What Is Love Spread Betting

👉🏻👉🏻👉🏻 ALL INFORMATION CLICK HERE 👈🏻👈🏻👈🏻

РекламаАбсолютно реальные цены! Экспресс доставка! · Москва · пн-сб 10:00-19:00, вс 10:00-18:00

РекламаСмотри фильм "LOVE" в хорошем качестве на IVI!

Spread betting is a derivative strategy, in which participants do not own the underlying asset they bet on, such as a stock or commodity. Rather, spread bettors simply speculate on whether the asset's price will rise or fall, using the prices offered to them by a broker.

www.investopedia.com/articles/active-tr…

How does spread betting work and what does it mean?

How does spread betting work and what does it mean?

Updated May 10, 2019. Spread betting is a derivative strategy, in which participants do not own the underlying asset they bet on, such as a stock or commodity. Rather, spread bettors simply speculate on whether the asset's price will rise or fall, using the prices offered to them by a broker.

www.investopedia.com/articles/active-tra…

Which is the most popular sport spread betting?

Which is the most popular sport spread betting?

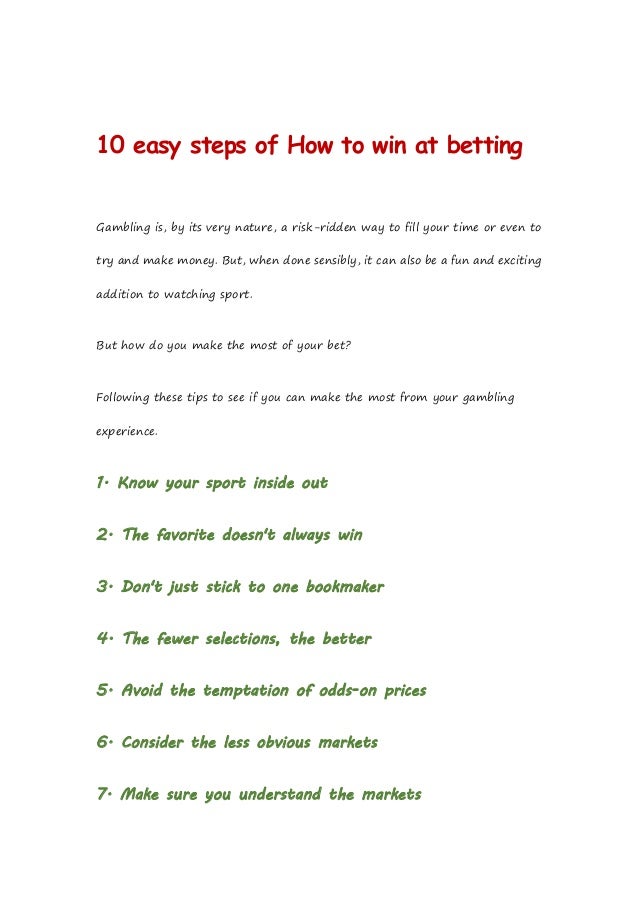

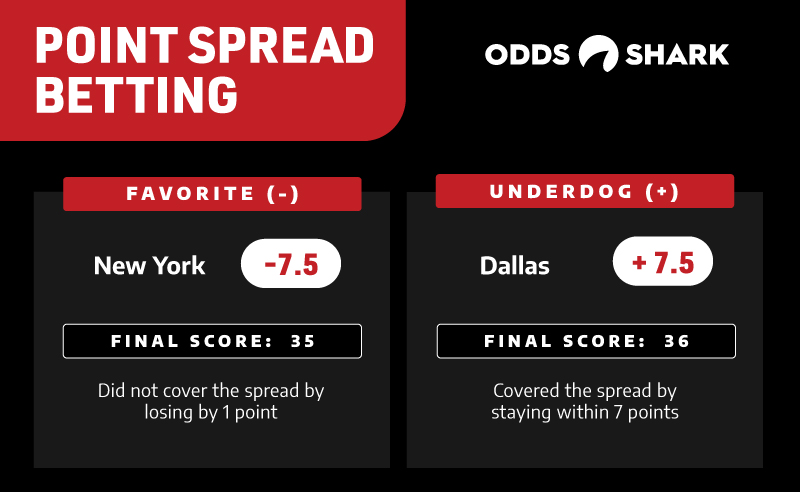

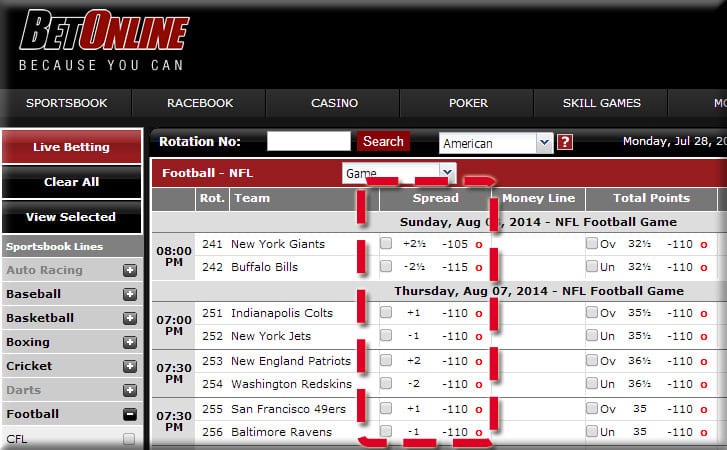

Points betting over a season is one of the most popular spread bets. The prediction from the spread betting company may look something like this: This means they are predicting Manchester United may finish on either 76 or 77 points. The lower one is the selling price. The higher one is the price you buy at.

www.oddsmonkey.com/blog/matched-betti…

Which is better spread betting with or without leverage?

Which is better spread betting with or without leverage?

Therefore, spread betting without leverage is considered far safer by many. Arbitrage or Hedging – Combining spread bets can lead to opportunities ‘arbing’, or allow trader to ‘hedge’ other derivative holdings. Spread betting full time as a job could well be worth your while if the following sounds like you:

When does spread betting arbitrage in the market?

When does spread betting arbitrage in the market?

However, spread betting arbitrage can still occur when two companies take separate stances on the market while setting their own spreads. At the expense of the market maker, an arbitrageur bets on spreads from two different companies.

www.investopedia.com/articles/active-tra…

https://www.investopedia.com/articles/active-trading/082113/what-spread-betting.asp

07.01.2021 · Spread betting is a derivative strategy, in which participants do not own the underlying asset they bet on, such as a stock or commodity. Rather, spread bettors simply speculate on whether the...

https://www.shiftingshares.com/what-is-spread-betting

23.04.2020 · Spread betting is a financial derivative product which traders do not take ownership of the underlying asset that they are betting on. Spread bettors are speculating on the rise and fall of the asset prices they are trading (e.g. stocks), which uses the spread offered by the spread bet broker or trading platform.

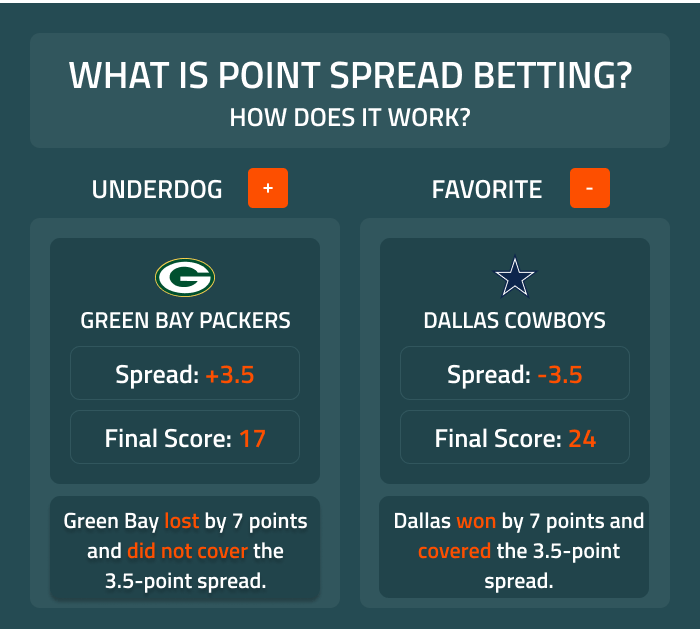

What Is Point Spread Betting | Football Betting 101

What is a Point Spread? | Sports Betting 101

Stream Spread Free Online Movie 2009

Spread Betting Explained: What is Spread Betting?

https://www.ontheballbets.com/what-is-spread-betting-on-football

18.08.2021 · Spread betting is a form of betting that became popular in the UK and across Europe during the 1990s and owes much to the boom in share dealing associated with some of the world’s economies, …

https://www.oddsmonkey.com/blog/matched-betting/spread-betting-sports

23.05.2017 · Spread betting is hugely popular, especially among people who work in or have an interest in finance. This is because it allows easy access to speculate on the …

https://www.captaingambling.com/betting/types/spread-bet

08.08.2021 · A more accurate way of referring to spread betting in sporting events is to refer to it as “sports spread betting” (just to clear any ambiguity), although it can still be called spread betting. Sports spread betting …

https://www.profitaccumulator.co.uk/news/matched-betting/what-is-spread-betting

02.08.2019 · Spread betting is not restricted to betting on the events of a given match, there are a number of longer-term spread betting markets are available. In the Premier League, for example, a bookmaker will offer a spread on the total points a team will achieve at the end of the season, allowing bettors to buy or sell if they think the prediction is correct or incorrect.

https://www.betpromo.uk/what-is-spread-betting

04.05.2020 · Where Spread Betting Is Used. Spread betting can be highly profitable, but it comes with a large element of risk. You could lose more than your original stake. Despite this, it is hugely popular and used a lot in football. You can bet on the spread of goals that will be scored in a game, all the way through to who will win the title.

https://www.daytrading.com/spread-betting

Regulation – Spread betting is regulated in many countries, including France, Germany, and the UK. This affords you certain rights and protects your money from a range of situations. Not to mention, regulation keeps you safe from spread betting scams. …

РекламаАбсолютно реальные цены! Экспресс доставка! · Москва · пн-сб 10:00-19:00, вс 10:00-18:00

РекламаСмотри фильм "LOVE" в хорошем качестве на IVI!

Не удается получить доступ к вашему текущему расположению. Для получения лучших результатов предоставьте Bing доступ к данным о расположении или введите расположение.

Не удается получить доступ к расположению вашего устройства. Для получения лучших результатов введите расположение.

Dan Blystone is the founder and editor of TradersLog.com, as well as the founder of the Chicago Traders Meetup Group.

Spread betting is a derivative strategy, in which participants do not own the underlying asset they bet on, such as a stock or commodity. Rather, spread bettors simply speculate on whether the asset's price will rise or fall, using the prices offered to them by a broker.

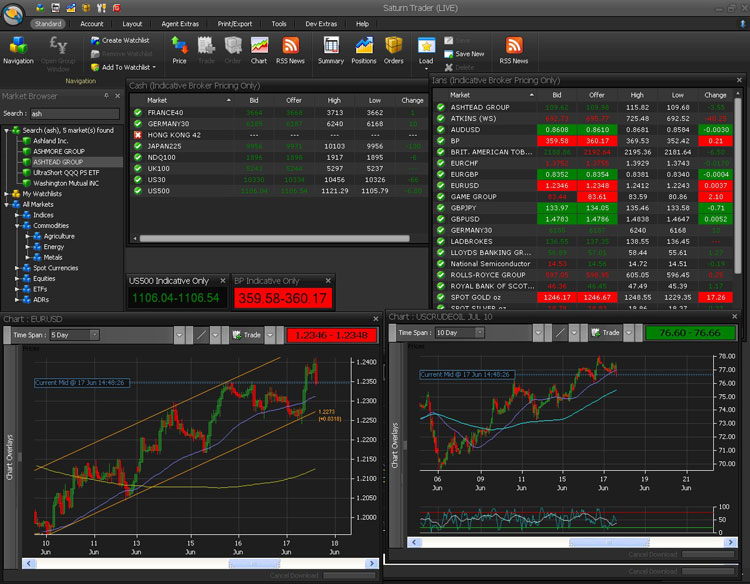

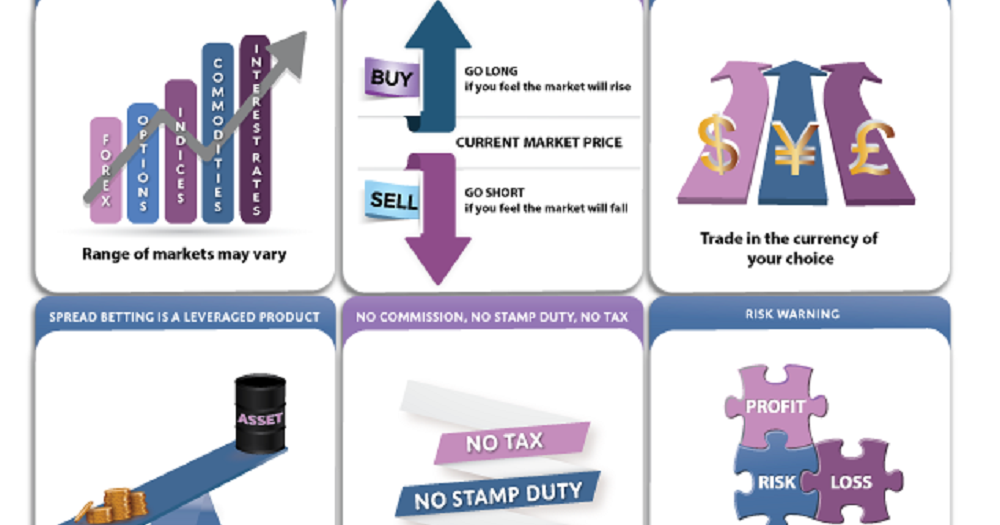

As in stock market trading, two prices are quoted for spread bets—a price at which you can buy (bid price) and a price at which you can sell (ask price). The difference between the buy and sell price is referred to as the spread. The spread-betting broker profits from this spread, and this allows spread bets to be made without commissions, unlike most securities trades.

Investors align with the bid price if they believe the market will rise and go with the ask if they believe it will fall. Key characteristics of spread betting include the use of leverage, the ability to go both long and short, the wide variety of markets available, and tax benefits.

Spread betting allows traders to bet on the direction of a financial market without actually owning the underlying security.

Spread betting is sometimes promoted as a tax-free, commission-free activity that allows investors to speculate in both bull and bear markets, but this remains banned in the U.S.

Like stock trades, spread bet risks can be mitigated using stop loss and take profit orders.

If spread betting sounds like something you might do in a sports bar, you're not far off. Charles K. McNeil, a mathematics teacher who became a securities analyst—and later a bookmaker—in Chicago during the 1940s has been widely credited with inventing the spread-betting concept. But its origins as an activity for professional financial-industry traders happened roughly 30 years later, on the other side of the Atlantic. A City of London investment banker, Stuart Wheeler, founded a firm named IG Index in 1974, offering spread betting on gold. At the time, the gold market was prohibitively difficult to participate in for many, and spread betting provided an easier way to speculate on it.

Despite its American roots, spread betting is illegal in the United States.

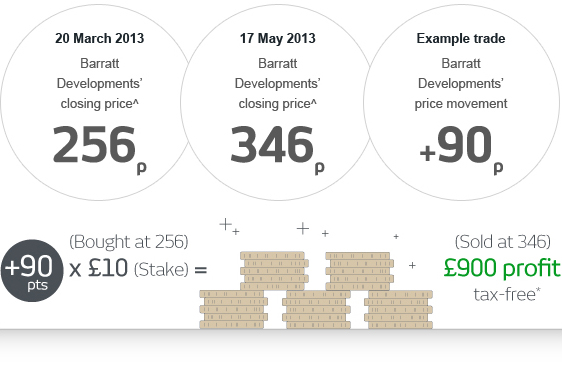

Let's use a practical example to illustrate the pros and cons of this derivative market and the mechanics of placing a bet. First, we'll take an example in the stock market, and then we'll look at an equivalent spread bet.

For our stock market trade, let's assume a purchase of 1,000 shares of Vodafone (LSE: VOD) at £193.00. The price goes up to £195.00 and the position is closed, capturing a gross profit of £2,000 and having made £2 per share on 1,000 shares. Note here several important points. Without the use of margin, this transaction would have required a large capital outlay of £193k. Also, normally commissions would be charged to enter and exit the stock market trade. Finally, the profit may be subject to capital gains tax and stamp duty.

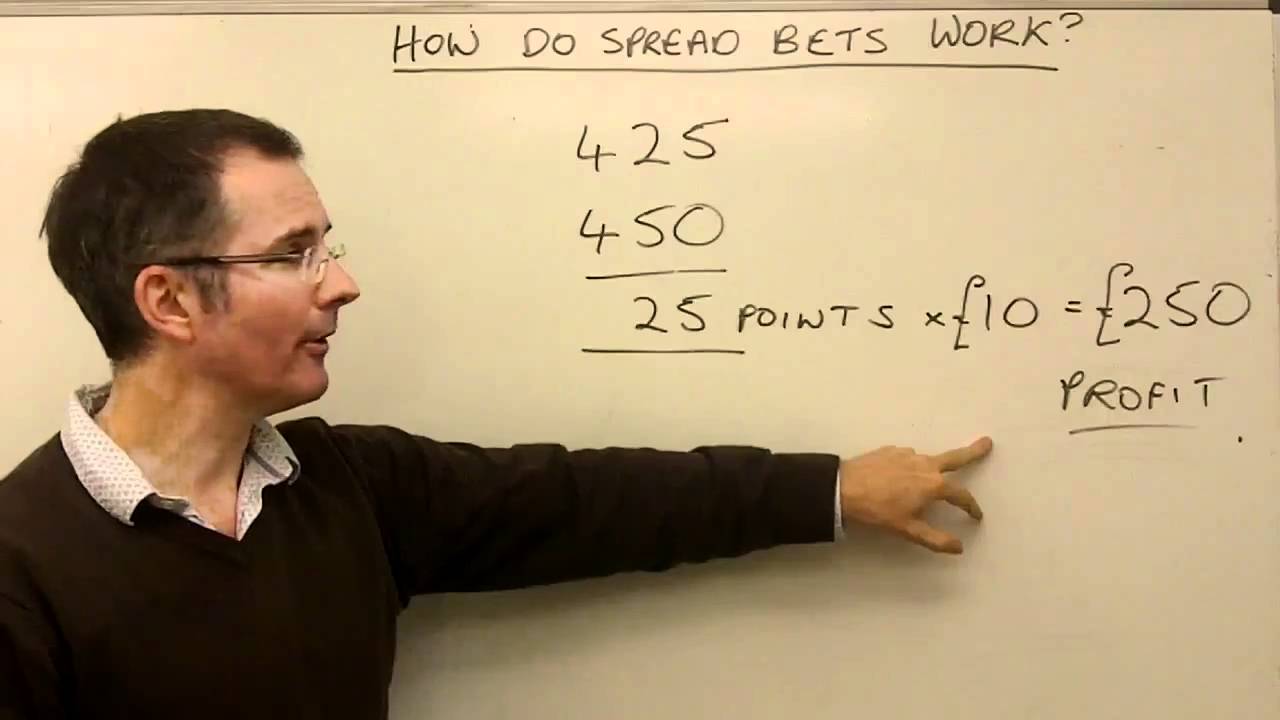

Now, let's look at a comparable spread bet. Making a spread bet on Vodafone, we'll assume with the bid-offer spread you can buy the bet at £193.00. In making this spread bet, the next step is to decide what amount to commit per "point," the variable that reflects the price move. The value of a point can vary.

In this case, we will assume that one point equals a one pence change, up or down, in the Vodaphone share price. We'll now assume a buy or "up bet" is taken on Vodaphone at a value of £10 per point. The share price of Vodaphone rises from £193.00 to £195.00, as in the stock market example. In this case, the bet captured 200 points, meaning a profit of 200 x £10, or £2,000.

While the gross profit of £2,000 is the same in the two examples, the spread bet differs in that there are usually no commissions incurred to open or close the bet and no stamp duty or capital gains tax due. In the U.K. and some other European countries, the profit from spread betting is free from tax.

However, while spread bettors do not pay commissions, they may suffer from the bid-offer spread, which may be substantially wider than the spread in other markets. Keep in mind also that the bettor has to overcome the spread just to break even on a trade. Generally, the more popular the security traded, the tighter the spread, lowering the entry cost.

In addition to the absence of commissions and taxes, the other major benefit of spread betting is that the required capital outlay is dramatically lower. In the stock market trade, a deposit of as much as £193,000 may have been required to enter the trade. In spread betting, the required deposit amount varies, but for the purpose of this example, we will assume a required 5% deposit. This would have meant that a much smaller £9,650 deposit was required to take on the same amount of market exposure as in the stock market trade.

The use of leverage works both ways, of course, and herein lies the danger of spread betting. As the market moves in your favor, higher returns will be realized; on the other hand, as the market moves against you, you will incur greater losses. While you can quickly make a large amount of money on a relatively small deposit, you can lose it just as fast.

If the price of Vodaphone fell in the above example, the bettor may eventually have been asked to increase the deposit or even have had the position closed out automatically. In such a situation, stock market traders have the advantage of being able to wait out a down move in the market, if they still believe the price is eventually heading higher.

Despite the risk that comes with the use of high leverage, spread betting offers effective tools to limit losses.

Risk can also be mitigated by the use of arbitrage, betting two ways simultaneously.

Arbitrage opportunities arise when the prices of identical financial instruments vary in different markets or among different companies. As a result, the financial instrument can be bought low and sold high simultaneously. An arbitrage transaction takes advantage of these market inefficiencies to gain risk-free returns.

Due to widespread access to information and increased communication, opportunities for arbitrage in spread betting and other financial instruments have been limited. However, spread betting arbitrage can still occur when two companies take separate stances on the market while setting their own spreads.

At the expense of the market maker, an arbitrageur bets on spreads from two different companies. When the top end of a spread offered by one company is below the bottom end of another’s spread, the arbitrageur profits from the gap between the two. Simply put, the trader buys low from one company and sells high in another. Whether the market increases or decreases does not dictate the amount of return.

Many different types of arbitrage exist, allowing for the exploitation of differences in interest rates, currencies, bonds, and stocks, among other securities. While arbitrage is typically associated with risk-less profit, there are in fact risks associated with the practice, including execution, counterparty, and liquidity risks. Failure to complete transactions smoothly can lead to significant losses for the arbitrageur. Likewise, counterparty and liquidity risks can come from the markets or a company’s failure to fulfill a transaction.

Continually developing in sophistication with the advent of electronic markets, spread betting has successfully lowered the barriers to entry and created a vast and varied alternative marketplace.

Arbitrage, in particular, lets investors exploit the difference in prices between two markets, specifically when two companies offer different spreads on identical assets.

The temptation and perils of being overleveraged continue to be a major pitfall in spread betting. However, the low capital outlay necessary, risk management tools available, and tax benefits make spread betting a compelling opportunity for speculators.

The offers that appear in this table are from partnerships from which Investopedia receives compensation. This compensation may impact how and where listings appear. Investopedia does not include all offers available in the marketplace.

Spread betting refers to speculating on the direction of a financial market without actually owning the underlying security.

A seller is any individual or entity, who exchanges a good or service in return for payment. In the options market, a seller is also called a writer.

Index arbitrage is a trading strategy that attempts to profit from the differences between actual and theoretical prices of a stock market index.

A leg is one component of a derivatives trading strategy in which a trader combines multiple options contracts or multiple futures contracts.

A futures contract is a standardized agreement to buy or sell the underlying commodity or other asset at a specific price at a future date.

A box spread is an options arbitrage strategy that combines buying a bull call spread with a matching bear put spread.

Investopedia is part of the Dotdash publishing family.

Shemale Hands Free Cumshot

Www Ass Time

Real Pictures On Naked Women

Http Www Porninvite Com Channels Vintage

Vintage Movie Train Seduction

What is spread betting on football? - OnTheBallBets

Spread betting in sport | What is spread betting? | OddsMonkey

Spread Betting 2021 | What is Spread Betting - Explained

Spread Betting 2021 | Tutorial and Best Spread Betting ...

What Is Love Spread Betting

/SportsBetting-58d2b6195f9b584683b46637.jpg)