"Understanding the Basics of ACH Payment Systems: How They Work and Why They Matter" Fundamentals Explained

Navigating Compliance and Security in ACH Payment Systems: Best Methods for Protecting Sensitive Data

The Automated Clearing House (ACH) repayment system is a largely utilized digital funds transactions system that permits the movement of money between financial institution accounts. Along with the raising reliance on digital settlements, it has become vital for organizations to recognize and apply finest methods for defending delicate data within the ACH remittance bodies. Conformity along with regulations and adherence to safety solution are vital to guard against fraudulence, unapproved gain access to, and record breaches.

1. Understanding Compliance Requirements

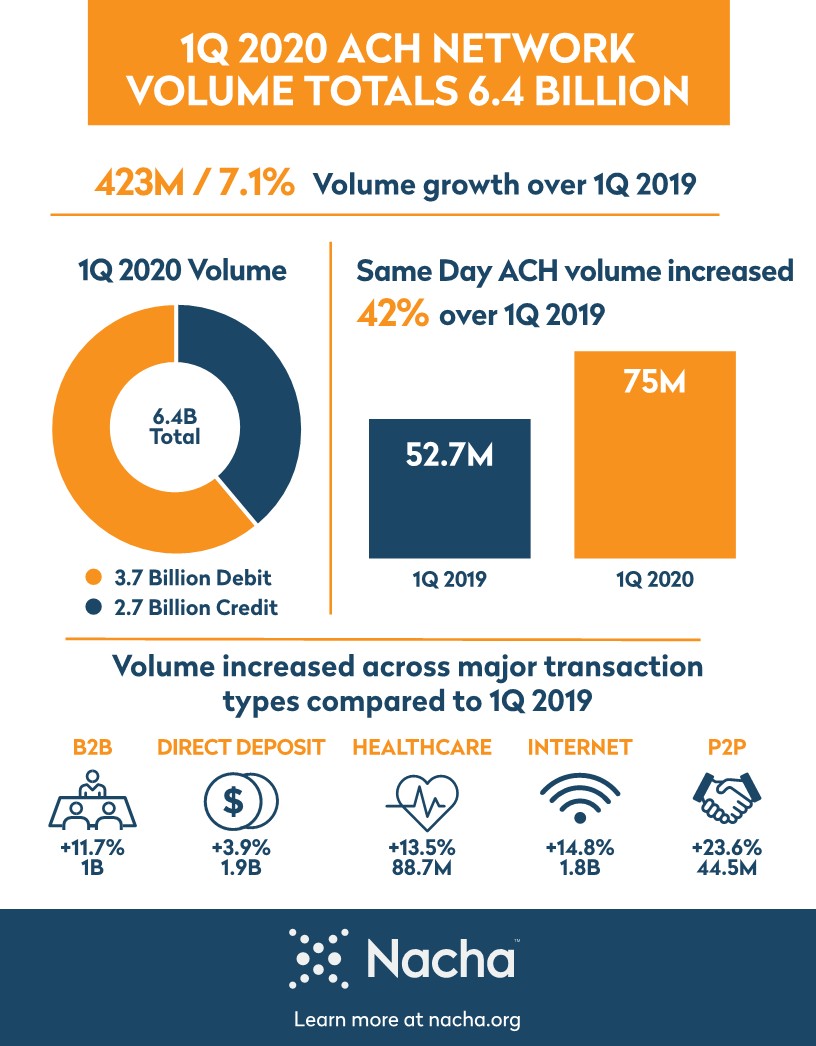

Compliance with governing criteria is a key part of sustaining surveillance in ACH payment systems. The National Automated Clearing House Association (NACHA) regulates the guidelines and policies coming to to ACH purchases in the United States. Inform yourself along with NACHA's Operating Rules and Guidelines, which provide complete relevant information on compliance specifications.

2. Apply Strong Authentication Measures

Tough authentication action are necessary for guarding sensitive record within ACH repayment devices. Utilize multi-factor authorization (MFA) protocols that need users to deliver several types of identification prior to accessing the unit. This can feature something they recognize (e.g., password), something they possess (e.g., token or mobile unit), or something they are (e.g., biometric information).

3. On a regular basis Update System Software

Software program updates typically include crucial spots that deal with susceptibilities within the system. Neglecting to update your software application regularly enhances the risk of profiteering by cybercriminals. Ensure that your ACH settlement unit is operating on the most recent version of program, including functioning systems, firewalls, anti-virus programs, and any kind of various other relevant applications.

4. Secure Data Transmission Channels

Security plays a vital duty in securing vulnerable information throughout gear box over systems or between bodies. Execute safe socket layer (SSL) or transportation layer safety and security (TLS) procedures to secure all interaction networks involved in ACH purchases. This ensures that even if intercepted, the information remains undecipherable and shielded.

5. Display and Sense Suspicious Tasks

Apply a sturdy display body that actively tracks consumer tasks, system traffic, and deal patterns within the ACH payment system. Regularly examine logs and review path to determine any kind of doubtful tasks or unapproved get access to efforts. Make use of invasion diagnosis systems (IDS) or breach deterrence units (IPS) to discover potential risks in real-time.

6. Carry out Regular Security Assessments

Routine safety assessments help identify weakness within your ACH settlement body and make certain observance with safety greatest techniques. Interact private third-party auditors or seepage testers to assess your system's structure, setups, get access to controls, and total safety stance. Attend to any type of recognized issues promptly to decrease the threat of information breaches.

7. Educate Employees on Security Best Practices

Individual mistake remains a substantial aspect in data breaches. Deliver comprehensive instruction for employees who have access to the ACH remittance device. Show them regarding phishing assaults, social engineering techniques, password hygiene, and other safety and security absolute best practices. Urge a culture of watchfulness when it happens to shielding vulnerable data.

8. Carry out Gain access to Commands

Limitation accessibility benefits based on task parts and accountabilities within the institution. Grant minimal required accessibility legal rights to workers included in ACH deals just when required for their tasks. Regularly review consumer approvals to make certain they straighten with existing functions and accountabilities.

9.Utilize Tokenization and Encryption for Data Storage

Tokenization involves switching out vulnerable record with arbitrarily created symbols that possess no purposeful worth if intercepted through unapproved individuals. Carry out tokenization procedures for holding vulnerable information such as banking company profile varieties or Social Security numbers within the ACH payment device's database. Also, encrypt saved data making use of solid shield of encryption algorithms to supply an added coating of defense versus unapproved accessibility.

10.Establish an Incident Response Plan

Despite applying preventative measures, there is actually still a possibility of safety happenings developing within your ACH repayment system environment. Establish Solution Can Be Seen Here happening reaction program that outlines the necessary steps to be taken in the celebration of a safety and security breach. This includes treatments for having the occurrence, checking out its root cause, alerting affected celebrations, and bring back ordinary procedures.

In verdict, guarding vulnerable data within ACH repayment devices demands comprehensive conformity along with governing criteria and sturdy safety and security techniques. Through applying strong verification action, regularly improving program, securing information transmission channels, keeping track of activities, performing safety and security evaluations, enlightening workers, carrying out accessibility managements, making use of tokenization and security for data storing, and creating an accident action strategy, organizations can easily lessen the danger of data violations and unauthorized gain access to to vulnerable info. Adhering to these best techniques makes certain a safe ACH remittance system environment that inspires self-confidence one of customers and partners alike.