Understanding the Benefits and Risks of Emergency Loans

Introduction

In times of financial crisis, Personal loans can be a lifesaver for individuals who need immediate funds. These loans can be used to cover unexpected costs such as medical bills, car repairs, or home repairs. However, emergency loans come with both profits and risks that borrowers should be aware of before applying for one.

This article provides an overview of emergency loan benefits and risks, who can apply for them, how to apply for them, and how to achieve finances with an emergency personal loan.

Why Should You Get an Emergency Personal Loan?

The primary reason for getting an emergency loan is to cover unexpected expenses that cannot be covered by funds or other sources of income. Emergency loan benefits comprise the ability to provide instant access to funds that can be used to pay for urgent expenses. One of the main emergency loan benefits is that they are usually within insufficient days of application. This can help entities avoid late fees, consequences, or other consequences of not paying bills on time.

Another benefit of the emergency loan is that they can be more reasonable than other forms of credit such as credit cards or payday loans. Emergency loans typically have lower interest rates than credit cards, and the refund terms are more flexible than payday loans. Moreover, emergency loan benefits include getting loans without the requirement of collateral (an item of value such as a house that a lender can seize if a borrower fails to repay a loan) or a credit check, creation them more accessible to individuals with low credit scores or no assets.

Who Can Apply for an Emergency Personal Loan?

Emergency loans are accessible to anyone who needs immediate funds to cover unexpected expenses. However, suitability standards may vary depending on the lender. Normally, lenders require borrowers to have a steady income, a valid ID, and a bank account. This is to confirm that borrowers have the means to repay the loan and to simplify the loan disbursement process.

In addition to these basic requirements, some lenders may also require borrowers to have a good credit score or to provide collateral to secure the loan.

However, some lenders offer emergency loans to individuals with bad credit scores or no collateral by charging advanced attention rates and fees to compensate for the higher risk they are taking. Therefore, borrowers with bad credit scores should compare changed lenders and their terms before choosing one to ensure that they are getting the best deal possible.

How to Get an Emergency Loan?

The first step for getting an emergency loan is to investigate different lenders and their terms to find the one that best suits one's needs. Once a lender has been chosen, apply for an emergency loan online or in person, conditional on the lender's guidelines.

To apply for an emergency loan, one will have to provide their personal and financial information, such as name, address, employment position, and income. Documents, such as pay stubs or bank statements, may also need to be provided to confirm the income and financial status in the process of how to get an emergency loan.

After one has applied for an emergency loan online, the lender will review it and decide whether to approve the loan or not. If accepted, one will accept the funds in their bank account within a few days, depending on the lender's policies.

It's important to note that emergency loans may come with higher interest rates and fees than traditional loans. Therefore, borrowers should carefully consider whether they can afford to repay the loan before applying. Borrowers would also make sure that they appreciate the loan terms and any potential fees or penalties before accepting the loan.

How to Manage Your Finances with an Emergency Personal Loan?

The first step to managing one's finances with an emergency personal loan is to create a budget and prioritize expenses. Identify fixed expenses, such as rent or mortgage payments, utilities, and groceries, and allot funds consequently. Then, identify any variable expenses, such as dining out or entertainment, and reduce them if required to free up funds for loan payments.

It's also important to make loan payments on time to avoid late fees and damage to your credit score. Set up automatic payments or reminders to ensure not miss a payment. In addition, reflects ways to grow one's income or reduce expenses to free up more funds for loan payments. This could include concluding a side job, relocating bills or expenses, or cutting back on discretionary expenditure.

If you're stressed about managing your finances or making loan payments, don't hesitate to reach out to your lender for assistance. Many lenders offer stretchy repayment options or hardship programs to help borrowers in their financial efforts.

Conclusion

Emergency personal loans can be a useful tool to help manage surprising expenses and bridge a financial gap. However, they also come with risks and should be managed carefully to avoid falling into debt. By thoughtful the profits and risks of emergency loans, assessing one's financial situation, and managing finances wisely, one can make well-versed decisions and protect their financial well-being in the long run.

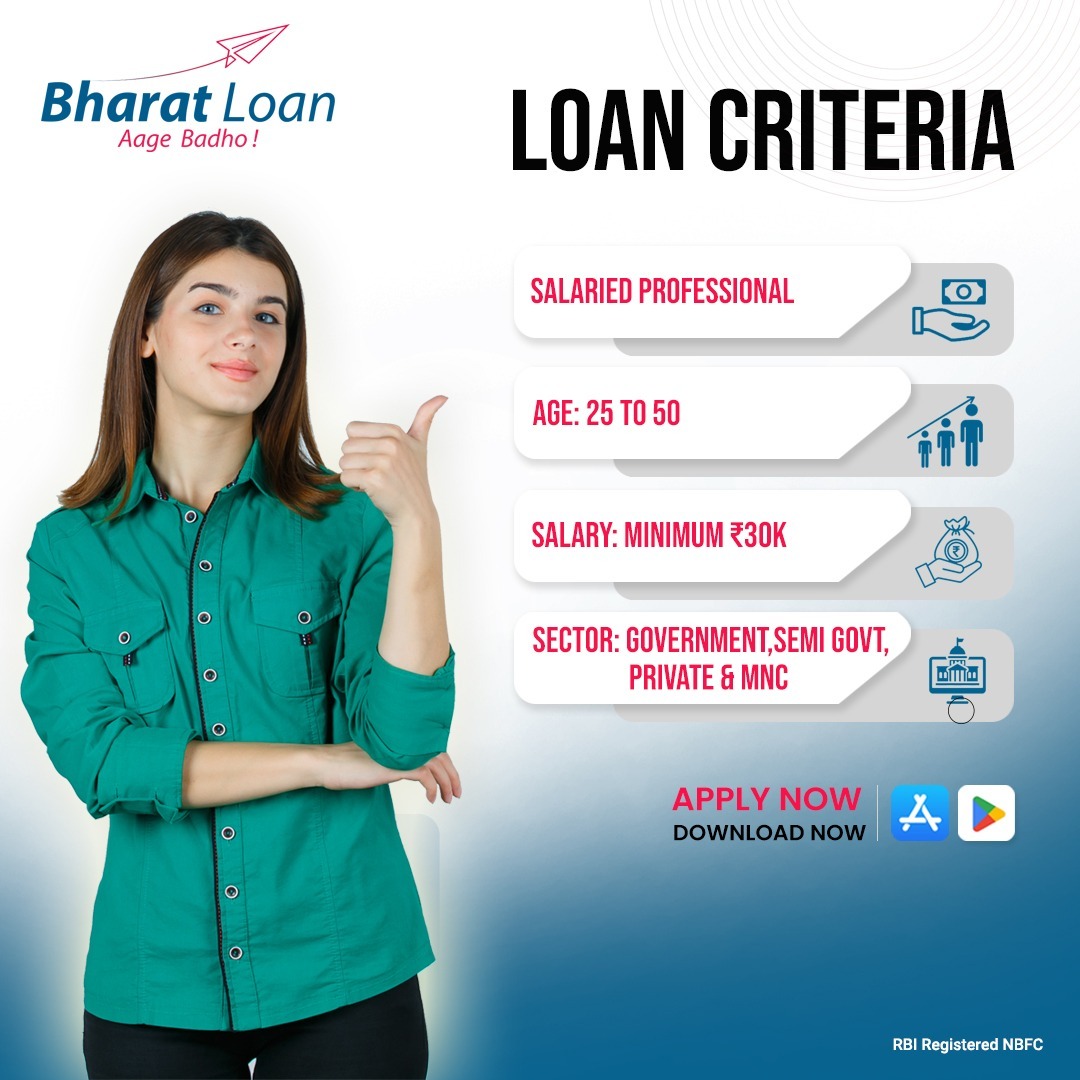

If one needs an emergency loan, it's important to choose a reputable lender with competitive rates and favorable terms. Apply for a personal emergency loan with Bharat Loan which offers flexible repayment options, attractive interest rates, and quick disbursal of reserves to manage unexpected expenses.

You can also download the Bharat Loan App now and experience all the services of Bharat Loan at your fingertips 24X7.

Apply For Personal Loan