Weekly Digest: New Fintech Records, Appboxo Funds, Japanese Brewery Deals

Maria SparkEvery week, the startup ecosystem is filled with new deals, funds, and market records. Let us review the brightest events of the last week.

Appboxo Raised $7M in the Latest Funding

The Appboxo`s solutions enable companies to discover and implement full-screen mini-applications and monetize their userbase. With the help of this platform, users can easily turn their ideas into super apps adding various functions for ordering food delivery, booking tables in restaurants, etc. All this will take just a couple of minutes so you can quickly start providing multiple services. On top of that, service providers can create embeddable mini-apps and develop new partnerships to drive affiliate traffic to their mini-apps.

The company was established in 2019 by Nursultan Keneshbekov and Kaniyet Rayev and is headquartered in Singapore. Their mission was to develop a powerful ecosystem of disruptive applications.

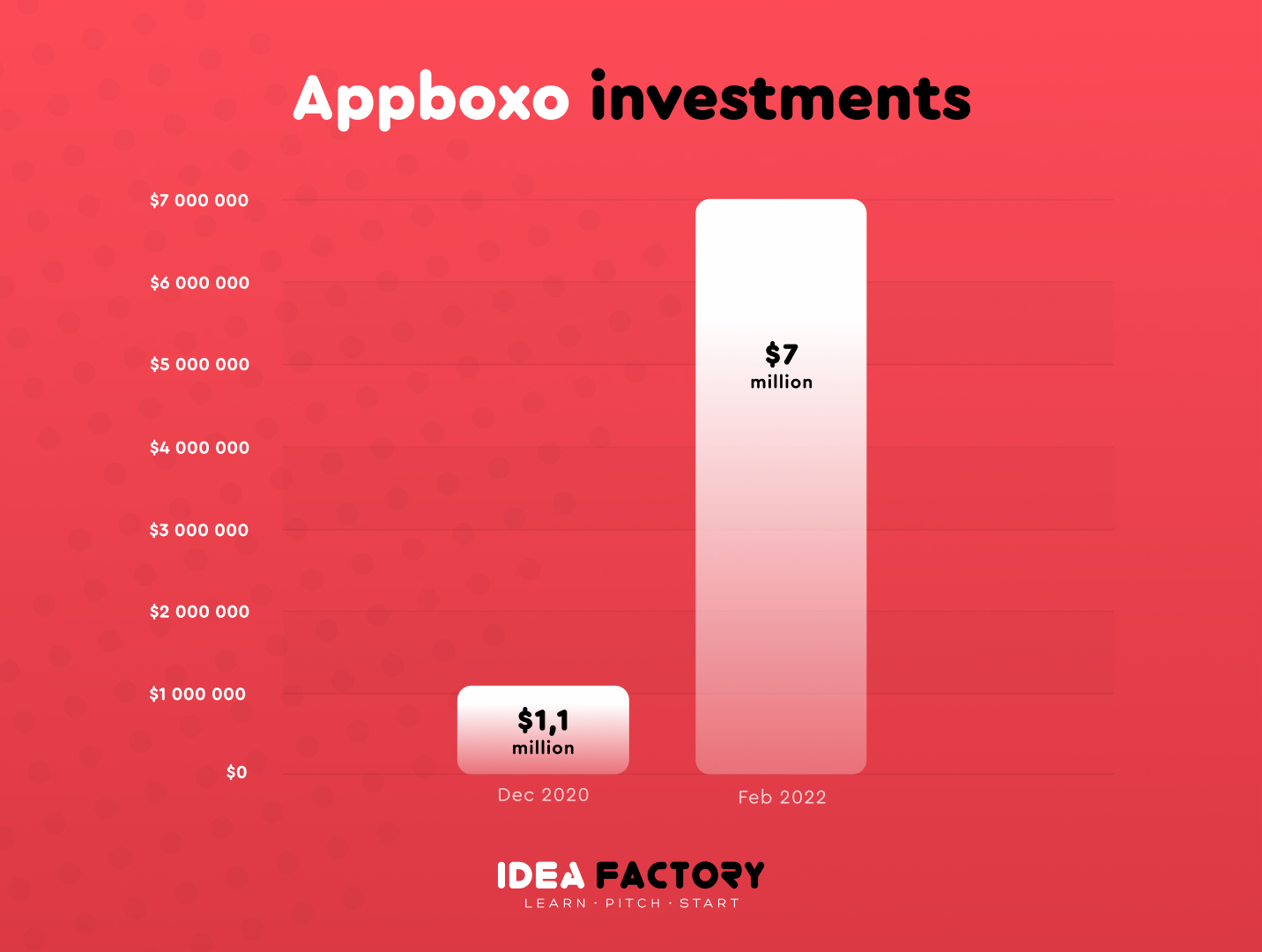

In 2020, they raised $1,1 million investments within a seed funding round from 500 Southeast Asia, Antler, Plug and Play Tech Center, and others. On 16 February 2022, Appboxo attracted $7 million in Series A funding. The round was led by RTP Global, Antler, and 500 Southeast Asia, as well as new investors SciFi VC, Gradient Ventures – Google’s AI-focused venture fund, and business angels Huey Lin and Kayvon Deldar.

The startup intends to allocate the money for developing a new app Shopboxo. It is aimed to help businesses to set up online stores providing their goods and services directly to consumers. Shopboxo empowers entrepreneurs with all the necessary tools to successfully manage their applications from their smartphones.

For the time being, the startup is collaborating with some of the largest super apps from Southeast Asia, India and South Africa, including GCash, Paytm, and VodaPay. Notably, the company has over 500 million users and helped more than 250 small and medium enterprises.

TripleDot Studios Is a New Unicorn

The startup develops casual mobile games such as solitaire apps and puzzle games. Three friends came up with an idea to build a studio of innovative games and founded TripleDot in 2017 with a head office in London. To date, the company has created a number of popular games such as Wooduku, Word Hop, Solitaire. The platform is visited by 30 million people per month.

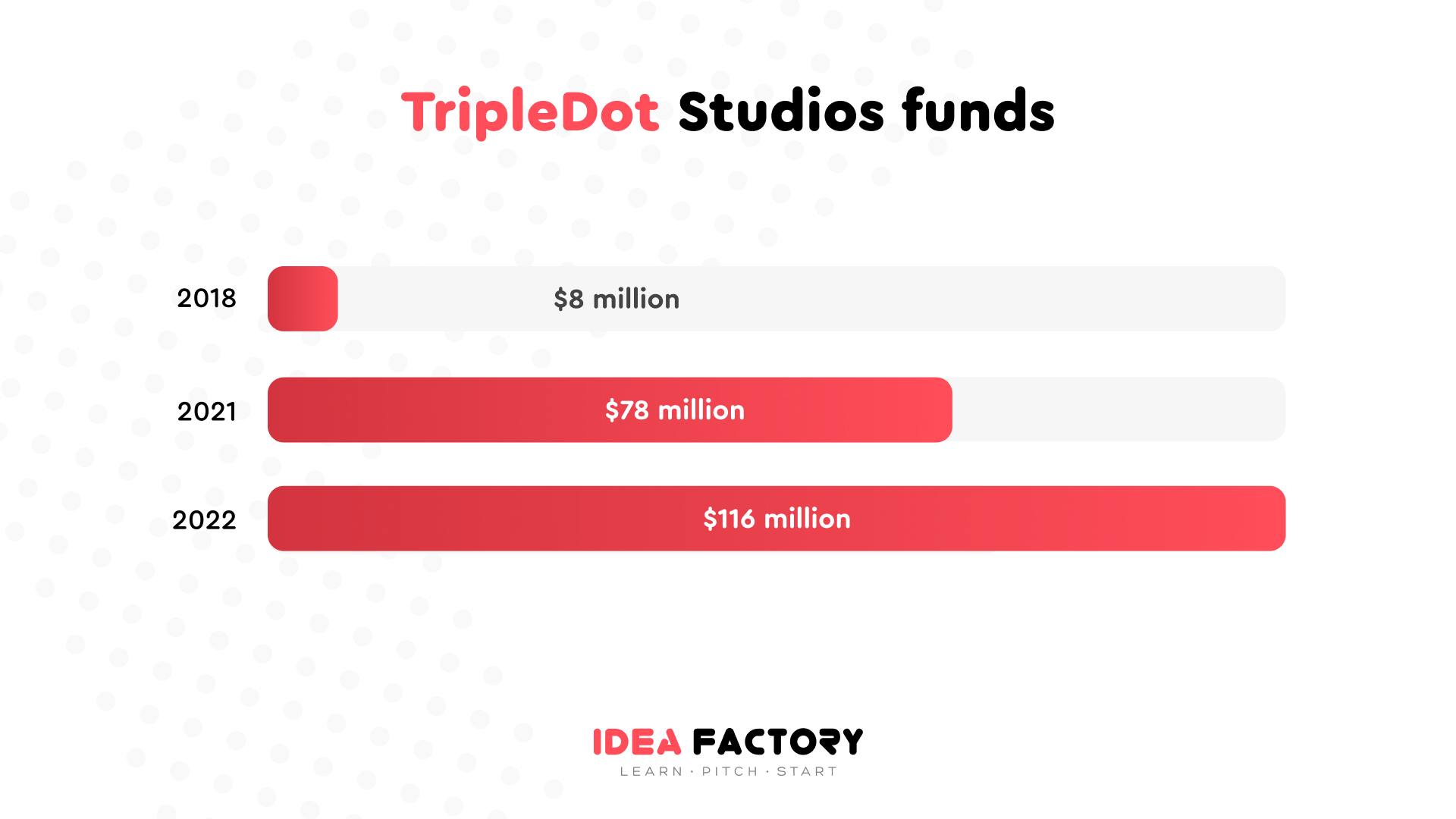

In 2018, the startup attracted $8 million and $78 million in April 2021. On February 14 2022, raised $116 million from 20VC, Lightspeed Ventures and Access Industries funds. The company's valuation at the end of the round reached $1,6 billion making the startup a new unicorn. In total, TripleDot raised $202 million including the current round.

Among the latest deals of Access Industries, there is a participation in a $60 million round in the Norwegian game studio PortalOne, $300 million in the telemedicine company Cerebral, $857 million in the American Archer Aviation.

Surge in the FinTech industry

According to the KPMG Pulse of Fintech report, the market broke a new record having exceeded 5,000 transactions last year.

Notably, the largest fintech agreements in the second half of 2021 included the acquisition of the Danish payment system Nets by the Italian Nexi for $9,2 billion and the merger of Calypso Technology, a developer of cloud fintech platforms, and AxiomSL for $3,75 billion. Among other prominent deals, there was the acquisition of PayPal by the Japanese company Paydy for $2,7 billion.

In the second half of 2021, four venture round worth over $1 billion were held. Particularly, the American company Generate raised $2 billion, the Brazilian Nubank and the American mobile banking provider Chime attracted $1,1 billion, and FTX gained $1 billion as well.

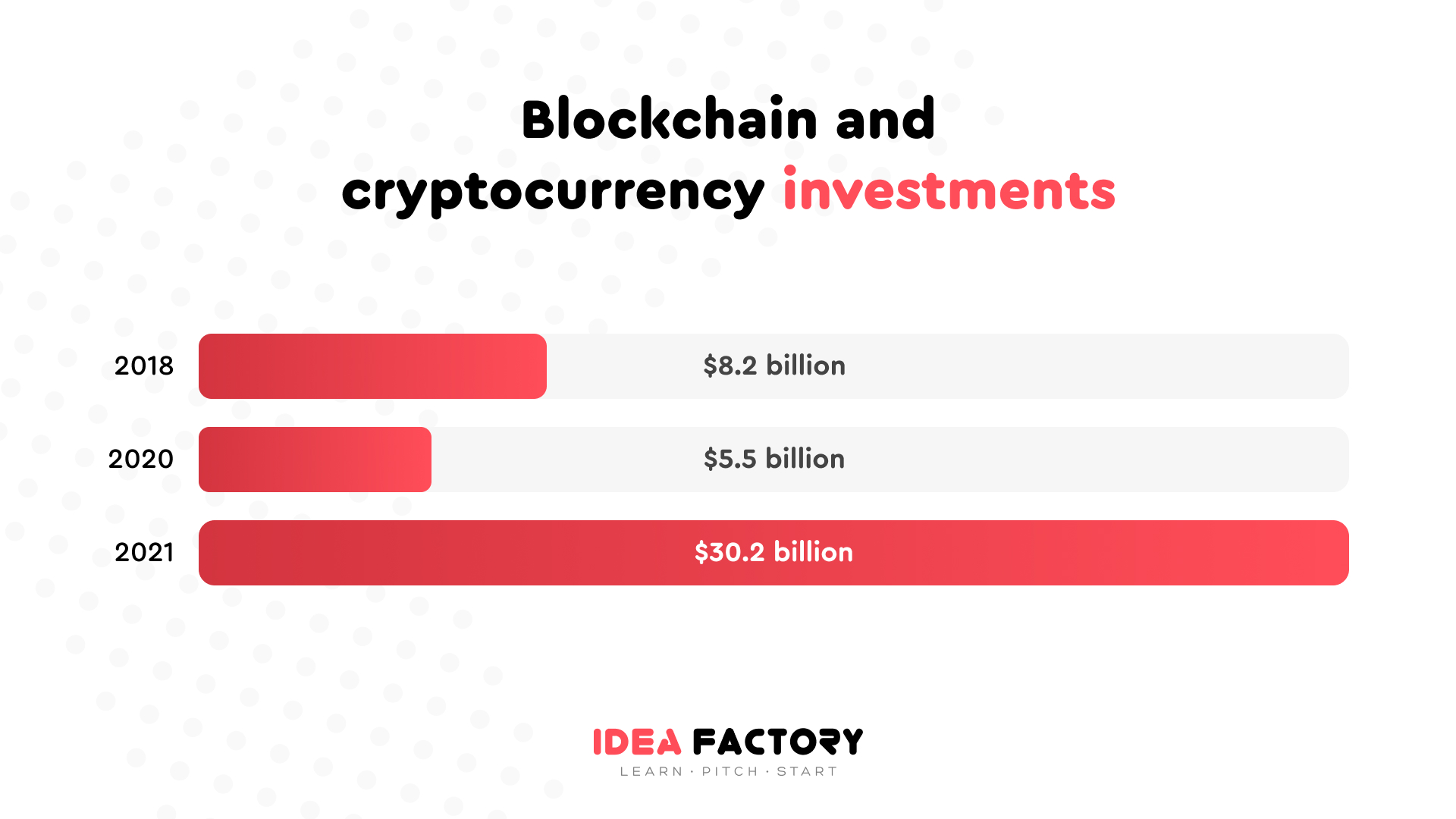

Blockchain and cryptocurrencies have attracted record investments of $30,2 billion compared to $5,5 billion in 2020, which is three times higher than the previous record of $8,2 billion recorded in 2018.

KPMG adds that the high activity in the field of investments and transactions reflects the growing recognition of the potential role of cryptocurrencies and underlying technologies in modern financial systems.

Japan`s Kirin to sell a 40% share to a Chinese Brewery

Kirin supervises domestic beverage business and provides specialized services. It was founded in 1888 and is regarded as a "Japanese-style pilsner".

The Chinese investment fund Plateau Consumer Ltd has agreed with the Japanese Kirin Holdings Ltd. to acquire its 40% stake in a joint venture operating in China with the brewing company China Resources Enterprise Ltd.

China Resources is engaged in the production of soft drinks. This is a Chinese state-owned conglomerate that runs multiple businesses in Hong Kong and Mainland China.

According to Kirin, its stake sale results from the revision of the company's business strategy. They are intended to keep collaborating with China Resources and, in particular, sustain the license agreements for the use of intellectual property.

Previously, Kirin ceased to cooperate with Myanmar Economic Holdings Public Company Limited, which is controlled by the military authorities of Myanmar, and left its market.

YallaMarket Raised $2,2M

This is a service of express delivery of products. The startup offers home delivery to customers for ordering groceries and other goods. It was established in 2021 with a head office in Dubai, UAE.

In February 2022, the service attracted $2,2 million from Qatar Technical Angels Doha Fund and the Angel Deck Club of venture investors.

The previous round of the company was held in December 2021. The project managed to raise $2.3 million from funds of local Wamba and Dubai Angel investors, as well as private Dubai and Russian investors during the pre-seed round. After the funding, the startup`s valuation amounted to $10 million.

The total amount of YallaMarket`s investments exceeded $5 million in the course of two rounds. The startup is planning to allocate the money for opening new dark warehouses in Dubai. It is also preparing for the next round which is scheduled for March 2022.

Since the closing of the preliminary seeding round, the team has increased revenue and the amount of orders fourfold while the number of mobile apps downloads has grown by 250% compared to November 2021. On top of that, their delivery area has been expanded thanks to the opening of new outlets in the Dubai Marina and Dubai Silicon Oasis districts.