What Does Tips for Keeping Accurate Records of Your Voided Checks Mean?

Electronic Payment Methods versus Standard Inspections: How Do They Compare When It Comes to Voids?

When it happens to repayment methods, companies possess two major choices: digital settlements and standard inspections. While these repayment techniques offer the very same objective, they differ in numerous means. One of the very most considerable distinctions between these two settlement techniques is how they manage gaps.

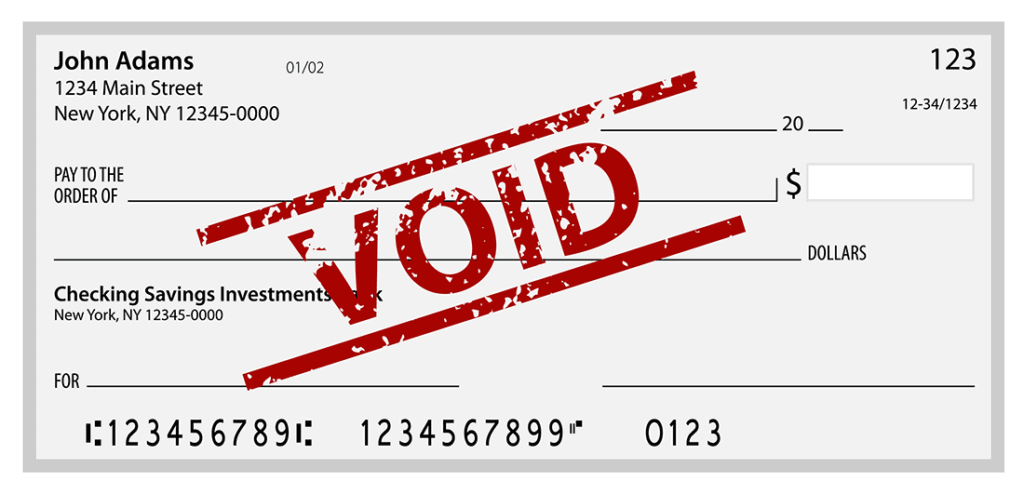

A invalidated settlement takes place when a organization terminates a deal before it goes through. Declaring null and void a settlement is typically important when a oversight has been created or when there is uncertainty of illegal task. The method of declaring null and void a settlement can easily be intricate and time-consuming, which is why companies need to pick their remittance approaches very carefully.

Electronic Payment Methods

Electronic settlement methods recommend to any deal that takes location over the internet. These purchases feature credit score memory cards, debit cards, PayPal, Venmo, and other mobile budgets. Electronic settlements are becoming more and more prominent because they are faster and a lot more convenient than traditional examinations.

One of the principal advantages of electronic remittances is that they can be cancelled quickly and effortlessly if an error takes place. If a company makes an mistake in processing an digital repayment or presumes deceptive activity, it may void the purchase instantaneously by talking to its company services provider.

One more perk of digital remittances is that they provide better security versus fraudulence than conventional examinations. Electronic payments are encrypted and safeguarded by innovative safety solution such as tokenization and encryption innovation that safeguard sensitive details from unwarranted get access to.

Nevertheless, electronic repayments likewise have their drawbacks when it happens to voids. One major disadvantage is that not all companies accept every kind of electronic payment approach. For example, some companies may only approve credit score cards but not mobile wallet apps like Venmo or PayPal.

Conventional Checks

Typical checks stay one of the very most prominent types of settlements for businesses worldwide despite technological advancements over latest years because they're quick and easy to utilize and allowed everywhere unlike some forms of electronic amount of money transfer solutions that aren't took almost everywhere yet.

When it happens to declaring null and void purchases, standard inspections are a little bit more complicated than electronic payments. Declared null and void checks possess to be actually came back to the banking company for processing, which can take numerous times or even weeks.

One more downside of typical checks is that they use little bit of defense versus fraudulence contrasted to electronic payments. Paper inspections may be conveniently altered or duplicated, and there is actually no means to track them once they leave behind the business's hands. This helps make them an very easy intended for illegal task.

Having said that, typical checks do possess some perks when it happens to spaces. For instance, companies can easily placed stop repayments on standard checks if they assume deceitful activity or helped make a blunder in processing the check. Reference stop the check from being paid and give services time to address any kind of issues before the remittance goes through.

Contrasting Electronic Payments and Traditional Inspections

When it happens to gaps, digital payments are commonly much easier and quicker than traditional checks. Electronic remittances can easily be cancelled promptly with only a couple of clicks on or taps on a monitor, while invalidating a conventional inspection needs bodily activity such as coming back it back to your banking company.

Electronic remittances likewise supply more significant protection versus fraud than conventional examinations because of their enhanced protection action that protect vulnerable relevant information coming from unauthorized gain access to.

On the other hand, while traditional inspections don't supply as a lot security coming from fraudulence as digital remittances do; they still allow organizations to placed stop-payments on them in case of reckoned illegal activity or mistake in handling.

Conclusion

In final thought, both electronic remittance strategies and conventional examinations happen with their personal collection of advantages and drawbacks when it comes to handling gaps. While electronic repayments are generally less complicated and much faster for organizations when it comes to calling off deals due to mistakes or believed deceptive activity; however, some vendors might not accept every type of electronic budget yet therefore there could possibly still be difficulties depending on who you're negotiating along with.

Standard newspaper cheques though might appear outdated but still remain an accepted type of payment worldwide due their ease of make use of and recognition just about everywhere. They do have some drawbacks when it happens to gaps, but they still offer businesses a means to cancel purchases if there are actually problems with them. Eventually, the option between electronic payments and standard examinations will certainly rely on the company's requirements and what works best for them.