What Do Betting Spreads Mean

💣 👉🏻👉🏻👉🏻 ALL INFORMATION CLICK HERE 👈🏻👈🏻👈🏻

Copyright © 2008-2021 OddsShark. All rights reserved. Contact About Us Terms RSS

A point spread in sports is a way for oddsmakers to make a matchup between two unbalanced teams more balanced by giving points to or taking points away from each team.

The favorite in a matchup, indicated by a minus (-) sign, will have a given number of points taken away from its final score, while the underdog , known by its plus (+) sign, will have the same number of points added to its final score.

Be sure to check out our sports betting glossary to assist you with some of the terms used in our sports betting guides.

NFL spread betting is probably the most common and popular way to bet on football as it adds some excitement and better odds over just picking an outright winner. If you are new to betting the NFL altogether, be sure to check out our great How to Bet on the NFL guide.

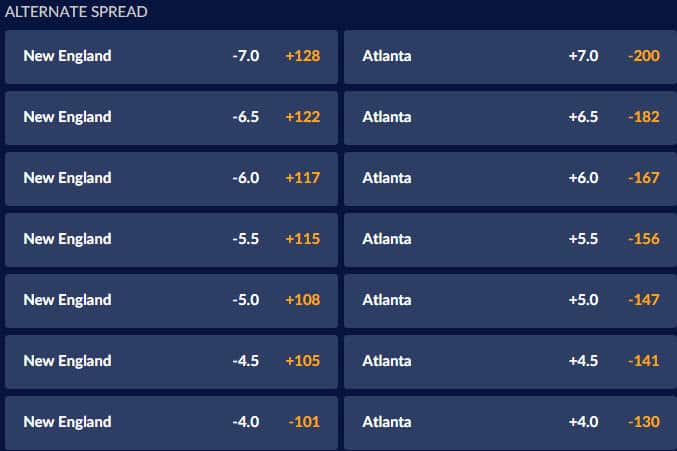

Here is an example of a point spread for an NFL game and how it would look:

As you can see, Dallas is the 4.5-point favorite, which means the Cowboys would need to win the game by five points or more to win the bet. Conversely, New York is a 4.5-point underdog, which means to win the bet the Giants would need to win outright or not lose the game by more than four points.

If the Cowboys win 20-17, they win by three points and do NOT cover the 4.5 points, but the Giants have “covered the spread” by staying within 4.5 points.

Point spread wagers often will be put into parlays in which you make multiple bets on one slip for a larger payout. If you have a few games that you’d like to wager on and want to see how a payout changes by adding or subtracting games, feel free to play around with our odds calculator to help you learn how odds work.

There are certain point spreads that bettors should be aware of that are known as “ key numbers .” These spreads are directly related to how points are scored in football such as a field goal (three points) or a touchdown (seven, assuming a successful one-point conversion). The three main key numbers in NFL point spread betting are 3, 7 and 10, representing a field goal, a touchdown and a field goal plus a touchdown.

The two most common margins of victory are three and seven points because of the type of scoring in the NFL. This is why you should shop around at different sportsbooks to find better lines to maybe gain an edge over the key numbers like getting a +3.5 spread as opposed to just +3 – you can get a quick look at the different books at our NFL odds page .

You can also “buy” points with a “ teaser bet ” in which you can move a +7 line to +8 but the odds may shift from -110 on the +7 to -135 at +8, meaning less of a return on your winning ticket. You can have key numbers on OVER/UNDER totals as well.

The most common betting line for a point spread is -110. A -110 line on either side is like paying a tax or commission to the sportsbook. Bettors would pay 10 percent (aka juice) to the sportsbook, which is essentially a fee for brokering the wager. So, the -110 indicates that a bettor must risk $110 to win $100. Some sportsbooks will even reduce the juice for you, which means you can earn the same $100 payout but risk less money to do it.

For example, if you see -7.5 (-107), then you only need to wager $107 to win $100 (saving you $3). If you see -7.5 (-102), then you only need to wager $102 to win $100.

There are three potential outcomes of your point spread wager: you win, you lose or you push (a tie). Typically, a point spread has odds of -110 for either side of the bet. In the example above between the Cowboys and Giants, the point spread is 4.5 points, while the odds are -110, meaning you would have to wager $110 to earn a profit of $100, or a profit of $0.91 for every dollar you bet.

A losing bet is quite simply you betting on the Cowboys -4.5 and they only win by four, for example. You lose the money that you placed on that bet.

A push wouldn’t happen in the example above because a team can’t win by half a point. It is very common, though, to have a betting line of +3/-3. Let’s say a favorite wins by exactly three. That is called a push and you simply get your money back with no profit and no loss.

PK or Pick’em means that the matchup is so close that there’s neither a favorite nor an underdog. Whatever team you pick to win when betting on the point spread simply has to win the game and the margin of victory doesn’t matter. In these cases, there may not even be a point spread available for the game and you can only bet on the moneyline .

This is a very common occurrence in sports betting and sportsbooks have the full right to shift the spread or odds for any given match prior to its start. Many factors can influence a change of the spread such as injuries, the number of bets coming in for either team or the weather, to name a few. Depending on the timing of placing the bet, the bettor can also have an advantage or a disadvantage depending on which way the spread has shifted.

Here is an example of a change in the spread:

If bettors had wagered on Dallas on Monday, they would be at a disadvantage compared to bettors who waited until Thursday because the Thursday bettors now only need Dallas to win by four points instead of five. But it can also go the other way:

If bettors had wagered on Dallas on Monday, they would now have the advantage over the bettors who waited until Thursday because the Thursday bettors need Dallas to win by eight points or more instead of only five.

Yes, in fact, sportsbooks also release spreads for different points in the match like after the first quarter or first half, which is called live betting or in-game betting . Oddsmakers will set spreads for those different checkpoints and it’s up to you as the bettor to determine which team will lead or trail by a certain number of points after that unit of time.

Here is an example of a first-half spread:

As you can see, Dallas is a 2.5-point favorite to lead the first half by three points or more whereas New York is a 2.5-point underdog, which means the Giants would need to be ahead or not trail by more than two points at the end of the first half.

The popularity of the point spread bet in the NFL is equally shared by NBA bettors and it works essentially the same way. When Giannis Antetokounmpo and the Milwaukee Bucks tip off at Madison Square Garden against the New York Knicks, the Bucks are going to be -800 on the moneyline but may have a point spread of -13.5 points with odds of -110, with the Knicks coming back at +13.5 with a -110 line.

As seen in the NFL with line movement throughout the week, in basketball, you’ll see the line movement occur much faster in a shorter time frame. When we looked at key numbers in the NFL, it was in regard to scoring. A similar approach can be taken in the NBA but it’s more connected to possessions. Look for key numbers such as five and seven because they tend to represent two- and three-possession games.

Be sure to check out our How to Bet on the NBA guide for more options and assistance in getting you in on the action for basketball.

A puckline is what a spread is called in the NHL, while a runline is associated with MLB betting. In both cases, the spread is almost always -1.5 for the favorite and +1.5 for the underdog, but the betting odds fluctuate a lot more than in NBA or NFL point spreads because the spread doesn’t usually change. There are instances in both the NHL and MLB where you see a 2.5-point runline or puckline but those are few and far between, typically between your league leader and a cellar-dweller.

Need more winning picks? Get $60 worth of premium member picks from Doc’s Sports – a recognized leader and trusted name in sports handicapping since 1971.

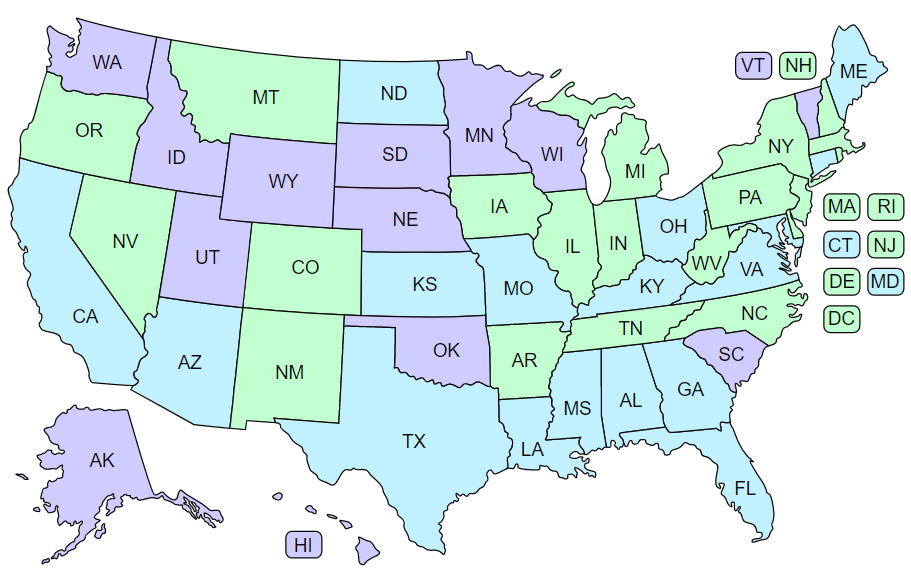

The handicapping, sports odds information contained on this website is for entertainment purposes only. Please confirm the wagering regulations in your jurisdiction as they vary from state to state, province to province and country to country. Using this information to contravene any law or statute is prohibited. The site is not associated with nor is it endorsed by any professional or collegiate league, association or team. Odds Shark does not target an audience under the age of 18. Please visit gambleaware.co.uk or gamcare.org.uk for guidelines on responsible gaming.

Spread betting allows traders to bet on the direction of a financial market without actually owning the underlying security.

Spread betting is sometimes promoted as a tax-free, commission-free activity that allows investors to speculate in both bull and bear markets, but this remains banned in the U.S.

Like stock trades, spread bet risks can be mitigated using stop loss and take profit orders.

Sponsored

Compete Risk Free with $100,000 in Virtual Cash

Put your trading skills to the test with our

FREE Stock Simulator.

Compete with thousands of Investopedia traders and trade your way to the top! Submit trades in a virtual environment before you start risking your own money.

Practice trading strategies

so that when you're ready to enter the real market, you've had the practice you need.

Try our Stock Simulator today >>

Spread betting refers to speculating on the direction of a financial market without actually owning the underlying security.

A seller is any individual or entity, who exchanges a good or service in return for payment. In the options market, a seller is also called a writer.

Index arbitrage is a trading strategy that attempts to profit from the differences between actual and theoretical prices of a stock market index.

A leg is one component of a derivatives trading strategy in which a trader combines multiple options contracts or multiple futures contracts.

A futures contract is a standardized agreement to buy or sell the underlying commodity or other asset at a specific price at a future date.

A box spread is an options arbitrage strategy that combines buying a bull call spread with a matching bear put spread.

#

A

B

C

D

E

F

G

H

I

J

K

L

M

N

O

P

Q

R

S

T

U

V

W

X

Y

Z

Investopedia is part of the Dotdash publishing family.

Spread betting is a derivative strategy, in which participants do not own the underlying asset they bet on, such as a stock or commodity. Rather, spread bettors simply speculate on whether the asset's price will rise or fall, using the prices offered to them by a broker.

As in stock market trading, two prices are quoted for spread bets—a price at which you can buy (bid price) and a price at which you can sell (ask price). The difference between the buy and sell price is referred to as the spread. The spread-betting broker profits from this spread, and this allows spread bets to be made without commissions, unlike most securities trades.

Investors align with the bid price if they believe the market will rise and go with the ask if they believe it will fall. Key characteristics of spread betting include the use of leverage, the ability to go both long and short, the wide variety of markets available, and tax benefits.

If spread betting sounds like something you might do in a sports bar, you're not far off. Charles K. McNeil, a mathematics teacher who became a securities analyst—and later a bookmaker—in Chicago during the 1940s has been widely credited with inventing the spread-betting concept. But its origins as an activity for professional financial-industry traders happened roughly 30 years later, on the other side of the Atlantic. A City of London investment banker, Stuart Wheeler, founded a firm named IG Index in 1974, offering spread betting on gold. At the time, the gold market was prohibitively difficult to participate in for many, and spread betting provided an easier way to speculate on it.

Despite its American roots, spread betting is illegal in the United States.

Let's use a practical example to illustrate the pros and cons of this derivative market and the mechanics of placing a bet. First, we'll take an example in the stock market, and then we'll look at an equivalent spread bet.

For our stock market trade, let's assume a purchase of 1,000 shares of Vodafone (LSE: VOD ) at £193.00. The price goes up to £195.00 and the position is closed, capturing a gross profit of £2,000 and having made £2 per share on 1,000 shares. Note here several important points. Without the use of margin, this transaction would have required a large capital outlay of £193k. Also, normally commissions would be charged to enter and exit the stock market trade. Finally, the profit may be subject to capital gains tax and stamp duty.

Now, let's look at a comparable spread bet. Making a spread bet on Vodafone, we'll assume with the bid-offer spread you can buy the bet at £193.00. In making this spread bet, the next step is to decide what amount to commit per "point," the variable that reflects the price move. The value of a point can vary.

In this case, we will assume that one point equals a one pence change, up or down, in the Vodaphone share price. We'll now assume a buy or "up bet" is taken on Vodaphone at a value of £10 per point. The share price of Vodaphone rises from £193.00 to £195.00, as in the stock market example. In this case, the bet captured 200 points, meaning a profit of 200 x £10, or £2,000.

While the gross profit of £2,000 is the same in the two examples, the spread bet differs in that there are usually no commissions incurred to open or close the bet and no stamp duty or capital gains tax due. In the U.K. and some other European countries, the profit from spread betting is free from tax.

However, while spread bettors do not pay commissions, they may suffer from the bid-offer spread, which may be substantially wider than the spread in other markets. Keep in mind also that the bettor has to overcome the spread just to break even on a trade. Generally, the more popular the security traded, the tighter the spread, lowering the entry cost .

In addition to the absence of commissions and taxes, the other major benefit of spread betting is that the required capital outlay is dramatically lower. In the stock market trade, a deposit of as much as £193,000 may have been required to enter the trade. In spread betting, the required deposit amount varies, but for the purpose of this example, we will assume a required 5% deposit. This would have meant that a much smaller £9,650 deposit was required to take on the same amount of market exposure as in the stock market trade.

The use of leverage works both ways, of course, and herein lies the danger of spread betting. As the market moves in your favor, higher returns will be realized; on the other hand, as the market moves against you, you will incur greater losses. While you can quickly make a large amount of money on a relatively small deposit, you can lose it just as fast.

If the price of Vodaphone fell in the above example, the bettor may eventually have been asked to increase the deposit or even have had the position closed out automatically. In such a situation, stock market traders have the advantage of being able to wait out a down move in the market, if they still believe the price is eventually heading higher.

Despite the risk that comes with the use of high leverage, spread betting offers effective tools to limit losses .

Risk can also be mitigated by the use of arbitrage, betting two ways simultaneously.

Arbitrage opportunities arise when the prices of identical financial instruments vary in different markets or among different companies. As a result, the financial instrument can be bought low and sold high simultaneously. An arbitrage transaction takes advantage of these market inefficiencies to gain risk-free returns.

Due to widespread access to information and increased communication, opportunities for arbitrage in spread betting and other financial instruments have been limited. However, spread betting arbitrage can still occur when two companies take separate stances on the market while setting their own spreads.

At the expense of the market maker, an arbitrageur bets on spreads from two different companies. When the top end of a spread offered by one company is below the bottom end of another’s spread, the arbitrageur profits from the gap between the two. Simply put, the trader buys low from one company and sells high in another. Whether the market increases or decreases does not dictate the amount of return.

Many different types of arbitrage exist, allowing for the exploitation of differences in interest rates, currencies, bonds, and stocks, among other securities. While arbitrage is typically associated with risk-less profit, there are in fact risks associated with the practice, including execution , counterparty, and liquidity risks. Failure to complete transactions smoothly can lead to significant losses for the arbitrageur. Likewise, counterparty and liquidity risks can come from the markets or a company’s failure to fulfill a transaction.

Continually developing in sophistication with the advent of electronic markets, spread betting has successfully lowered the barriers to entry and created a vast and varied alternative marketplace.

Arbitrage, in particular, lets investors exploit the difference in prices between two markets, specifically when two companies offer different spreads on identical assets.

The temptation and perils of being overleveraged continue to be a major pitfall in spread betting. However, the low capital outlay necessary, risk management tools available, and tax benefits make spread betting a compelling opportunity for speculators.

https://www.oddsshark.com/sports-betting/point-spread-betting

https://www.investopedia.com/articles/active-trading/082113/what-spread-betting.asp

Younger Boy Mature Homemade

Xvideos Mama I Sin Com

Porno Fucked My Wife After A Party

What Is Point Spread Betting? | How to Bet on Point Spreads

What Is Spread Betting? - Investopedia

A Simple Explanation: How to Read Sports Betting Odds ...

How to Read Betting Odds | Moneyline.com

How To Read Sports Betting Odds | What Do + and – In Odds ...

How to Read Football Point Spreads: What the Odds and ...

What Do The + and The – Signs Mean in Sports Betting ...

How Do Betting Odds Work in Casino & Sports Betting

What does the + and - mean in sports betting - Sports ...

What Do Betting Spreads Mean