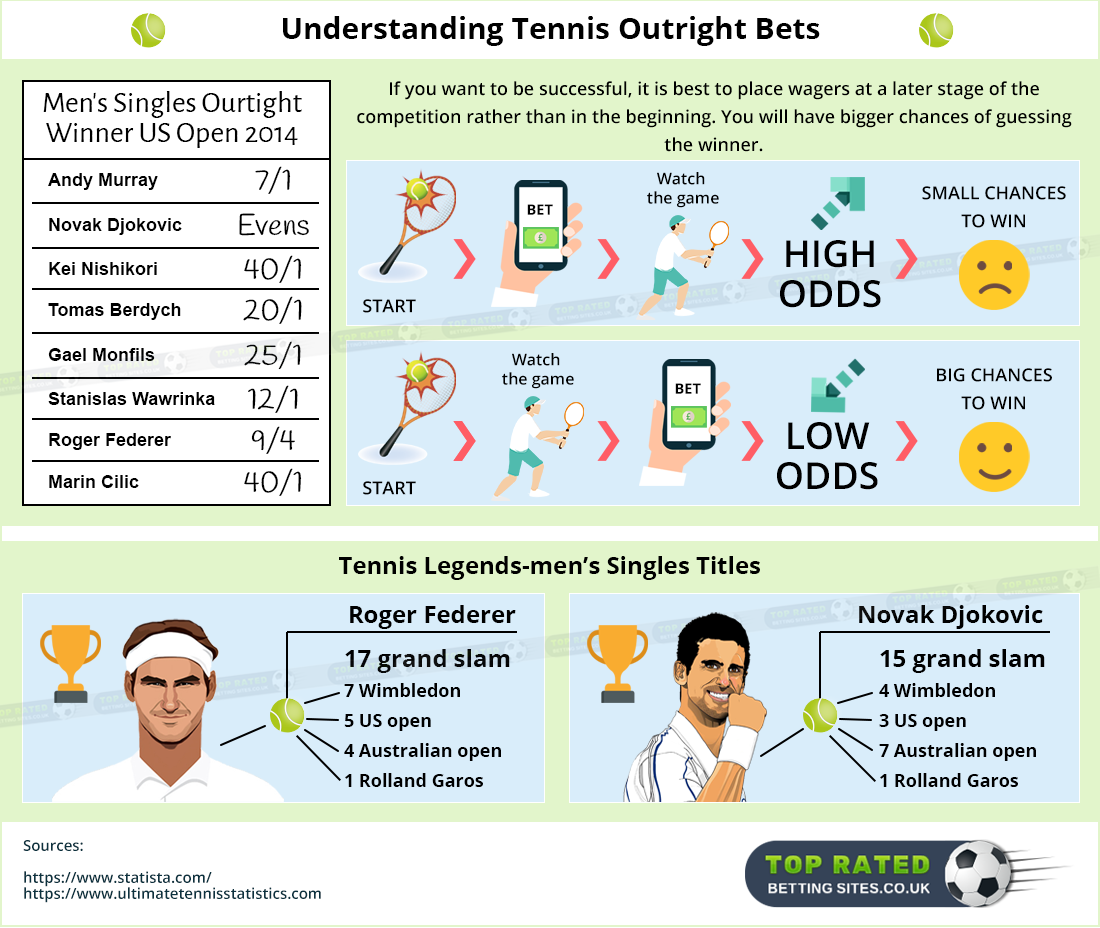

Spread betting is a concept which was discovered many years ago. It is a leveraged investment model and professionally used by thousands of people around the world. European countries like the United Kingdom and Ireland have the highest percentage of spread betting investors. Spread betting also used in sports betting in which you can bet on the ongoing session of a sport with the winning and losing.

Spread betting is a kind of investment which is as much risky as futures and options in the stock market. But it will give you quicker results than any other investment type. The time of investment is limited in the spread betting just like a particular session for the sports.

Here in this article we will discuss both spread betting on sports sessions and spread betting on leverage items and share market stocks.

Basically, spread betting is an event in which the output of wager is totally dependent on the accuracy of the bet, not on just winning and losing. I will describe it later via examples, so you can easily understand the concept of it.

According to wikipedia the definition of spread betting is,” Spread betting is any of various types of wagering on the outcome of an event where the pay-off is based on the accuracy of the wager, rather than a simple “win or lose” outcome, such as fixed-odds betting or parimutuel betting.”

But one thing for sure is that the limit of time is fixed in the spread betting. You will get to know it when we discuss it through sports spread betting.

Before you open an account for spread betting investment, I want to share a fact with you which is 70% of investors lose their money when they bet on the spread system. That means investors have only 30% chances to get profit from the spread betting.

You can easily open an account of spread betting investment from thousands of broker firms out there. Some of them are IG, ETX Capitals, Spreadex, and City Index etc. It totally depends on the country where you live or you can also find these broker firms on the internet.

The online broker firms can open your account from the distance in which you don’t have to visit physically. An investor just needs to fulfill the online form provided by the broker firms. So, if you want to open an account I recommend you to go online and work from anywhere you want.

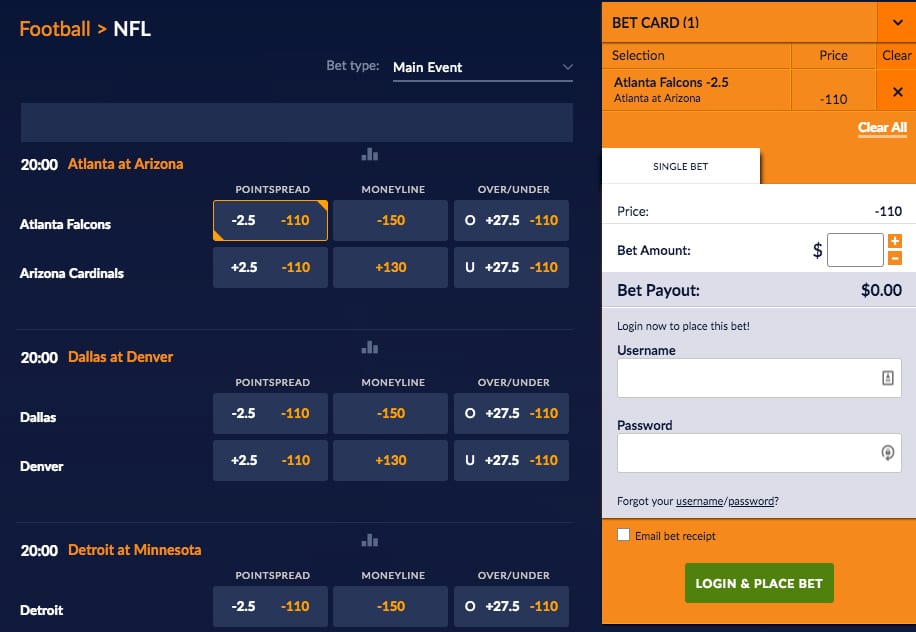

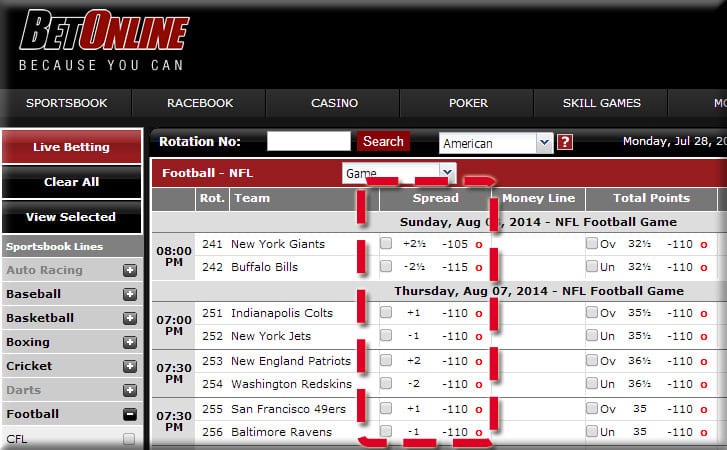

The point spread concept is only used in the sport spread betting. As we all know that two teams play a match which could be Basketball or soccer, these teams have different sets of skills. There are no chances that two different teams have equal skills and stamina.

In any match one team is always an underdog and one team has much stronger qualities. So, brokers and bookies use a point spread system in which they actually handicap one team by subtracting some points and adding some points to another team.

Let’s look at this little example so you can understand it better-

There are two teams playing a match of Basketball Team A and Team B. Now imagine that team A has strong players and never loses any matches in the tournament. On the other side team B is an underdog and never won any of the title and tournament. So, odds are always with the team and to make it equal, brokers use point spread.

For making these teams equal and equal betting from both sides, bookies add 10 points to the underdog team. It means whatever the score they have, the underdog team will get 10 points at the end of the spread session.

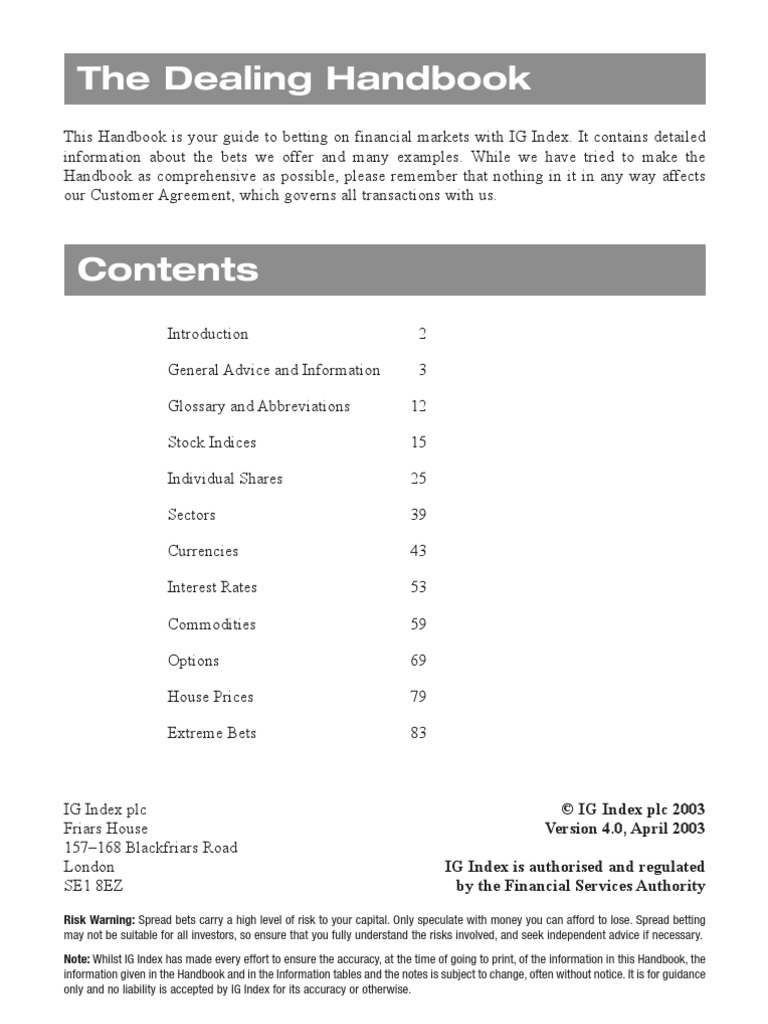

I have already written an article on CFD trading in which I have described everything related to spread in the very detail. Stock market is the largest investment business module. Spread betting is not a new concept in the stock market.

In the stock market people invest money on the commodity, stocks, and shares. But in spread betting you only bet on the rising and falling prices of these things. The profit and loss is directly based on the pricing curve which you have to speculate when you invest for the particular time.

FTSE abbreviated from Financial Times Stock Exchange and it is a share index of 100 companies in the LondonStock Exchange Market with the highest market capitalization. You can do spread betting on the FTSE 100 index by speculating the accurate price changing of particularly selected companies shares.

Every company holds a bid price (buying price) and offer price (selling price) and the spread betting is actually guessing on which direction the buying and selling price will go. Your profit and outcome will depend on how accurate your speculation is. The difference between buying and selling price is known as “spread”. The commission of the broker is also based on “spread”.

You will find a variety of brokers and bookies in the eery leverage business. Each has different qualities, advantages and disadvantages. Spread betting brokers allow you to trade on spread betting and price movement.

Before choosing any broker for spread betting you must have to understand how it works and what are the benefits of a spread betting broker. Now imagine that one broker has 250 options on which you can bet and another one has 1000 options. So, I strongly recommend you should choose the broker with higher possible options.

The commision also varies in different broker firms of spread betting. So, before investing you should have little knowledge about that firm. It’s all on the internet nowadays.

As we all know that we are living in a digital world and everything is in the mobile. We can do a lot of work from home using mobile apps. Mobile apps are designed for quick compilation of queries. And unlike any other business module spread betting is also possible through mobile and desktop apps.

There are many apps that provide extreme spread betting experience on your 5 inch mobile device. Here is the list of apps which provide spread betting options.

The above list is according to brokernotes.

But before installing and filling you credentials in the app please read terms and conditions related to spread betting and firm broker commissions.

Just like CFD spread betting is also a complex instrument which comes with higher levels of risk. Spread betting options are calls and puts where calls are right to buy a particular market and puts is a right to sell a particular market.

There is also one more important thing in this scenario which is the expiry date. Because all the spread betting options have expiry date, it may be short term or long term.

There are many financial management magazines available in the market. If you are really interested in investing in something you should subscribe to some of them. Because there is no harm in learning something new. If you don’t have any idea how to get these financial magazines, you can do online research.

In the magazines people share their experience of investing in all types of stock market and bet on particular commodities. And one of the best advantages is that you can learn from their mistakes.

I have subscribed to many magazines and newspapers for increasing my knowledge on the subject. And it helps me a lot.

Well, the best way to learn something is experiencing it by ourselves. Average people learn from their mistakes and smart people learn from mistakes of another person. There are many free courses available on the internet and videos on YouTube from which you can learn spread betting in detail.

I have also learned and cleared my concepts on many subjects from the internet. But if you need to get detailed knowledge on spread betting you should join a course.

The United Kingdom was one of the beginning countries where spread betting became legal and tax free. In the share market and CFD trading you have to give taxable income to the government but not in spread betting because it has much higher risk than any other leverage business.

The United Kingdom invented many virtual businesses like CFD, stock exchange, forex and spread betting. Spread betting became popular when it was included in sports betting. In the United Kingdom it has a large number of investors.

Is spread betting legal in Australia? I think everybody who has little knowledge about the international stock market already knows it. It all started in 2002 in Australia, both sports spread betting and stock market price speculation is legal.

It is tax free in the United Kingdom and spread betting is tax free in Australia also.

Spread betting and CFDs (contracts for difference) are both equally risky and profitable and the profit depends on future predictions. The major difference between CFD and spread betting is how they treated acquired capital gains.

As we discussed earlier spread betting is totally tax free because it doesn’t include any assets, stocks and commodities. On the other hand CFD trading includes assets and commodities on which you have to pay tax on gains.

In a short note it is a quick guide to spread betting. You can have basic knowledge of the spread betting by this short article. I am planning to write on a related subject in the near future.

But before investing you must read about the contacts carefully. You must gain more and more knowledge about leverage business before investing. Girdhari Keer

You should also look into CFD trading meaning and spread finance which I have already published earlier.

I hope you all find this article little helpful and if you want me to change anything please suggest in the comment box so I can review it.

Like!! Great article post.Really thank you! Really Cool.

Hi there I am so excited I found your web site, I

really found you by error, while I was browsing on Digg

for something else, Nonetheless I am here now

and would just like to say thanks for a tremendous post and a all round thrilling blog

(I also love the theme/design), I don’t have time to read it all at the moment but I have saved it and also added in your RSS feeds, so

when I have time I will be back to read more, Please do keep

up the superb work.

Outstanding post but I was wanting to know if you could write a litte more on this topic?

I’d be very thankful if you could elaborate a little bit more.

Hi this is somewhat of off topic but I was wondering if blogs use

WYSIWYG editors or if you have to manually code with HTML.

I’m starting a blog soon but have no coding knowledge so I wanted to get

advice from someone with experience. Any help would be enormously appreciated!

Nice post.

Discovery Kids Latin America

Korean Porno Zvezda Seks Video

Neil Younger Milton Keynes Business Appointment

Account Pornhub Daily

Billie Eilish Sex Fake

Spread Betting Definition - investopedia.com

Spread betting - Wikipedia

What is Spread Betting? Spread Betting Explained

SPREAD BETTING | meaning in the Cambridge English Dictionary

Spread betting in sport | What is spread betting? | OddsMonkey

What Is The Meaning Of Spread Betting

/cdn.vox-cdn.com/uploads/chorus_image/image/50878633/602229764.0.jpg)