What Does Refinance Broker Melbourne Do?

These brokers are quite much treated like VIPs and also you'll see the benefit! The reason is that brokers that operate through a collector have access to a better number of credit report companies.

Ask them what costs, if any kind of, are to be paid upfront and discover out what their payment price is. They may have a particular accreditation with the industrial arm of a bank or lender however, depending on the intricacy of your needs, it's constantly great to seek out someone with experience.

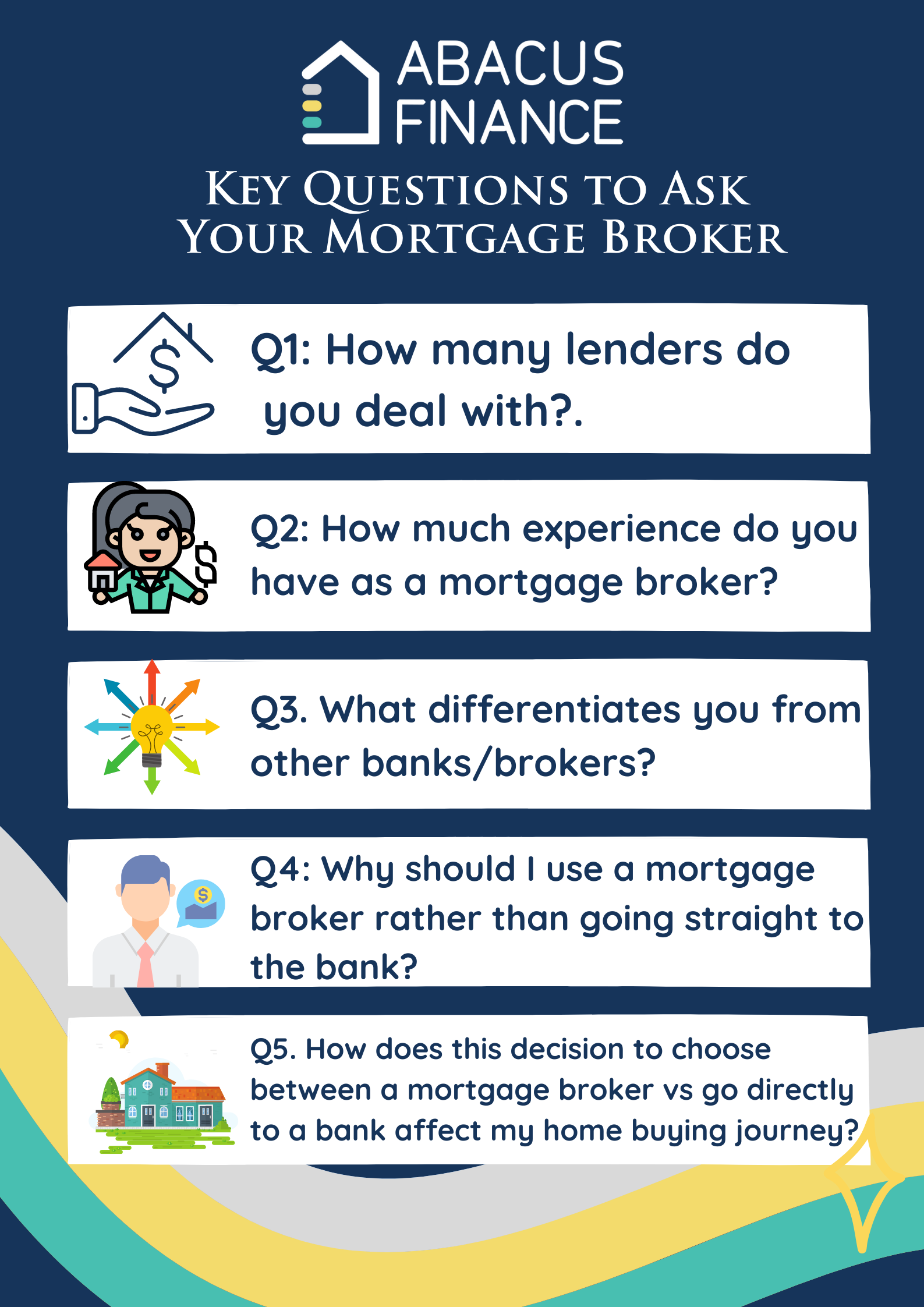

The various other problem is that brokers only associate with a choose few lenders that they are "approved" with and also do not offer products from lenders Australia-wide. Some brokers are extra restricted than others so be wary of a broker that only deals with ten loan providers instead of a broker that has upwards of 40 lending institutions on their panel.

Did they have a great experience? You might even intend to ask the broker for the call information of a few of their own clients. Considering that buying a building is just one of the greatest investments that you'll ever make, research loan items on your own and also always ask challenging concerns of your broker including what their payment rate is.

Mortgage Broker Melbourne for Beginners

You must never ever really feel like you're being pushed to join to a mortgage. You can always request even more time to consider your choice. An on the internet home mortgage broker may be easier yet at what cost? As your economic as well as personal scenario adjustments with time, whether it is because of having children, requiring to renovate or nearing retirement, you'll require a mortgage that advances with you.

From application, pre-approval, approval-in-principle (AIP or condition authorization) as well as negotiation, they ought to be there with you every action of the way and past. If you want to speak to among our senior home mortgage brokers for a free, no responsibility, just call us on or complete our online enquiry kind today.

The duty of a Mortgage Broker can be complicated, especially if you are an initial house customer - loan broker melbourne. Knowledgeable home mortgage brokers play a vital function in functioning as the go-between for you and available lending institutions. It pays to be knowledgeable about the different pros and also cons of collaborating with home mortgage brokers.

Mortgage brokers generally do not charge you a fee for their solution, yet rather gain commissions on finance they assist in arranging from the financial institution. They mostly earn money the same per bank, so you don't need to fret about your broker offering you prejudiced home mortgage items. Home loan brokers will certainly suggest mortgage items that are straightened with your one-of-a-kind circumstance.

Mortgage Broker Melbourne for Dummies

A great deal of mortgage brokers are brand-new startups that have actually not been around that lengthy. Not all home mortgage brokers are backed by a qualified assistance team.

Shore Financial sticks out among all various other home loan brokers as the # 1 trusted partner that property representatives are most likely to recommend in Australia. It has actually been awarded the best, large independent home loan broker, which implies you can trust that you're collaborating with a broker that has the scale, strength, and experience to eliminate for the ideal bargain for you.

If you are in the market for a home mortgage, you may be thinking about utilizing a home mortgage broker. In Australia, home mortgage brokers write more than 50% of all mortgage. So why are much more Australians selecting to utilize a home loan broker? In the write-up below we discover the pros and also disadvantages of utilizing a home loan broker for your following home mortgage.

They will bargain with financial institutions, cooperative credit union and also other credit service providers on your behalf, and also might be able to set up special bundles or offers. A home mortgage broker can also help you manage the process from application to settlement, giving suggestions along the road - mortgage broker melbourne. A mortgage broker will certainly do the leg job for you.

Melbourne Broker - The Facts

The solutions of a mortgage broker are typically at no expense to you, as the lender pays a compensation to the broker once the funding has actually resolved (refinance melbourne). This means that you have accessibility to a solution to get the very best lending for you without setting you back any type of additional. refinance broker melbourne. Similar to a medical professional or technician, mortgage brokers are experts in their field.

As an example, if a credit report service provider does not pay compensations, the broker might not include their fundings on the checklist of products they suggest (melbourne broker). Home loan brokers are urged by legislation to reveal the information of their payments with the intro of a disclosure paper under the Home mortgage and also Financing Organization of Australia's National Non-mortgage consumer debt Protection Act.

Unicorn Financial Services

Address: 1/30 Warwick Ave, Springvale VIC 3171, Australia

Phone: +61 3 8566 1288

Contact us on today for a private conversation on just how we can aid you.

This is a minimum requirement to work as a broker in Australia and will also aid to qualify you for further research. loan broker melbourne. There are several academic institutes that provide this program so see to it you do your research and select an acknowledged, accredited company. mortgage broker melbourne. This is not a requirement for licensing, it is extremely recommended that you proceed your studies after completing the Certificate IV.

The Only Guide for Mortgage Broker Melbourne

Your mentor will not just assist you via the first two years of your profession however they will generally additionally function as an aggregator, providing you access to a variety of lenders. There are a couple of choices in Australia, consisting of the Home loan and Financing Organization of Australia (MFAA) as well as the Money Brokers Organization of Australia (FBAA).