Understanding LLCs: Key Info for Business Owners

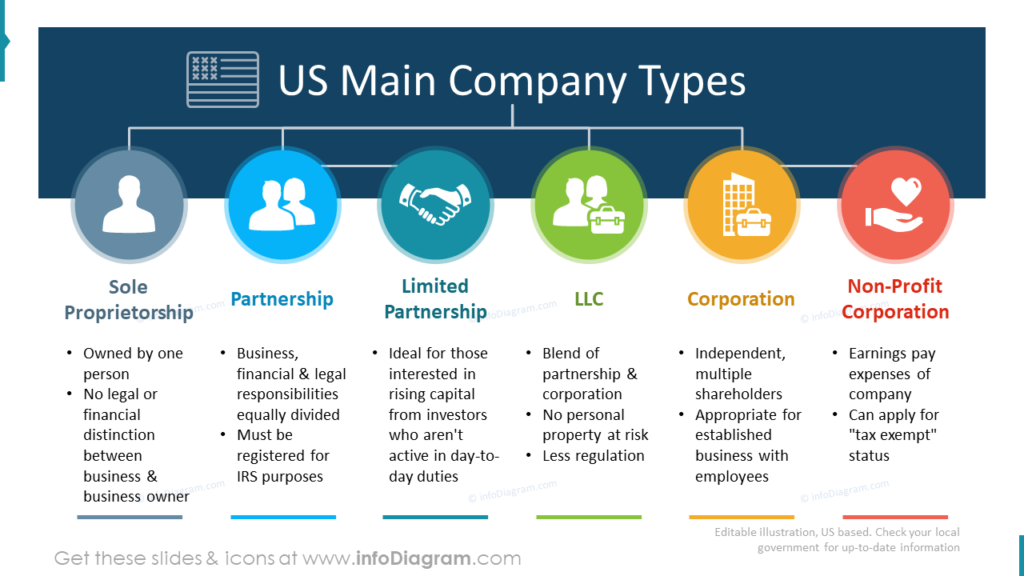

Developing an LLC, or Limited Obligation Business, is a prominent choice for lots of business owners as a result of its versatility and defense advantages. This company framework uniquely incorporates components of both companies and partnerships, giving the limited obligation features of a firm with the tax obligation effectiveness and operational flexibility of a partnership. An LLC can be owned by several people, that are referred to as members. Unlike investors in a company, LLC participants can directly handle the service, or they can choose to have supervisors that might or might not be members themselves. This makes it an optimal structure for a large range of businesses, from sole proprietorships to bigger business with numerous employees.

One of the most attractive facets of an LLC is the security it provides its members from personal obligation for debts and claims against the organization. This suggests that in case the LLC faces insolvency or claims, the individual assets of the participants, such as their homes, vehicles, and other individual belongings, are generally shielded. Nevertheless, this defense is not outright, and under specific conditions, such as scams or inappropriate conduct, participants may still be held directly accountable. Another significant benefit is the pass-through taxes function of LLCs. Unlike a corporation, where profits are tired at both the business and individual degrees, an LLC's profits are just strained once. This occurs at the private participants' degree, which can lead to substantial tax financial savings, specifically in states with beneficial tax obligation laws for LLCs.

Understanding Minimal Responsibility Companies (LLCs)A Restricted Obligation Business (LLC) is a popular company structure amongst business owners due to its versatile nature and safety features. An LLC blends aspects of both partnership and company frameworks, which not only provides simpleness in management but likewise offers restricted obligation security to its owners, typically described as members. Among the primary advantages of an LLC is that it shields participants from individual liability for company financial debts and commitments. This means that in case of monetary loss or claims against the company, the personal properties of the members, such as individual checking account, homes, or various other investments, are commonly not in jeopardy. In addition, LLCs are recognized for their tax effectiveness. Unlike traditional companies, LLCs usually take advantage of pass-through taxes, where income is only strained once at the participant's personal revenue degree, avoiding the double taxes usually connected with corporations. The functional versatility of LLCs likewise enables members to establish their very own protocols for administration and profit sharing, which can be outlined in an operating arrangement customized to the certain needs of the service. This arrangement can specify everything from the appropriation of profits and losses to the treatments for adding or eliminating participants, making it a crucial file for guaranteeing smooth operation and management. LLCs are acknowledged as lawful entities across all 50 states in the U.S., each of which may have various laws and requirements for LLCs, hence it is necessary for prospective service proprietors to comprehend the particular legislations and commitments in their state of consolidation. This framework not just helps with less complicated monitoring and prospective tax obligation advantages yet additionally offers considerable adaptability that can be important for adapting to the altering dynamics of the organization atmosphere.

Recognizing the Framework and Advantages of an LLC

Restricted Liability Firms (LLCs) are a popular option for business owners seeking a versatile yet protective structure for their venture. An LLC distinctively integrates the features of both a corporation and a collaboration, supplying individual property defense along with functional and tax obligation adaptability. The individual responsibility of the members, or owners, is restricted to the quantity they have bought the company, guarding individual possessions such as homes and financial savings from service financial obligations and cases. This feature belongs to the securities afforded by a company. However, unlike firms that are required to comply with rigid operational frameworks and formalities such as holding annual meetings and preserving comprehensive documents, an LLC offers an extra unwinded operational setting.

In regards to taxes, an LLC is naturally versatile. By default, LLCs are dealt with as pass-through entities for tax functions, implying that business itself does not pay earnings tax obligations. Rather, losses and profits are passed through to the members, that then report these on their personal income tax return. This framework stays clear of the dual tax typically seen in firms, where profits are exhausted at both the company and private levels. LLC participants can additionally choose to have their LLC exhausted as a firm if this verifies even more helpful for their monetary circumstances.

Additionally, establishing an LLC can boost the credibility of a company, predicting a specialist photo that may help in bring in capitalists or safeguarding financing from financial institutions. The needs to set up an LLC differ by state, however normally include declaring Articles of Organization with the appropriate state company and paying a filing cost. Some states likewise need the publication of a notice of intent to create an LLC and the visit of a signed up agent who will certainly manage legal and tax records in support of the company.

Given these attributes, an LLC is a helpful choice for numerous business owners and small company proprietors. It gives the liability defenses of a bigger corporation without imposing the very same degree of functional intricacy and inflexible rules, providing a well balanced service for those looking for both protection and simplicity.

Recognizing the Structure and Advantages of Minimal Liability Companies (LLC)The Minimal Obligation Firm (LLC) is a preferred service framework amongst entrepreneurs throughout different industries due to its flexibility and security advantages. An LLC distinctively combines the characteristics of both collaborations and corporations, offering the minimal liability of a corporation with the tax obligation benefits and operational flexibility of a collaboration. This structure allows members to shield their individual possessions from organization responsibilities; in situation of lawsuit or financial debt, individual assets like individual financial institution cars and trucks, homes, or accounts are typically safeguarded. LLCs are additionally favored for their tax therapy: losses and earnings can go through to personal tax obligation returns, and participants can stay clear of the double taxes normally seen in companies. In addition, LLCs offer substantial versatility in administration. Unlike companies, which need policemans and directors, an LLC can be handled directly by its participants or by picked supervisors that may or might not be participants themselves. This can be specifically advantageous for local business that like a much less official framework with fewer management burdens. Furthermore, establishing an LLC does not include as numerous rigorous needs as setting up a company, making it a less complex and extra practical alternative for lots of start-ups and small companies. LLCs are qualified of existing perpetually, regardless of modifications in membership, which includes to their security and allure as a service framework. With these advantages, the LLC framework continues to be a very eye-catching choice for local business owner looking for versatility and defense.

Recognizing the Versatility and Protection Used by LLCsThe structure of a Restricted Obligation Company (LLC) offers distinctive benefits that provide particularly to medium-sized and little business, blending the flexibility of a partnership with the safety elements of a firm. This hybrid structure enables LLCs to operate with fewer rules than corporations while still giving its participants with liability security from company financial debts and claims, a feature not usually readily available in sole proprietorships or partnerships. https://orderstamp24.bravejournal.net/10-to-help-improve-and-promote-your-photography-company is even more seen in tax therapy; an LLC can select to be exhausted as a sole proprietor, partnership, or company, giving substantial critical financial planning possibilities to optimize tax obligation responsibilities based upon the particular requirements of the organization and its proprietors. Moreover, the monitoring of an LLC is extremely adaptable. Members can take care of the service straight, or they can choose supervisors to deal with the daily operations, which is excellent for owners that prefer not to be associated with the regular organization procedures. This is specifically useful for services with passive capitalists or for those running in fields where the administration calls for certain knowledge. Furthermore, the ease of setting up and maintaining an LLC attracts numerous business owners. Unlike firms, which are often strained with considerable record-keeping, reporting requirements, and intricate administration structures, LLCs delight in a streamlined procedure that generally involves fewer obstacles and reduced startup and maintenance costs. This simpleness not just makes it simpler to establish an entity yet also reduces the management load, allowing owners to focus extra on expanding their service as opposed to being bogged down by conformity problems. Lastly, the ability of an LLC to establish customizable subscription frameworks and flexible profit distributions implies that it can be customized to satisfy the varied requirements of its participants, even more boosting its appeal as a versatile service entity developed for modern service demands.