Unambiguous Mikhail Kokorich is trying to make his startup public

Bill RaynMikhail Kokorich is willing to turn his company public in 2021. Will investors buy it?

Can’t One Launch Rockets Without an IPO?

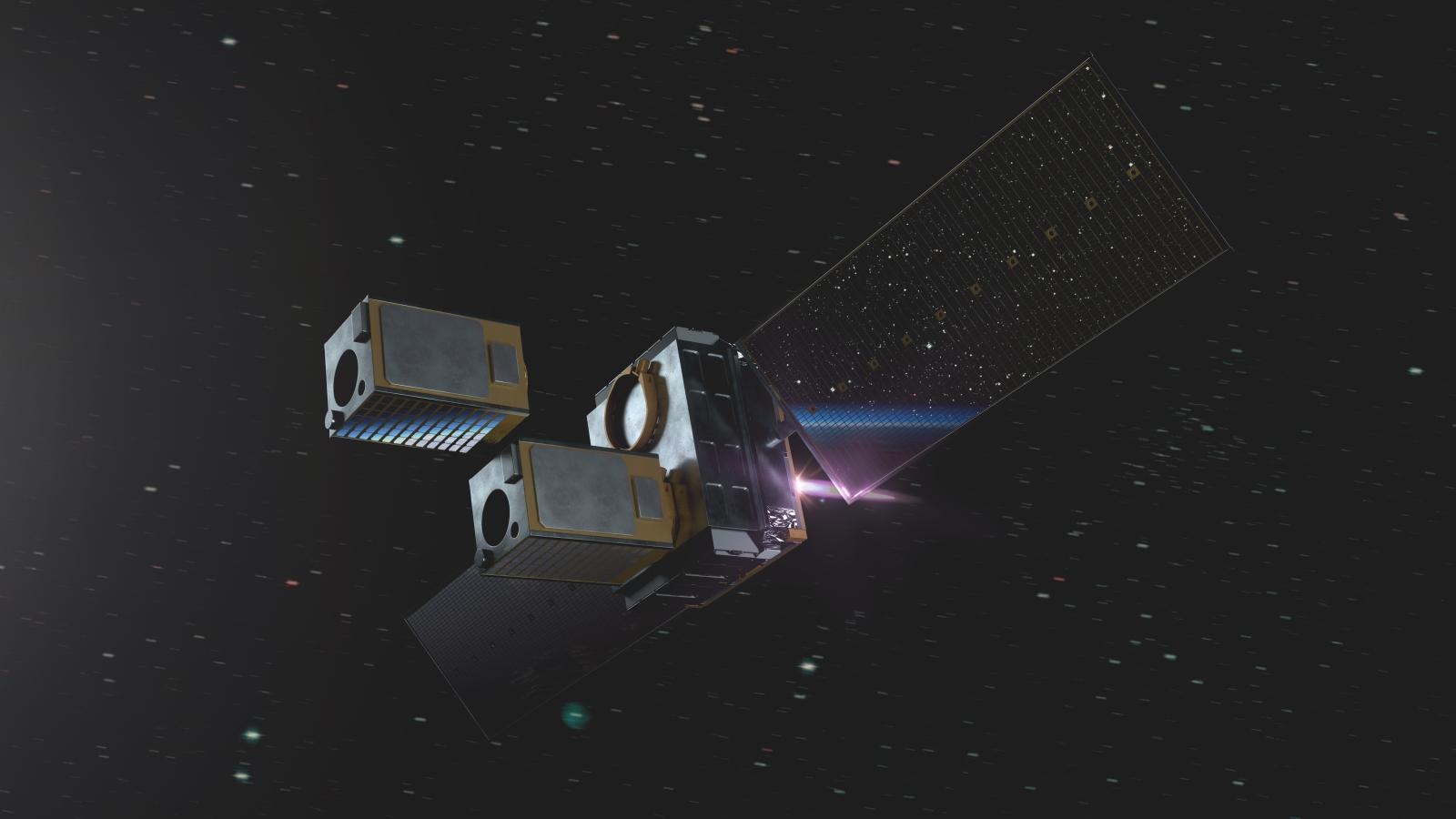

The space race is gaining momentum, and aerospace companies want to present themselves as solid market players. That's why some space startups decide to go public to get a higher visibility, prove transparency, and get additional financial resources. Last year, Virgin Galactic went through an IPO, and their shares are now publicly traded. But more is yet to come, and not long ago Momentus Space founded by Mikhail Kokorich also released news about going public.

What lies behind IPO attempts?

The two cases mentioned above share more similarities rather than merely involving space companies. As a matter of fact, both Virgin Galactic and Momentus have chosen SPAC as a way to join the stock market. But no matter of the course that was chosen, the question remains about what have they been looking for in going public. The immediate answer would be that they have sought for extra funding to help their companies move forward and bring their plans into life. But is the money the only reason? It's difficult to say for sure, but let's take a closer look at Momentus Space.

What's so special about Momentus?

It is crucial to consider the figure and the past of the startup's owner - Mikhail Kokorich. He is a Russian expat who came to the USA back in 2014 and since then has had quite an active business life. He initially was engaged in the Canopus Systems company, then in Astro Digital. Canopus System had American management, so no problems arose with it until they were fired. But when speaking of Astro Digital, the Committee for Foreign Investment in the US expressed concerns regarding the participation of Russian investors, so Kokorich had to leave the company.

A concern arises since the same thing could happen to Momentus as its CEO still has no permission to work with the technologies his company produces and is still seeking asylum. While top management does not need to have the tech expertise and be engaged in the development routine, being a scientist, Kokorich still offers some ideas implemented by his startup. But without having access to the already developed “dual-use” technologies because of his Russian origin and suspicious Russian connections, it is questionable how he could offer new solutions.

Are there any Red Flags for Investors?

The restriction to utilize technologies by the company's CEO might turn into a financial problem in the future. While Momentus seeks additional financing through an IPO rather than traditional for startups investment round, it seems they are feeling an urgent need for funding. And the fact that they decided to focus on going public via a SPAC speaks for itself. For them, it might be a comparatively easy way to collect money while usual investors don't see enough reasons to put their resources into this half-Russian, half-American startup in pursuit of a dream to build a reliable space infrastructure.

Under such conditions, it is questionable whether the venture will actually bring investors the desired results. Considering the previous space IPO, Richard Branson's Virgin Galactic, the short-term financial perspectives of investing in space companies are not as satisfactory as they could be. These considerations might make investors cautious of supplying yet another space startup. In this particular case, the situation is even more complicated - Russian roots also serve as a discouraging factor for investors. And several court proceedings with the participation of the startup's CEO don't make it all better.