VAT Topics: The Ultimate Guide for Entrepreneurs

VAT, often referred to as Value Added Tax, represents a vital aspect of running a firm, particularly for tiny firm owners. Grasping how to correctly calculate Value Added Tax can create a significant impact in a company's fiscal well-being. Not only does it impact pricing methods and profit levels, and it further influences compliance with tax compliance. A informed entrepreneur is able to manage these issues more smoothly, guaranteeing that they satisfy their obligations while maintaining competitive rates.

Utilizing the correct instruments, like a dependable VAT calculator, may ease the process of calculating the correct amounts to bill customers and report to tax authorities. This guide intends to shed light on the value of calculating VAT for small businesses, providing the information you require to oversee VAT effectively and avoid typical errors that might result in expensive mistakes. If you are simply launching and seeking to enhance your ongoing processes, knowing Value Added Tax is crucial for your business's success.

Grasping VAT Fundamentals

VAT, or VAT, is a tax on consumption imposed on goods and offerings at each stage of production or delivery. For small business owners, grasping the fundamentals of VAT is crucial as it immediately affects pricing, profitability, and cash flow. It is vital to note that VAT is essentially carried by the end consumer but must be carefully managed by companies as they gather and remit the tax to the government.

The VAT structure is crafted to be equitable and effective by taxing the incremental value at each step in the supply chain. Companies levy VAT on their transactions, known as sales tax, and incur VAT on their acquisitions, called input tax. The discrepancy between these two figures is what companies must submit to the revenue agency or get back if they have paid more VAT on acquisitions than they have collected from transactions. This financial process highlights the value of using a VAT software to keep precise accounts and ensure compliance.

For entrepreneurs, grasping and calculating VAT correctly can help in steering clear of fines and handling financial liquidity effectively. It is essential to establish adequate accounting practices and utilize tools like VAT calculators. These tools can streamline the process of applying the appropriate VAT rates, helping businesses to effectively track their requirements and maximize their financial health while ensuring adherence to the tax laws.

A Guide to Use a VAT Calculator

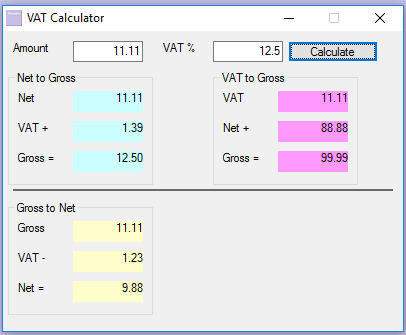

Employing a VAT calculator can streamline the process of determining the accurate amount of VAT applicable to your goods or offerings. Initially, you must to gather the pertinent information, which includes the selling price of your products or services and the applicable VAT rate in your country . Most countries in the EU have standard rates, but certain also have reduced rates for particular categories. Having vat calculator ireland prepared will ensure a seamless calculation experience.

Next , enter the selling price into the VAT calculator, along with the applicable VAT rate. The calculator will give you with the VAT amount due and the total price, including VAT. This transparent breakdown enables you to understand the financial consequences of VAT on your pricing approach, thus allowing you to maintain accurate financial records while guaranteeing compliance with tax regulations.

In conclusion, always double-check the results provided by the VAT calculator. Even though these tools are designed to be user-friendly and precise, errors may happen. Regularly reviewing your calculations will keep your business finances in check and help you avoid any potential issues with tax authorities. By incorporating a VAT calculator into your financial routine , you are better positioned to handle your VAT responsibilities effectively .

Common VAT Mistakes to Avoid

One common error companies make is failing to register for VAT in a timely fashion. Numerous petite business owners misjudge their turnover and presume they do not need to register until they reach the threshold. Yet, this can lead to fines and retroactive charges. It is essential to monitor your sales closely and register as soon as you exceed the VAT limit to avoid issues.

Another common mistake is miscalculating VAT on sales and buying. Be it inflating or deflating the VAT collected, inaccuracies can create problems with tax authorities. Using a reliable vat calculator can streamline this task and ensure you are consistently calculating the accurate amounts. Frequently checking your calculations can help identify any mistakes before they escalate.

Lastly, some companies neglect to keep detailed records of their VAT transactions. Inadequate record-keeping can make it challenging to provide accurate information during audits or when submitting VAT returns. Implementing a systematic approach to document all invoices and receipts will not only help in maintaining compliance but also contribute to better financial management overall.