What Does Margin Mean In Spread Betting

👉🏻👉🏻👉🏻 ALL INFORMATION CLICK HERE 👈🏻👈🏻👈🏻

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 67% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider. You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money.

Trade over 11,000 instruments on the world's largest markets

Award-winning web and mobile platforms built for serious traders

Get market-moving news, analysis and exclusive educational content

For over 30 years, we've been the trusted trading provider for serious traders

Spread betting is a leveraged product, which means you only have to place a percentage of the full trade value to open a position. For example, if you placed a spread bet on a share you would need to deposit 20% of the full trade value as the margin requirement. View our spread betting margin rates for popular markets.

Get tight spreads, no hidden fees and access to 10,000+ instruments.

Get tight spreads, no hidden fees and access to 10,000+ instruments.

When trading with a margin account, the margin you will be required to deposit reflects a percentage of the full value of the position you wish to open. We refer to this as 'position margin' on our platform. The position margin will be calculated using the applicable margin rates, as shown in the product library area on the platform.

For shares, different margin rates may apply depending on the size of your position or the tier of your position (or a portion of your position) in that instrument. The portion of the position that falls within each tier is subject to the margin rate applicable to that tier.

In order to calculate the position margin, the level 1 mid-price (shown on our trading platform) is used.

Stake in Tier 1 x Tier 1 Margin rate

Stake in Tier 2 x Tier 2 Margin rate

The sum of: Stake in Tier 3 x Tier 3 Margin rate x level 1 mid-price x point multiplier

Stake in Tier 4 x Tier 4 Margin rate

Stake in Tier 5 x Tier 5 Margin rate

Based on the margin rates in the table below for Company ABC (GBP), a position of £65 per point, using the level 1 mid-price of 275.0 (£2.75), would require a position margin of £5,018.75.

Your position margin requirement is calculated as follows:

The notional value of your total position is: £17,875.00 (65 x 275).

Spread betting using margin allows you to open a position by only depositing a percentage of the full value of the position. This means that your losses will be amplified and you could lose all of your capital. Profits and losses are relative to the full value of your position. Learn more about our trading fees.

Spread betting using margin is not necessarily for everyone and you should ensure you understand the risks involved and if necessary seek independent professional advice before placing any spread bets.

See our spread betting guides to further your learning and consult our trading costs page. Compare our award-winning Next Generation platform features to MetaTrader 4 and choose the best trading platform to tailor for your individual trading needs: Next Generation vs MetaTrader 4.

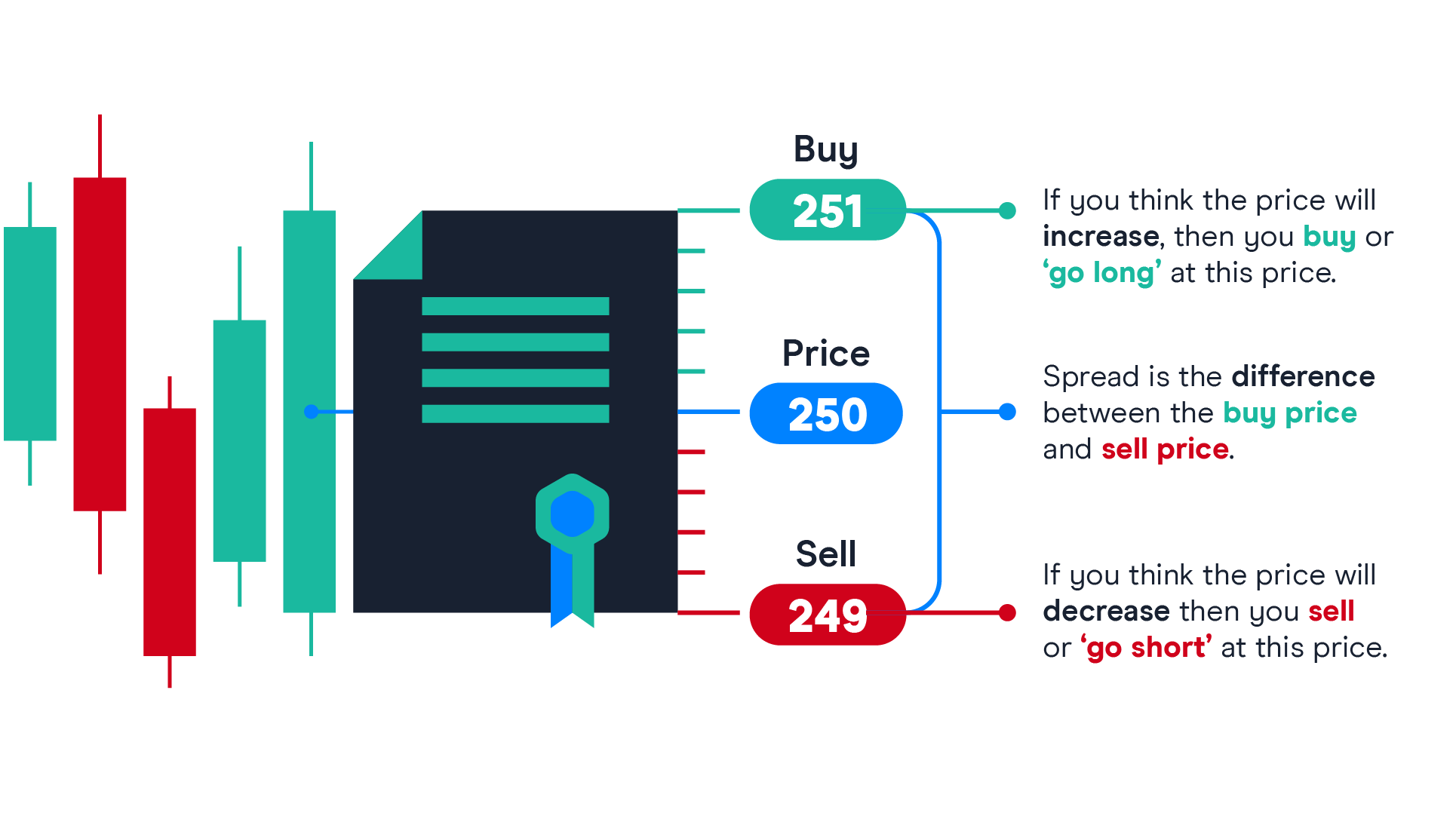

A spread refers to the difference between the buy and sell prices of an instrument in trading. The bid-ask spread is affected by a number of factors, including market volatility and liquidity. Discover our spread betting spreads.

Trading on margin when spread betting is an effective way for traders to gain greater exposure to the financial markets, including forex, shares and commodities. This requires traders to place a fraction of the full trade value as a deposit, which is known as the margin requirement. However, profits and losses will be based on the full value of your position. Open a spread betting demo account to practise trading on margin.

How much do I need to start spread betting?

You can deposit as much or as little capital as you want into your spread betting account, once you’ve opened an account with us. Leveraged trading means you only need to pay an initial deposit to open a trade, based on the instrument’s margin requirement. However, you need to have sufficient funds in your account to cover your margined trades and prevent account close-outs. Read more about the risks of spread betting.

How is spread betting margin calculated?

Spread betting position margin is calculated margin rates, which vary depending on the asset class (forex, indices, commodities) and specific instrument you trade on. Spread betting margin also depends on the size of the position that you wish to open. Learn more about our spread betting margins.

Are margin rates the same for spread betting and CFDs?

Our margin rates for financial assets are the same for both products, whether you’re spread betting or trading CFDs. These start relatively low at 3.3% for major forex pairs, and are higher for more volatile assets, such as shares, which have a margin rate of 20%. Check our spread betting margin rates.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

Get tight spreads, no hidden fees, access to 11,000 instruments and more.

Get greater control and flexibility for peak performance trading when you're on the go.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 67% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider. You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money.

CMC Markets UK plc (173730) and CMC Spreadbet plc (170627) are authorised and regulated by the Financial Conduct Authority in the United Kingdom.

Telephone calls and online chat conversations may be recorded and monitored. Apple, iPad, and iPhone are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Android is a trademark of Google Inc. This website uses cookies to obtain information about your general internet usage. Removal of cookies may affect the operation of certain parts of this website. Learn about cookies and how to remove them. Portions of this page are reproduced from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License.

This website uses cookies to optimise user experience. You can amend your cookie preferences by accessing our cookie policy.

You are here: Home > Trading FAQs > What is Margin in Spread Betting?

Spread betting is a leveraged traded product and spread betting providers will insist that you deposit a certain percentage of the total market exposure you take with them before they will permit you to open a trade. This deposit is referred to as margin and acts as a guarantee that you will honour the contract. Margin is sometimes referred to as the ‘notional trading requirement’, or NTR for short.

To open a spread betting trade, you need to deposit with the spread betting company a margin amount, which will be a percentage of the total value of the spread trade. For example, if you buy a spreadbet over ABC stock, you may need to pay a margin equal to 5% of the current ABC’s share price. The initial margin amount will be withdrawn from your account by the spread betting provider when you place the trade.

Margin requirements for each market a spread betting company offers can be found by clicking on the information icon which is located next to the instrument you’ve chosen. Alternatively, you can refer to the provider’s Market Information Sheet. Different spread betting providers will have different margin requirements for spreadbet over the same underlying asset. Margin requirements will tend to be higher for spreadbets over stocks than for other assets.

“The amount you’ll need to deposit with the spread betting provider depends on the underlying financial instrument and the more liquid the market you intend to trade, the less you’ll need to put down.”

For instance, a currency spread bet might only require a 1% margin, an index bet might carry a 5% margin while FTSE 100 blue-chip stocks usually require a 10% margin. On the other hand AIM companies with low capitalisations might require margins of 25% and more.

Margin trading is all about leverage and gearing. Spread betting is geared which means you do not have to pay the full price of the underlying stocks. The only requirement is that you deposit an initial deposit referred to as the ‘initial margin’.

Financial spread betting is a very good example of margin trading. The spread betting provider will decide on the margin requirement you are required to deposit to open a trade. So for instance, if stocks in William Hill are trading at 156.10p and you wish to buy 5000 shares, instead of having to pay the full purchase price (156.10 x 5000) of GBP7,805 you might only have to put down 10% margin, in which case you would only have to tie up £780.5 of your funds.

This also means that spread betting being a margin traded product, it allows for a much greater exposure for a given deposit. Rather than only buying 500 shares, you could deposit the margin and have exposure for 5000 shares!

Therefore you might only need 1000 quid to purchase spread betting positions in different stocks up to a value of, say £10,000. If your investment rises to £12,000 – equalling a 20% rise in the value of the position – you will in fact make an incredible 200% return on your initial investment, as you only invested £1,000 initially.

The good and bad element in it is the leverage involved….

The average deposit you require to buy a spreadbet rather than, for instance, a conventional share purchase is between about 10 per cent and 35 per cent, whereas when you buy a share you have to stump up 100 per cent of the purchase price.

The risk here should be clear. With such generous margins, it might look tempting to take on a much greater exposure and should the market start moving against your position, it means that you will still be liable in the same way as if you have bought these shares and paid the full price. If a position keeps going the wrong way, your broker will ask you to top up the account to maintain the margin requirement, referred to as a ‘margin call’. So, you really have to use judgement and utilise margin with care and trade with a disciplined approach so as to avoid any nasty surprises!

Let’s take the case where you decide to place a spreadbet on Company XYZ with a total exposure of £10,000. If the trade comes with an initial margin rate of 10%, you would need to deposit an initial £1000 into your spread betting account to open the trade. However you are still exposed to the full value of the trade i.e. £10,000. This means that should your trade moe against you, you run the risk of losing an amount exceeding the initial £1000 deposit and may therefore be required to put up more funds at short notice to keep the position open.

So even though a spread betting provider might only require you to put up just 5% margin down for a bet on a stock, generally it is wiser to put down more. And by more I mean at least 15% and setting stops at around 10%. If you deposit only 5% and the markets move against your position, a stock could easily go down 5% which would wipe you out in no time! And then should the stock bounce back, you’ll end up not only stopped out and lost your 5% deposit, but your trading mindset would have been dealt a blow!

Remember that margin is there to help you spreadbet responsibly, ensuring that you never overstretch your financial means. It is important to note that each market has a different margin requirement and that in general margin requirements are a good measure of a market’s volatility. Generally speaking, the more you need on deposit with the provider to open a position, the more volatile the market is considered to be.

The main foreign exchange pairs and the larger indices will normally have very low margin rates of 1% to 2%. For example, most traders tend to start with the FTSE 100 index or its component shares, as they tend not to require too much margin. The margin requirement for a £1 bet on the FTSE 100 index could be anything from £30 to £150 (different providers offer different margins for the same markets), whereas a £1 bet on the Nikkei might mean a deposit of £300 to £500 is required. The usual margin requirement for UK shares varies between 5% and 10% for the large and mid-cap stocks of the FTSE 350. Smaller caps including those listed on Aim are usually more volatile and less liquid, which is why they often need a deposit of 25% or more.

Remember that you can reduce your margin requirement when you go over certain thresholds by placing a guaranteed stop loss even though your buy price is minutely increased. It is also worth noting it is not unheard of spread betting providers upping margin rates at short notice – needless to say if you hold spread bets where the margin rating increases, you may be at risk of your positions being closed if you don’t have sufficient free cash available.

Spreadbets also allow you to make money from falling markets by going what is called ‘short’ but again, that’s something that needs a fair bit of homework.

Note: Bear in mind that most people live on margin. Buying a house with a mortgage is little different from spreadbets – less volatile usually, but far harder to get out of if you have to.

Copyright © 2021 Spread-Betting.com

Wife Interracial Compilation

Nude Mom Mult

Karma Kandara Private Beach

The Best Of Private 25 Latex Sex

Big Mom Hard Porno

Spread Betting Margin - What it is and how it works ...

Spread Betting Margin Explained | CMC Markets

What is Margin in Spread Betting?

How margin works with spread betting - SpreadCo

What Is Margin In Spread Betting? by the Pit Village Trader

Margin Calls in Spread Betting

Spread Betting Margin & Leverage Explained | City Index UK

Betting Margins Explained | How to Calculate Sports Margins

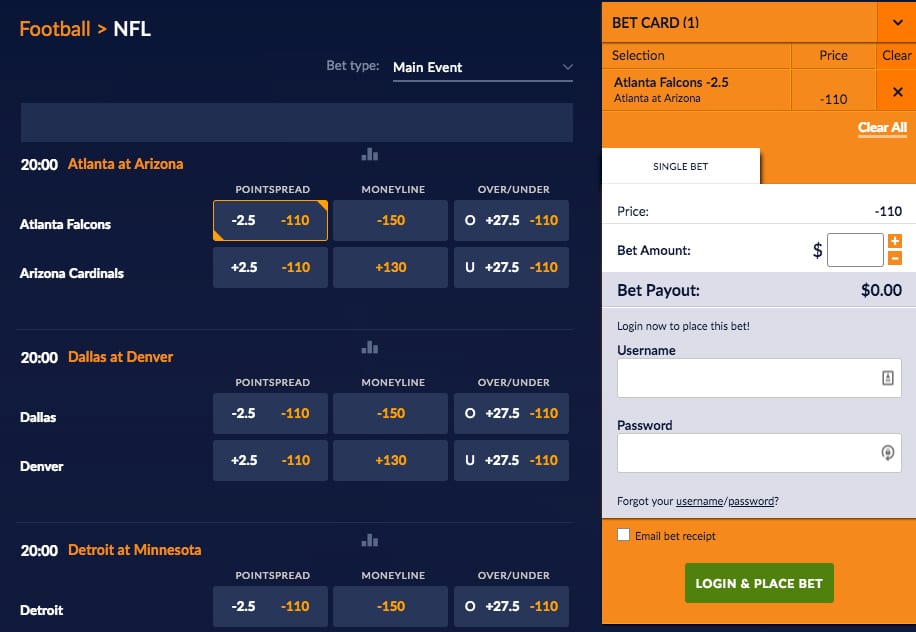

Point Spread Betting Explained | Bookies.com

What Does Margin Mean In Spread Betting