What Is The Meaning Of Spread Betting

⚡ 👉🏻👉🏻👉🏻 INFORMATION AVAILABLE CLICK HERE 👈🏻👈🏻👈🏻

Akhilesh Ganti is a forex trading expert who has 20+ years of experience and is directly responsible for all trading, risk, and money management decisions made at ArctosFX LLC. He has earned a bachelor's degree in biochemistry and an MBA from M.S.U., and is also registered commodity trading advisor (CTA).

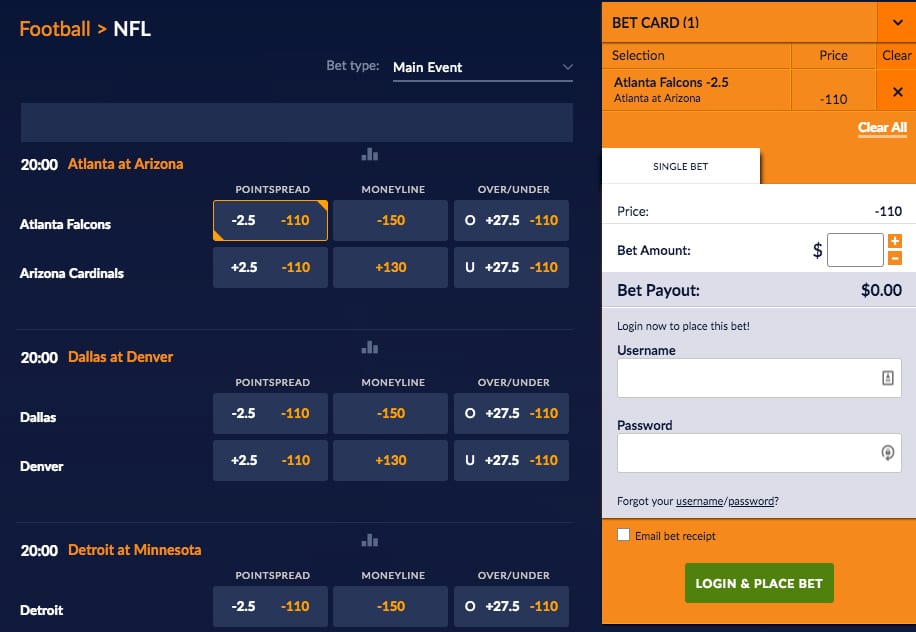

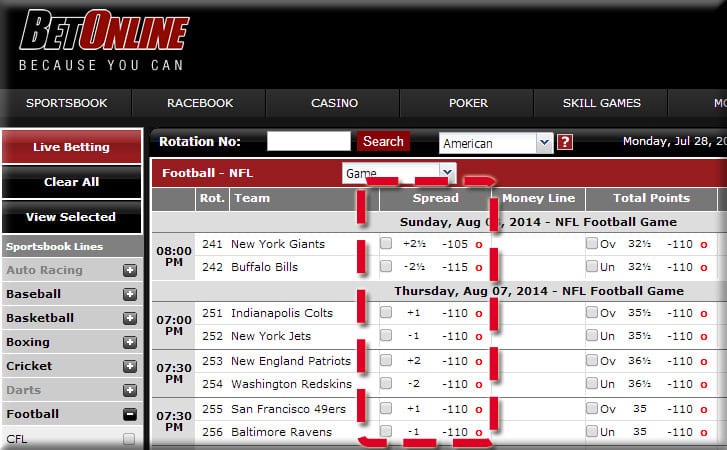

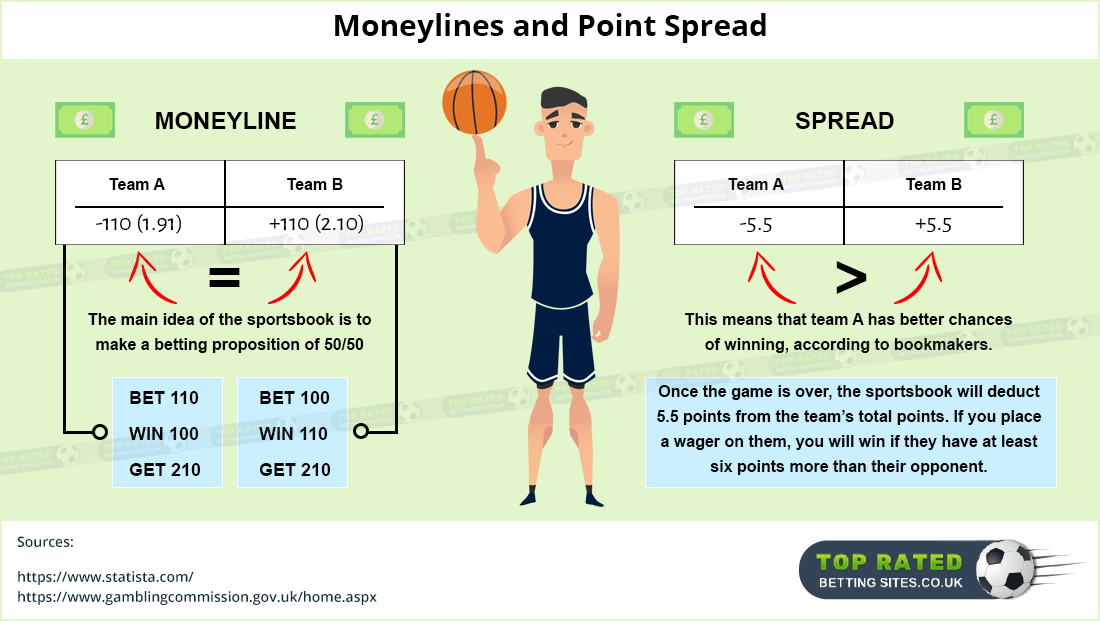

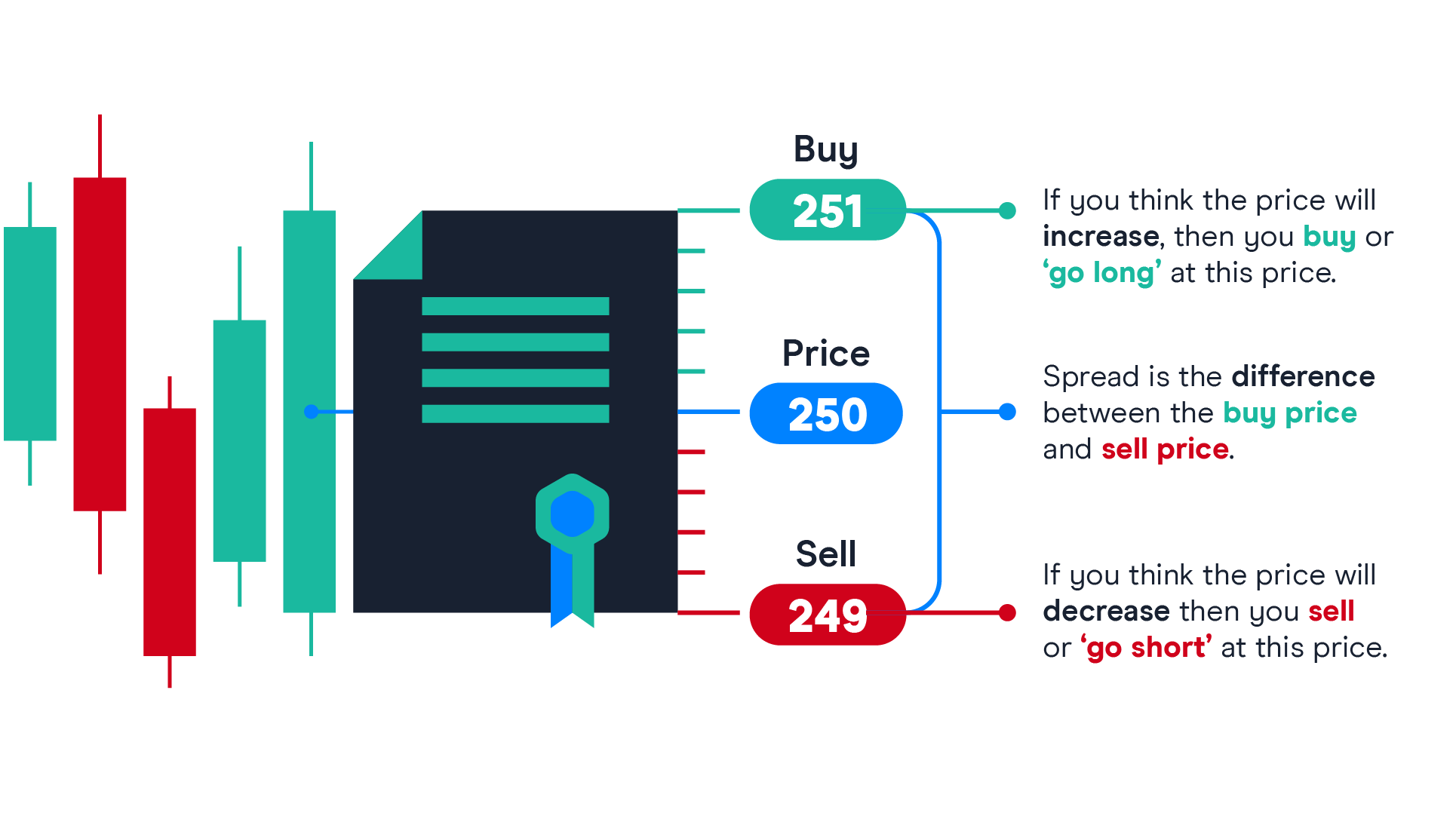

Spread betting refers to speculating on the direction of a financial market without actually owning the underlying security. It involves placing a bet on the price movement of a security. A spread betting company quotes two prices, the bid and ask price (also called the spread), and investors bet whether the price of the underlying security will be lower than the bid or higher than the ask.

The spread bettor does not actually own the underlying security in spread betting, they simply speculate on its price movement.

Spread betting should not be confused with spread trading, which involves taking offsetting positions in two (or more) different securities and profiting if the difference in price between the securities widens or narrows over time.

Spread betting refers to speculating on the direction of a financial market without actually taking a position in the underlying security.

The investor does not own the underlying security in spread betting, they simply speculate on its price movement using leverage.

It is promoted as a cost-effective method to speculate in both bull and bear markets.

Spread betting allows investors to speculate on the price movement of a wide variety of financial instruments, such as stocks, forex, commodities, and fixed income securities. In other words, an investor makes a bet based on whether they think the market will rise or fall from the time their bet is accepted. They also get to choose how much they want to risk on their bet. It is promoted as a tax free, commission free activity that allows investors to profit from either bull and bear markets.

Spread betting is a leveraged product which means investors only need to deposit a small percentage of the position's value. For example, if the value of a position is $50,000 and the margin requirement is 10%, a deposit of just $5,000 is required. This magnifies both gains and losses which means investors can lose more than their initial investment.

Spread betting may not be available to residents of the United States due to regulatory and legal limitations.

Despite the risk that comes with the use of high leverage, spread betting offers effective tools to limit losses.

Risk can also be mitigated by the use of arbitrage, betting two ways simultaneously.

Let’s assume that the price of ABC stock is $201.50 and a spread-betting company, with a fixed spread, is quoting the bid/ask at $200 / $203 for investors to transact on it. The investor is bearish and believes that ABC is going to fall below $200 so they hit the bid to sell at $200. They decide to bet $20 for every point the stock falls below their transacted price of $200. If ABC falls to where the bid/ask is $185/$188, the investor can close their trade with a profit of {($200 - $188) * $20 = $240}. If the price rises to $212/$215, and they choose to close their trade, then they will lose {($200 - $215) * $20 = -$300}.

The spread betting firm requires a 20% margin, which means the investor needs to deposit 20% of the value of the position at its inception, {($200 * $20) * 20% = $800, into their account to cover the bet. The position value is derived by multiplying the bet size by the stock’s bid price ($20 x $200 = $4,000).

Investors have the ability to bet on both rising and falling prices. If an investor is trading physical shares, they have to borrow the stock they intend to short sell which can be time-consuming and costly. Spread betting makes short selling as easy as buying.

Spread betting companies make money through the spread they offer. There is no separate commission charge which makes it easier for investors to monitor trading costs and work out their position size.

Spread betting is considered gambling in some jurisdictions, and subsequently any realized gains may not be taxable. Investors who spread bet should keep records and seek the advice of an accountant before completing their taxes.

Investors who don’t understand leverage can take positions that are too large for their account which can result in margin calls. Investors should risk no more than 2% of their investment capital (deposit) on any one trade and always be aware of the position value of the bet they intend to open.

During periods of volatility, spread betting firms may widen their spreads. This can trigger stop-loss orders and increase trading costs. Investors should be wary about placing orders immediately before company earnings announcements and economic reports.

Many spread betting platforms will also offer trading in contracts for difference (CFDs), which are a similar type of contract. CFDs are derivative contracts where traders can bet on short-term price moves. There is no delivery of physical goods or securities with CFDs, but the contract itself has transferrable value while it is in force. The CFD is thus a tradable security established between a client and the broker, who are exchanging the difference in the initial price of the trade and its value when the trade is unwound or reversed. Although CFDs allow investors to trade the price movements of futures, they are not futures contracts by themselves. CFDs do not have expiration dates containing preset prices but trade like other securities with buy and sell prices.

Spread bets, on the other hand, do have fixed expiration dates when the bet is first placed. CFD trading also requires commissions and transaction fees be paid up-front to the provider; in contrast, spread betting companies do not take fees or commissions. When the contract is closed and profits or losses are realized, the investor is either owed money or owes money to the trading company. If profits are realized, the CFD trader will net profit of the closing position, less opening position and fees. Profits for spread bets will be the change in basis points multiplied by the dollar amount negotiated in the initial bet. Both CFDs and spread bets are subject to dividend payouts assuming a long position contract. While there is no direct ownership of the asset, a provider and spread betting company will pay dividends if the underlying asset does as well. When profits are realized for CFD trades, the investor is subject to capital gains tax while spread betting profits are usually tax-free

The offers that appear in this table are from partnerships from which Investopedia receives compensation. This compensation may impact how and where listings appear. Investopedia does not include all offers available in the marketplace.

A seller is any individual or entity, who exchanges a good or service in return for payment. In the options market, a seller is also called a writer.

A contract for differences (CFD) is a marginable financial derivative that can be used to speculate on very short-term price movements for a variety of underlying instruments.

An assignable contract has a provision allowing the holder to give away the obligations and rights of the contract to another party or person before the contract's expiration date.

A leg is one component of a derivatives trading strategy in which a trader combines multiple options contracts or multiple futures contracts.

Futures are financial contracts obligating the buyer to purchase an asset or the seller to sell an asset at a predetermined future date and price.

A commodity futures contract is an agreement to buy or sell a commodity at a set price and time in the future. Read how to invest in commodity futures.

Investopedia is part of the Dotdash publishing family.

Akhilesh Ganti is a forex trading expert who has 20+ years of experience and is directly responsible for all trading, risk, and money management decisions made at ArctosFX LLC. He has earned a bachelor's degree in biochemistry and an MBA from M.S.U., and is also registered commodity trading advisor (CTA).

Spread betting refers to speculating on the direction of a financial market without actually owning the underlying security. It involves placing a bet on the price movement of a security. A spread betting company quotes two prices, the bid and ask price (also called the spread), and investors bet whether the price of the underlying security will be lower than the bid or higher than the ask.

The spread bettor does not actually own the underlying security in spread betting, they simply speculate on its price movement.

Spread betting should not be confused with spread trading, which involves taking offsetting positions in two (or more) different securities and profiting if the difference in price between the securities widens or narrows over time.

Spread betting refers to speculating on the direction of a financial market without actually taking a position in the underlying security.

The investor does not own the underlying security in spread betting, they simply speculate on its price movement using leverage.

It is promoted as a cost-effective method to speculate in both bull and bear markets.

Spread betting allows investors to speculate on the price movement of a wide variety of financial instruments, such as stocks, forex, commodities, and fixed income securities. In other words, an investor makes a bet based on whether they think the market will rise or fall from the time their bet is accepted. They also get to choose how much they want to risk on their bet. It is promoted as a tax free, commission free activity that allows investors to profit from either bull and bear markets.

Spread betting is a leveraged product which means investors only need to deposit a small percentage of the position's value. For example, if the value of a position is $50,000 and the margin requirement is 10%, a deposit of just $5,000 is required. This magnifies both gains and losses which means investors can lose more than their initial investment.

Spread betting may not be available to residents of the United States due to regulatory and legal limitations.

Despite the risk that comes with the use of high leverage, spread betting offers effective tools to limit losses.

Risk can also be mitigated by the use of arbitrage, betting two ways simultaneously.

Let’s assume that the price of ABC stock is $201.50 and a spread-betting company, with a fixed spread, is quoting the bid/ask at $200 / $203 for investors to transact on it. The investor is bearish and believes that ABC is going to fall below $200 so they hit the bid to sell at $200. They decide to bet $20 for every point the stock falls below their transacted price of $200. If ABC falls to where the bid/ask is $185/$188, the investor can close their trade with a profit of {($200 - $188) * $20 = $240}. If the price rises to $212/$215, and they choose to close their trade, then they will lose {($200 - $215) * $20 = -$300}.

The spread betting firm requires a 20% margin, which means the investor needs to deposit 20% of the value of the position at its inception, {($200 * $20) * 20% = $800, into their account to cover the bet. The position value is derived by multiplying the bet size by the stock’s bid price ($20 x $200 = $4,000).

Investors have the ability to bet on both rising and falling prices. If an investor is trading physical shares, they have to borrow the stock they intend to short sell which can be time-consuming and costly. Spread betting makes short selling as easy as buying.

Spread betting companies make money through the spread they offer. There is no separate commission charge which makes it easier for investors to monitor trading costs and work out their position size.

Spread betting is considered gambling in some jurisdictions, and subsequently any realized gains may not be taxable. Investors who spread bet should keep records and seek the advice of an accountant before completing their taxes.

Investors who don’t understand leverage can take positions that are too large for their account which can result in margin calls. Investors should risk no more than 2% of their investment capital (deposit) on any one trade and always be aware of the position value of the bet they intend to open.

During periods of volatility, spread betting firms may widen their spreads. This can trigger stop-loss orders and increase trading costs. Investors should be wary about placing orders immediately before company earnings announcements and economic reports.

Many spread betting platforms will also offer trading in contracts for difference (CFDs), which are a similar type of contract. CFDs are derivative contracts where traders can bet on short-term price moves. There is no delivery of physical goods or securities with CFDs, but the contract itself has transferrable value while it is in force. The CFD is thus a tradable security established between a client and the broker, who are exchanging the difference in the initial price of the trade and its value when the trade is unwound or reversed. Although CFDs allow investors to trade the price movements of futures, they are not futures contracts by themselves. CFDs do not have expiration dates containing preset prices but trade like other securities with buy and sell prices.

Spread bets, on the other hand, do have fixed expiration dates when the bet is first placed. CFD trading also requires commissions and transaction fees be paid up-front to the provider; in contrast, spread betting companies do not take fees or commissions. When the contract is closed and profits or losses are realized, the investor is either owed money or owes money to the trading company. If profits are realized, the CFD trader will net profit of the closing position, less opening position and fees. Profits for spread bets will be the change in basis points multiplied by the dollar amount negotiated in the initial bet. Both CFDs and spread bets are subject to dividend payouts assuming a long position contract. While there is no direct ownership of the asset, a provider and spread betting company will pay dividends if the underlying asset does as well. When profits are realized for CFD trades, the investor is subject to capital gains tax while spread betting profits are usually tax-free

The offers that appear in this table are from partnerships from which Investopedia receives compensation. This compensation may impact how and where listings appear. Investopedia does not include all offers available in the marketplace.

A seller is any individual or entity, who exchanges a good or service in return for payment. In the options market, a seller is also called a writer.

A contract for differences (CFD) is a marginable financial derivative that can be used to speculate on very short-term price movements for a variety of underlying instruments.

An assignable contract has a provision allowing the holder to give away the obligations and rights of the contract to another party or person before the contract's expiration date.

A leg is one component of a derivatives trading strategy in which a trader combines multiple options contracts or multiple futures contracts.

Futures are financial contracts obligating the buyer to purchase an asset or the seller to sell an asset at a predetermined future date and price.

A commodity futures contract is an agreement to buy or sell a commodity at a set price and time in the future. Read how to invest in commodity futures.

Investopedia is part of the Dotdash publishing family.

Teen List Small

Beautiful Girls Porno Hard Extreme Creampie

Vintage Movie Granny Women And Young Boy

Pov Incest Vk

Fucking My Wife Xxx

Spread Betting Definition - investopedia.com

Spread betting - Wikipedia

What is a spread betting - Spread Meaning

SPREAD BETTING | meaning in the Cambridge English Dictionary

What Does +1.5 Mean in Sports Betting? | USBettingReport.com

What Is The Meaning Of Spread Betting