Weekly Digest: Cybersecurity Boom, Acquisition of Tegna, Doubling of Berkshire`s Net Profit

Maria SparkEco-friendly Home Goods Startup Raises $20M

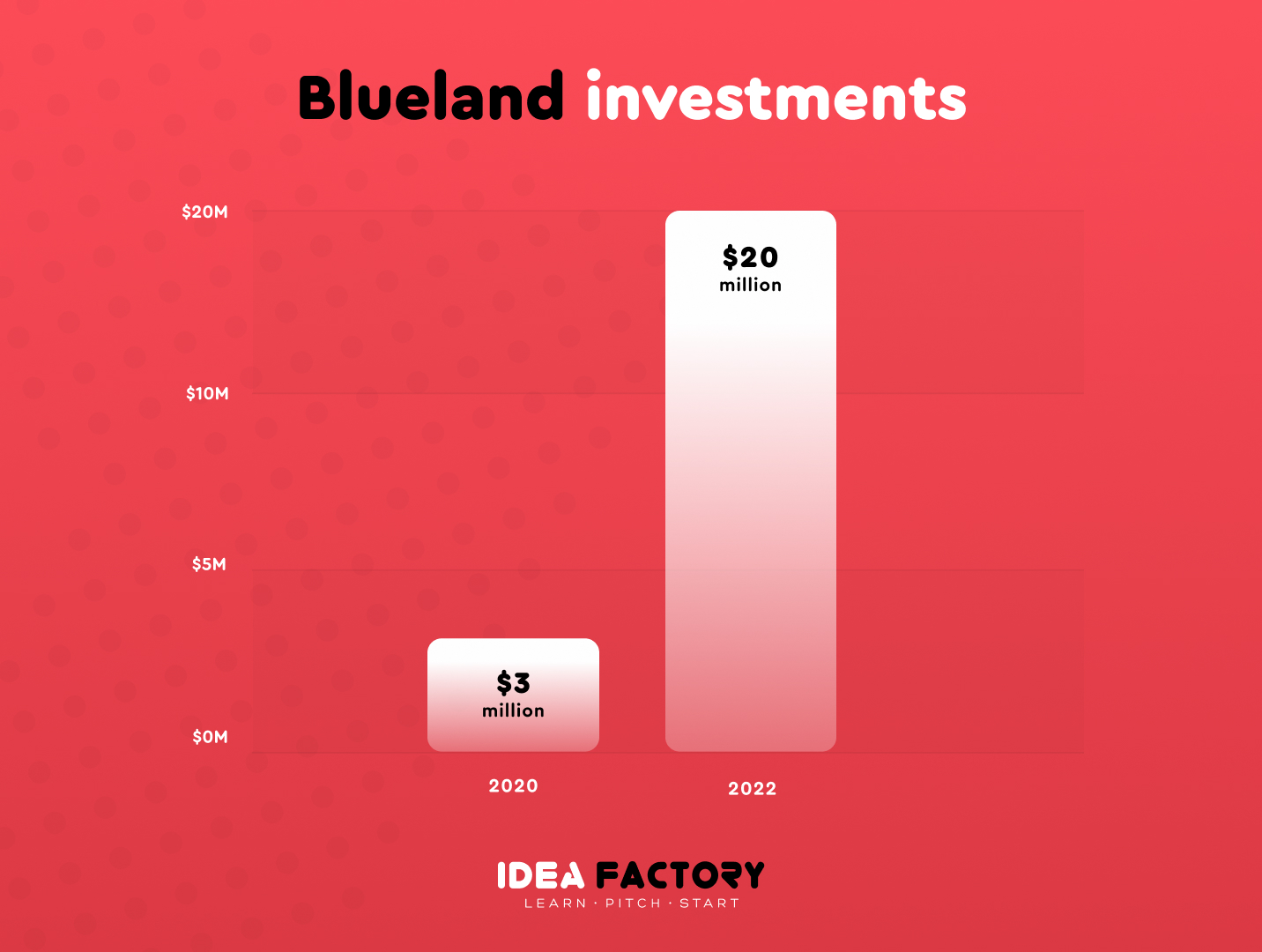

On February 16, Blueland attracted $20 million from Prelude Growth Partners within a seed funding. In 2020, the company raised $3 million, including from musician Justin Timberlake. The startup itself was valued at $13,5 million. Overall, the amount of investments amounts to $35 million. Blueland plans to allocate the money for eliminating the single-use from home cleaning.

What is Blueland?

The company revolutionizes cleaning to end single-use plastic using conscious ingredients and materials. Blueland does not have offline stores but customers can subscribe to tablets that will be delivered to their homes.

Since its foundation, the manufacturer of household chemicals has delivered 10 million products to the United States, and its products were purchased by over 1 million people. In the future, the brand is intended to expand its range of products for home and sell not only household chemicals.

The starter kit offered by the startup costs $16 and includes three tablets and a reusable plastic bottle that does not contain harmful BPA compounds. The range also involves detergents for washing dishes, toilet bowls and laundry.

Background

In the mid 2010-s, an American entrepreneur Sarah Paiji and her friend John Mascara decided to launch a startup Blueland, which was supposed to help customers reduce plastic consumption.

Studying how to give up plastic packaging, Sarah found out that about 90% of the composition of household chemicals was water, and the remaining 10% accounted for a cleaning agent. As she claims, buyers had to overpay for water, its delivery and plastic packaging.

The partners planned to produce "dry" household chemicals - in tablets. They found organically decomposing pill bags to reduce the amount of garbage. The rejection of water helped to reduce the price of products: conventional detergent takes up more space during transportation than pressed concentrate, which means it requires more resources for transportation.

Cybersecurity Is The Most Attractive Industry For Investors

The global cybersecurity market reached $163 billion in 2021 according to Astute Analytica. Last year, the number of investment transactions including mergers and acquisitions has reached an all-time high. The M&A market was valued at $77.5 billion, nearly $30 billion of investments. What does the cybersecurity industry look to date and what is it expected to be in the nearest future?

The market in numbers

In 2021, 1,043 financing agreements and 286 M&A transactions were signed in the field of cybersecurity. Among them, 14 M&A contracts included transactions over $1 billion, 83 exceeded $100 million, 130 firms decided to make private investments in cybersecurity, and this is far from the limit.

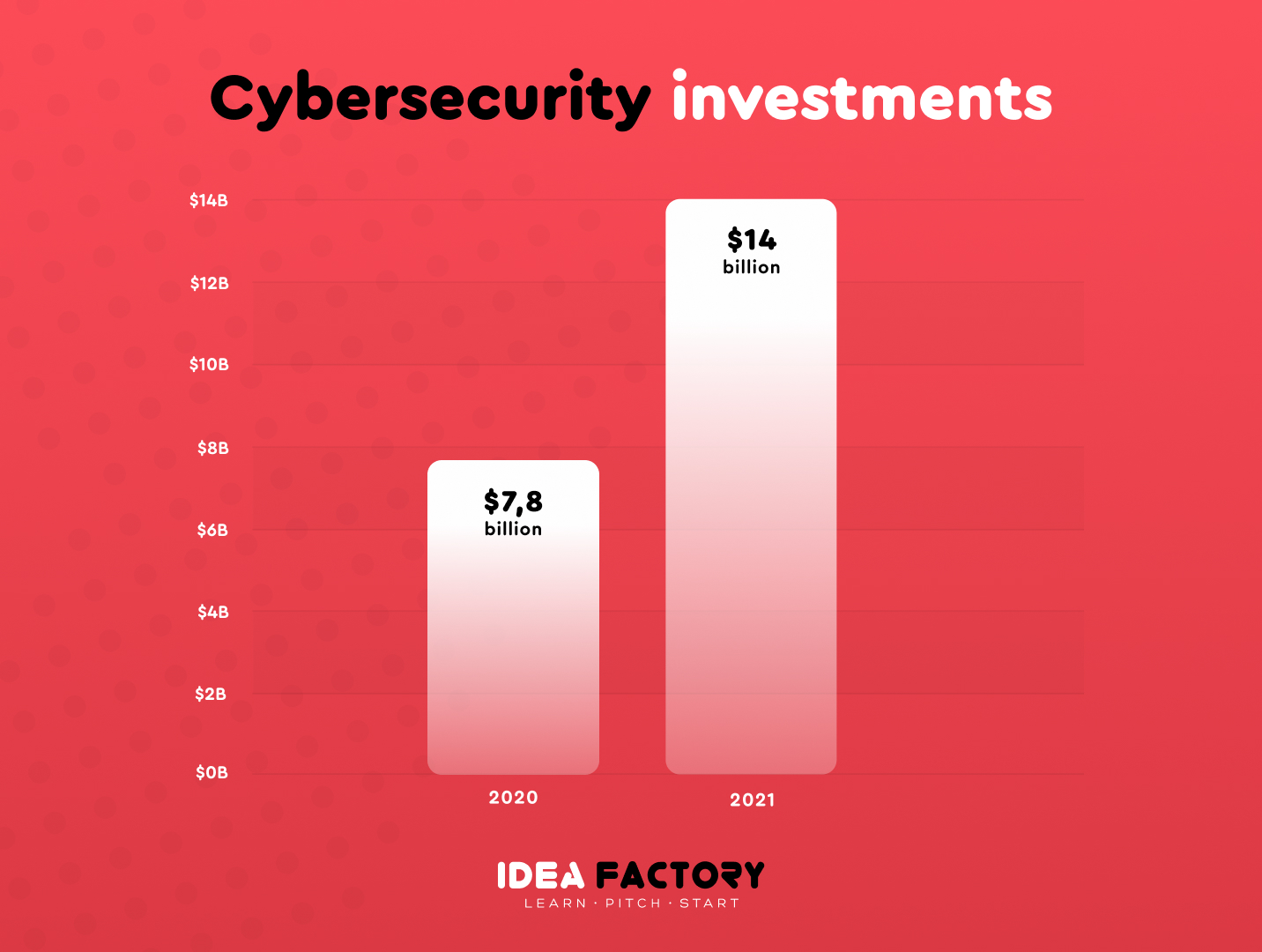

In October 2021, Crunchbase estimated that over the year, investments in cybersecurity alone exceeded $14 billion which broke the previous record of $7.8 billion in 2020. CrowdStrike Holdings has raised most of funds. The market capitalization amounting to $65 billion has made this brand a leader in the number of investments in the field of endpoint protection. The company is followed by Fortinet ($55 billion), Datadog ($50 billion), Palo Alto Networks ($50 billion), Zscaler ($42 billion), Okta ($40 billion), Splunk ($27 billion), Akamai ($18 billion), SentinelOne ($17 billion) in the ranking of the most attractive firms to invest in.

What are the most attractive cybersecurity segments?

Most of the funds are invested in cloud security, identity and access management, and endpoint protection. The cloud security segment holds the highest market share - more than 30% in 2021, as cloud solutions provide accurate recovery of information and applications. The growing demand for cloud security and hybrid cloud platforms, such as Amazon Web Services (AWS) and Azure among other key platforms, opens up great opportunities for the growth of the global cybersecurity market. As more and more organizations use cloud security to support work environments both in the office and at home, it is receiving a significant positive response in the market.

According to Express VPN, today there is a great amount of different hacking forms, which makes entrepreneurs line up reliable systems to procet their companies from cyberattacks. A virtual private network can help them prevent some cybercrimes, in particular, packet sniffing, fake Wi-Fi networks, and intermediary attacks.

Global statistics

The North American cybersecurity market held the highest market share, amounting to about 35%, with the support of key market players in the region who supply advanced solutions worldwide. North America is followed by Europe and the Asia-Pacific region, which account for about 51% of the total market share in 2021.

What are the reasons for surge in cybersecurity services?

- Cyberattacks are becoming more sophisticated which makes companies develop new security strategies and implement innovative tools to counter phishing and ransomware.

- As practice shows, firms that have allocated a budget for the maintenance of the information security department remain leaders. After all, the consequences of hacker attacks are devastating not only for the companies` welfare but also their reputation.

- The value of cyber products is not limited to protection against hacker attacks. The image of a company that cares about information security attracts customers. Consumers are more likely to buy a product or service if the brand guarantees the protection from leaks. In fact, to create a credible image, it is necessary to adhere to the values of the digital age such as honesty, accessibility and confidentiality.

Forecasts

The size of the global cybersecurity market is projected to expand depending on various factors, such as the growing demand for data and information protection worldwide and increase of cybercrimes. In addition, the boom of Internet users contributes to the growth of the cybersecurity industry across the globe.

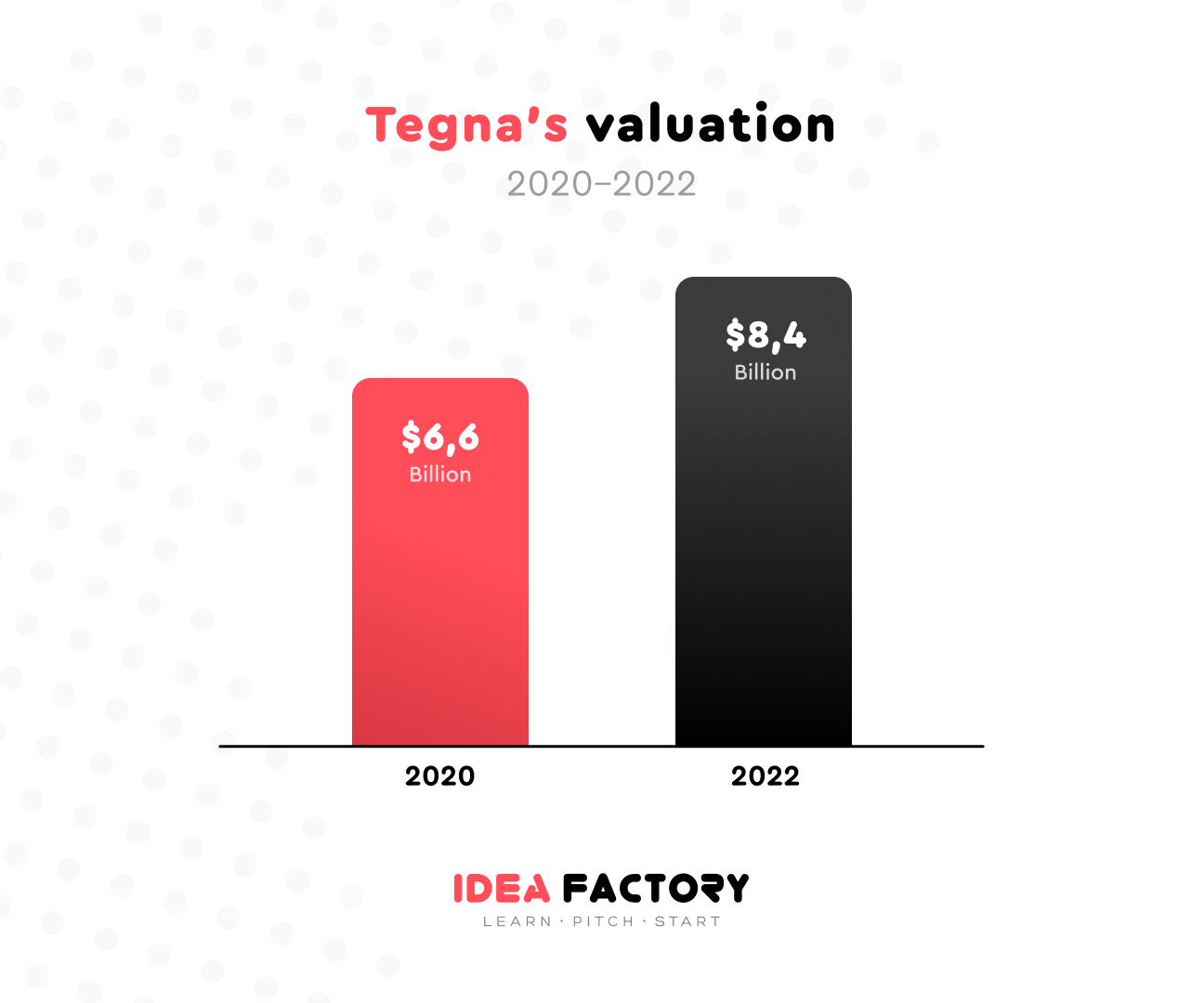

Investcompany Standard General Acquires Tegna for $5,5 billion

Referring to the latest press release from Tegna, Standard General will pay $24 per share of the media company, which is 15% more than the price of $21 at the close of trading last Friday.

The deal is expected to be completed in the second half of 2022. After that, the Tegna stations in Austin, Dallas and Houston will be sold to Cox Media Group.

What is Tegna?

This is a broadcast and digital media firm providing marketing solutions and services to customers. Tegna delivers highly relevant and smart content to help people make the best choices. Their portfolio of TV and digital businesses includes some of the biggest, most diverse broadcasters across the US. Such great digital companies as Cars.com, CareerBuilder and G/O Digital belong to Tegna.

Howard Elias, Chairman of the Board of Directors of Tegna, asserted that after comparing this opportunities and the prospects of Tegra as an independent company, as well as other strategic alternatives, the board concluded that the deal can maximize its value.

Tegna's stock prices rose nearly 6% during preliminary trading in New York on Tuesday. But the bidding had stopped after the deal was announced. Over the past 3 months, the company`s capitalization has fallen by 1%, while the S&P 500 index has decreased by 7% over this period.

Berkshire Doubles its Net Profit

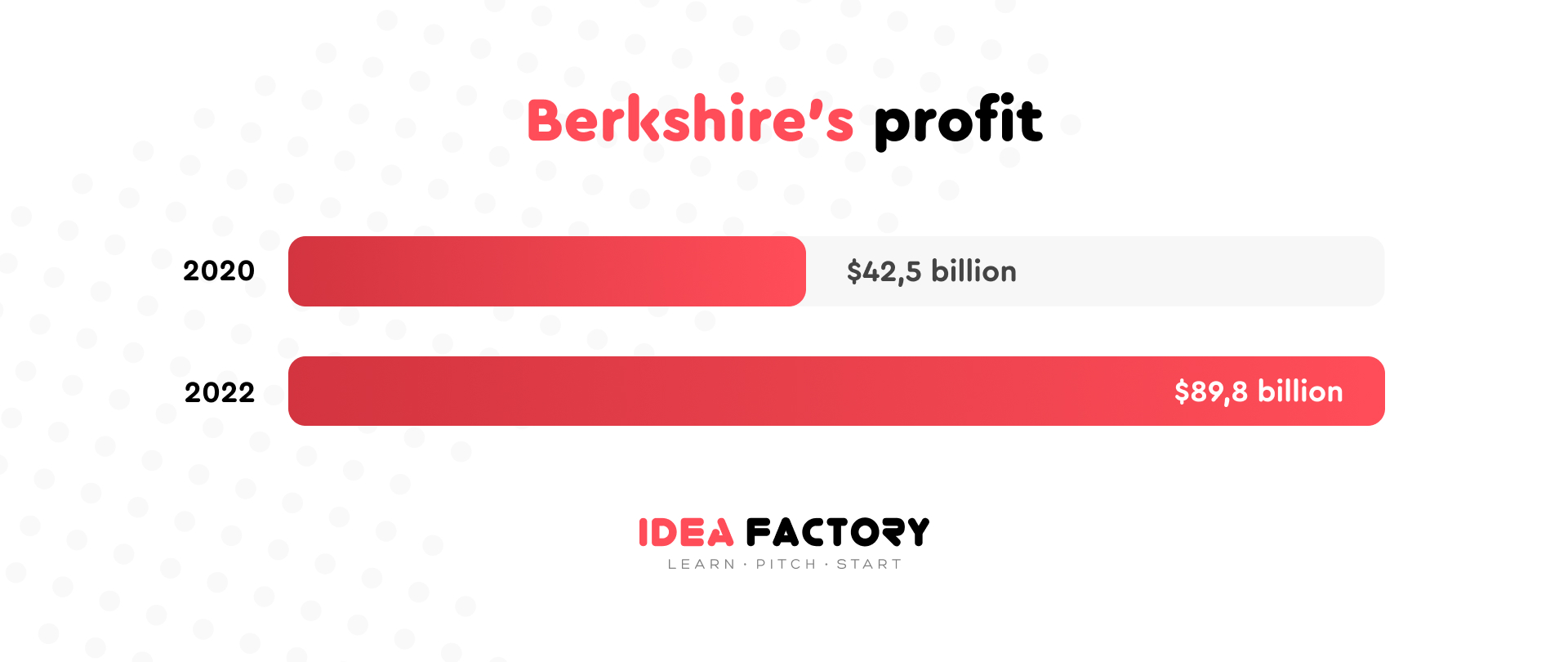

Berkshire Hathaway, the investment company of American billionaire Warren Buffett, has more than doubled its net income by the end of 2021 up to nearly $90 billion, according to a press release. Investment income was $62 billion compared to $32 billion in 2020.

Operating profit, which Buffett calls more indicative for the company and which does not take into account income/losses from investments and derivatives, increased by a quarter to around $28 billion.

Berkshire in numbers

Revenue has grown by 12.5% and reached $276 billion. The revenue of the department, which includes railway, energy and utilities business, rose by 15% to $48 billion. The volume of premiums collected by the insurance department increased by almost 10%, reaching approximately $70 billion.

Berkshire bought back its own shares for a record price of $27 billion last year compared wtih $25 billion in 2020.

In the fourth quarter, the investment firm increased its net profit by 11% to $40 billion whereas last year it accounted for $36 billion. Operating profit soared by 45% reaching $7.3 billion.

The company's total assets at the end of 2021 amounted to nearly $960 billion compared to $874 billion a year ago.

Notably, the portfolio of shares owned by the investment company was estimated at $350 billion in contrast to $280 billion at the end of 2020. Almost 73% of this amount was invested in stocks of four companies: American Express ($24.8 billion), Apple ($161 billion), Bank of America ($46 billion) and Coca-Cola ($24 billion).

Worldline SA Sells its Business

The company`s head intends to sell the payment service to the investment fund Apollo Global Management Inc. It is reported that Apollo offers to pay €1.7 billion for the business at once, as well as make an additional payment with its own preferred shares in the amount of up to €900 million if certain financial metrics are achieved. So far, the deal is valued at €2.3 billion in total.

In October 2020, Worldline began to radically rethink its business strategy in order to focus on a higher-margin segment of cloud payment services. The company was considering the possibility of selling the terminal business, and Apollo was named among the contenders for its purchase. Over the last month, the company's capitalization increased by 4.3% to €12.37 billion.

What is Wordline?

This is the largest provider of payment terminals in Europe and ranks second in the U.S. market. It connects and secures transactions on a regular basis. Thanks to their broad technological expertise and millions of highly critical transactions running through their systems, Worldline creates and operates digital platforms that can handle all the transactions between a company, its partners and customers.