WHAT IS ETF?

Various types of classic trading instruments from stock markets, such as derivatives, are gradually coming to the cryptocurrency market. Derivatives allow you to safely invest in assets without buying it directly, thus providing a safer and more reliable portfolio diversification. The world of cryptocurrencies has been waiting for the launch of one of the most long-awaited types of derivatives – ETFs (exchange-traded fund – funds traded on the exchange). And it will be discussed today.

Among crypto-activists, the attitude to ETFs is ambiguous. The man-legend Andreas Antonopoulos released a special video "Why am I against ETFs", where he calls it "an inevitable evil".

In mid-August 2018, no less legendary Nick Szabo also spoke negatively about ETFs for cryptocurrencies.

"I am not the person who will lobby for ETFs, as, indeed, any investments from Wall Street. This can do more harm than good. How much bad money was poured into the crypto and how many self-confident investors failed. Stupid people will leave this sphere, and we don't need new ones," said Nick Sambo.

The same publication quotes the former executive director of Morgan Stanley, Caitlin Long: "I hope the hodlers realize that Wall Street is not a friend of Bitcoin." Thus, he hinted that ETFs can be traded not only for the growth of cryptocurrencies but also to short them – that is, to play down. About the same as happened after the launch of Bitcoin futures on two American exchanges – CBOE and CME in December 2017.

What is an ETF?

Let's start with the definition: an ETF (exchange-traded fund) or a fund traded on an exchange is a security that tracks some stock index, commodity, bonds, or basket of assets – like an index fund, which quotes reflect the rate of a certain stock index.

How does an index fund work?

We select an exchange index, find what shares are included in the basket of this exchange index, buy for the index fund all those shares that are in the index basket of interest to us, and take them in the same proportion. So there is no need to hire expensive managers.

What is the meaning of such a fund?

Economists have long proved that the value of the index basket is growing ahead of GDP. If you invest in a mutual index fund, you are guaranteed to overtake prices and stay in the black.

What does mean an ETF, that will be invested in Bitcoin spot (a cash asset)?

This means that all funds should be spent on the purchase of Bitcoins. And nothing else. If the prospectus of another ETF says that it will be invested in Bitcoin futures for a period of 1 month, this means that the managers of this fund will buy exclusively fresh one-month futures.

It turns out that the ETF behaves like a hodler. Such funds are good because you do not need to buy the services of expensive investment managers. The issue prospectus of this fund describes everything in detail – what exactly is bought in the portfolio, in what proportions.

Unlike mutual funds (more about them below), an ETF security is traded like ordinary shares on a stock exchange. ETF shares experience exchange rate fluctuations during the day when it is bought and sold. But for mutual funds, according to the results of the day (as a rule), regular calculations of the value of assets are carried out.

ETFs usually have higher daily liquidity and a lower fee (fund commission) than mutual funds, which makes them an attractive alternative for individual investors.

Differences between mutual funds and ETFs

In fact, a mutual investment fund is a portfolio with different assets, for example, company shares, bonds, commodity futures, and other securities.

The mutual fund in its prospectus describes the types of assets where it plans to invest. A mutual fund usually has a manager who makes decisions – what to buy and what to sell. That is, the mutual fund has a wider choice – where and how to invest. It is more flexible than an ETF, but also riskier for this reason. After all, managers can make mistakes.

ETFs are usually less profitable in the short term than mutual funds. But in the long run – they are more profitable for a small investor because there is no need to track the exchange rate of shares and overpay investment managers.

Since an ETF is traded on an exchange in the same way as stocks, it does not have a net asset value (NAV) calculated once at the end of each day, as mutual funds do.

How is the NAV of a mutual fund calculated?

The mutual fund publishes the structure of its assets – what and how much has been purchased and is managed by the fund. For example, a mutual fund has some shares of company A, some shares of company B, some of company C, and some government bonds, and some gold futures. All these assets are usually listed on the stock exchange and their rates are known.

Let's multiply the number of shares of company A held by the fund by its exchange rate. The same is done with the shares of company B – and so we sum up the total amount of the value of the mutual fund portfolio. Once the value of the fund is known, it is easy to calculate how much one share in such a fund costs.

How does an ETF work?

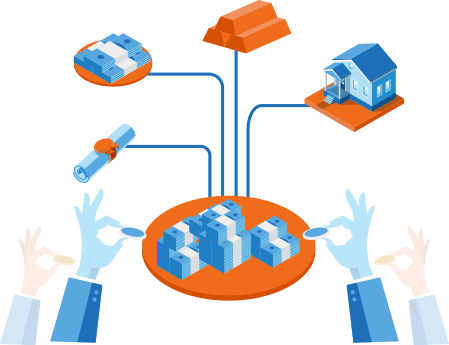

The ETF itself owns the underlying assets with which it works (stocks, bonds, oil futures, gold bars, foreign currency, cryptocurrency, etc.). The ETF issues shares traded on the exchange, the owners of which – investors – indirectly own the underlying assets.

The shareholders of the ETF are entitled to a share of the profits, for example, the interest earned by the underlying assets or the dividends paid. Shareholders can also receive the residual value of the fund's assets in the event of its liquidation.

The fund's ETF shares could be easily bought, sold, or transferred since they are traded on public stock exchanges.

Some more about how it works

The issuance of ETF shares is regulated through a mechanism known as "creation and repayment". The creation/repayment process involves the participation of several large specialized investors, the so-called "authorized participants" (AP). To launch an ETF, large financial institutions with high liquidity have to act as AP, these should be prominent market makers – banks and investment companies.

When an ETF is created, a group of authorized participants collects the necessary portfolio of underlying assets – a starter package is purchased.

Let's assume that AP buys Bitcoins for half of the starting amount of the fund, Ethers for a quarter of the amount, and XRP for another quarter. Now they turn this portfolio of basic assets into the "First Three Cryptocoins" ETF fund itself while becoming owners of blocks of shares of this fund in exchange for money that they provided for the purchase of Bitcoin, Ether, and Ripple in the interests of this fund.

In the future, there may be an additional purchase of basic assets in the fund's basket – for example, they bought more BTC, ETH, and XRP. And all this is certainly under the proportions and principles set out in the prospectus of the issue of this fund.

In case of liquidation of this ETF, the AP returns the shares of the First Three Cryptocoins fund, and in return, they receive all the same Bitcoins, Ethers, and XRP.

How does the valuation of an ETF take place?

The fair share price of the ETF is supported by the market quite rigidly. Since the shares of the ETF, like its underlying assets, are traded daily, during the day, traders can take advantage of instant arbitrage.

For example, if the shares of the "First Three Cryptocoins" fund are overvalued (the price is inflated against the real one), then you can sell one share and use the money to buy more BTC, ETH, and XRP. And the value of the purchased crypto coins will be higher than the value of the coins per share of the fund.

And if the shares are undervalued, you can sell the crypto coins, and use the money to buy a share of the fund. And then the value of the crypto coins per share will be higher than the value of the crypto coins sold at the very beginning.

Using derivatives on assets – futures and others, as the underlying asset – ETFs can earn both on the increase and the decrease of a particular asset.

These broad opportunities to play down and increase the underlying assets are the reason for the SEC's refusals and delays: the risk of manipulating the exchange rate of the underlying asset. Studies have already been published claiming that transactions with Tether were actively used in November-December to "inflate" the Bitcoin exchange rate. Obviously, the SEC would like to receive convincing guarantees that such manipulation will not be possible with ETFs.

Advantages of ETF

There are two key advantages of the ETF:

A) receiving income from the underlying asset without direct ownership of it;

B) temporary exemption from the tax on the growth of the underlying asset. As long as the investor has not received money from the sale of shares or as a result of receiving dividends, the fund's earnings are not taxed. That is, only the fixed profit received as a result of the sale of shares of the ETF fund and the payment of dividends on it (if such payment is provided for in the fund's issue prospect) is subject to taxation.

Both advantages are extremely important for investors interested in investing in crypto assets.

Owning shares of an ETF for which Bitcoin is the underlying asset shifts operational risks (for example, the risk of hacking a crypto wallet) from a small investor to the fund itself, which obviously has much more opportunities to ensure security.

Especially for this reason investment banks and "old" exchanges are actively working to create custodian institutions. Having a custodian in the market infrastructure also dramatically reduces operational risks.

By owning ETF shares, investors increase the liquidity of their investments and reduce the costs of operations with crypto assets, since they operate not with the crypto-assets themselves, but with the shares of the fund that owns them. It is no secret that the commission for the sale/purchase of shares of the fund is many times less than the commission/spreads faced by those who want to officially buy/sell crypto assets directly.