Volume Spread Analysis

⚡ ALL INFORMATION CLICK HERE 👈🏻👈🏻👈🏻

Volume Spread Analysis

Prices are increasing in February, lock in current rate for life by Signing Up Today

Volume Spread Analysis – How to Apply it Like a Professional Trader

Home / Forex / Currency , Futures , Technical Analysis , Trading Strategies / Volume Spread Analysis – How to Apply it Like a Professional Trader

By George | 2019-08-06T12:51:07-04:00 July 25th, 2018 |

Owner, founder and head trader at TRADEPRO Academy.

frolep rotrem January 16, 2020 at 5:35 am - Reply

If you want to be a professional trader then you're in the right place. Nothing short of excellent educational content ... that is continually growing and being updated. They give you all the tools to become a successful Futures, Options or Stock Trader. And on top of that you get an amazing psychology course in the Elite Membership that won't only change your career, it will change your life! Thank you TradePro! read more

It is hands down THE best place to learn and continue developing one's career in trading as being part of an amazing ... trading community! read more

I can't say enough good stuff about TPA...If you really want to learn to be a great trader...this is the place.

Awesome course. Awesome people...if you want to succeed as a trader, this is where you should call home

The team at TradePro are excellent. The education is top notch - from Learning fundamentals through to day trading like ... a pro. Importantly, it also covers trading pshychology and a plan to be consistently profitable.The community is inclusive and an important aspect of developing your skills and keeping a growth mindset as you build your trading career.I highly recommend joining the community. read more

+1 866-887-2338 support@tradeproacademy.com 1179 King Street West Suite 215 Toronto, ON M6K 3C5

Copyright 2012 - 2019 TRADEPRO Academy TM Inc. | All Rights Reserved

You have likely heard the term Volume Spread Analysis before. It is often abbreviated as just VSA.

If you have heard of it, chances are you have been put off by how confusing it is.

In today’s article I will show you the simplified and practical way to use VSA.

Theoretically, you will find that mastering VSA will take a long time as it gets complex. However, always remember that theory is not what makes you money in the market.

It is only the beginning, the real secret sauce is perfecting your execution methods and risk management.

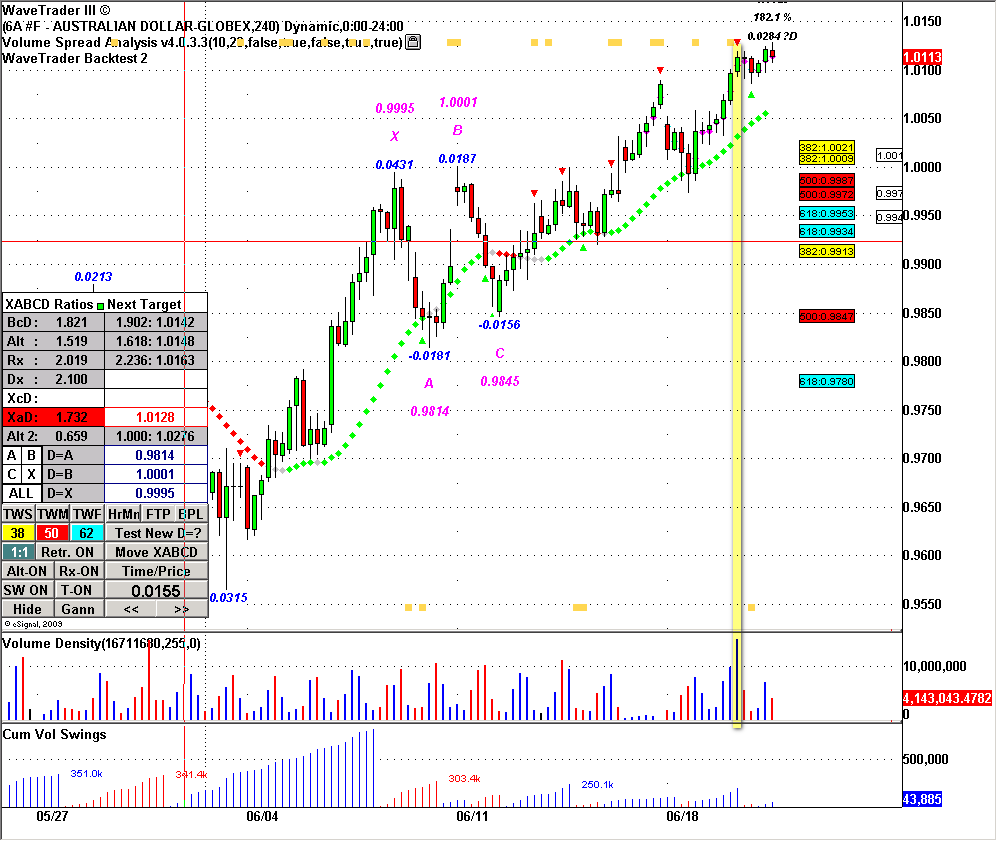

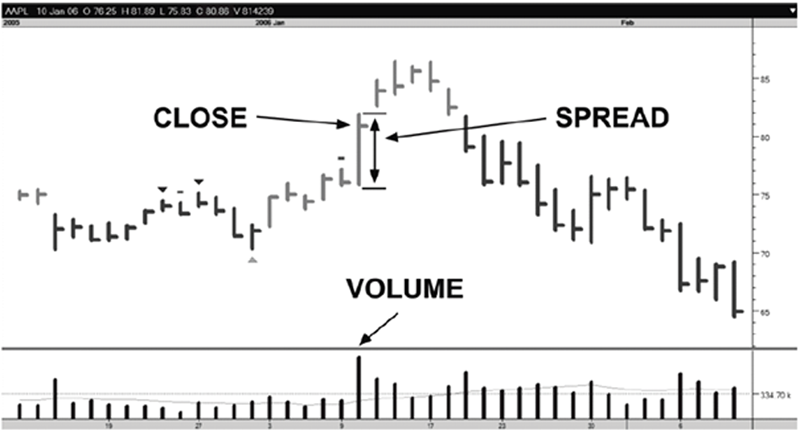

VSA is a comparison of the distance between a period high and low to the total volume traded.

That is, what is the difference between the closing price and the open price of the candle. Furthermore, how does that distance compare to the volume traded?

If you are starting to get confused at this point, hang tight as I will illustrate it with real world examples shortly.

Before you continue, it is recommended to read up on trading volume in this article if you need a refresher.

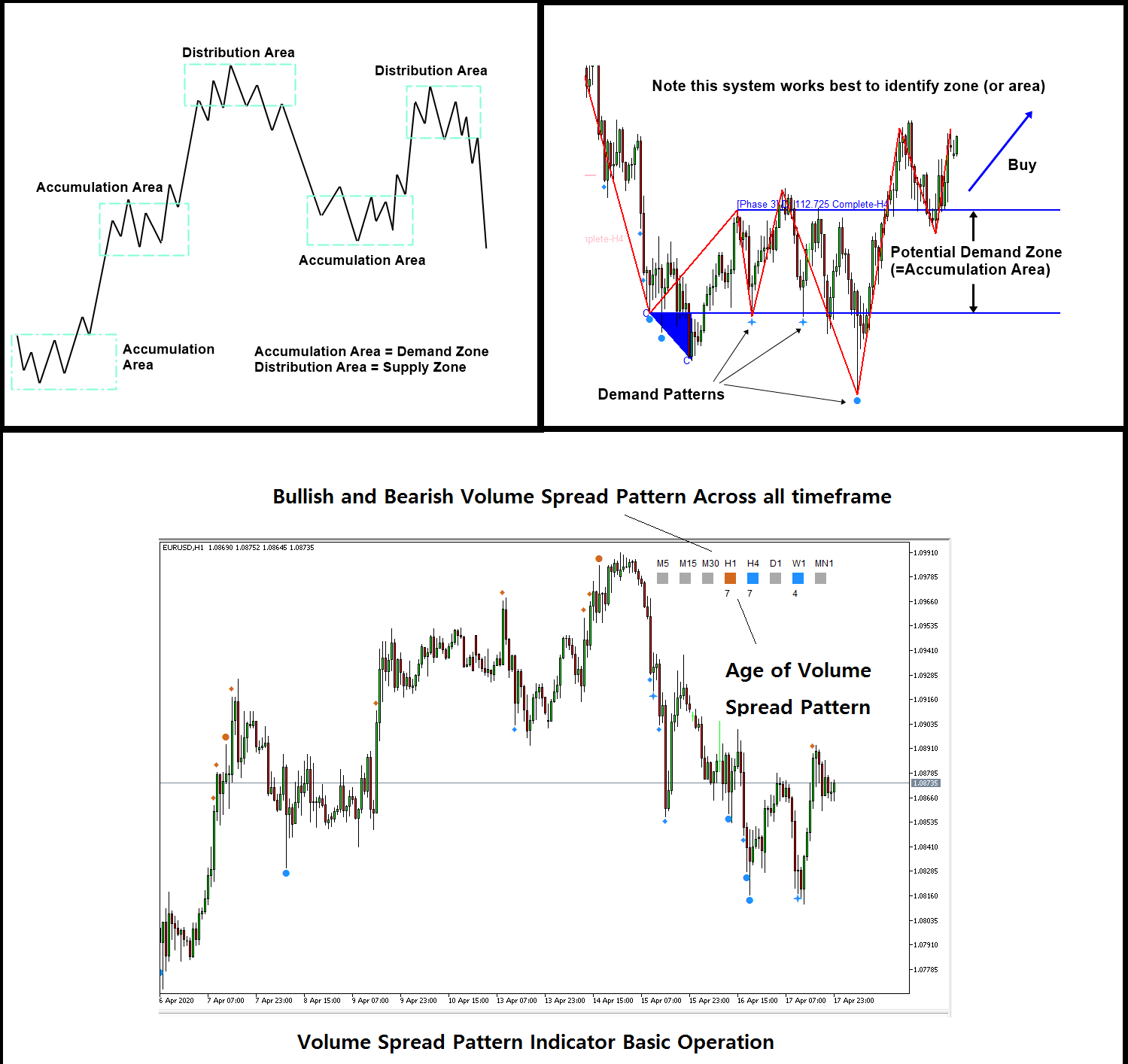

Before I show you the visual examples of VSA I want to explain the two strategies.

I will jump into each of these strategies into more details and illustrate a trade setup to help you better understand VSA.

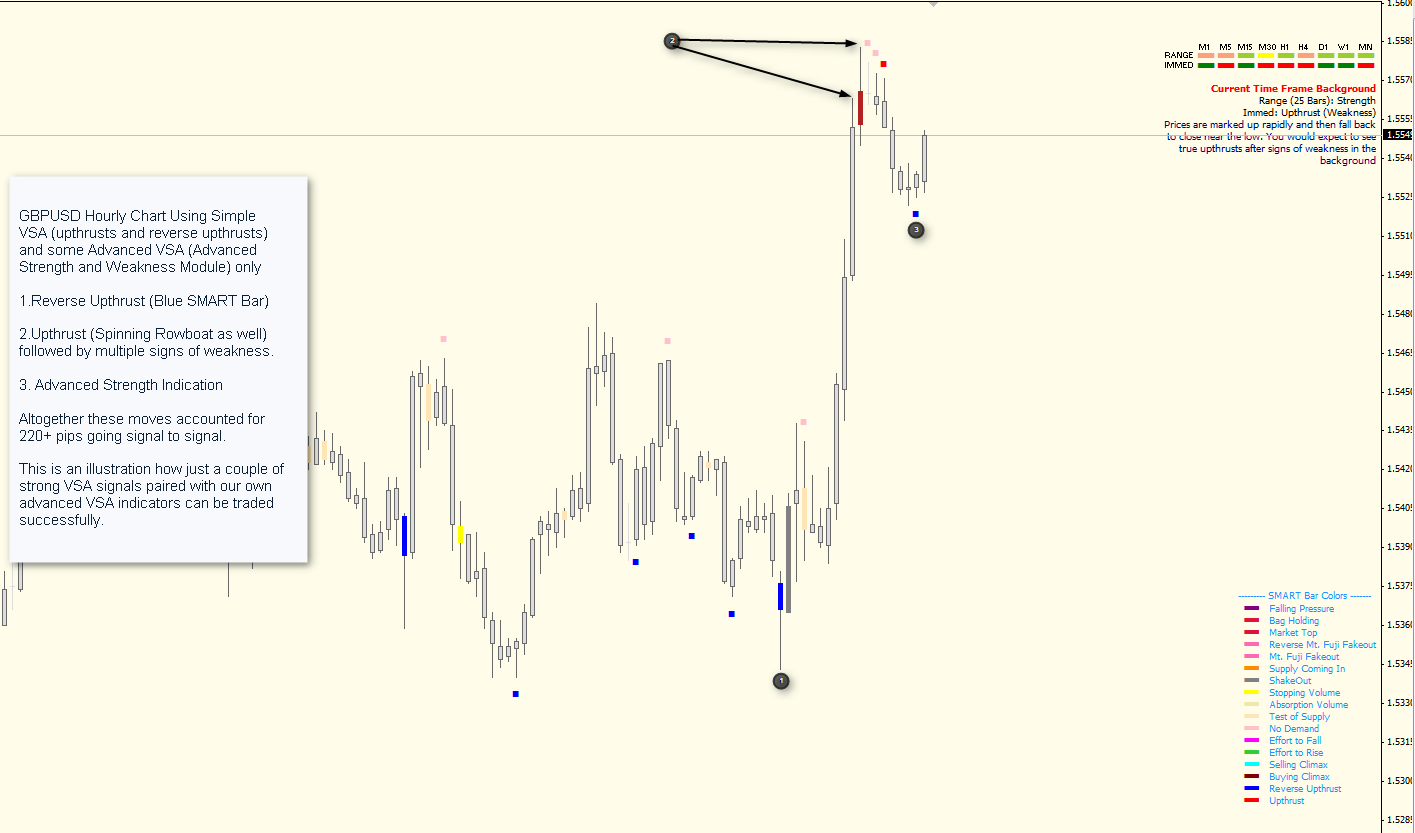

Both of these trading strategies work on any time frame. If you are swing trading or day trading, it does not matter.

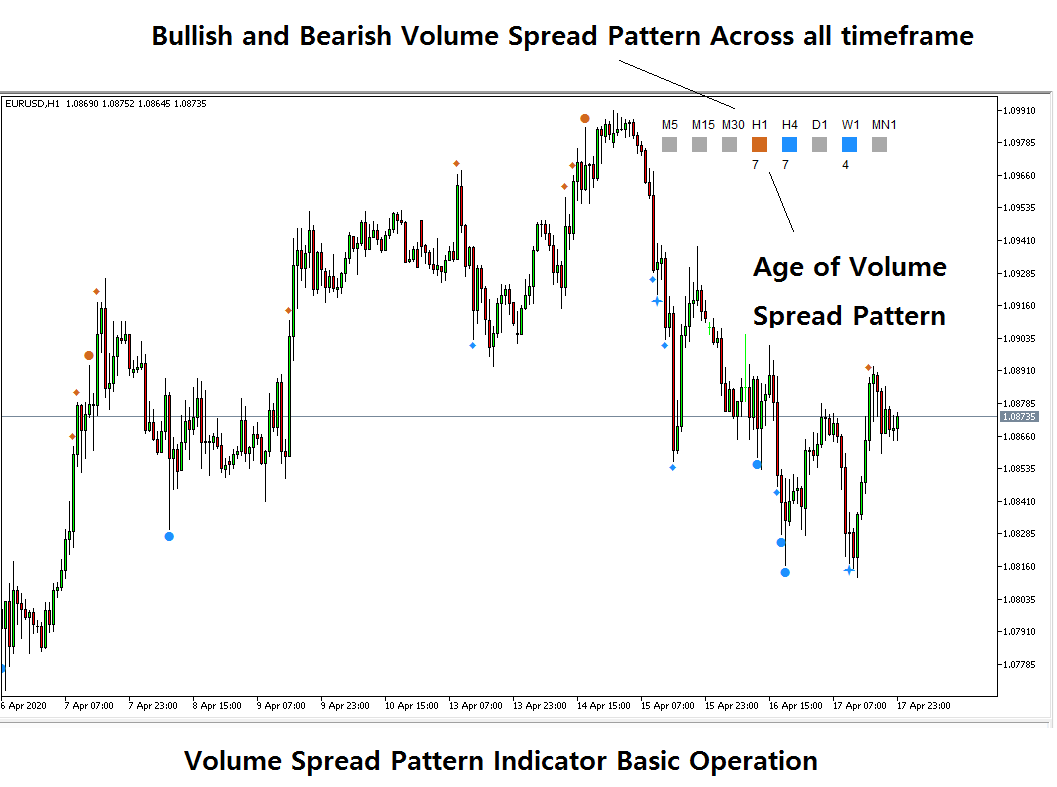

You will find that VSA is equally powerful on all time frames and especially effective on multiple time frame analysis.

This simple trading strategy will be very effective when applied to your current strategy.

Remember that not trading strategy is stand-alone perfect out of the box. Everything requires constant adjustment and this is just one tool to be combined with others for more precision and success.

Volume Spread Analysis – Short opportunity when:

In the char below you can see an example of this setup on the Apple daily chart.

Volume Spread Analysis – No demand on up bar.

But how did this trade opportunity workout?

You can see in the next chart that our VSA was followed by a 6.06% drop in just 8 trading days! This is an amazing trading opportunity.

This becomes even more profitable when you combine it with options trading.

Now let’s flip the setup and look at how to use volume spread analysis to catch long reversal trades.

As you can see on the chart below, the candle range (high minus low) is very narrow. This is a low spread.

At the same time you can see that volume was also weaker than the past two days.

This indicates a lack of selling pressure, and a potential exhaustion of the selling wave.

Therefore, you are looking for a long opportunity.

Once you get your other trading strategy qualifiers present you can try a low risk, high probability long here.

You can see that this trade setup generated a whopping 15% return in just 12 trading days. That is a great return for less than a three week holding period.

The information contained in this post is solely for educational purposes, and does not constitute investment advice. The risk of trading in securities markets can be substantial. You should carefully consider if engaging in such activity is suitable to your own financial situation. TRADEPRO Academy is not responsible for any liabilities arising as a result of your market involvement or individual trade activities.

Thank you, I have recently been searching for info approximately this topic for ages and yours is the greatest I’ve found out till now. However, what about the bottom line? Are you positive in regards to the source?

Trend trading strategy for stocks, futures, forex and crypto.

Transforming individuals into profitable traders, and providing a community of professionals for constant growth.

Learn the complete strategy in our upcoming FREE training, and how you can consistently identify profitable trades.

Join the event and get a free order flow trading guide with step-by-step instructions.

Notifications can be turned off anytime from browser settings.

Volume Spread Analysis

Volume Spread Analysis - How to Apply it Like a Professional Trader

Volume Spread Analysis Trading Method - Forex Strategies - Forex...

Your First Guide to Volume Spread Analysis (VSA) - Trading Setups Review

Volume Spread Analysis | MarketVolume.com

Выбрать язык русский азербайджанский албанский амхарский английский арабский армянский африкаанс баскский белорусский бенгальский бирманский болгарский боснийский валлийский венгерский вьетнамский гавайский галисийский греческий грузинский гуджарати датский зулу иврит игбо идиш индонезийский ирландский исландский испанский итальянский йоруба казахский каннада каталанский киргизский китайский (традиционный) китайский (упрощенный) корейский корсиканский креольский (Гаити) курманджи кхмерский кхоса лаосский латинский латышский литовский люксембургский македонский малагасийский малайский малаялам мальтийский маори маратхи монгольский немецкий непальский нидерландский норвежский ория панджаби персидский польский португальский пушту руанда румынский самоанский себуанский сербский сесото сингальский синдхи словацкий словенский сомалийский суахили суданский таджикский тайский тамильский татарский телугу турецкий туркменский узбекский уйгурский украинский урду филиппинский финский французский фризский хауса хинди хмонг хорватский чева чешский шведский шона шотландский (гэльский) эсперанто эстонский яванский японский

compressed file archive

582.4 KB

Adobe Acrobat Document

664.6 KB

compressed file archive

583.7 KB

Compressed Archive in ZIP Format

30.4 KB

Compressed Archive in ZIP Format

3.1 KB

compressed file archive

70.6 KB

Adobe Acrobat Document

321.6 KB

Better Volume indicators- for the last version metatrader 4

compressed file archive

74.5 KB

Accept all

Accept only selected

Save and go back

Your support is fundamental for the future to continue sharing the best free strategies and indicators.

Submit by

Forexstrategiesresources

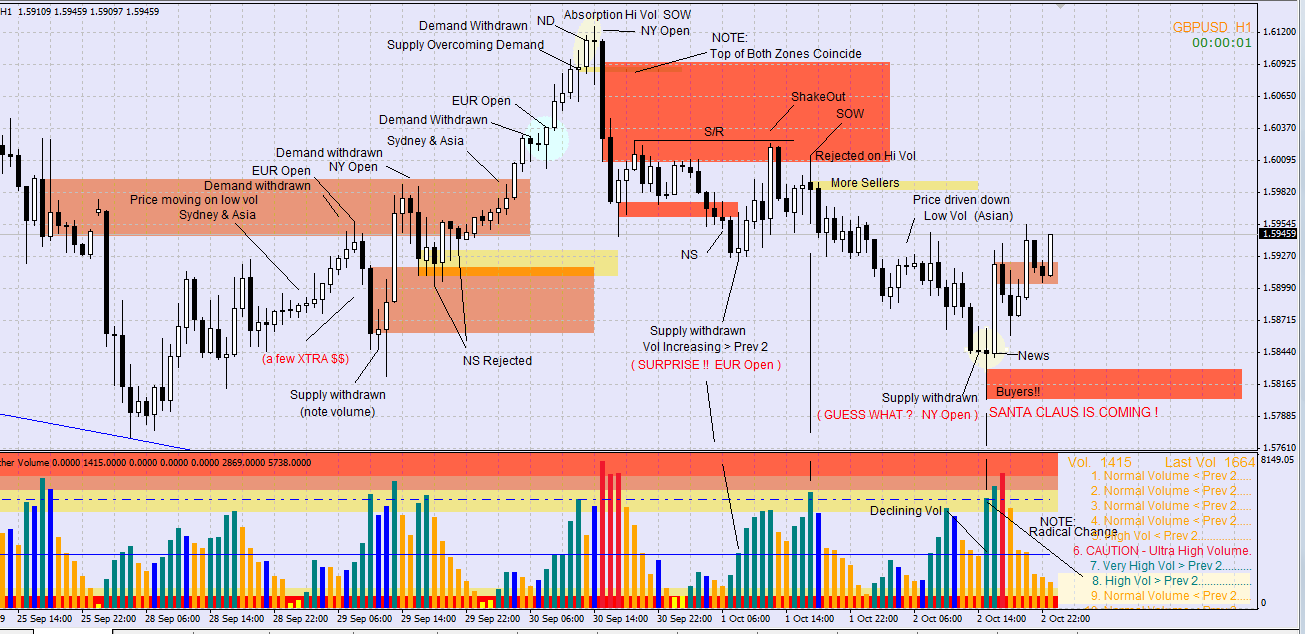

Volume is the major indicator for the professional

trader.

You have to ask yourself why the members of the self-regulated Exchanges around

the world like to keep true volume information away from you as far as possible. The reason is because they know how important it is in analysing a market!

The significance and importance of volume appears little understood by most

non-professional traders.

Perhaps this is because there is very little information and limited teaching

available on this vital part of technical analysis. To use a chart without volume data is similar to buying an automobile without a gasoline tank.

Where volume is dealt with in other forms of technical analysis, it is often

viewed in isolation, or averaged in some way across an extended timeframe.

Analysing volume, or price for that matter, is something that cannot be broken

down into simple mathematical formulae...read pdf

To see Indicators, Templete and manual PDF file.

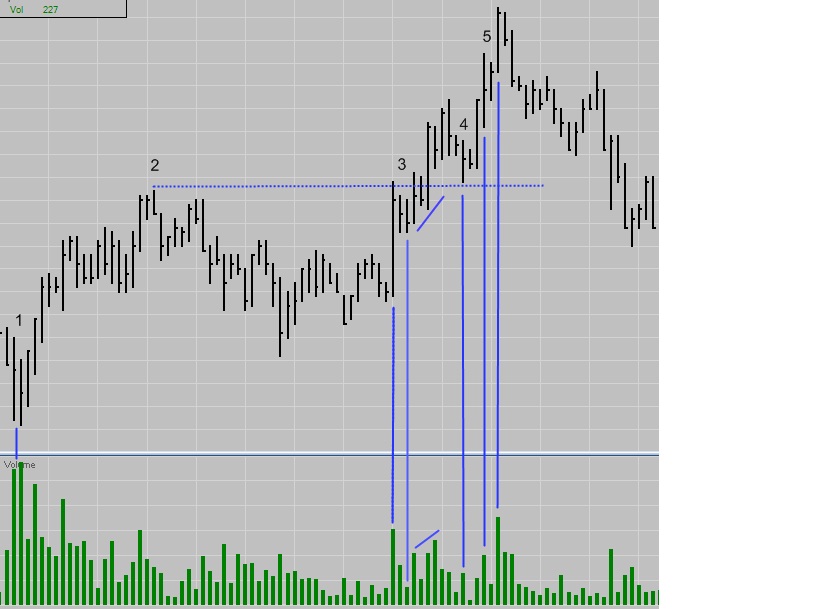

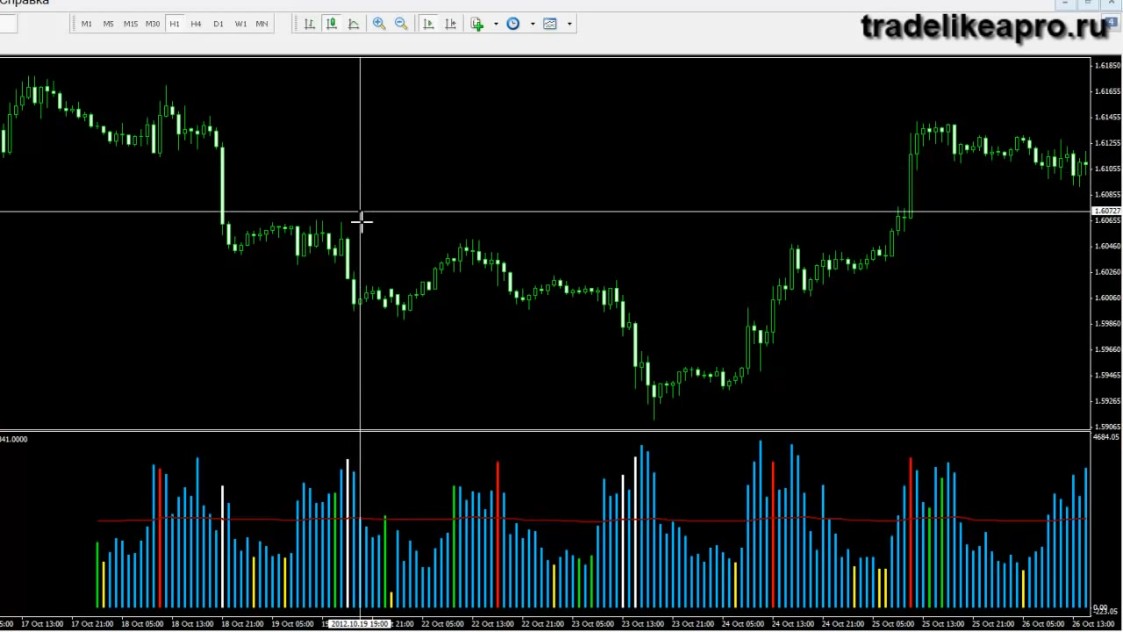

The Better Volume indicator uses a combination of bid/ask volume and range to identify

Volume Climax, High Volume Churn and Low Volume bars.

Market tops are characterized by Volume Climax Up bars, High Volume Churn and Low

Volume Up bars (also called Testing).

Market bottoms are characterized by Volume Climax Down bars, High Volume Churn

and Low Volume Down bars (Testing).

Pullbacks, in either up or down trends, are similar to market topping or bottoming

patterns, but shorter in duration and with simpler volume patterns.

The Better Volume indicator works in all markets and for all time frames – but is

particularly useful for tick charts.

Share your opinion, can help everyone to understand the forex strategy.

Vums ( Monday, 05 March 2018 10:25 )

Hi thank you for great job I really appreciate. But can you give me the download link for the VSA rectangle S and D trend indicator thosebred and green rectangles.Thank you

omakao ( Thursday, 22 October 2015 03:47 )

can we get some advice on how to install ?? should we download all the files ?

by the way, i've tried to download the manual PDF, but came up with a message cannot read file broken, :(

thanks

Tradeking ( Thursday, 23 April 2015 11:46 )

Hi all , please can anyone who has tried this system share some of its comments here. Is it profitable or not

venu ( Monday, 08 September 2014 02:56 )

Joy

Can you please share a swing volume indicator , where we can set the reversal value say by 5, 10, 15 pips etc?. If it can show the swing lines and also the cumilative volume amount and the number of

bars in the swing it would really be awesome. I am sorry i am not a coder , hence the request.

If you see weiswave indicator you will understand what i mean

Thanks for sharing and really like the passion you have for these , wish you all the success

Sebastian ( Tuesday, 29 April 2014 16:20 )

Thank you, I will try see how it works in the BackTesting.

Admin ( Friday, 25 April 2014 17:57 )

khaled ( Friday, 16 August 2013 03:49 )

thanks so much > i will try VSA with my demo account and i wish it will work good

Solo Nylon Girl

Naughty America Girlfriend

X Sensual Teen

Kissing Sperm Video

Reality Kings Hd